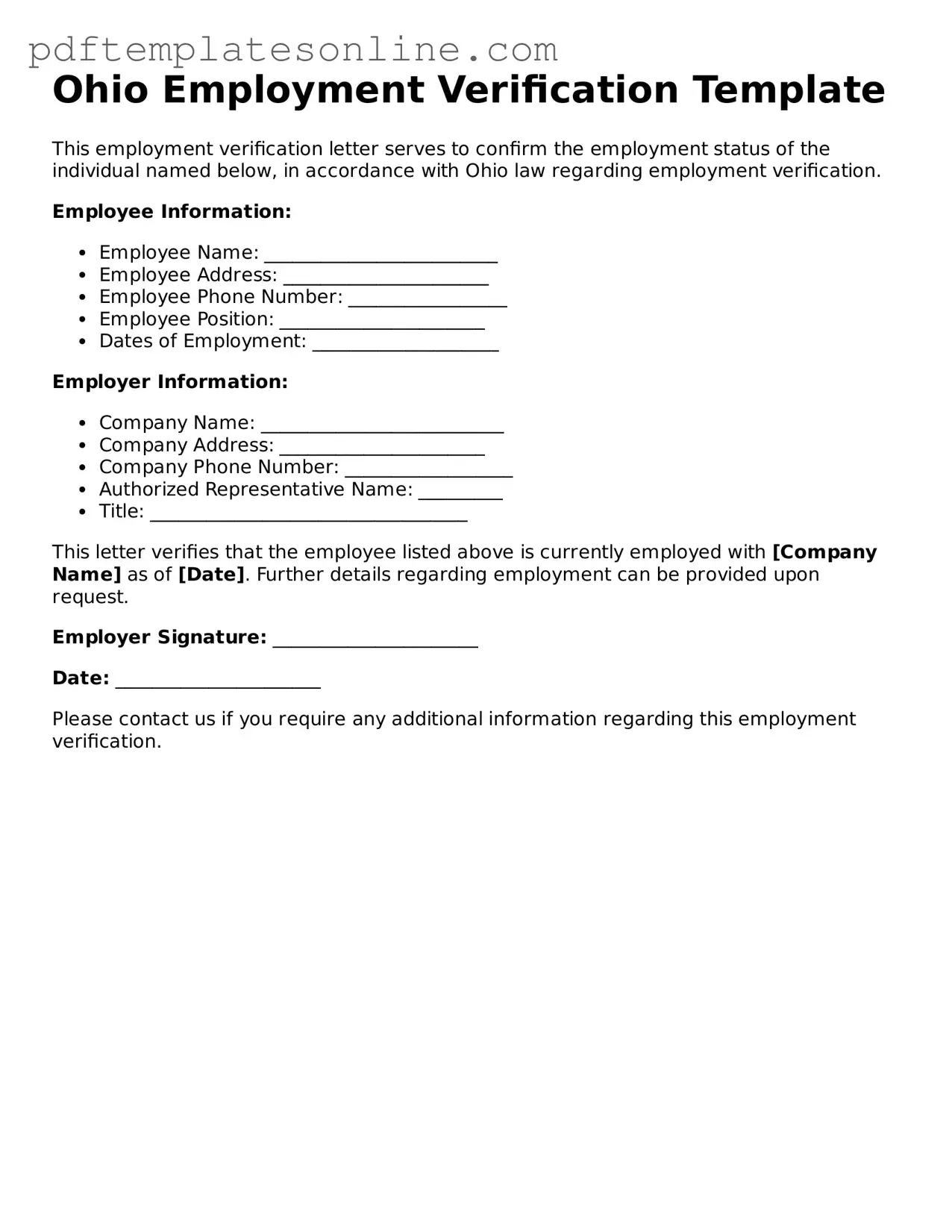

Official Ohio Employment Verification Document

Key takeaways

When filling out and using the Ohio Employment Verification form, it is essential to understand several key points to ensure accuracy and compliance. Below are important takeaways to consider:

- The form is designed to confirm an employee's job status and income, which may be required for various purposes, including loan applications and public assistance.

- Accurate completion of the form is crucial. Ensure all information is correct to avoid delays or complications.

- Both the employer and employee must sign the form. This signature verifies the authenticity of the information provided.

- Employers should provide clear and concise information regarding the employee’s position, dates of employment, and salary.

- Employees should review the completed form for accuracy before submission to ensure that all details reflect their employment situation.

- Keep a copy of the completed form for personal records. This can be helpful for future reference or disputes.

- Submit the form to the appropriate agency or institution promptly to prevent any delays in processing your request.

- Be aware of privacy concerns. Only share the form with authorized parties who require this information.

