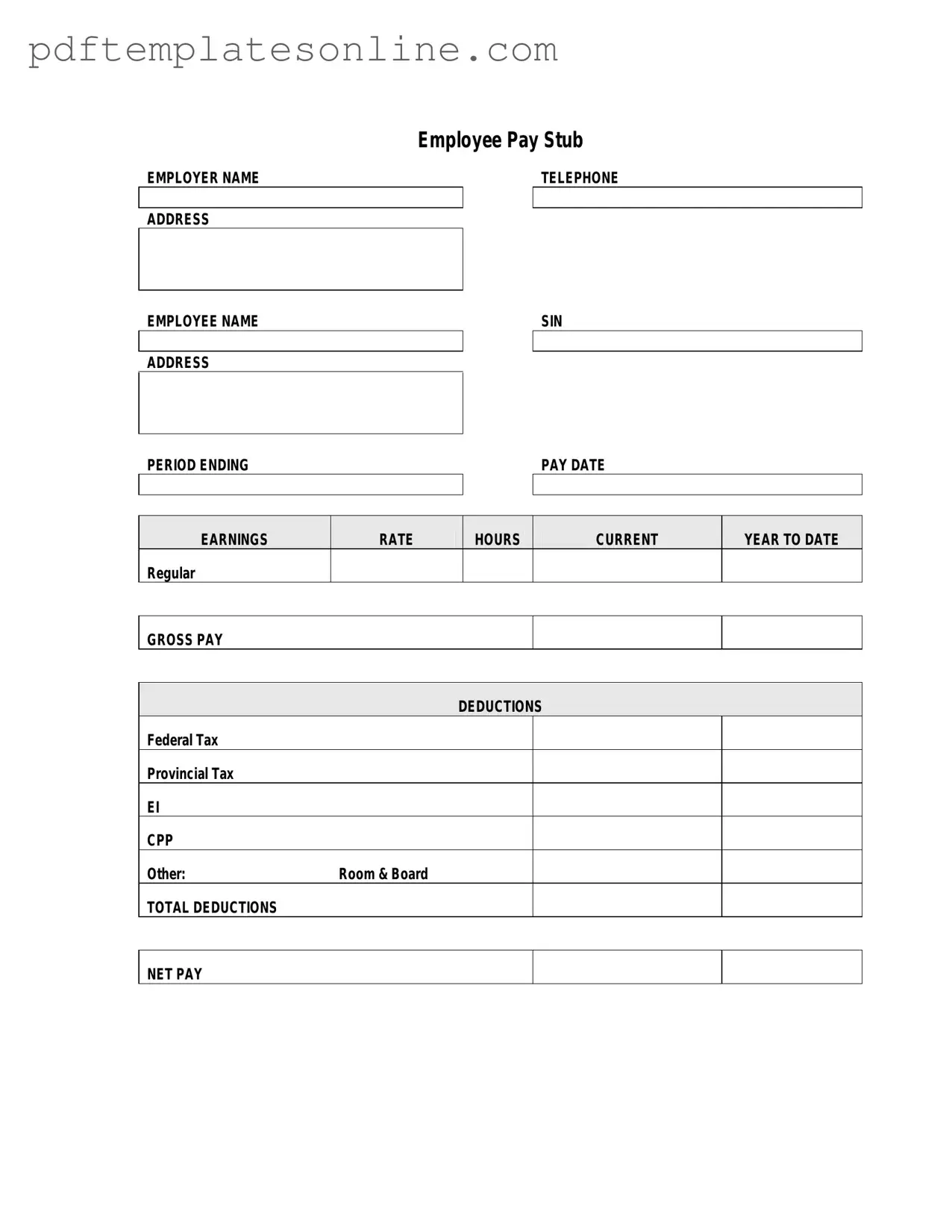

Blank Pay Stub Form

Key takeaways

When filling out and using a Pay Stub form, there are several important points to keep in mind. Here are some key takeaways to ensure accuracy and compliance:

- Understand the Components: Familiarize yourself with the different sections of the pay stub, including earnings, deductions, and net pay.

- Accurate Information: Ensure that all personal information, such as your name and Social Security number, is correct to avoid issues with tax reporting.

- Check Earnings: Review your gross earnings to confirm that all hours worked and overtime pay are accurately reflected.

- Review Deductions: Look closely at deductions for taxes, insurance, and retirement contributions to understand how they impact your take-home pay.

- Net Pay Awareness: Be aware of your net pay, which is the amount you take home after all deductions. This is crucial for budgeting.

- Frequency of Pay: Note the frequency of payment (weekly, bi-weekly, monthly) as it affects your financial planning.

- Year-to-Date Totals: Pay attention to year-to-date totals for earnings and deductions, which are helpful for tax preparation.

- Keep Records: Retain copies of your pay stubs for your records. They can be useful for loan applications or tax purposes.

