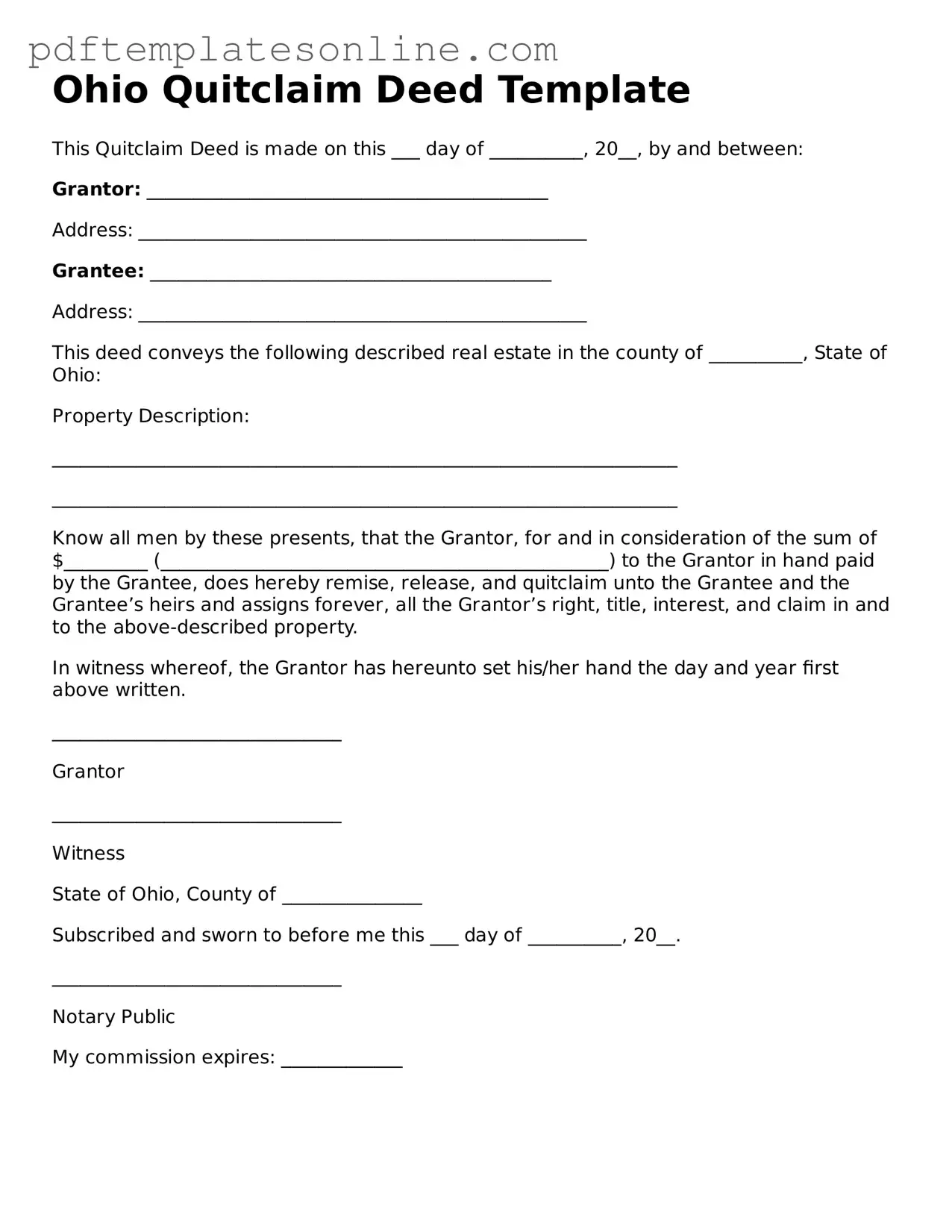

Official Ohio Quitclaim Deed Document

Key takeaways

When dealing with property transfers in Ohio, understanding the Quitclaim Deed form is essential. Here are ten key takeaways to keep in mind:

- Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without guaranteeing that the title is clear. It is often used among family members or in divorce settlements.

- Parties Involved: The form requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A clear and accurate description of the property must be included. This typically involves the property’s address and legal description.

- Notarization: The Quitclaim Deed must be signed in the presence of a notary public. This step is crucial for the document to be legally binding.

- Recording the Deed: After signing, the Quitclaim Deed should be filed with the county recorder’s office where the property is located. This step officially updates public records.

- Consideration: Although not always required, it is common to include a nominal amount of money (like $1) as consideration to validate the transfer.

- Tax Implications: Be aware of potential tax implications that may arise from the transfer of property. Consulting with a tax professional is advisable.

- Use Cases: Quitclaim Deeds are often used for transfers between family members, to clear up title issues, or to add or remove someone from the title.

- Limitations: This type of deed does not provide any warranties or guarantees about the property’s title. If there are existing liens or claims, the grantee assumes those risks.

- Legal Advice: While it is possible to complete a Quitclaim Deed without legal assistance, seeking advice from a real estate attorney can help avoid potential pitfalls.

Understanding these key points can help ensure a smoother property transfer process in Ohio using the Quitclaim Deed form.

Common mistakes

Filling out a Quitclaim Deed in Ohio can seem straightforward, but many people encounter pitfalls that can lead to complications down the road. One common mistake is failing to include the correct legal description of the property. This description must be precise, as it identifies the property being transferred. Omitting details or using vague terms can result in confusion or disputes later.

Another frequent error is neglecting to include the names of all parties involved. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. Incomplete or incorrect names can invalidate the deed, causing legal headaches for everyone involved.

