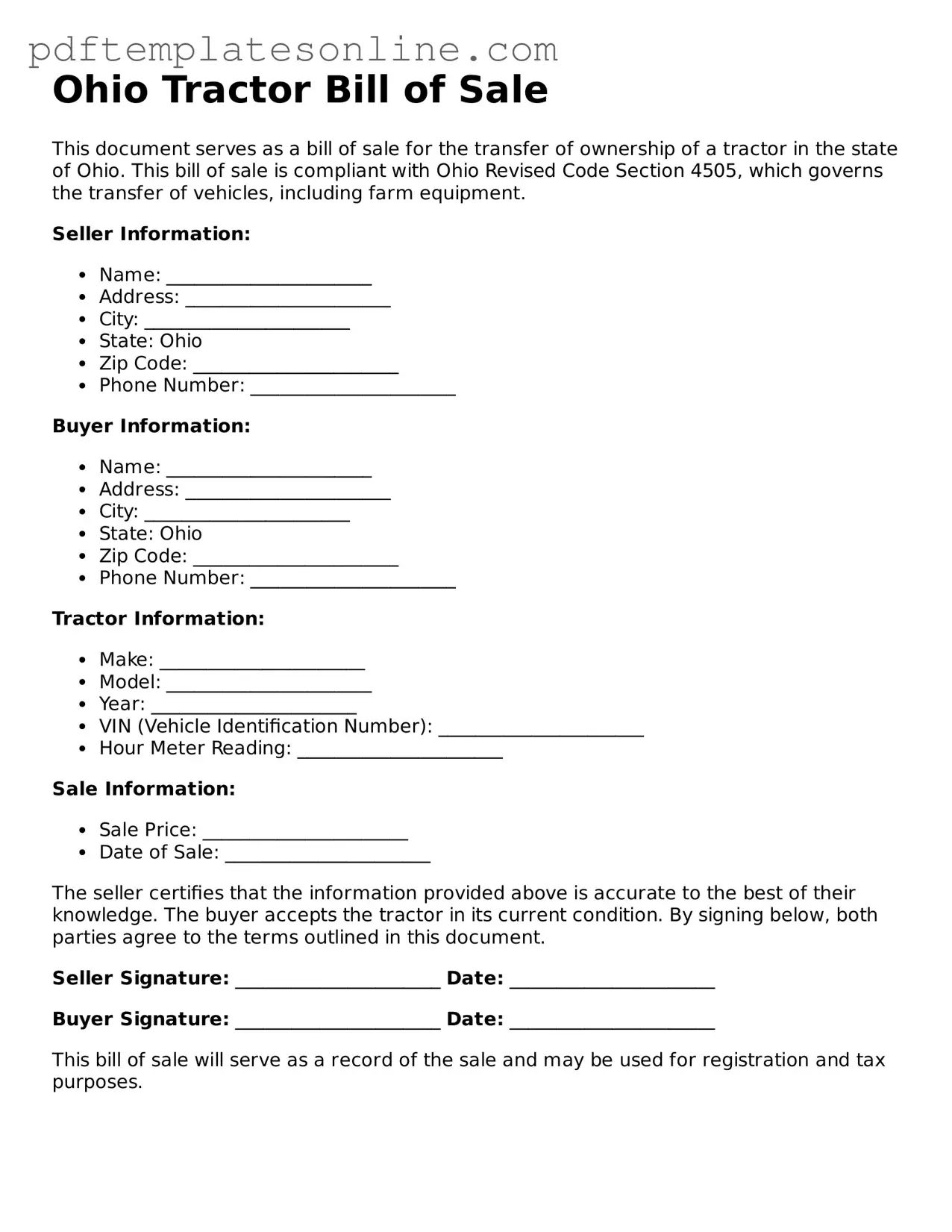

Official Ohio Tractor Bill of Sale Document

Key takeaways

When filling out and using the Ohio Tractor Bill of Sale form, consider the following key points:

- Ensure all information is accurate. Include the names and addresses of both the buyer and seller.

- Clearly describe the tractor. Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price. This should be the agreed amount for the transaction.

- Include the date of sale. This establishes when the transaction took place.

- Both parties should sign the document. Signatures validate the agreement and indicate acceptance of the terms.

- Consider notarization. While not required, having the bill of sale notarized can add an extra layer of authenticity.

- Keep a copy for your records. Both the buyer and seller should retain a copy for future reference.

- Check local requirements. Different counties may have specific regulations regarding the sale of tractors.

- Use the form for tax purposes. The bill of sale can serve as proof of purchase for tax reporting.

Common mistakes

Filling out the Ohio Tractor Bill of Sale form can seem straightforward, but many individuals make critical mistakes that can lead to complications later on. One common error is failing to include all necessary information about the tractor. This includes details like the make, model, year, and Vehicle Identification Number (VIN). Omitting any of this information can create confusion and may even affect the registration process.

