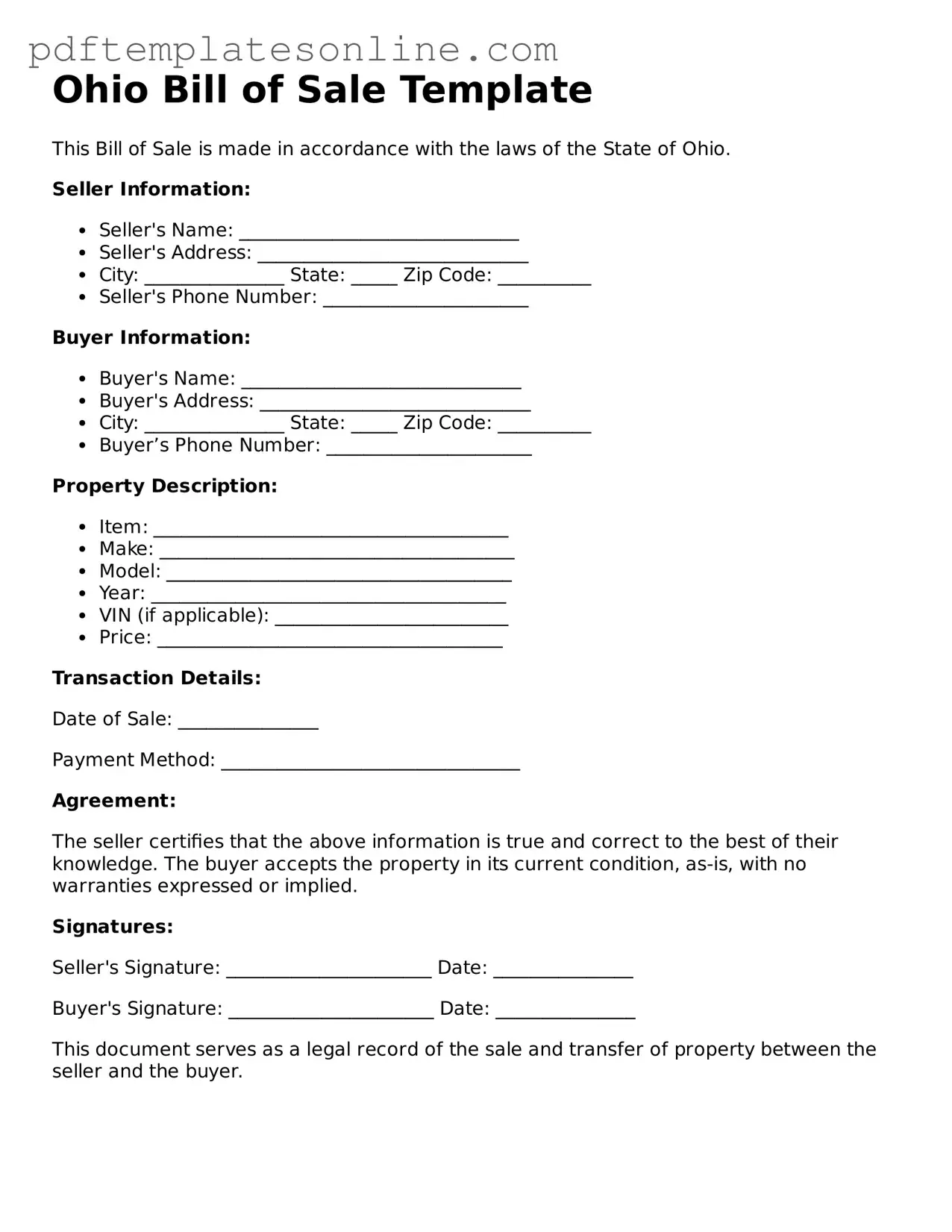

Official Ohio Bill of Sale Document

Key takeaways

When completing and utilizing the Ohio Bill of Sale form, several key points should be considered to ensure the process is smooth and legally sound.

- The Ohio Bill of Sale serves as a legal document that records the transfer of ownership for personal property.

- It is essential to include the full names and addresses of both the buyer and seller to establish clear identification.

- Accurate descriptions of the item being sold, including make, model, year, and VIN (for vehicles), are crucial for clarity.

- The document must specify the purchase price to reflect the agreed-upon value of the item.

- Both parties should sign the Bill of Sale to validate the agreement and confirm the transfer of ownership.

- Consider having the document notarized, as this can provide additional legal protection and verification.

- Retain a copy of the Bill of Sale for personal records, as it may be needed for future reference or disputes.