- If any issues arise during the verification process, contact the employer or the requesting agency for clarification and assistance.

Common mistakes

Completing the Ohio Employment Verification form can be straightforward, but many individuals make common mistakes that can delay the process. One frequent error is providing inaccurate personal information. This includes misspellings of names or incorrect Social Security numbers. Even a small typo can lead to significant complications, so double-checking this information is essential.

Another mistake involves omitting necessary details about employment history. Applicants sometimes forget to include previous job titles, dates of employment, or the names of past employers. This omission can raise questions about a candidate's qualifications and work experience. It is vital to ensure that all relevant employment history is thoroughly documented.

People also often overlook the importance of signatures. Failing to sign the form can result in immediate rejection. It’s crucial to sign and date the form in the designated areas. Remember, a signature signifies that the information provided is accurate and complete.

In addition, individuals may not provide the required supporting documentation. The form often requires additional paperwork, such as pay stubs or tax forms, to verify employment. Neglecting to include these documents can stall the verification process. Always check the form's requirements to ensure all necessary attachments are included.

Another common issue is the failure to follow the submission guidelines. Each form has specific instructions regarding how and where to submit it. Ignoring these guidelines can lead to delays or rejection. Make sure to read the instructions carefully and submit the form according to the specified procedures.

Some applicants mistakenly assume that the form is only for current employment. However, it is essential to include all relevant employment history, even if it is from years ago. Providing a complete picture of your work history can enhance your credibility and help avoid any misunderstandings.

Lastly, individuals may rush through the form without reviewing their entries. Taking the time to proofread can catch errors that might otherwise go unnoticed. A thorough review can save time and prevent complications down the line. Always take a moment to ensure everything is correct before submitting the form.

Misconceptions

Understanding the Ohio Employment Verification form is crucial for both employers and employees. However, several misconceptions often arise regarding its use and purpose. Below are four common misconceptions, along with explanations to clarify them.

- The form is only for new hires. Many believe that the Ohio Employment Verification form is exclusively for individuals who are starting a new job. In reality, it can also be used for current employees who need to verify their employment status for various reasons, such as applying for loans or renting an apartment.

- Only employers can fill out the form. Some think that only employers have the authority to complete the form. However, employees can also request their employers to fill it out. This collaborative approach ensures that the information provided is accurate and reflects the employee's current status.

- The form is not legally binding. A common misconception is that the Ohio Employment Verification form holds no legal weight. In fact, the information provided on this form can be used in legal contexts, such as disputes over employment status or benefits. Therefore, it is essential that all information is truthful and precise.

- It can be submitted without any supporting documents. Some individuals believe that the form can be submitted independently, without any additional documentation. However, it is often beneficial to include supporting documents that verify the employee's identity and employment status, as this can expedite the verification process.

By addressing these misconceptions, individuals can better navigate the employment verification process in Ohio, ensuring that they have the necessary documentation when needed.

Dos and Don'ts

When filling out the Ohio Employment Verification form, it's important to approach the task with care. Here are four things you should and shouldn't do:

- Do provide accurate and complete information. Ensure that all details about your employment history, including dates and job titles, are correct.

- Do double-check your contact information. Make sure your phone number and email address are current so that the verifier can reach you easily.

- Don't omit any required fields. Leaving sections blank can delay the verification process and may lead to complications.

- Don't provide misleading information. Honesty is crucial; inaccuracies can lead to serious consequences for your employment status.

By following these guidelines, you can help ensure a smooth verification process.

Browse Popular Employment Verification Forms for US States

Verify Employment History - Understanding local laws about verification can assist both employees and employers.

When dealing with disputes, utilizing an effective Cease and Desist Letter can be crucial for asserting your rights. This document serves as a formal means to communicate your position and outline the actions you wish to prohibit. For those in need of an accessible template, exploring the user-friendly Cease and Desist Letter form can simplify the process significantly.

Texas Proof of Employment Letter - It helps ensure that the information provided in a resume or application is truthful.

Detailed Guide for Writing Ohio Employment Verification

Once you have the Ohio Employment Verification form in hand, you will need to complete it accurately to ensure a smooth verification process. Follow these steps carefully to fill out the form correctly.

- Start by entering your personal information at the top of the form. This includes your full name, address, and contact number.

- Provide your Social Security number. Make sure to double-check this number for accuracy.

- Fill in the name of your employer, along with the company’s address and phone number.

- Indicate your job title and the dates of your employment. Be specific about your start and end dates, if applicable.

- Complete the section regarding your employment status. Mark whether you are currently employed or if you have left the position.

- If required, sign and date the form at the designated area to verify that the information is correct.

- Finally, submit the form according to the instructions provided, whether that’s mailing it or delivering it in person.