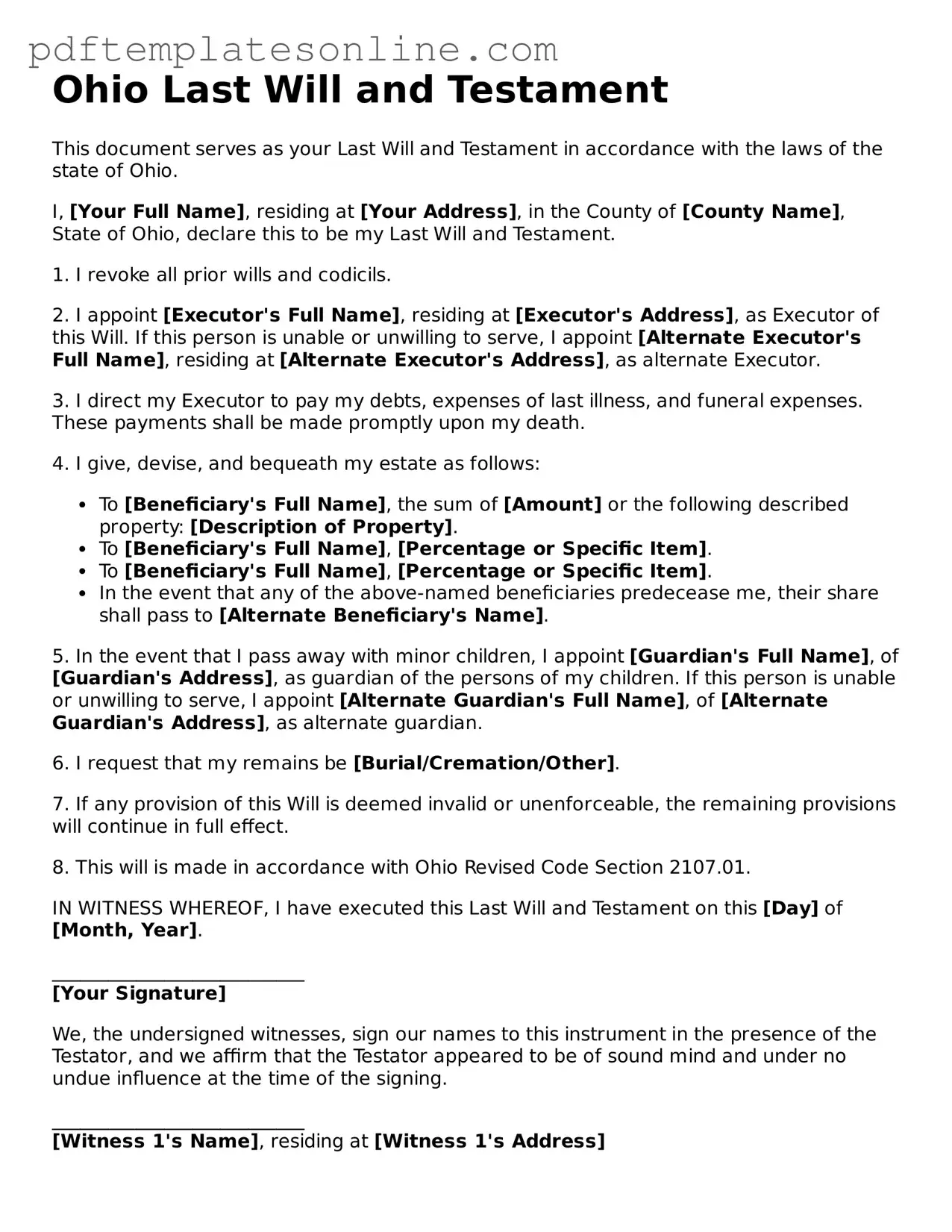

Official Ohio Last Will and Testament Document

Key takeaways

Filling out and using the Ohio Last Will and Testament form is an important step in ensuring your wishes are honored after your passing. Here are some key takeaways to consider:

- Clear Identification: Make sure to clearly identify yourself in the will. Include your full name, address, and any other relevant personal information.

- Executor Selection: Choose a trustworthy executor. This person will be responsible for carrying out your wishes, so select someone who is reliable and organized.

- Specific Bequests: Clearly outline your wishes regarding specific assets. Be precise about who receives what to avoid confusion or disputes among beneficiaries.

- Signatures and Witnesses: Ensure your will is signed and dated. Ohio law requires that your will be witnessed by at least two individuals who are not beneficiaries.

Common mistakes

Filling out the Ohio Last Will and Testament form can be a daunting task. Many individuals make common mistakes that can lead to confusion or even invalidate the will. Awareness of these pitfalls can help ensure that your intentions are clearly communicated.

One frequent mistake is not clearly identifying the testator. The form should include the full legal name of the person creating the will. Omitting middle names or using nicknames can lead to complications later. Always use the name as it appears on official documents.

