Official Ohio Durable Power of Attorney Document

Key takeaways

When considering the Ohio Durable Power of Attorney form, it is essential to understand its significance and the steps involved in filling it out correctly. Here are some key takeaways to keep in mind:

- Purpose: The Durable Power of Attorney allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so.

- Durability: Unlike a standard power of attorney, this document remains effective even if you become incapacitated.

- Choosing an Agent: Select a trustworthy person as your agent. This individual will have significant authority over your financial matters.

- Specific Powers: Clearly outline the powers you wish to grant your agent. This can include managing bank accounts, real estate, and investments.

- Signatures Required: Ensure that the form is signed by you and, in most cases, witnessed or notarized to validate the document.

- Revocation: You can revoke the Durable Power of Attorney at any time as long as you are still competent. This can be done by creating a new document or providing written notice.

- State-Specific Regulations: Familiarize yourself with Ohio's specific requirements and regulations regarding the Durable Power of Attorney to ensure compliance.

By understanding these key aspects, you can effectively use the Ohio Durable Power of Attorney form to protect your interests and ensure your wishes are honored when you cannot advocate for yourself.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form in Ohio can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One of the most frequent errors is failing to clearly identify the principal and the agent. The principal is the person granting authority, while the agent is the one receiving it. If their names or details are not accurately provided, it can create confusion about who is authorized to act on behalf of the principal.

Another common mistake is neglecting to specify the powers granted to the agent. The DPOA should clearly outline what decisions the agent can make, whether they pertain to financial matters, healthcare, or both. Omitting specific powers can limit the agent's ability to act effectively when needed.

Many individuals also forget to date the document. A DPOA without a date can lead to questions about its validity, especially if there are changes in circumstances or if the principal becomes incapacitated. It is essential to include the date to establish when the authority begins.

Not having witnesses or a notary public sign the document is another mistake that can invalidate the DPOA. Ohio law requires that the DPOA be signed in the presence of a notary or two witnesses. Skipping this step can render the document unenforceable.

Some people mistakenly believe that a DPOA remains effective even after the principal's death. However, this is not the case. A Durable Power of Attorney ceases to be effective once the principal passes away. Understanding this limitation is crucial for proper estate planning.

Another frequent oversight is failing to review the DPOA periodically. Life circumstances change, and so do relationships. Regularly reviewing and updating the document ensures that it reflects current wishes and appoints the right person to act on behalf of the principal.

It is also common to overlook the importance of discussing the DPOA with the chosen agent. The agent should be aware of their responsibilities and the principal's wishes. A lack of communication can lead to misunderstandings when the time comes for the agent to act.

Some individuals do not consider the implications of appointing more than one agent. While it is possible to name co-agents, doing so can complicate decision-making. If the agents disagree, it can lead to delays and conflicts that the principal likely wanted to avoid.

Another mistake is assuming that a DPOA is a one-size-fits-all document. Each situation is unique, and the powers granted should be tailored to fit the specific needs of the principal. Generic forms may not adequately address individual circumstances.

Finally, people often fail to keep copies of the DPOA in accessible locations. After completing the form, it should be stored safely but also be easy to find when needed. Ensuring that copies are available to the agent and relevant institutions can help avoid delays in decision-making.

Misconceptions

When it comes to the Ohio Durable Power of Attorney (DPOA) form, several misconceptions can lead to confusion. Understanding these misconceptions can help individuals make informed decisions about their legal and financial matters.

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The agent must be a lawyer.

- Misconception 3: A Durable Power of Attorney is only valid while the principal is alive.

- Misconception 4: Once a DPOA is signed, it cannot be changed.

- Misconception 5: A DPOA can be used to make decisions after the principal's death.

- Misconception 6: A Durable Power of Attorney is the same as a living will.

This is not entirely true. While many people use a DPOA to manage financial decisions, it can also grant authority over healthcare decisions. A separate healthcare power of attorney is often recommended for clarity.

This is incorrect. The agent, or the person designated to act on behalf of the principal, can be a trusted friend or family member. It is not necessary for the agent to have legal training.

This statement is misleading. A DPOA remains effective even if the principal becomes incapacitated, which is a key feature that distinguishes it from a regular power of attorney.

This is false. The principal can revoke or amend the DPOA at any time, as long as they are mentally competent. This flexibility allows individuals to adapt to changing circumstances.

This is not accurate. The authority granted under a DPOA ends upon the principal's death. After that point, the estate will be managed according to the will or state laws of intestacy.

This is a common misunderstanding. A living will outlines specific wishes regarding medical treatment at the end of life, while a DPOA designates someone to make decisions on behalf of the principal, which can include healthcare decisions but is not limited to them.

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it’s essential to approach the process with care. Here are some important dos and don’ts to keep in mind:

- Do ensure that you understand the powers you are granting to your agent.

- Do choose a trustworthy individual to act as your agent.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Do discuss your wishes with your agent before finalizing the document.

- Don't leave any sections of the form blank; complete all required fields.

- Don't use vague language when describing the powers granted.

- Don't forget to date the form when you sign it.

- Don't assume that the form is valid without proper notarization.

Browse Popular Durable Power of Attorney Forms for US States

Financial Power of Attorney Georgia - This legal tool provides a framework for trusted individuals to ensure your affairs are managed even when you’re not able to do so.

