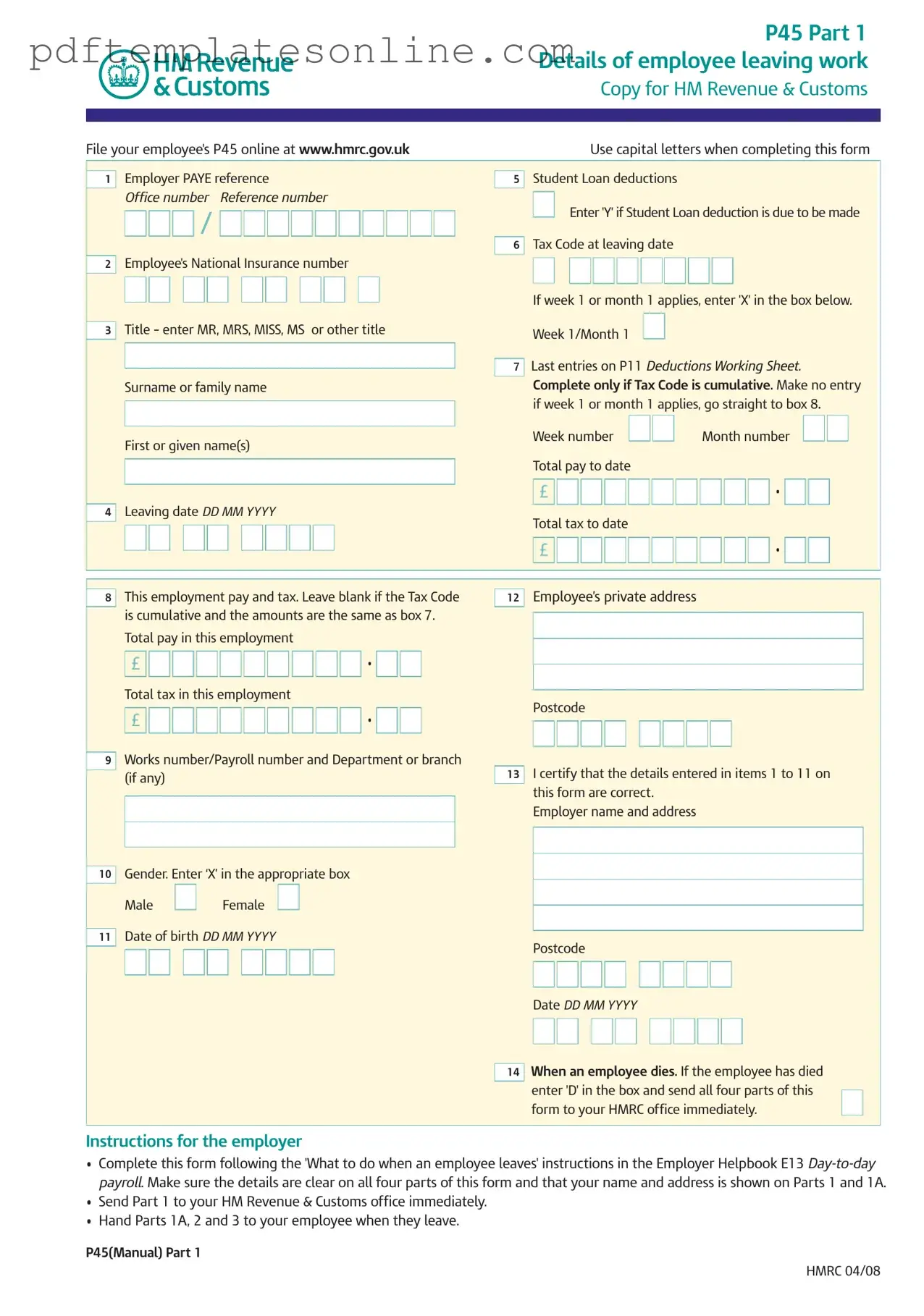

Blank P 45 It Form

Key takeaways

- The P45 form is used when an employee leaves a job, providing essential information for tax purposes.

- It consists of three parts: Part 1 for HM Revenue & Customs (HMRC), Part 1A for the employee, and Part 2 for the new employer.

- Employers must fill out the form clearly, ensuring all details are accurate to avoid tax issues.

- When completing the form, use capital letters and include the employee's National Insurance number and tax code.

- If the employee is leaving due to death, mark the appropriate box and send all parts of the form to HMRC immediately.

- Employees should keep Part 1A safe, as it may be needed for future tax returns or claims.

- New employers should request Parts 2 and 3 from the employee to ensure correct tax deductions.

- If an employee does not want their new employer to see their P45 details, they can send it directly to HMRC.

- For those becoming self-employed, registration with HMRC must occur within three months to avoid penalties.

Common mistakes

Filling out the P45 form can be a straightforward task, but there are common mistakes that people often make. One frequent error is not using capital letters where required. The form specifically asks for capital letters in certain sections, such as the employee's name and address. Failing to do this can lead to confusion and delays in processing.

