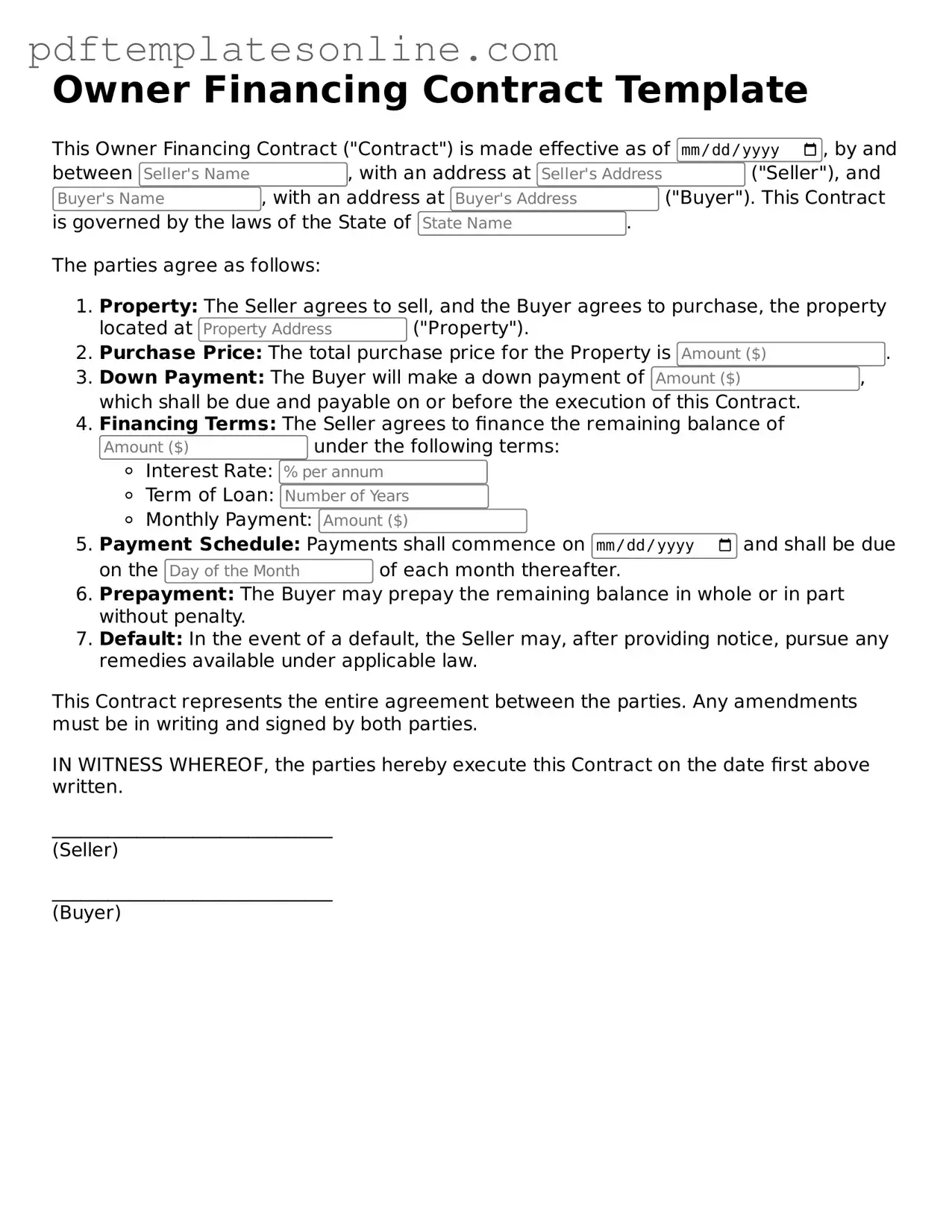

Fillable Owner Financing Contract Document

Key takeaways

When dealing with an Owner Financing Contract, it’s essential to understand the key elements involved. Here are some important takeaways:

- Clear Terms: Ensure all terms, including interest rates and payment schedules, are clearly defined. This helps avoid misunderstandings later.

- Legal Compliance: Verify that the contract complies with local laws. Each state has specific regulations regarding owner financing.

- Documentation: Keep thorough records of all communications and payments. This documentation can be crucial if disputes arise.

- Professional Review: Consider having a legal professional review the contract before signing. Their expertise can help identify potential issues.

Common mistakes

When individuals fill out the Owner Financing Contract form, several common mistakes can lead to complications later on. Understanding these errors is essential for ensuring a smooth transaction. One frequent mistake is failing to provide accurate property details. This includes the address, legal description, and any relevant identifiers. Inaccuracies can result in disputes or delays in the financing process.

