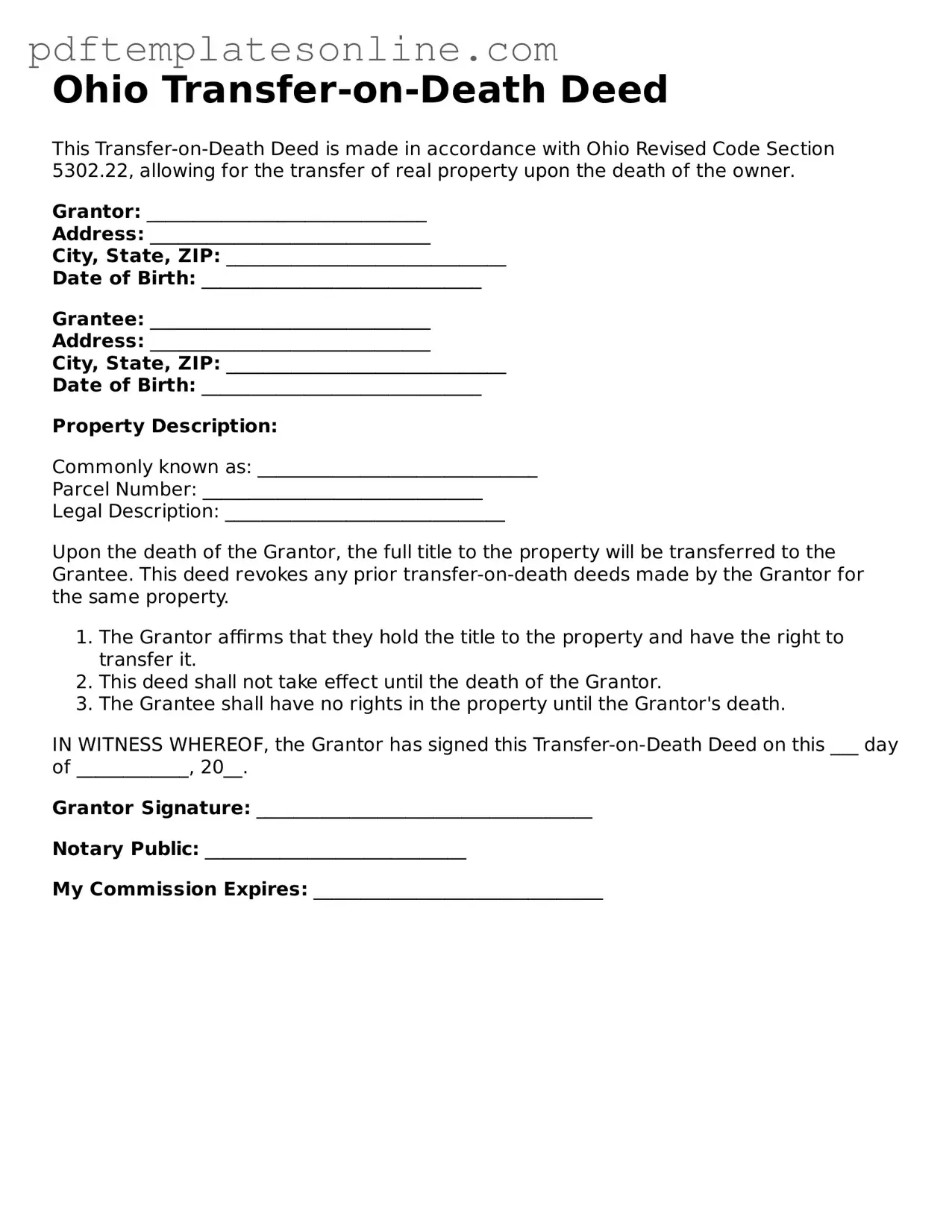

Official Ohio Transfer-on-Death Deed Document

Key takeaways

Understanding the Ohio Transfer-on-Death Deed form is essential for effective estate planning. Here are key takeaways to consider:

- Purpose: The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- Eligibility: This deed can be used for various types of real estate, including residential homes and commercial properties, as long as the owner is a resident of Ohio.

- Filling Out the Form: Accurate completion of the form is crucial. Ensure that all required information, such as the property description and beneficiary details, is clearly provided.

- Signatures: The deed must be signed by the property owner in the presence of a notary public. This step is vital for the deed to be legally binding.

- Recording: After signing, the deed should be recorded with the county recorder's office where the property is located. This action makes the transfer official.

- Revocation: The Transfer-on-Death Deed can be revoked at any time before the owner's death. A new deed must be executed and recorded to replace the previous one.

These takeaways highlight important aspects of the Transfer-on-Death Deed in Ohio, ensuring that individuals can navigate the process effectively.

