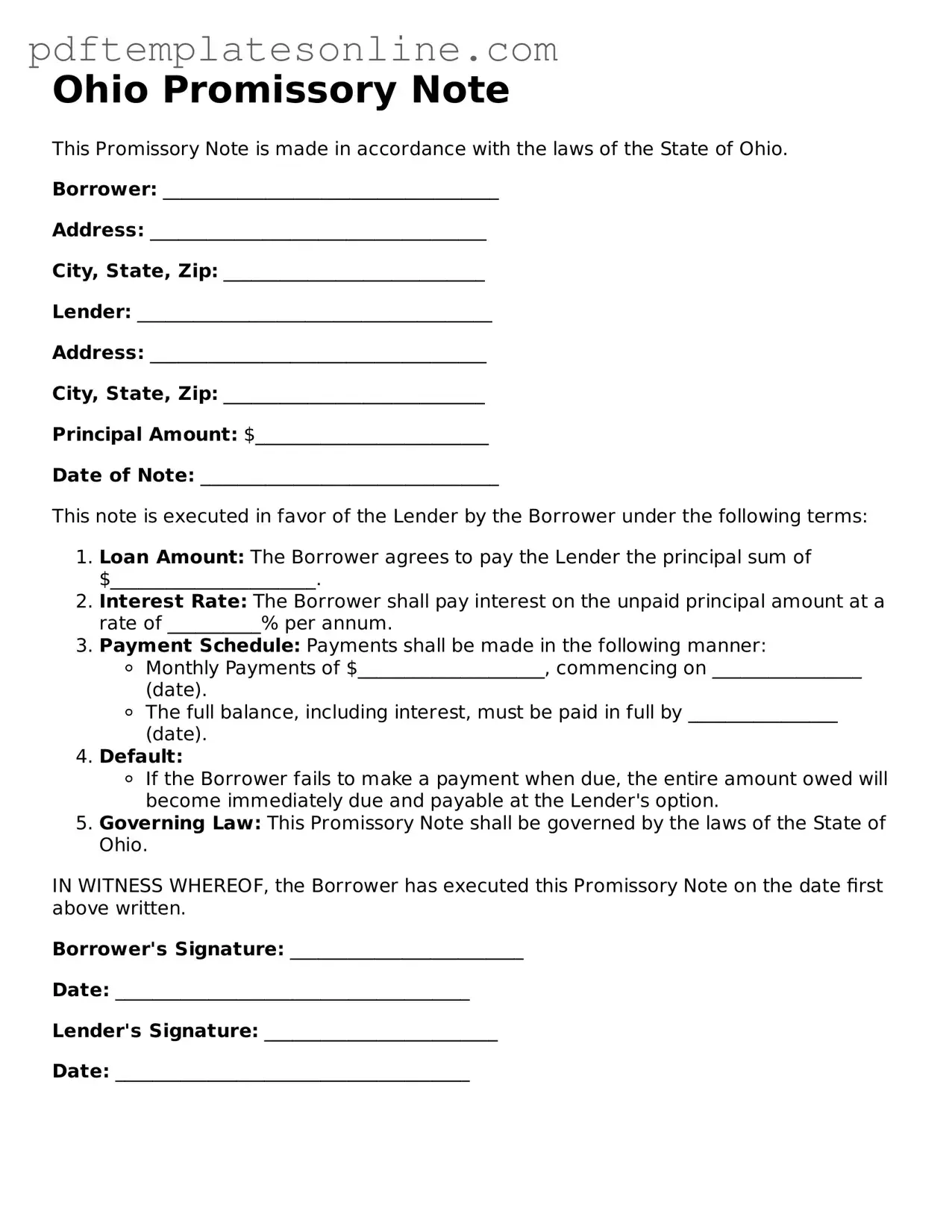

Official Ohio Promissory Note Document

Key takeaways

When filling out and using the Ohio Promissory Note form, it is essential to understand several key aspects to ensure that the document serves its intended purpose effectively.

- The promissory note must clearly state the amount of money being borrowed. This amount is crucial as it defines the borrower's obligation.

- Both the lender and the borrower should provide their full names and contact information. This information is necessary for any future correspondence related to the note.

- The repayment terms must be detailed. This includes the payment schedule, interest rate, and any late fees that may apply.

- It is important to specify the due date for the loan repayment. This clarity helps both parties understand when the obligation must be fulfilled.

- Signatures of both parties are required. Without these signatures, the note may not be legally binding.

- Consider having the document notarized. Notarization adds an extra layer of authenticity and can be beneficial if disputes arise in the future.

By paying attention to these key points, both lenders and borrowers can navigate the process of creating a promissory note more confidently.

Common mistakes

Filling out a promissory note can seem straightforward, but many people make common mistakes that can lead to confusion or legal issues down the line. One frequent error is neglecting to include the date. Without a clear date, it becomes challenging to determine when the loan was made, which can complicate matters if repayment becomes an issue.

Another common mistake is failing to specify the loan amount clearly. Writing an ambiguous figure or omitting the amount entirely can lead to disputes later. The amount should be written in both numerical and written form to ensure clarity. For instance, instead of just writing “500,” it should read “Five Hundred Dollars ($500).”

People often overlook the importance of including interest rates. If a borrower is expected to pay interest, it must be explicitly stated. Not mentioning an interest rate can create misunderstandings about the total amount due over time. If there is no interest, it’s wise to note that as well.

