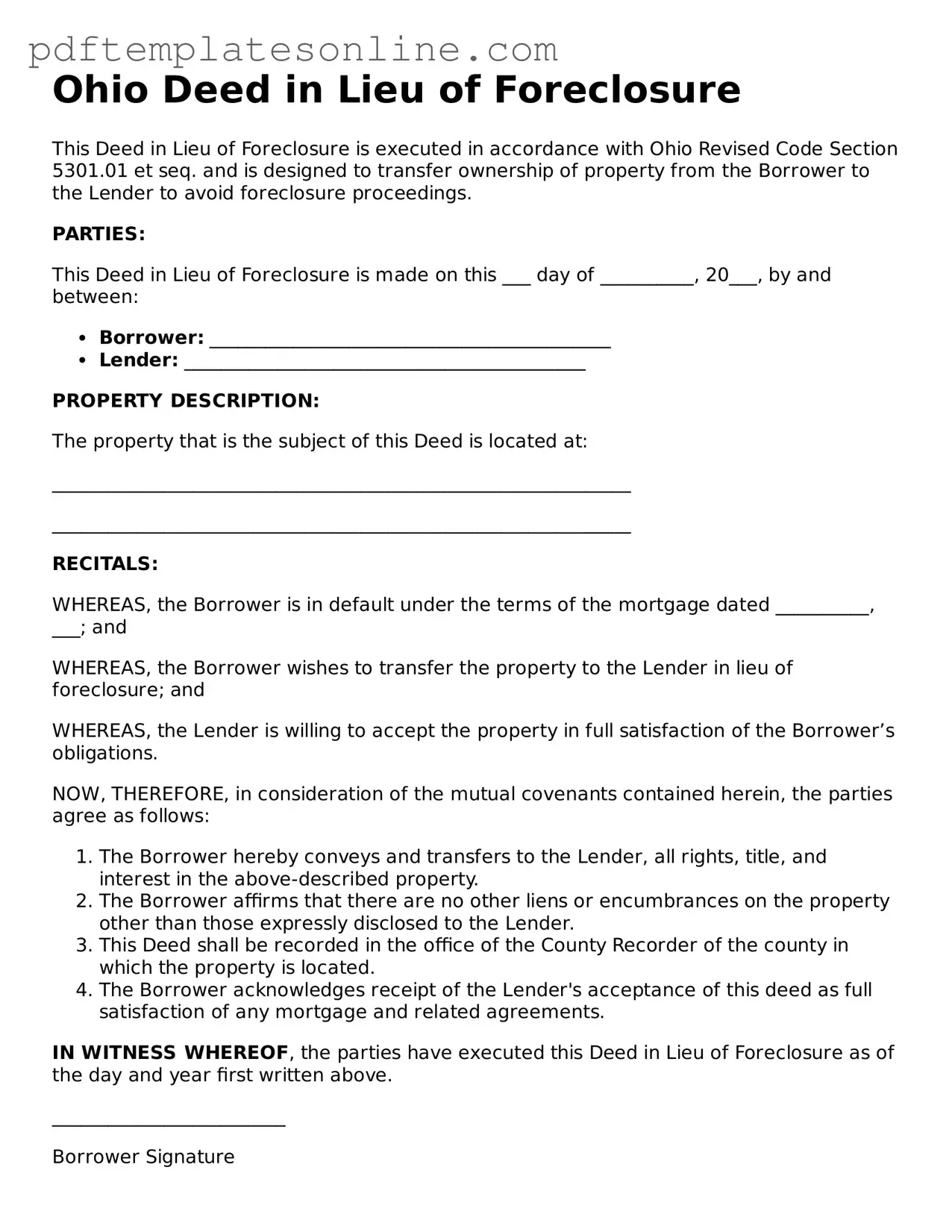

Official Ohio Deed in Lieu of Foreclosure Document

Key takeaways

Understanding the Ohio Deed in Lieu of Foreclosure form is crucial for anyone facing the possibility of foreclosure. Here are some key takeaways to keep in mind:

- What it is: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure proceedings.

- Eligibility: Not everyone qualifies. Lenders typically require that the homeowner is facing financial hardship and has exhausted other options.

- Benefits: This process can be less damaging to your credit score compared to a foreclosure and may help you avoid legal fees associated with foreclosure proceedings.

- Documentation: Be prepared to provide financial documents, including income statements and tax returns, to support your case for the deed in lieu.

- Negotiation: You may have the opportunity to negotiate terms with your lender, including potential forgiveness of remaining debt.

- Legal Advice: Consulting with a legal professional can provide clarity and ensure that your rights are protected throughout the process.

- Title Issues: Ensure there are no outstanding liens or title issues on the property before proceeding with the deed in lieu.

- Timelines: The process can take time, so it’s important to act quickly and stay in communication with your lender.

- Future Housing: Understand how this decision may impact your ability to secure housing in the future, as it may still show up on credit reports.

Being informed and proactive can make a significant difference when navigating the complexities of a Deed in Lieu of Foreclosure. Take the time to consider your options and seek guidance when needed.