- Report Errors Promptly: If you notice any discrepancies, report them to your employer's payroll department as soon as possible.

- Understand State Regulations: Be aware of your state’s specific requirements regarding pay stubs, as they can vary significantly.

By following these guidelines, you can effectively manage your pay stub and ensure that all information is accurate and useful for your financial planning.

Common mistakes

Filling out a Pay Stub form accurately is crucial for both employees and employers. Mistakes can lead to confusion, discrepancies in pay, and even legal issues. Here are eight common errors that people make when completing this important document.

One frequent mistake is not double-checking personal information. It’s essential to ensure that your name, address, and Social Security number are correct. Even a small typo can create significant problems down the line, such as issues with tax filings or benefits eligibility.

Another common error involves miscalculating hours worked. Employees should accurately record their hours to avoid underpayment or overpayment. It's advisable to keep a personal log of hours worked to cross-reference with the Pay Stub form.

Many individuals also overlook not understanding deductions. Pay stubs often include various deductions for taxes, health insurance, and retirement contributions. Not fully grasping these can lead to confusion about take-home pay. Take the time to review each deduction and understand its purpose.

Some people fail to update their tax withholding information when their personal circumstances change, such as getting married or having a child. This can result in either owing taxes at the end of the year or having too much withheld from each paycheck. Regularly reviewing and updating this information is vital.

Another mistake is not keeping copies of past pay stubs. These documents serve as important records for tax purposes and can help resolve discrepancies. Always save copies of your pay stubs for at least a year.

Additionally, people often forget to review their pay stub for errors. It’s important to regularly check for mistakes in pay calculations, deductions, and hours worked. If something seems off, address it immediately with your employer or payroll department.

Some individuals make the error of ignoring state-specific regulations. Different states have different rules regarding pay stubs, including what information must be included. Familiarizing yourself with your state's requirements can prevent potential issues.

Lastly, many fail to communicate with HR or payroll when they notice discrepancies. If an error is found, it’s crucial to report it as soon as possible. Delaying communication can complicate the resolution process and may result in additional stress.

By being aware of these common mistakes and taking proactive steps to avoid them, you can ensure that your Pay Stub form is filled out correctly and that your financial interests are protected.

Misconceptions

Understanding pay stubs is essential for employees and employers alike. However, several misconceptions can lead to confusion. Here are nine common misconceptions about the Pay Stub form:

-

All pay stubs look the same.

In reality, pay stubs can vary significantly between companies. Each employer may have a unique format and layout.

-

Pay stubs are only for full-time employees.

Part-time and temporary employees also receive pay stubs, which detail their earnings and deductions.

-

Pay stubs show only gross pay.

They typically display both gross pay and net pay, along with deductions for taxes and benefits.

-

Pay stubs are not important.

They serve as crucial documents for verifying income, budgeting, and filing taxes.

-

Employers can withhold pay stubs.

Most states require employers to provide pay stubs to employees regularly.

-

Pay stubs are only necessary for tax purposes.

They can also be used for loan applications, rental agreements, and other financial transactions.

-

All deductions on pay stubs are mandatory.

Some deductions, like retirement contributions or health insurance, may be optional, depending on the employer's offerings.

-

Pay stubs cannot be corrected once issued.

If there is an error, employers can issue corrected pay stubs to reflect accurate information.

-

Understanding pay stubs is difficult.

While they may seem complex, many resources are available to help individuals understand the information presented.

Dos and Don'ts

When filling out the Pay Stub form, it is essential to ensure accuracy and clarity. Below is a list of things you should and shouldn't do to help you complete the form correctly.

- Do double-check all personal information for accuracy.

- Do use clear and legible handwriting if filling out the form by hand.

- Do include all relevant earnings and deductions.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations that might confuse the reader.

- Don't forget to sign and date the form if required.

- Don't submit the form without reviewing it for errors.

Other PDF Forms

Medical Consent Form for Babysitter - This form eliminates ambiguity surrounding medical treatment decisions while parents are away.

Panel Schedule - Assists project managers in coordinating electrical work across teams.

California Board of Behavioral Sciences - Participants must ensure that all dates and hours reported are truthful and complete.

Detailed Guide for Writing Pay Stub

Filling out the Pay Stub form is an important step for ensuring accurate record-keeping of your earnings and deductions. Following the steps below will help you complete the form efficiently and accurately.

- Begin by entering your employee information. This includes your name, address, and employee ID number.

- Next, provide your pay period dates. Specify the start and end dates for the pay period you are documenting.

- Fill in your gross earnings. This is the total amount earned before any deductions are made.

- List all deductions. Include taxes, insurance, and any other withholdings that apply to your pay.

- Calculate your net pay by subtracting total deductions from gross earnings. This is the amount you will receive.

- Review all the information for accuracy. Ensure that there are no mistakes or omissions.

- Finally, sign and date the form to certify that the information provided is correct.