Official Ohio General Power of Attorney Document

Key takeaways

Filling out and using the Ohio General Power of Attorney form is an important step in managing your affairs. Here are key takeaways to consider:

- Understand the Purpose: This form allows you to designate someone to act on your behalf in financial and legal matters.

- Choose Your Agent Wisely: Select a trustworthy individual who understands your wishes and will act in your best interest.

- Be Specific: Clearly outline the powers you are granting. This can include managing bank accounts, signing documents, or making investment decisions.

- Consider Limitations: You can set limits on the authority granted to your agent. Specify any restrictions to ensure your preferences are followed.

- Sign and Notarize: The form must be signed in the presence of a notary public to be valid. This adds a layer of protection and legitimacy.

- Review Regularly: Life circumstances change. Periodically review your Power of Attorney to ensure it still meets your needs and reflects your current situation.

Common mistakes

Filling out the Ohio General Power of Attorney form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to specify the powers granted. The form allows for broad or limited authority. When individuals do not clearly outline the powers they wish to grant, it can create confusion and lead to disputes down the line. It's crucial to take the time to understand what powers are necessary and to list them explicitly.

Another mistake is neglecting to date the document. A power of attorney is only valid if it is signed and dated. Without a date, it may be questioned when the authority begins or whether it is still in effect. This oversight can lead to complications, especially if the principal’s condition changes and the agent needs to act on their behalf. Always ensure that the document is dated at the time of signing.

People often overlook the importance of having witnesses or a notary. In Ohio, while it is not always required, having a notary can add an extra layer of validity to the document. If the form is not notarized, it may be challenged in certain situations. It is wise to check the requirements and ensure that the document is properly executed to avoid any future issues.

Lastly, individuals sometimes forget to communicate their intentions with their chosen agent. Even if the form is filled out correctly, if the agent is unaware of their responsibilities or the principal’s wishes, it can lead to misunderstandings. Open communication is essential. Discussing the powers granted and any specific instructions ensures that the agent understands their role and can act in the best interest of the principal.

Misconceptions

Understanding the Ohio General Power of Attorney (GPOA) form is essential for anyone considering this legal document. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: A General Power of Attorney is the same as a Durable Power of Attorney.

- Misconception 2: The agent can do anything they want with the principal's assets.

- Misconception 3: A General Power of Attorney must be notarized to be valid.

- Misconception 4: Once a General Power of Attorney is signed, it cannot be revoked.

This is not accurate. A General Power of Attorney typically becomes invalid if the principal (the person granting the authority) becomes incapacitated. In contrast, a Durable Power of Attorney remains effective even if the principal loses the ability to make decisions.

While the agent does have significant authority, their powers are not unlimited. The agent must act in the best interest of the principal and follow the guidelines set forth in the GPOA. Misusing the authority can lead to legal consequences.

Although notarization is highly recommended for the GPOA to ensure its acceptance by banks and other institutions, it is not strictly required under Ohio law. However, having the document notarized can help avoid disputes regarding its validity.

This is incorrect. The principal retains the right to revoke the GPOA at any time, as long as they are mentally competent. Revocation should be done in writing and communicated to the agent and any relevant institutions to ensure clarity.

Dos and Don'ts

When filling out the Ohio General Power of Attorney form, it’s important to follow certain guidelines to ensure that the document is valid and meets your needs. Here’s a list of things you should and shouldn’t do:

- Do clearly identify the person you are granting power to. Use their full legal name.

- Do specify the powers you are granting. Be as detailed as possible to avoid confusion.

- Do sign the document in front of a notary public. This adds an extra layer of validity.

- Do keep a copy of the signed document for your records.

- Don't leave any sections blank. Fill out every part of the form to prevent any misunderstandings.

- Don't choose someone who you do not trust. The person you designate will have significant control over your affairs.

- Don't forget to review the document regularly. Changes in your life may require updates to the power of attorney.

Browse Popular General Power of Attorney Forms for US States

Nys Power of Attorney Form - General Power of Attorney is about choosing your advocates and ensuring your wishes come first.

The California Notary Acknowledgment form is an essential document used to verify the authenticity of a signer's identity and signature in legal documents. To facilitate this process, you can utilize resources such as California PDF Forms, which provide easy access to the necessary forms. This process ensures that the signer appears before the Notary Public, confirms their identity, and acknowledges their signature willingly and under their own power, thereby preventing fraud and maintaining the integrity of legal documents.

General Power of Attorney Form Georgia - This document can be particularly useful for elderly individuals planning for future care.