Common mistakes

Filling out the Ohio Deed in Lieu of Foreclosure form can be a complex process, and many people make common mistakes that can lead to delays or complications. One frequent error is failing to provide accurate property information. It’s essential to include the correct legal description of the property. Omitting details or using incorrect information can result in the deed being rejected.

Another mistake is not obtaining the necessary signatures. All parties involved must sign the deed for it to be valid. This includes not just the borrower, but also any co-owners or spouses. If one signature is missing, it can create significant legal issues down the line.

Many individuals also overlook the importance of having the deed notarized. In Ohio, notarization is a requirement for the deed to be legally binding. Without a notary's seal, the document may not hold up in court, which defeats the purpose of the deed in lieu of foreclosure.

People often fail to consider the tax implications of executing a deed in lieu of foreclosure. While it may seem like a straightforward solution to avoid foreclosure, it can have consequences for your tax situation. Consulting with a tax professional before signing the deed is advisable to understand any potential liabilities.

Finally, some individuals neglect to communicate with their lender throughout the process. It’s crucial to keep the lines of communication open. Lenders may have specific requirements or forms that need to be completed alongside the deed. Failing to follow these guidelines can lead to misunderstandings and further complications.

Misconceptions

Understanding the Ohio Deed in Lieu of Foreclosure can be challenging, especially with various misconceptions surrounding it. Here are nine common misunderstandings that people often have:

- It eliminates all debts associated with the property. Many believe that signing a deed in lieu of foreclosure wipes out all debts. However, this is not always the case. If there are other loans secured by the property, such as a second mortgage, those may still need to be addressed.

- It is the same as a foreclosure. While both processes involve the transfer of property back to the lender, a deed in lieu of foreclosure is typically less damaging to the homeowner’s credit score compared to a formal foreclosure.

- It is a quick and easy solution. Some think that this process is straightforward and quick. In reality, it can take time to negotiate terms with the lender and ensure all paperwork is properly completed.

- Homeowners can choose this option at any time. Many assume they can opt for a deed in lieu of foreclosure whenever they want. However, lenders usually require homeowners to demonstrate that they are unable to continue making payments before considering this option.

- It guarantees the homeowner will not owe any money afterward. This is a common belief, but it’s important to understand that lenders can pursue a deficiency judgment if the property sells for less than the outstanding mortgage balance.

- All lenders accept deeds in lieu of foreclosure. Not every lender is willing to accept this option. Some may prefer to proceed with a traditional foreclosure process, depending on their policies and the specific circumstances of the loan.

- It can be done without legal assistance. While it is possible to navigate this process alone, having legal guidance can help ensure that all rights are protected and that the process goes smoothly.

- It is a permanent solution to financial problems. Although a deed in lieu of foreclosure can relieve the burden of a mortgage, it does not address underlying financial issues. Homeowners may still need to seek other forms of financial assistance or counseling.

- It has no tax implications. Some believe that there are no tax consequences associated with a deed in lieu of foreclosure. In reality, homeowners may face tax liabilities if the lender forgives any portion of the debt.

By clearing up these misconceptions, homeowners can make more informed decisions about their options in challenging financial situations.

Dos and Don'ts

When completing the Ohio Deed in Lieu of Foreclosure form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do provide accurate information about the property, including the address and legal description.

- Do ensure that all parties involved in the transaction sign the document.

- Do consult with a legal professional if you have any questions or uncertainties.

- Don't leave any sections of the form blank; complete all required fields.

- Don't rush through the process; take your time to review the document for errors.

Browse Popular Deed in Lieu of Foreclosure Forms for US States

Foreclosure Process in Georgia - Homeowners considering this option must communicate their intent to the lender beforehand.

When engaging in the buying or selling of a mobile home in California, it's essential to properly complete the California Mobile Home Bill of Sale form, which can often be found at California PDF Forms. This document not only acts as evidence of the transaction but also plays a significant role in ensuring compliance with the legal requirements governing mobile home sales in the state.

Deed in Lieu Vs Foreclosure - This arrangement provides an opportunity for lenders to take possession of property without auctions.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu of Foreclosure is a way to avoid foreclosure proceedings.

California Pre-foreclosure Property Transfer - This alternative often requires fewer legal steps than traditional foreclosure, streamlining the resolution process.

Detailed Guide for Writing Ohio Deed in Lieu of Foreclosure

Once the Ohio Deed in Lieu of Foreclosure form is completed, it should be submitted to the lender for review. This process can help resolve the mortgage situation without going through a lengthy foreclosure. Ensure all information is accurate and complete to avoid any delays.

- Obtain the Ohio Deed in Lieu of Foreclosure form from your lender or a reliable legal resource.

- Fill in the name of the property owner(s) in the designated section. Ensure the names match those on the mortgage documents.

- Provide the complete address of the property, including street number, street name, city, state, and zip code.

- Include the legal description of the property. This can usually be found in the mortgage documents or the property deed.

- Indicate the name of the lender or mortgage company in the appropriate field.

- Sign the form in the presence of a notary public. Both the property owner(s) and the lender may need to sign, depending on the form's requirements.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender along with any required supporting documents.