Common mistakes

Filling out the Ohio Transfer-on-Death Deed form can be straightforward, but several common mistakes can lead to complications. One frequent error is not providing complete property information. It’s essential to include the full legal description of the property, not just the address. Omitting details can create confusion and may invalidate the deed.

Another mistake is failing to sign the deed in front of a notary public. The law requires that the deed be notarized for it to be valid. Without this step, the document may not be recognized by the county recorder, which can hinder the transfer process.

People often forget to include the names of the beneficiaries clearly. It is crucial to list the full names of all beneficiaries. Using nicknames or initials can lead to disputes or challenges later on. Ensure that the names match the official identification documents of the beneficiaries.

Some individuals neglect to check the eligibility of the beneficiaries. Not all individuals can be named as beneficiaries under Ohio law. For instance, a minor cannot inherit property directly. It’s important to understand the rules regarding who can receive property through a Transfer-on-Death Deed.

Another common error involves not recording the deed promptly. After completing the form and having it notarized, it must be filed with the county recorder’s office. Delaying this step can create issues, especially if the property owner passes away before the deed is recorded.

People sometimes assume that a Transfer-on-Death Deed can be used for all types of property. However, certain types of property, such as joint tenancies or properties with existing liens, may not be eligible for this type of transfer. It’s important to verify the property type before proceeding.

Misunderstanding the implications of the deed can also lead to mistakes. A Transfer-on-Death Deed does not eliminate the need for estate planning. Individuals may mistakenly believe that this deed alone is sufficient for their estate planning needs. Comprehensive planning is still necessary to address other assets and debts.

Lastly, individuals may overlook the importance of keeping the deed in a safe place. After recording the deed, it should be stored securely, and beneficiaries should be informed of its existence. Failing to do so can result in confusion or disputes after the property owner’s death.

Misconceptions

Understanding the Ohio Transfer-on-Death Deed can help individuals make informed decisions about estate planning. However, several misconceptions exist regarding this legal tool. Below are some common misunderstandings:

- It automatically transfers property upon death. The Transfer-on-Death Deed only transfers property after the owner's death. Until that point, the owner retains full control.

- It replaces a will. A Transfer-on-Death Deed does not replace a will. It functions alongside a will and should be considered as part of a comprehensive estate plan.

- All property can be transferred this way. Not all types of property are eligible for transfer using this deed. Certain properties, like those held in a trust, may not qualify.

- It avoids probate entirely. While a Transfer-on-Death Deed can help avoid probate for the transferred property, other assets may still go through the probate process.

- It is irrevocable once signed. The deed can be revoked or changed by the owner at any time before their death, as long as the proper procedures are followed.

- Beneficiaries have immediate rights to the property. Beneficiaries do not have rights to the property until the owner passes away and the deed is executed.

- It is only for married couples. Anyone can use a Transfer-on-Death Deed, regardless of marital status, to designate beneficiaries for their property.

- It eliminates taxes on the property. While it may simplify the transfer process, taxes may still apply to the property, depending on its value and the beneficiaries' circumstances.

Being aware of these misconceptions can aid in making better choices regarding property transfer and estate planning in Ohio.

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure that the document is completed correctly and serves its intended purpose. Here are five important dos and don'ts to consider:

- Do ensure that you accurately identify the property being transferred.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Don't forget to file the deed with the appropriate county recorder's office.

- Don't use vague language that may lead to confusion about the intent of the deed.

Browse Popular Transfer-on-Death Deed Forms for US States

Texas Deed Transfer Form - Local regulations may also define specific language necessary in the deed to ensure validity.

How to Avoid Probate in Pa - Beneficiaries can receive the property without having to go through the will process, resulting in faster access.

The Affidavit of Death is an important legal document that outlines the necessary steps for managing the affairs of a deceased person. To learn more about this crucial process, you can find a detailed guide on the application of the Affidavit of Death form that helps facilitate the transfer of assets to rightful heirs.

Transfer on Death Deed Form Georgia - It can be revoked or modified by the property owner at any time before their death.

Transfer on Death Deed California Common Questions - A clear and straightforward way to manage property succession.

Detailed Guide for Writing Ohio Transfer-on-Death Deed

Once you have the Ohio Transfer-on-Death Deed form, you will need to complete it carefully. Ensure all required information is accurate, as this will affect the transfer of property. Follow these steps to fill out the form correctly.

- Begin by entering the name of the current property owner(s) in the designated space.

- Provide the address of the property being transferred.

- Include a legal description of the property. This can typically be found on the property deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon the owner’s death.

- Indicate the relationship of the beneficiary to the owner, if applicable.

- Sign and date the form in the appropriate section. Ensure that all owners sign if there are multiple owners.

- Have the form notarized. This step is crucial for the deed to be valid.

- Finally, file the completed deed with the county recorder’s office in the county where the property is located.