Official Ohio Deed Document

Key takeaways

When filling out and using the Ohio Deed form, consider the following key takeaways:

- Ensure you have the correct type of deed for your needs, such as a warranty deed or quitclaim deed.

- Provide complete and accurate information about the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Include a legal description of the property. This description should be precise and often comes from the property’s title or previous deed.

- Sign the deed in front of a notary public to validate the document. Notarization is essential for the deed to be legally recognized.

- Check for any local requirements or additional forms that may need to accompany the deed.

- File the completed deed with the appropriate county recorder’s office. This step is crucial for public record and ownership transfer.

- Consider consulting with a real estate professional or attorney if you have questions about the deed or the process.

- Keep copies of the signed deed for your records. Documentation is important for future reference.

- Be aware of any potential tax implications or fees associated with transferring property ownership.

Common mistakes

Filling out the Ohio Deed form can be a straightforward process, but mistakes often occur that can lead to complications down the line. One common error is failing to provide accurate property descriptions. The legal description must be precise, including boundaries and any relevant identifiers. Omitting or incorrectly stating this information can create confusion and may result in disputes over property ownership.

Another frequent mistake involves the omission of signatures. All parties involved in the transaction must sign the deed. If even one signature is missing, the document may be deemed invalid. It’s crucial to ensure that everyone’s signature is present before submitting the form.

People often overlook the importance of notarization. In Ohio, a deed must be notarized to be legally binding. Without a notary’s signature and seal, the deed could be challenged in court. It’s advisable to have the document notarized promptly after signing to avoid any delays.

Additionally, many individuals fail to check the names of the parties involved for accuracy. Spelling errors or incorrect names can lead to significant legal issues. It’s essential to verify that all names match the official identification documents of the parties involved.

Another mistake is neglecting to include the date of the transaction. The date is a critical element that establishes when the transfer of ownership takes place. Leaving this field blank can lead to misunderstandings regarding the effective date of the deed.

Lastly, individuals sometimes forget to record the deed after completion. Even if the deed is filled out correctly, failing to file it with the county recorder’s office can result in a lack of public notice regarding the property transfer. Recording the deed is vital to protect ownership rights and ensure that the transaction is recognized legally.

Misconceptions

Many people have misunderstandings about the Ohio Deed form. Here are seven common misconceptions explained:

- All deeds are the same. Many believe that all deed forms are identical. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving different purposes.

- A deed must be notarized to be valid. While notarization is important for many legal documents, not all deeds require it. Some deeds may be valid without notarization, depending on local laws.

- Once a deed is signed, it cannot be changed. This is not true. Deeds can be modified or revoked, but the process can be complex and requires following specific legal steps.

- Only a lawyer can prepare a deed. While it's advisable to consult a lawyer, especially for complex transactions, many people can prepare a simple deed on their own using the correct forms and guidelines.

- Deeds are only necessary for property sales. Deeds are not just for selling property. They are also used for gifting property, transferring ownership, and even in divorce settlements.

- Once a deed is recorded, it cannot be contested. This is a misconception. Even recorded deeds can be challenged in court under certain circumstances, such as fraud or misrepresentation.

- All deeds must be filed with the county. While it is recommended to file deeds with the county recorder to establish public record, not all deeds are legally required to be filed.

Understanding these misconceptions can help you navigate property transactions more effectively.

Dos and Don'ts

When filling out the Ohio Deed form, there are several important practices to follow and avoid. Adhering to these guidelines can help ensure the process runs smoothly.

- Do: Ensure all names are spelled correctly and match legal documents.

- Do: Provide accurate property descriptions, including parcel numbers.

- Do: Sign the deed in the presence of a notary public.

- Do: Include the date of the transaction.

- Do: Double-check for any required signatures from all parties involved.

- Don't: Leave any fields blank; all sections must be completed.

- Don't: Use abbreviations that may cause confusion.

- Don't: Forget to check local recording requirements before submission.

- Don't: Alter the form without proper authorization.

- Don't: Submit the deed without the necessary fees for recording.

Browse Popular Deed Forms for US States

Nys Deed Form - This document acts as a safeguard during property exchanges, offering peace of mind to both parties.

Filling out the EDD DE 2501 form correctly is vital for those seeking state disability insurance benefits in California, as it outlines your medical condition and work history. For guidance on how to complete this form, you can refer to the useful resource available at https://mypdfform.com/blank-edd-de-2501.

How Do I Get a Copy of My House Title in California - Notarization may be required to confirm authenticity.

House Deed Sample - May need to accompany other paperwork, such as closing statements.