Durable Power of Attorney California - Creating a Durable Power of Attorney can help alleviate stress for your family during challenging times.

The California Small Estate Affidavit form is a legal document used to simplify the process of estate distribution for estates valued below a certain threshold. Through this form, eligible individuals can bypass the often lengthy and complex probate court procedures. This expedited process allows for a more efficient transfer of assets to heirs or beneficiaries. For more information, you can access California PDF Forms.

Ny Statutory Power of Attorney - Consider using this document to simplify the management of your affairs in case of unforeseen circumstances.

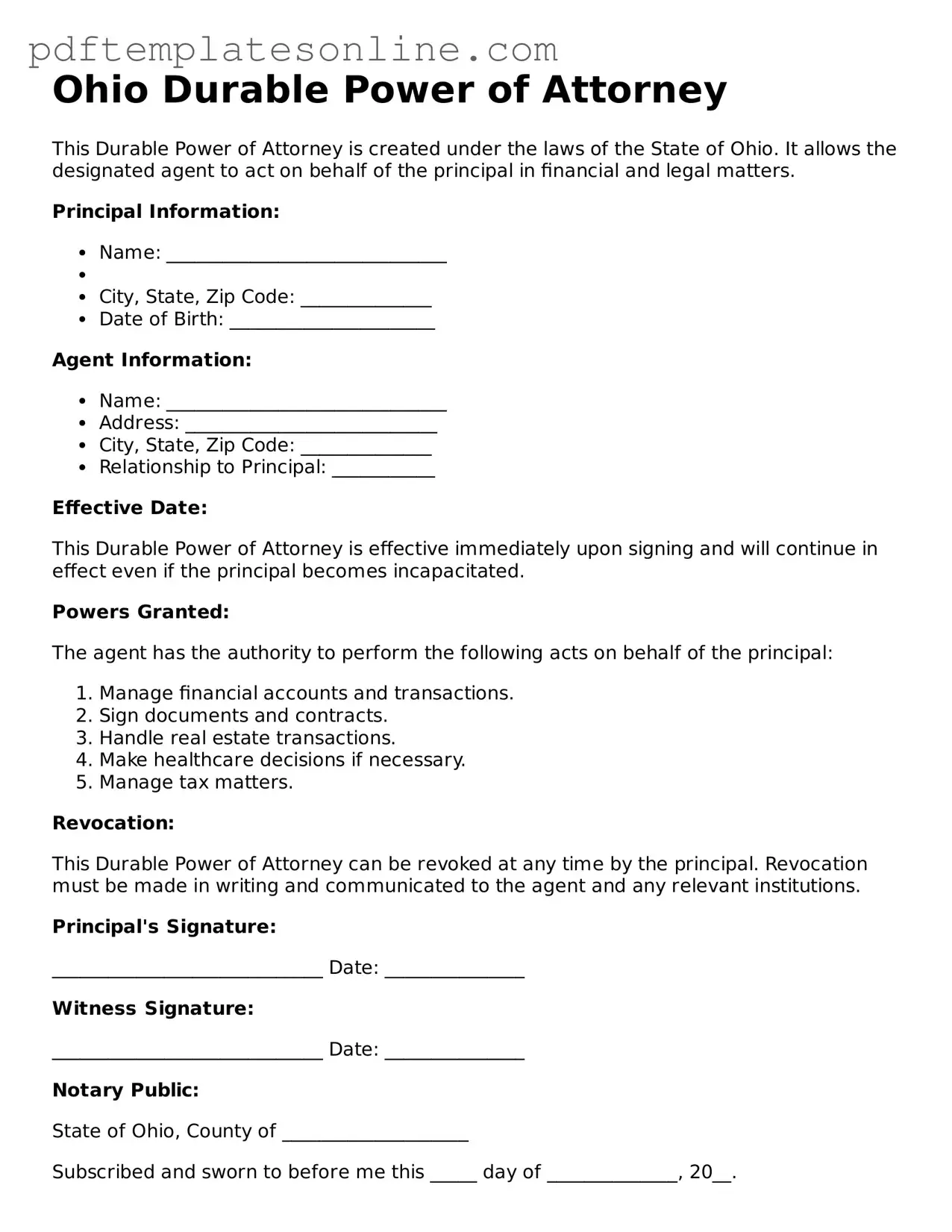

Detailed Guide for Writing Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form requires careful attention to detail. This document allows you to designate someone to make decisions on your behalf in various situations. Follow the steps below to ensure the form is completed accurately.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or through legal resources.

- Read the instructions provided with the form to understand the requirements and options available.

- Fill in your full name and address at the top of the form. This identifies you as the principal.

- Designate your chosen agent by providing their full name and address. This person will act on your behalf.

- Specify the powers you wish to grant your agent. You can select general powers or limit them to specific areas.

- Include any special instructions or limitations that apply to the powers granted.

- Sign and date the form in the designated area. Your signature must be witnessed or notarized, depending on the requirements.

- Have your signature witnessed by at least one person who is not your agent. Alternatively, you may choose to have the form notarized.

- Provide copies of the completed form to your agent and any relevant institutions, such as banks or healthcare providers.

Once the form is filled out and properly signed, it becomes effective immediately or at a future date, depending on your preference. Ensure that all parties involved understand their roles and responsibilities as outlined in the document.