Official Ohio Motor Vehicle Bill of Sale Document

Key takeaways

When filling out and using the Ohio Motor Vehicle Bill of Sale form, keep these key points in mind:

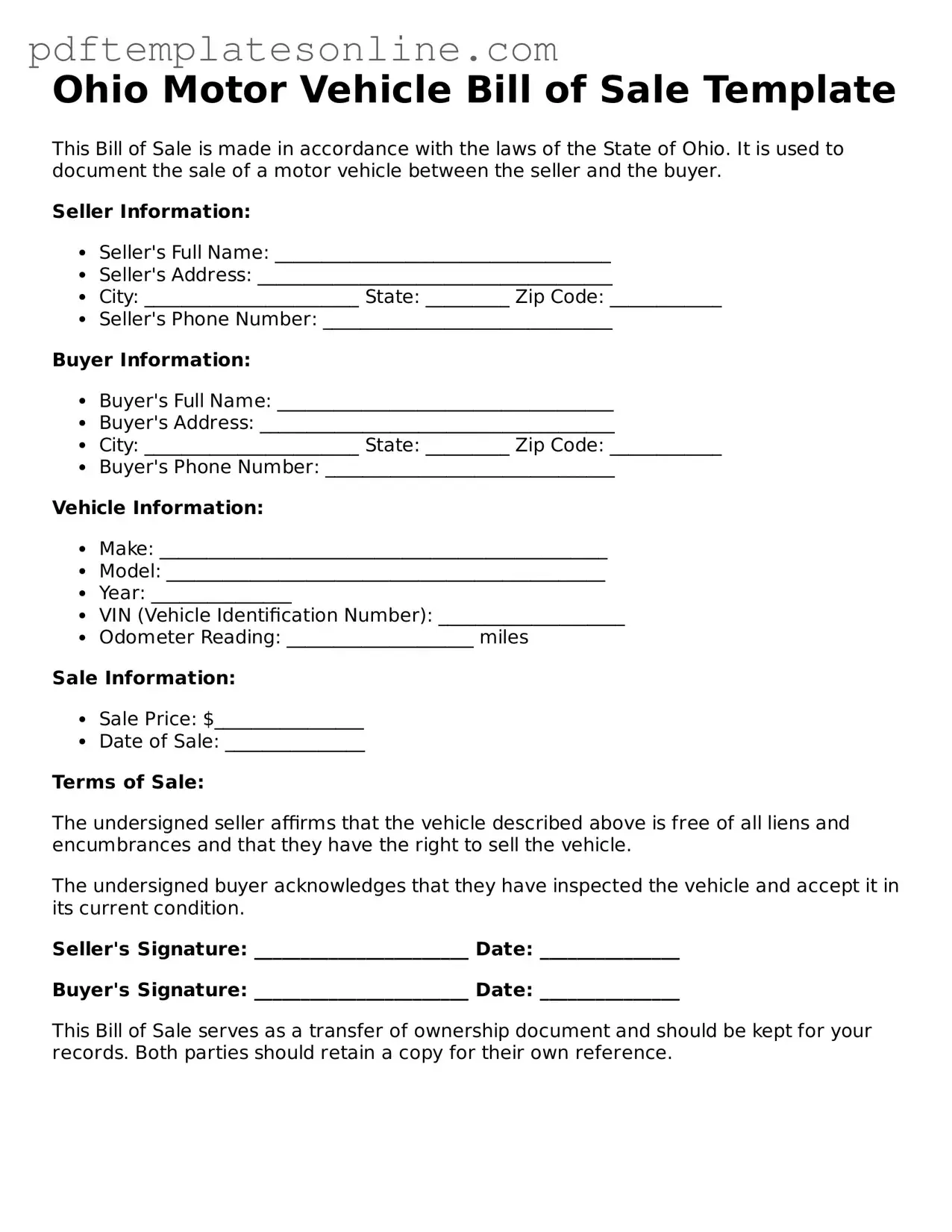

- Complete Information: Ensure all fields are filled out accurately, including the buyer's and seller's names, addresses, and contact information.

- Vehicle Details: Provide specific information about the vehicle, such as the make, model, year, VIN, and odometer reading.

- Purchase Price: Clearly state the purchase price of the vehicle to avoid any misunderstandings.

- Signatures Required: Both the buyer and seller must sign the form for it to be valid. Make sure to include the date of the transaction.

- Notarization: While not required, having the bill of sale notarized can add an extra layer of security and authenticity.

- Keep Copies: Both parties should retain a copy of the completed bill of sale for their records.

- Transfer of Ownership: This document serves as proof of ownership transfer and should be submitted when registering the vehicle.

- Tax Implications: Be aware that the purchase price may affect sales tax obligations, so keep that in mind when completing the form.

- State Requirements: Always check for any updates or changes to Ohio state laws regarding vehicle sales to ensure compliance.

Common mistakes

Filling out the Ohio Motor Vehicle Bill of Sale form is an important step in the process of transferring ownership of a vehicle. However, many individuals make common mistakes that can lead to complications down the line. One frequent error is neglecting to include all necessary information about the vehicle. This includes the Vehicle Identification Number (VIN), make, model, and year. Omitting any of these details can create confusion and may affect the validity of the sale.