Another common error is neglecting to specify the financing terms clearly. The interest rate, payment schedule, and loan duration should be explicitly stated. Ambiguities in these areas can create misunderstandings between the buyer and seller, potentially leading to financial strain or legal issues down the line.

People often overlook the importance of including contingencies in the contract. Contingencies serve as protective measures for both parties. For instance, specifying conditions under which the contract may be voided can safeguard against unforeseen circumstances. Without these clauses, individuals may find themselves bound to unfavorable terms.

Additionally, many individuals fail to include all necessary signatures. An incomplete contract can invalidate the agreement. Each party involved must sign the document, and if there are co-signers, their signatures are equally important. Ensuring that all required parties have signed is crucial to enforceability.

Another mistake arises from not seeking legal advice before finalizing the contract. While it may seem straightforward, owner financing agreements can be complex. Consulting with a legal professional can provide clarity and help identify potential pitfalls. This step is particularly important for those unfamiliar with real estate transactions.

Finally, individuals sometimes neglect to keep copies of the signed contract. Document retention is vital for future reference. Having a copy ensures that all parties can refer back to the terms of the agreement if any disputes arise. Proper documentation can prevent misunderstandings and protect the interests of everyone involved.

Misconceptions

Owner financing can be a great option for both buyers and sellers, but several misconceptions can lead to confusion. Here are five common misconceptions about the Owner Financing Contract form:

- Owner financing is only for buyers with bad credit. Many people believe that owner financing is a last resort for those who cannot qualify for traditional loans. In reality, it can be an attractive option for buyers with good credit who want to avoid the lengthy approval process of banks.

- The seller has no legal protections. Some assume that the seller is at a disadvantage in an owner financing agreement. However, the contract can include various protections for the seller, such as the ability to reclaim the property if the buyer defaults on payments.

- Owner financing is the same as a lease-to-own agreement. While both options involve the seller financing the buyer, they are distinct. In a lease-to-own agreement, the buyer typically rents the property with the option to purchase later, whereas owner financing involves the buyer purchasing the property outright with the seller acting as the lender.

- Interest rates in owner financing are always higher. Many believe that sellers will charge exorbitant interest rates to compensate for the risk. In practice, interest rates can be competitive and may even be lower than those offered by traditional lenders, depending on the terms negotiated.

- Owner financing is too complicated. Some think that the process is too complex to navigate without legal assistance. While it is essential to understand the terms, many resources are available to simplify the process, and many sellers and buyers successfully complete these transactions independently.

Understanding these misconceptions can help both buyers and sellers make informed decisions about owner financing. Clear communication and a well-drafted contract are crucial for a successful transaction.

Dos and Don'ts

When filling out the Owner Financing Contract form, it is essential to approach the task with care. Here are six important dos and don'ts to keep in mind:

- Do: Read the entire form thoroughly before starting to fill it out.

- Do: Provide accurate information about the buyer and seller.

- Do: Clearly outline the terms of the financing agreement, including interest rates and payment schedules.

- Do: Seek legal advice if you have any questions about the terms.

- Don't: Rush through the form; take your time to ensure everything is correct.

- Don't: Leave any sections blank unless instructed to do so.

Browse Common Types of Owner Financing Contract Templates

Pdf Personal Guarantee Template - The individual signing the guarantee is referred to as the guarantor and assumes responsibility for the debt.

For anyone looking to buy or sell property in New York, it is crucial to understand the implications of the New York Real Estate Purchase Agreement, as it lays down the foundational terms of the transaction. To ensure all aspects are covered and to minimize potential disputes, it can be beneficial to refer to templates, such as the one available at NY Templates, which provide a structured format for this essential document.

Detailed Guide for Writing Owner Financing Contract

Filling out the Owner Financing Contract form is a straightforward process that requires attention to detail. By following the steps outlined below, you can ensure that all necessary information is accurately recorded, making the agreement clear and enforceable.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Fill in the names of the seller(s) and buyer(s) in the designated spaces.

- Provide the property address. Include the street address, city, state, and ZIP code.

- Specify the purchase price of the property. This should be a clear and accurate figure.

- Detail the down payment amount. This is the initial payment made by the buyer.

- Fill in the loan amount. This is the total amount being financed after the down payment is subtracted from the purchase price.

- Indicate the interest rate. This should be expressed as a percentage.

- Define the loan term. Specify the duration in months or years for which the loan will be in effect.

- Outline the payment schedule. Specify whether payments will be made monthly, quarterly, or annually.

- Include any additional terms or conditions. This may include clauses regarding late payments, prepayment penalties, or property maintenance responsibilities.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are in the designated spaces.

Once the form is completed, review it carefully for accuracy. Both parties should retain a copy for their records. This ensures that everyone is on the same page regarding the terms of the agreement.