Another mistake involves the repayment terms. Some individuals might write vague terms like “when convenient” or “as agreed.” This lack of specificity can lead to confusion about when payments are due. Clear terms, such as “monthly payments of $100 starting on January 1, 2024,” are essential for avoiding future disputes.

Signatures are critical in a promissory note. Many people forget to sign the document or assume that a verbal agreement is sufficient. A signature from both the borrower and the lender is necessary to validate the note legally. Without signatures, the note may not hold up in court.

Additionally, failing to identify the parties involved can be a significant oversight. The full names and addresses of both the borrower and the lender should be included. This information ensures that both parties are clearly defined and can be easily contacted if necessary.

Some individuals mistakenly think they can use a generic template without tailoring it to their specific situation. While templates can be helpful, they should be customized to reflect the unique terms of the loan. This customization helps prevent misunderstandings and protects both parties.

Another frequent error is not considering the consequences of default. A promissory note should outline what happens if the borrower fails to repay the loan. Including provisions for late fees or legal actions can provide clarity and help both parties understand their rights and responsibilities.

People sometimes forget to keep copies of the signed promissory note. After filling it out, it’s crucial for both parties to retain a copy for their records. This ensures that everyone has access to the agreed-upon terms and can refer back to them if needed.

Lastly, many overlook the importance of having the document notarized. While notarization isn’t always required, it can add an extra layer of protection. A notary can verify the identities of the signers, making it harder for either party to dispute the validity of the agreement later.

Misconceptions

Understanding the Ohio Promissory Note form can be challenging due to various misconceptions. Here are ten common misunderstandings and clarifications about this important document:

- It must be notarized. Many believe that an Ohio Promissory Note requires notarization. In fact, notarization is not a requirement for the note to be legally binding, although it can provide an extra layer of security.

- Only banks can issue promissory notes. This is incorrect. Individuals and businesses can create and issue promissory notes, not just financial institutions.

- It must be in writing. While a written promissory note is preferred for clarity, oral agreements can also be enforceable. However, proving the terms of an oral agreement can be difficult.

- All promissory notes are the same. This is a misconception. Promissory notes can vary widely in terms of terms, conditions, and legal requirements, depending on the state and the specific agreement between parties.

- Interest rates must be included. While many promissory notes include interest rates, it is not a legal requirement. A note can be interest-free if both parties agree to those terms.

- They are only for loans. Promissory notes are often associated with loans, but they can also be used for other financial agreements, such as repayment for services rendered.

- They cannot be transferred. This is not true. Promissory notes can often be transferred or sold to another party, depending on the terms outlined in the note.

- There is no statute of limitations. Some believe that promissory notes are enforceable indefinitely. However, Ohio has a statute of limitations that applies, typically allowing for a period of six years to enforce the note.

- They are only valid if signed by both parties. While having both signatures is ideal, a promissory note can still be valid if it is signed by one party and accepted by the other, as long as the terms are clear.

- They are only for personal loans. This is a common misconception. Promissory notes can be used in business transactions, real estate deals, and various other financial arrangements.

By addressing these misconceptions, individuals can better understand how to utilize the Ohio Promissory Note form effectively and ensure that their agreements are clear and enforceable.

Dos and Don'ts

When completing the Ohio Promissory Note form, it is essential to follow specific guidelines to ensure accuracy and legality. Here is a list of things to do and avoid:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information about both the borrower and the lender.

- Do include the exact amount of the loan in numerical and written form.

- Do specify the interest rate clearly, if applicable.

- Do outline the repayment schedule in detail, including due dates.

- Don't leave any sections blank; every part of the form must be filled out.

- Don't use vague terms or unclear language when describing the loan terms.

- Don't forget to sign and date the document in the appropriate places.

- Don't overlook the need for witnesses or notarization, if required.

Following these guidelines will help ensure that the Promissory Note is valid and enforceable. Take the time to double-check your entries for accuracy.

Browse Popular Promissory Note Forms for US States

Texas Promissory Note Form - Using a promissory note helps protect the interests of both parties involved in a loan.

Promissory Note Template California Word - The lender has the right to seek payment through legal means if the borrower defaults.

Completing the EDD DE 2501 form accurately is vital for those seeking state disability insurance benefits in California, as it lays the groundwork for receiving necessary financial assistance during temporary disability. For further guidance on filling out this important document, you can visit https://mypdfform.com/blank-edd-de-2501/ for resources and additional information.

Promissory Note for Personal Loan - A vital record for tracking debts and payment obligations over time.

Notarized Promissory Note - Interest rates on the note can be fixed or variable, depending on the terms agreed upon.

Detailed Guide for Writing Ohio Promissory Note

Once you have the Ohio Promissory Note form ready, it is important to fill it out accurately to ensure clarity and enforceability. Follow these steps carefully to complete the form.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Identify the borrower. Write the full name and address of the individual or entity borrowing the money.

- Next, specify the lender's information. Include the full name and address of the individual or entity providing the loan.

- Clearly state the principal amount being borrowed. This should be a numerical figure followed by the written amount in words.

- Detail the interest rate. Indicate whether it is a fixed or variable rate and provide the percentage.

- Outline the repayment schedule. Specify the due date for each payment, including any grace periods.

- Include any late fees or penalties for missed payments. Clearly state the terms for these fees.

- Sign and date the form at the bottom. Ensure that both the borrower and lender sign the document.

After completing the form, make copies for both parties. It is advisable to keep the original in a safe place. Review the document to confirm that all information is accurate before finalizing any agreements.