Another common mistake is failing to provide accurate information about the buyer and seller. Both parties' names, addresses, and signatures must be included. If any of this information is incorrect or incomplete, it may result in disputes or delays in the registration process. Additionally, forgetting to sign the form is a significant oversight. Without signatures from both the buyer and seller, the document lacks authenticity and may not be accepted by the Ohio Bureau of Motor Vehicles.

Many individuals also overlook the importance of including the sale price. This figure should be clearly stated, as it is essential for tax purposes. Failing to report the correct sale price can lead to issues with the state, including penalties. Furthermore, some people forget to date the bill of sale. A date is crucial as it establishes when the transfer of ownership occurred, which can be vital in case of future legal disputes.

Another mistake involves not providing a clear description of the vehicle’s condition. It is wise to note any existing damages or issues. This transparency protects both the buyer and seller by ensuring that both parties are aware of the vehicle's status. In some cases, sellers may also fail to disclose whether there are any liens on the vehicle. Not mentioning this can lead to complications for the buyer, who may find themselves responsible for debts attached to the vehicle.

Some individuals mistakenly assume that a verbal agreement is sufficient. A bill of sale serves as a legal document that provides proof of the transaction. Relying solely on a verbal agreement can lead to misunderstandings and disputes. Additionally, it is essential to keep a copy of the completed bill of sale for personal records. Failing to do so can create difficulties if questions arise regarding the transaction in the future.

Lastly, many people do not take the time to review the entire form before submission. Errors can easily be overlooked, but a careful review can help identify and correct mistakes before they become problematic. Taking the time to ensure all information is accurate and complete can save both parties from potential headaches in the future.

Misconceptions

Here are eight common misconceptions about the Ohio Motor Vehicle Bill of Sale form:

- It is only necessary for private sales. Many believe that a Bill of Sale is only required when selling a vehicle privately. However, it is also useful for dealership transactions to document the sale.

- It must be notarized. Some think that notarization is mandatory for the Bill of Sale to be valid. In Ohio, notarization is not required, but it can provide additional proof of the transaction.

- It is not needed if the title is signed over. While signing over the title is essential, a Bill of Sale serves as a separate record of the transaction and can be beneficial for both parties.

- All sales require a Bill of Sale. Not every transaction requires a Bill of Sale. For instance, if the vehicle is a gift or inherited, a Bill of Sale may not be necessary.

- Only the seller needs to keep a copy. Both the buyer and seller should retain a copy of the Bill of Sale for their records, as it can help resolve future disputes.

- It cannot be used for trade-ins. Some believe that a Bill of Sale is not applicable for trade-ins. However, it can document the value of the trade-in vehicle and the new purchase.

- It is the same as a receipt. While a Bill of Sale and a receipt both document a transaction, the Bill of Sale includes more detailed information about the vehicle and the parties involved.

- It is only for cars. The Bill of Sale can be used for various types of vehicles, including motorcycles, boats, and trailers, not just cars.

Dos and Don'ts

When filling out the Ohio Motor Vehicle Bill of Sale form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of things you should and shouldn’t do:

- Do double-check all information before submitting the form.

- Do include the vehicle identification number (VIN) accurately.

- Do provide the correct names and addresses of both the buyer and seller.

- Do indicate the sale price clearly.

- Do sign and date the form appropriately.

- Don't leave any required fields blank.

- Don't use abbreviations that could cause confusion.

- Don't forget to keep a copy for your records.

- Don't alter any information after signing the document.

- Don't forget to check for any local requirements that may apply.

By following these guidelines, you can ensure that your Bill of Sale is completed correctly, which will help facilitate a smooth transaction.

Browse Popular Motor Vehicle Bill of Sale Forms for US States

Texas Auto Bill of Sale - Encourages responsible ownership transfers among individuals and dealerships.

Trailer Bill of Sale Georgia - With clear documentation, the risks associated with buying or selling a vehicle can be significantly reduced.

Dmv Statement of Facts - A copy of the completed form should be retained by both parties for their records.

Detailed Guide for Writing Ohio Motor Vehicle Bill of Sale

Once you have the Ohio Motor Vehicle Bill of Sale form in hand, you can begin the process of filling it out. This form is essential for documenting the sale of a vehicle, and it ensures that both the buyer and seller have a record of the transaction. Follow the steps below to complete the form accurately.

- Obtain the Form: Download the Ohio Motor Vehicle Bill of Sale form from the Ohio Bureau of Motor Vehicles website or obtain a physical copy from a local BMV office.

- Enter the Date: Write the date of the sale at the top of the form.

- Fill in Seller Information: Provide the seller's full name, address, and phone number in the designated sections.

- Fill in Buyer Information: Enter the buyer's full name, address, and phone number in the appropriate fields.

- Vehicle Details: Include the vehicle's make, model, year, color, and Vehicle Identification Number (VIN).

- Sale Price: Write the total sale price of the vehicle in the specified area.

- Odometer Reading: Record the odometer reading at the time of sale to ensure transparency regarding the vehicle's mileage.

- Signatures: Both the seller and buyer must sign and date the form to validate the transaction.

- Provide Copies: Make copies of the completed form for both the buyer and seller for their records.

After completing the form, the next step is to ensure that the buyer registers the vehicle in their name at the local BMV office. This will involve providing the completed Bill of Sale along with any other required documentation.