Another frequent mistake is not providing accurate contact information for both the buyer and the seller. It’s essential to ensure that names, addresses, and phone numbers are correct. Inaccurate information can hinder communication and complicate any future transactions or disputes.

Some people neglect to date the form. The date is crucial because it establishes when the sale occurred. Without a date, it becomes challenging to prove ownership transfer and may lead to legal issues down the line.

Many individuals also forget to sign the form. Both the buyer and the seller must sign the document for it to be legally binding. A missing signature can render the bill of sale invalid, causing problems for both parties.

Another mistake involves using outdated or incorrect forms. Ohio may update its forms or requirements periodically. Using an old version can lead to unnecessary delays or rejections. Always check for the most current form before proceeding.

Some sellers may assume that a bill of sale is not necessary for a tractor transaction. However, having this document is important for legal protection. It serves as proof of sale and can be critical in resolving disputes.

In addition, people often forget to keep copies of the completed bill of sale. Both parties should retain a copy for their records. This documentation can be invaluable if any issues arise regarding ownership or payment.

Another common oversight is not including the sale price. This detail is essential for tax purposes and for establishing the value of the transaction. Leaving it blank can lead to complications with tax authorities.

Lastly, individuals may overlook the importance of including any warranties or conditions of the sale. If the tractor is sold "as-is," this should be clearly stated in the bill of sale. Failing to include this information can lead to misunderstandings about the condition of the tractor after the sale.

Misconceptions

The Ohio Tractor Bill of Sale form is an important document for anyone buying or selling a tractor in Ohio. However, several misconceptions can lead to confusion. Below are five common misconceptions about this form.

- It is not necessary to have a Bill of Sale for a tractor. Many people believe that a Bill of Sale is optional. In reality, this document serves as proof of ownership and is essential for registering the tractor.

- Only licensed dealers can provide a Bill of Sale. This is false. Any private seller or buyer can create a Bill of Sale. It does not require a dealer's involvement.

- The Bill of Sale must be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for the Ohio Tractor Bill of Sale.

- All information on the Bill of Sale is optional. This is incorrect. Specific details, such as the names of the buyer and seller, the tractor's identification number, and the sale price, are mandatory.

- A Bill of Sale is only needed for new tractors. This misconception overlooks the fact that a Bill of Sale is required for both new and used tractors to establish legal ownership.

Understanding these misconceptions can help ensure a smooth transaction when buying or selling a tractor in Ohio.

Dos and Don'ts

When filling out the Ohio Tractor Bill of Sale form, it is important to be thorough and accurate. Here are some things you should and shouldn't do:

- Do provide accurate information about the tractor, including the make, model, year, and VIN.

- Do include the sale price clearly to avoid any misunderstandings.

- Do ensure both the buyer and seller sign the form to validate the transaction.

- Do keep a copy of the completed form for your records.

- Do check for any specific requirements in your county regarding the bill of sale.

- Don't leave any sections blank; fill out all required fields.

- Don't use abbreviations or unclear terms that may confuse the reader.

- Don't forget to date the form; this is crucial for record-keeping.

- Don't rush through the process; take your time to ensure everything is correct.

Browse Popular Tractor Bill of Sale Forms for US States

Tractor Bill of Sale Word Template - A clear record of sale can also help in potential warranty claims.

Do Tractors Need to Be Registered - Encourages ethical selling by ensuring both parties are aware of the sale details.

Understanding the importance of a Notary Acknowledgment form is crucial for anyone involved in legal transactions in California. This form protects against potential disputes regarding the validity of a document by confirming the identity and signature of the signer. For those looking to obtain or modify such forms, resources like California PDF Forms can be invaluable tools in ensuring that all necessary paperwork is completed correctly and efficiently.

Does a Tractor Have a Title - This form serves as a useful reference in case of future disputes regarding ownership.

Detailed Guide for Writing Ohio Tractor Bill of Sale

Once you have the Ohio Tractor Bill of Sale form, you can begin filling it out. This document is essential for transferring ownership of a tractor. Make sure you have all necessary information ready before you start.

- Start by entering the date of the sale at the top of the form.

- Fill in the seller's full name and address. This identifies who is selling the tractor.

- Next, provide the buyer's full name and address. This shows who is purchasing the tractor.

- Include a detailed description of the tractor. This should cover the make, model, year, and Vehicle Identification Number (VIN).

- State the sale price of the tractor clearly. This amount should reflect the agreed-upon price between the buyer and seller.

- Both the seller and buyer should sign and date the form. This confirms that both parties agree to the terms of the sale.

- Make a copy of the completed form for your records. This is important for both parties.