Another mistake is neglecting to enter the correct National Insurance number. This number is crucial for tax and social security purposes. If it's incorrect or missing, it can complicate the employee's tax records. Always double-check this information before submitting the form.

Many individuals also forget to indicate whether the employee's tax code is cumulative. This is done by completing the appropriate box. If the tax code is cumulative and this detail is not provided, it can result in inaccurate tax deductions in the future.

People often overlook the importance of the leaving date. This date must be accurate to ensure the employee's records are correct. An incorrect leaving date can cause issues with tax filings and benefits. It’s essential to enter the date in the correct format, as specified in the form.

Another common oversight is not certifying the details at the end of the form. The certification is a declaration that the information provided is correct. Without this signature, the form may be considered incomplete, leading to further complications.

Some individuals also forget to provide the employee’s total pay and tax to date. This information is vital for the new employer and helps in calculating future tax deductions. Leaving this blank can create confusion and lead to incorrect tax calculations.

Additionally, failing to keep a copy of the P45 can be a mistake. Employees should retain their parts of the form for their records. This is particularly important for tax returns or if there are any discrepancies in the future.

Lastly, many people do not read the instructions that accompany the form. These instructions provide valuable information on how to complete the form correctly and what to do with the different parts. Taking a moment to read through these can save a lot of time and trouble later on.

Misconceptions

- Misconception 1: The P45 form is only necessary for employees who are leaving their jobs voluntarily.

- Misconception 2: Employees do not need to keep their P45 once they start a new job.

- Misconception 3: Employers are not responsible for providing a P45 if the employee leaves without notice.

- Misconception 4: A P45 is not needed if an employee is moving to a different position within the same company.

- Misconception 5: The P45 form is only relevant for tax purposes.

This is not true. The P45 form is required for any employee who leaves a job, regardless of the circumstances. This includes resignations, layoffs, or even termination due to misconduct.

In fact, it is important for employees to keep their P45. They may need it for tax purposes or to fill out a tax return in the future. Losing this document can complicate tax matters.

Employers are still obligated to provide a P45 even if an employee leaves without notice. This document is crucial for the employee's tax records and must be issued regardless of the circumstances of departure.

This is incorrect. A P45 is only issued when an employee leaves a job entirely. If an employee is changing roles within the same company, a P45 is not necessary, but other documentation may be required.

While the P45 is indeed important for tax purposes, it also serves other functions. It helps in determining eligibility for benefits, such as Jobseeker's Allowance, and is useful for employers when onboarding new staff.

Dos and Don'ts

When filling out the P45 IT form, consider the following do's and don'ts:

- Use capital letters throughout the form to ensure clarity.

- Double-check all entries for accuracy before submitting.

- Provide complete and correct information regarding the employee's National Insurance number.

- Send Part 1 to HM Revenue & Customs immediately after completion.

- Do not leave any required fields blank; ensure all necessary information is filled in.

- Avoid using abbreviations or shorthand that may cause confusion.

- Do not submit the form without verifying that all parts are included.

- Refrain from altering any information once the form has been signed.

Other PDF Forms

Dmv Power of Attorney - The Vehicle POA REG 260 form makes vehicle transactions straightforward and efficient.

When entering into a financial agreement, understanding the specifics of a loan is crucial; hence, the California Loan Agreement form serves as an essential tool for both borrowers and lenders. This form not only delineates the loan amount, interest rate, and repayment schedule but also outlines the obligations of each party involved. For those seeking a reliable template, resources like California PDF Forms can provide customizable options to suit individual needs, ensuring that the terms are clear and legally enforceable for future reference.

Discharge Upgrade to Medical Retirement - Veterans seeking an upgrade from other than honorable discharges can use this form.

Detailed Guide for Writing P 45 It

Filling out the P45 IT form is an important task when an employee leaves a job. This form is used for tax purposes and needs to be completed accurately to ensure that the employee's tax records are correct. Follow the steps below to fill out the form properly.

- Begin with the employer's PAYE reference. Write it clearly in the designated box.

- Enter the office number and reference number in the appropriate fields.

- Provide the employee's National Insurance number. This is essential for tax records.

- In the title box, enter MR, MRS, MISS, MS, or another title as applicable.

- Fill in the employee's surname or family name.

- Enter the first or given name(s) of the employee.

- Indicate the leaving date in the format DD MM YYYY.

- Record any student loan deductions, if applicable, by entering 'Y' in the box provided.

- If the employee's tax code is cumulative, complete the total pay to date and total tax to date. If it is week 1 or month 1, leave this section blank.

- Complete the total pay in this employment and total tax in this employment fields.

- Fill in the employee's private address and postcode.

- Indicate the works number or payroll number, if available.

- Certify that the details entered are correct by signing and dating the form.

- For gender, enter ‘X’ in the appropriate box for male or female.

- Lastly, include the employee's date of birth in the format DD MM YYYY.

Once the form is completed, it is crucial to send Part 1 to HM Revenue & Customs immediately. The other parts should be given to the employee when they leave. Keeping accurate records helps ensure a smooth transition for both the employer and employee.