Another error occurs when individuals fail to sign the will in the presence of witnesses. Ohio law requires that the will be signed by the testator and witnessed by at least two individuals. If this step is overlooked, the will may not hold up in court.

Many people also neglect to date the will. Including the date is crucial as it helps to establish the most current version of the will. Without a date, it can become challenging to determine which document reflects the testator's latest wishes.

Some individuals mistakenly assume that a handwritten will is automatically valid. While Ohio does recognize holographic wills, they must still meet specific criteria. If the will is not properly formatted or lacks necessary signatures, it may be deemed invalid.

Another common oversight is failing to name an executor. The executor is responsible for carrying out the terms of the will. Without this designation, the probate court may appoint someone who may not align with the testator's wishes.

It is also important to be specific when naming beneficiaries. Vague language can lead to disputes among family members. Clearly identifying beneficiaries and their respective shares can help prevent misunderstandings.

Lastly, people often forget to update their wills after significant life events. Changes such as marriage, divorce, or the birth of a child can impact how assets should be distributed. Regularly reviewing and updating the will ensures that it accurately reflects current intentions.

Misconceptions

Understanding the Ohio Last Will and Testament form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- Only wealthy individuals need a will. Many people believe that a will is only necessary for those with substantial assets. In reality, anyone can benefit from having a will, regardless of their financial situation. A will ensures that your wishes are followed regarding your property and guardianship of dependents.

- A will is only needed if you have minor children. Some think that a will is only necessary if they have children. However, a will can help dictate how all assets are distributed, making it important for everyone, including those without children.

- Oral wills are valid in Ohio. Many people assume that a verbal agreement about their wishes is sufficient. In Ohio, oral wills are not recognized. A written will is required to ensure that your intentions are legally binding.

- Once created, a will cannot be changed. There is a misconception that a will is permanent once it is signed. In fact, you can modify or revoke your will at any time as long as you follow the legal requirements for doing so.

- All assets automatically go to the spouse. Some individuals believe that their spouse will automatically inherit everything. While a spouse may have rights to certain assets, a will clarifies your wishes and can help prevent disputes.

- Wills are only for after death. Many think that a will only matters after someone passes away. However, having a will can also assist in managing your affairs if you become incapacitated, ensuring that your preferences are respected.

Dos and Don'ts

When preparing your Ohio Last Will and Testament, it is essential to approach the task with care and attention. Here are some guidelines to help you navigate the process effectively.

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Do clearly state your intentions regarding the distribution of your assets.

- Do name an executor who will be responsible for carrying out your wishes.

- Do have witnesses present when you sign your will to validate it.

- Don't use vague language that could lead to confusion about your wishes.

- Don't forget to update your will after major life events, such as marriage or the birth of a child.

- Don't assume that a handwritten will is automatically valid; follow Ohio's legal requirements for wills.

By adhering to these guidelines, you can create a clear and effective Last Will and Testament that reflects your wishes and protects your loved ones. Taking the time to do this correctly can provide peace of mind for you and your family.

Browse Popular Last Will and Testament Forms for US States

Is It Legal to Write Your Own Will - A legal document outlining an individual's wishes for the distribution of their property after death.

Free Ny Will Template - A proactive step in estate planning that can relieve significant stress for family members.

California Holographic Will - Can include a letter of wishes for additional guidance to the executor.

A Texas Durable Power of Attorney form is essential for individuals who want to ensure that their financial and healthcare decisions are managed by a trusted person in case they become unable to make such decisions themselves. This legal document allows for a seamless transition of authority and remains effective even if the individual becomes incapacitated. For those looking to take proactive steps in planning their future, utilizing a Durable Power of Attorney form is a crucial step—get started by clicking the button below.

Simple Will Template Georgia - This form can address any specific wishes you have for your estate's management.

Detailed Guide for Writing Ohio Last Will and Testament

Filling out the Ohio Last Will and Testament form is an important step in ensuring that your wishes regarding your estate are honored after your passing. It is essential to approach this task with care and thoughtfulness, as it involves making decisions about your assets and how they will be distributed. Once you have completed the form, you will need to sign it in the presence of witnesses, ensuring that it meets Ohio's legal requirements.

- Begin by clearly writing your full name at the top of the form.

- Specify your current address, including city, state, and zip code.

- State your intention to create a Last Will and Testament by including a declaration such as "This is my Last Will and Testament."

- List your assets, including real estate, bank accounts, personal property, and any other items of value.

- Designate an executor, the person who will be responsible for carrying out your wishes as outlined in the will. Include their full name and contact information.

- Indicate how you wish your assets to be distributed among your beneficiaries. Clearly name each beneficiary and specify what they will receive.

- Include provisions for any minor children, if applicable, such as naming a guardian.

- Review the completed form for accuracy and clarity, ensuring that all necessary information is included.

- Sign the form in the presence of at least two witnesses, who should also sign the document. Ensure that these witnesses are not beneficiaries of the will.

- Consider having the will notarized to add an extra layer of authenticity, although this is not required in Ohio.