Many individuals also overlook the importance of notarization. A Quitclaim Deed must be signed in the presence of a notary public to be legally binding. Failing to have the document notarized can render it ineffective, meaning the property transfer may not be recognized by the state.

Inaccurate dates can create confusion as well. It is essential to include the correct date of execution on the deed. This date marks when the transfer takes place and can impact the timeline of ownership. Errors here can lead to misunderstandings about when the property officially changes hands.

Another mistake involves the failure to check for existing liens or encumbrances on the property. Before transferring ownership, it's crucial to ensure that there are no outstanding debts or claims against the property. If these issues are not addressed, the grantee may inherit unwanted financial obligations.

Some individuals also forget to provide a clear statement of consideration, which is the amount paid for the property. While a Quitclaim Deed does not require a specific amount, including a nominal sum (like $1) can clarify the intent of the transaction and help avoid potential disputes.

Additionally, people often neglect to file the Quitclaim Deed with the county recorder's office after completion. This step is vital, as it officially records the transfer of ownership and provides public notice. Without this filing, the deed may not be enforceable against third parties.

Lastly, many individuals fail to seek legal advice before completing the Quitclaim Deed. Consulting with a real estate attorney can help identify potential issues and ensure that all necessary steps are taken. This guidance can save time, money, and stress in the long run.

Misconceptions

When it comes to the Ohio Quitclaim Deed, many people have misunderstandings that can lead to confusion. Here are seven common misconceptions:

-

Quitclaim Deeds Transfer Ownership Completely.

Many believe that a quitclaim deed transfers full ownership rights. While it does transfer whatever interest the grantor has, it does not guarantee that the grantor has any ownership to transfer.

-

Quitclaim Deeds Are Only for Family Transfers.

Although quitclaim deeds are often used among family members, they can be used in various situations, including sales between unrelated parties or to clear up title issues.

-

Quitclaim Deeds Are Always Risky.

While there is less protection compared to warranty deeds, quitclaim deeds can be safe when both parties understand the transaction and trust each other.

-

Quitclaim Deeds Eliminate Liens.

A quitclaim deed does not remove existing liens on the property. Buyers should conduct thorough title searches to uncover any financial claims against the property.

-

Quitclaim Deeds Are Only for Real Estate.

Although primarily used for real estate, quitclaim deeds can also be used for transferring interests in other types of property, like vehicles or personal belongings.

-

Once a Quitclaim Deed Is Signed, It Cannot Be Changed.

While a quitclaim deed is effective once signed and recorded, it can be revoked or modified if both parties agree and follow the proper legal procedures.

-

All Quitclaim Deeds Are the Same.

Quitclaim deeds can vary in format and language. It is essential to use the correct version that complies with Ohio laws and suits the specific needs of the transaction.

Understanding these misconceptions can help individuals make informed decisions regarding property transfers in Ohio. Always consider seeking professional guidance when dealing with real estate transactions.

Dos and Don'ts

When filling out the Ohio Quitclaim Deed form, it's important to approach the task with care. This document is a legal instrument that transfers property ownership, so accuracy is crucial. Below are four key things to keep in mind.

- Do ensure all information is accurate. Double-check names, addresses, and property descriptions to avoid any mistakes.

- Do sign the document in front of a notary. A notary public must witness your signature to validate the deed.

- Do provide a clear description of the property. Include details such as the parcel number and legal description to avoid confusion.

- Do keep a copy for your records. After the deed is executed, retain a copy for your personal files.

- Don't leave any blank spaces. Every section of the form should be completed to prevent delays in processing.

- Don't forget to check local requirements. Some counties may have specific rules or additional forms that need to be submitted.

- Don't use incorrect names or titles. Ensure that the names of all parties are spelled correctly and match legal documents.

- Don't rush the process. Take your time to review the form thoroughly before submission.

By following these guidelines, you can help ensure that your Quitclaim Deed is filled out correctly, making the process smoother for everyone involved.

Browse Popular Quitclaim Deed Forms for US States

Quit Claim Deed Instructions - This form does not eliminate mortgages or liens on the property being transferred.

Quitclaim Deed Pa - Being aware of the risks associated with this type of deed is essential for all parties involved.

Quit Claim Deed Form Georgia - Consideration for the transfer does not have to be monetary for a Quitclaim Deed.

For those looking to establish a clear rental agreement, the California Room Rental Agreement form is essential, as it serves as a legally binding contract between a landlord and a tenant for the rental of a room within a larger dwelling. This document outlines the specifics of the rental arrangement, including terms, rent amount, and duration. It ensures both parties have a clear understanding of their rights and responsibilities, providing a foundation for a harmonious rental relationship, which can be smoothly managed using resources like California PDF Forms.

Printable Quit Claim Deed Form - This deed simplifies processes during life changes, such as marriage or separation.

Detailed Guide for Writing Ohio Quitclaim Deed

Filling out the Ohio Quitclaim Deed form is a straightforward process. Once you complete the form, you will need to file it with the appropriate county recorder's office to ensure the transfer of property is legally recognized.

- Obtain the Ohio Quitclaim Deed form. You can find it online or at your local county recorder's office.

- Enter the name of the grantor (the person transferring the property) in the designated space. Ensure the name is accurate and matches official documents.

- Provide the name of the grantee (the person receiving the property) in the appropriate section. Again, accuracy is crucial.

- Include the property description. This should be detailed and may include the property address, parcel number, and any other identifying information.

- Specify the consideration amount, which is the value exchanged for the property. If no money is involved, you can state “love and affection” or a similar phrase.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Check that all required fields are filled out completely and accurately.

- Make copies of the completed and notarized Quitclaim Deed for your records.

- Submit the original Quitclaim Deed to the county recorder’s office for filing. Be prepared to pay any applicable recording fees.