Detailed Guide for Writing Ohio Deed

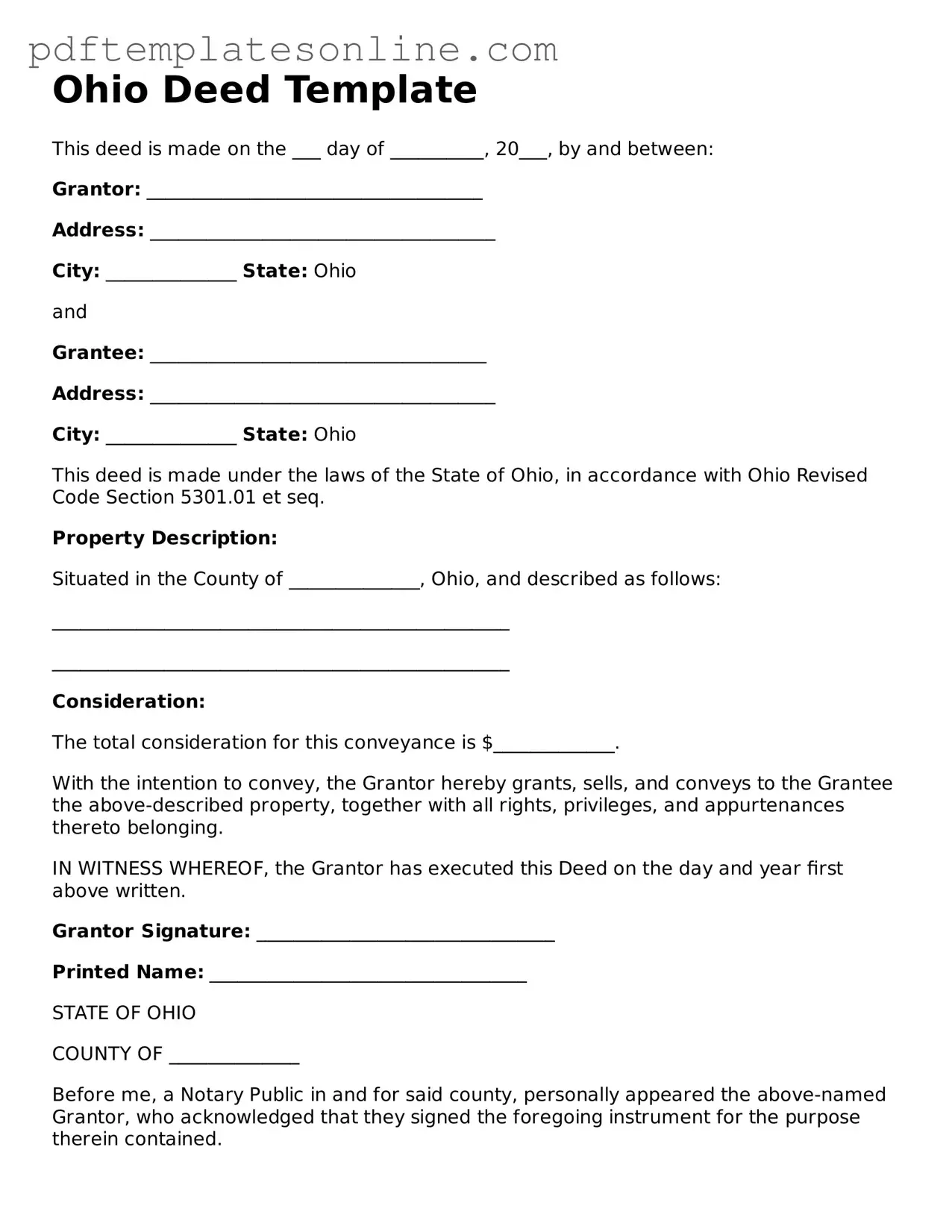

Once you have your Ohio Deed form ready, it’s time to fill it out carefully. Ensuring all information is accurate is crucial, as this document will be a public record of the property transfer. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form. This should be the date you are completing the deed.

- Next, identify the grantor, or the person transferring the property. Fill in their full name and address in the designated space.

- Then, provide the details of the grantee, or the person receiving the property. Again, include their full name and address.

- In the next section, describe the property being transferred. This includes the address and any legal descriptions necessary to identify the property accurately.

- Next, indicate the consideration, or the amount of money exchanged for the property, if applicable. If it’s a gift, you can state that as well.

- After that, both the grantor and grantee should sign the form. Ensure that the signatures are clear and legible.

- Finally, have the deed notarized. A notary public will verify the identities of the signers and affix their seal to the document.

Once you have completed these steps, your deed will be ready for recording with the county recorder's office. Make sure to keep a copy for your records, as this will serve as proof of the property transfer.