Official Ohio Operating Agreement Document

Key takeaways

When filling out and using the Ohio Operating Agreement form, there are several key points to keep in mind to ensure clarity and compliance. Here are some essential takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures of your LLC. It serves as a foundational document that guides member interactions.

- Detail Member Contributions: Clearly specify each member's financial contributions and responsibilities. This helps prevent misunderstandings and ensures everyone is on the same page.

- Define Profit Distribution: Outline how profits and losses will be shared among members. This section should reflect the agreed-upon terms to avoid disputes later on.

- Establish Management Roles: Specify who will manage the LLC and their respective duties. This clarity is crucial for smooth operations and decision-making.

- Include Amendment Procedures: Outline how changes can be made to the Operating Agreement. This flexibility allows the document to evolve as the business grows.

- Seek Legal Guidance: While the form provides a framework, consulting with a legal professional can help ensure that your agreement complies with Ohio laws and meets your specific needs.

By focusing on these key areas, you can create a comprehensive Operating Agreement that supports the success of your LLC in Ohio.

Common mistakes

When filling out the Ohio Operating Agreement form, many individuals make common mistakes that can lead to confusion or legal issues down the line. One frequent error is failing to include all members' names. Each member's name should be clearly stated in the agreement. Omitting a member can create disputes about ownership and responsibilities.

Another mistake is not specifying the management structure of the business. It is essential to clarify whether the company will be member-managed or manager-managed. This decision impacts how the business operates daily and who has the authority to make decisions.

Some people overlook the importance of detailing each member's financial contributions. Clearly outlining how much each member invests helps prevent misunderstandings regarding ownership percentages and profit distribution. Without this information, disputes may arise over financial expectations.

Additionally, many individuals forget to include procedures for handling disputes. It is wise to establish a method for resolving disagreements among members. This could involve mediation or arbitration. Having a clear plan in place can save time and money if conflicts occur.

Another common error is neglecting to update the Operating Agreement when changes occur. If a member leaves or new members join, the agreement should reflect these changes. Keeping the document current ensures that it accurately represents the business's structure and operations.

Finally, some people fail to sign and date the agreement properly. A signed Operating Agreement is a legally binding document. Without proper signatures, the agreement may not hold up in court. Always ensure that all members sign and date the document to validate it.

Misconceptions

Understanding the Ohio Operating Agreement form is essential for anyone involved in a limited liability company (LLC) in Ohio. However, several misconceptions can cloud this understanding. Here are nine common misconceptions and clarifications about the form:

- It is not necessary to have an Operating Agreement. Many people believe that an Operating Agreement is optional. In Ohio, while it is not legally required, having one is highly recommended to outline the management structure and operational procedures of the LLC.

- All members must sign the Operating Agreement. Some think that every member's signature is mandatory for the agreement to be valid. In reality, as long as the agreement is adopted by the members, it can be valid even if not all members sign it.

- Operating Agreements are only for large companies. This misconception suggests that only large LLCs need an Operating Agreement. In truth, all LLCs, regardless of size, can benefit from having a clear agreement to avoid disputes and clarify roles.

- Once created, the Operating Agreement cannot be changed. Many believe that the Operating Agreement is set in stone. However, it can be amended as needed, provided that the process for amendments is outlined within the agreement itself.

- The Operating Agreement must be filed with the state. Some think that the Operating Agreement needs to be submitted to the Ohio Secretary of State. This is incorrect; the agreement is an internal document and does not need to be filed.

- All provisions in the Operating Agreement are enforceable. While many provisions are enforceable, some may not be valid if they contradict state laws. It’s important to ensure that the agreement complies with Ohio law.

- Operating Agreements are only for multi-member LLCs. A common belief is that single-member LLCs do not need an Operating Agreement. However, having one can still provide clarity and protection for the owner.

- The Operating Agreement is the same as the Articles of Organization. Some confuse the two documents. The Articles of Organization are filed with the state to form the LLC, while the Operating Agreement outlines the internal workings of the LLC.

- Creating an Operating Agreement is too complicated. Many people think that drafting an Operating Agreement is a daunting task. In reality, templates and resources are available to simplify the process and help tailor the agreement to specific needs.

By dispelling these misconceptions, individuals can better understand the importance of the Ohio Operating Agreement and ensure their LLC operates smoothly.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, it's important to approach the task with care and attention to detail. Here are some essential dos and don'ts to guide you through the process.

- Do ensure that all members' names and addresses are accurately listed.

- Do clearly define the management structure of the LLC.

- Do include provisions for profit and loss distribution among members.

- Do review the document thoroughly before submitting it to avoid errors.

- Don't leave any sections blank; all required fields must be completed.

- Don't use vague language; be specific in your terms and definitions.

- Don't ignore state regulations; ensure compliance with Ohio laws.

- Don't rush the process; take your time to ensure accuracy.

Browse Popular Operating Agreement Forms for US States

Operating Agreement Llc California Template - It can help in securing financing or partnerships by demonstrating structure.

The Profit and Loss form is a crucial tool that helps businesses summarize their revenues, costs, and expenses over a designated timeframe. To effectively evaluate your company's financial performance and gain a clearer understanding of its overall health, it is advisable to utilize the Profit And Loss form as part of your financial analysis strategy.