Detailed Guide for Writing Ohio General Power of Attorney

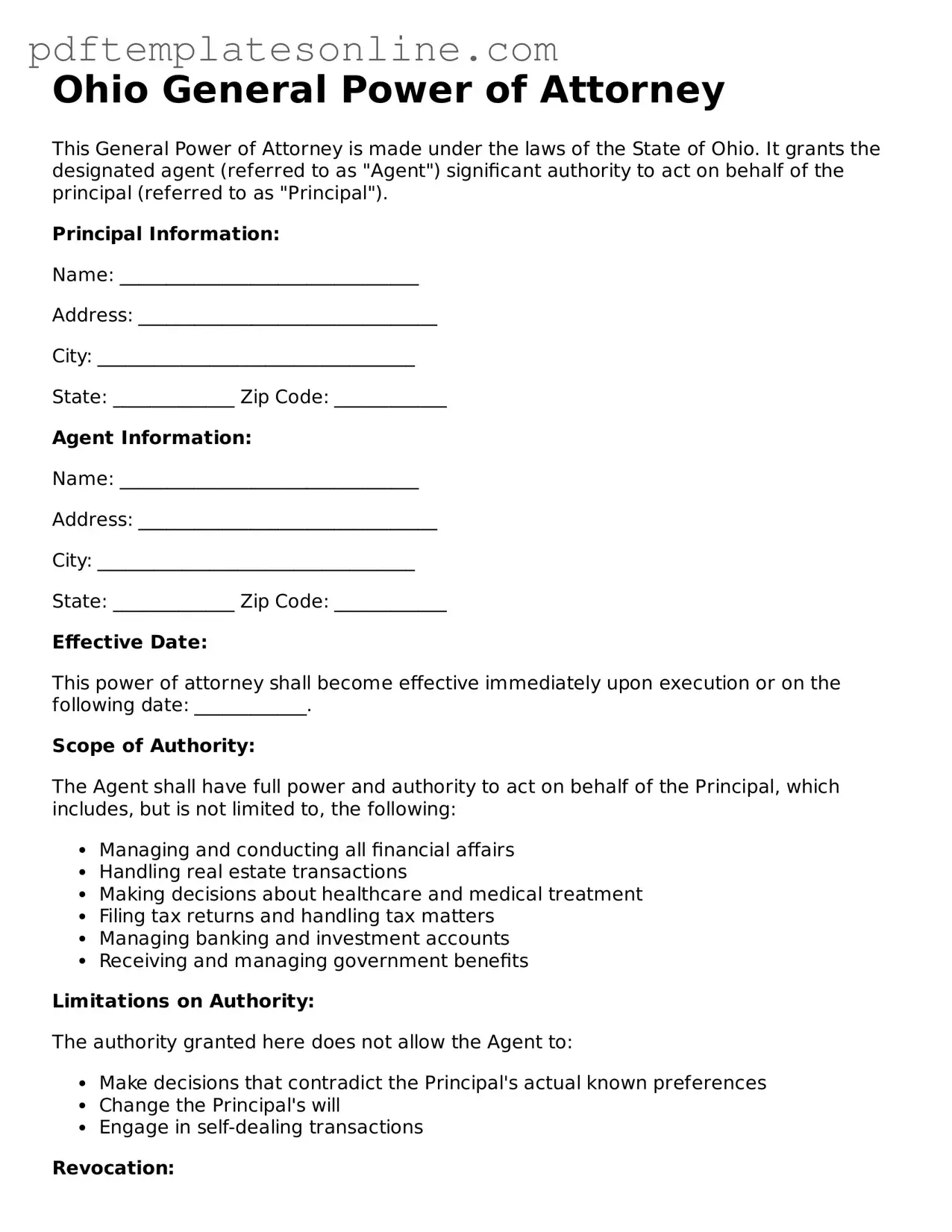

Filling out the Ohio General Power of Attorney form is an important task that requires careful attention to detail. Once completed, the form allows you to designate someone to act on your behalf in financial or legal matters. Follow these steps to ensure the form is filled out correctly.

- Obtain the Ohio General Power of Attorney form. You can find it online or at a local legal office.

- Read the instructions carefully to understand the requirements and implications of the form.

- Fill in your name and address in the designated section as the "Principal." This identifies you as the person granting authority.

- Provide the name and address of the person you are appointing as your "Agent." This individual will have the authority to act on your behalf.

- Specify the powers you are granting to your Agent. You may choose to give broad or limited powers based on your needs.

- If applicable, include any specific limitations or conditions regarding the Agent's authority.

- Sign and date the form in the presence of a notary public. This step is crucial for the validity of the document.

- Provide copies of the signed form to your Agent and any relevant financial institutions or entities.