- Check local regulations, as some jurisdictions may have specific requirements for the Bill of Sale.

- Using the Ohio Bill of Sale can simplify the process of registering the item with the appropriate authorities.

Common mistakes

Filling out the Ohio Bill of Sale form can be straightforward, but many people make common mistakes that can lead to complications later. One frequent error is failing to include all necessary details about the vehicle or item being sold. It's essential to provide accurate information such as the make, model, year, and Vehicle Identification Number (VIN) for vehicles. Omitting these details can create confusion and may affect the registration process.

Another mistake is not obtaining the appropriate signatures. Both the seller and buyer must sign the form for it to be valid. If either party neglects to sign, the document may not hold up in legal situations. Always double-check that all required signatures are present before finalizing the transaction.

People often overlook the importance of including the sale price. This figure is crucial for both parties. It establishes the value of the transaction and may be needed for tax purposes. Without a clearly stated sale price, misunderstandings may arise, leading to disputes later on.

Lastly, some individuals fail to keep a copy of the completed Bill of Sale. Retaining a copy is vital for both the seller and the buyer. It serves as proof of the transaction and can be helpful in case any issues arise in the future. Always ensure that both parties have a signed copy for their records.

Misconceptions

When it comes to the Ohio Bill of Sale form, several misconceptions can lead to confusion for individuals engaging in transactions. Understanding these misconceptions can help ensure a smoother process when buying or selling personal property.

- Misconception 1: A Bill of Sale is only necessary for vehicle transactions.

- Misconception 2: A Bill of Sale does not need to be notarized.

- Misconception 3: A Bill of Sale is the same as a title transfer.

- Misconception 4: A Bill of Sale protects the seller more than the buyer.

This is not true. While many people associate a Bill of Sale primarily with the sale of vehicles, it is actually applicable to a wide range of personal property transactions. This includes everything from furniture and electronics to boats and livestock. A Bill of Sale serves as a legal record of the transaction, regardless of the item being sold.

In Ohio, notarization is not a strict requirement for a Bill of Sale. However, having the document notarized can add an extra layer of security and authenticity. It can help verify the identities of the parties involved and may be beneficial if disputes arise in the future.

While both documents are important in the process of transferring ownership, they serve different purposes. A Bill of Sale provides proof of the transaction, while a title transfer is specifically related to the legal ownership of vehicles. For vehicles, both documents may be required to complete the transfer of ownership properly.

This is a common belief, but a well-drafted Bill of Sale can protect both parties. For the buyer, it serves as proof of purchase and details the condition of the item at the time of sale. For the seller, it offers protection against future claims regarding ownership or condition. Thus, it is beneficial for both parties involved in the transaction.

Dos and Don'ts

When filling out the Ohio Bill of Sale form, it is important to follow certain guidelines to ensure the document is valid and serves its purpose effectively. Here is a list of things you should and shouldn't do:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, such as make, model, year, and VIN for vehicles.

- Do clearly state the purchase price to avoid any confusion later.

- Do sign and date the document in the presence of a witness or notary if required.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any blank spaces on the form; fill in all necessary fields to prevent alterations.

- Don't use vague language; be specific to ensure clarity in the transaction.

- Don't forget to check for any local requirements that may need to be included.

- Don't rush through the process; take your time to review the document thoroughly.

- Don't sign the document without understanding all the terms and conditions involved.

Browse Popular Bill of Sale Forms for US States

Example of a Bill of Sale for a Car - Helps in documenting transactions for tax purposes.

Best Place to Sell Your Car Privately - The Bill of Sale outlines the details of the property being sold.

Sample of Car Bill of Sale - Useful in situations where no formal contract is present.

Detailed Guide for Writing Ohio Bill of Sale

After obtaining the Ohio Bill of Sale form, you will need to complete it accurately to ensure a smooth transaction. This document serves as a record of the sale between the buyer and seller. Follow these steps to fill out the form correctly.

- Identify the Parties: Write the full name and address of both the seller and the buyer at the top of the form.

- Describe the Item: Provide a detailed description of the item being sold. Include make, model, year, and any identifying numbers, such as VIN for vehicles.

- Specify the Sale Price: Clearly state the total sale price of the item in both numerical and written form.

- Indicate the Date of Sale: Fill in the date on which the sale is taking place.

- Signatures: Both the seller and the buyer must sign the form. Include the date of each signature.

- Witness or Notary (if required): Some transactions may require a witness or notary signature. Check local requirements.

Once completed, both parties should retain a copy of the Bill of Sale for their records. This document can be important for future reference, especially for ownership verification or tax purposes.