How to Make an Operating Agreement - It may define how the business pays its employees and contractors.

What Is an Llc Business - It includes provisions for adding new members or handling the exit of existing members.

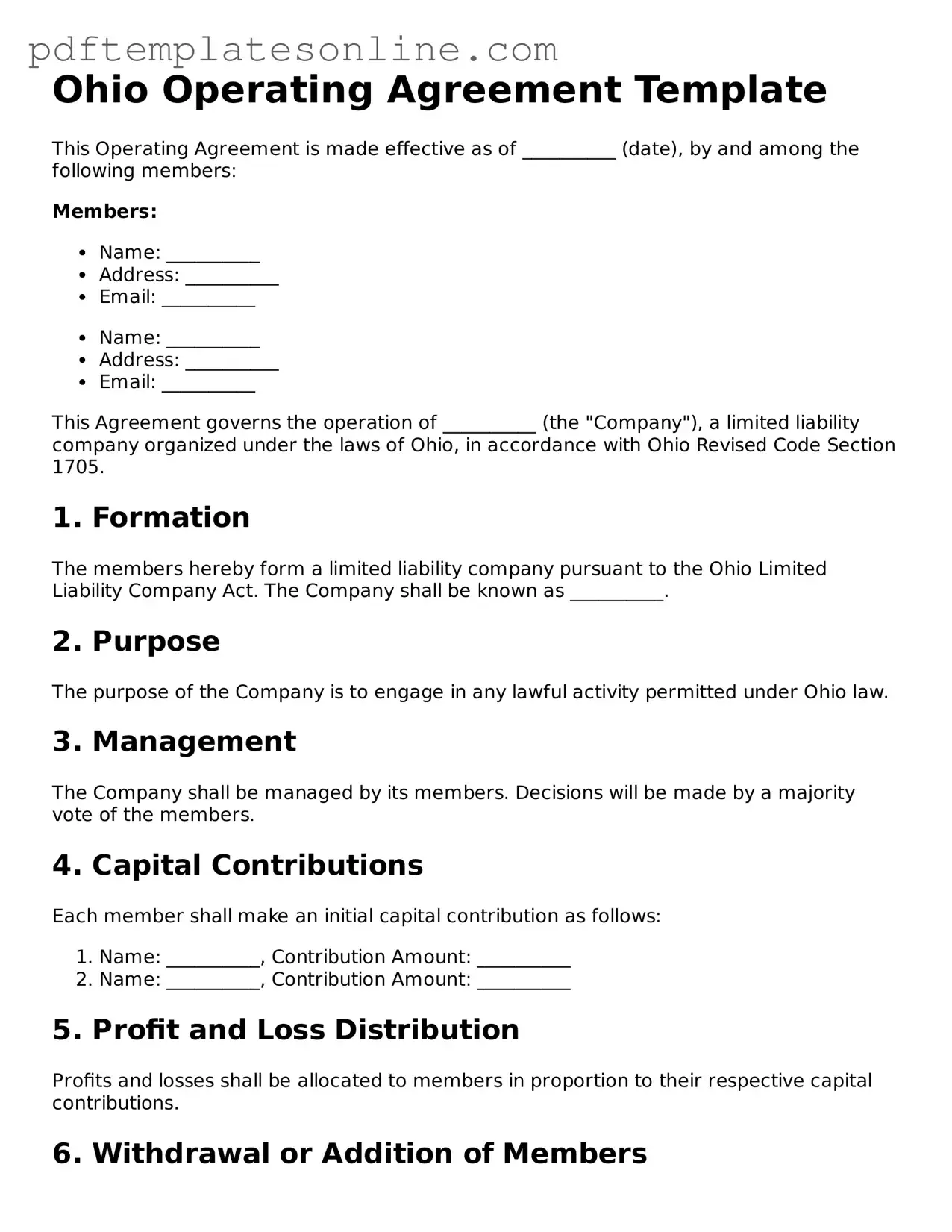

Detailed Guide for Writing Ohio Operating Agreement

Once you have the Ohio Operating Agreement form in hand, it's important to ensure that all sections are completed accurately. This form serves as a foundational document for your business, detailing the structure and operational guidelines. Follow these steps carefully to fill it out correctly.

- Begin with the name of your LLC. Write the full legal name as it appears in your Articles of Organization.

- Next, provide the principal office address. This should be the main location where your business operates.

- List the names and addresses of all members. Include each member's full name and their respective addresses.

- Indicate the management structure. Specify whether the LLC will be member-managed or manager-managed.

- Outline the purpose of the LLC. Describe the business activities your LLC will engage in.

- Detail the capital contributions. State the amount each member is contributing to the LLC.

- Explain the distribution of profits and losses. Clarify how profits and losses will be allocated among members.

- Include provisions for meetings. Specify how often meetings will occur and the procedures for calling them.

- Describe the process for adding or removing members. Outline the steps that will be taken if a member needs to be added or removed.

- Finally, have all members sign and date the document. Ensure that each member's signature is present for validity.