Blank Nwmls 21 Form

Key takeaways

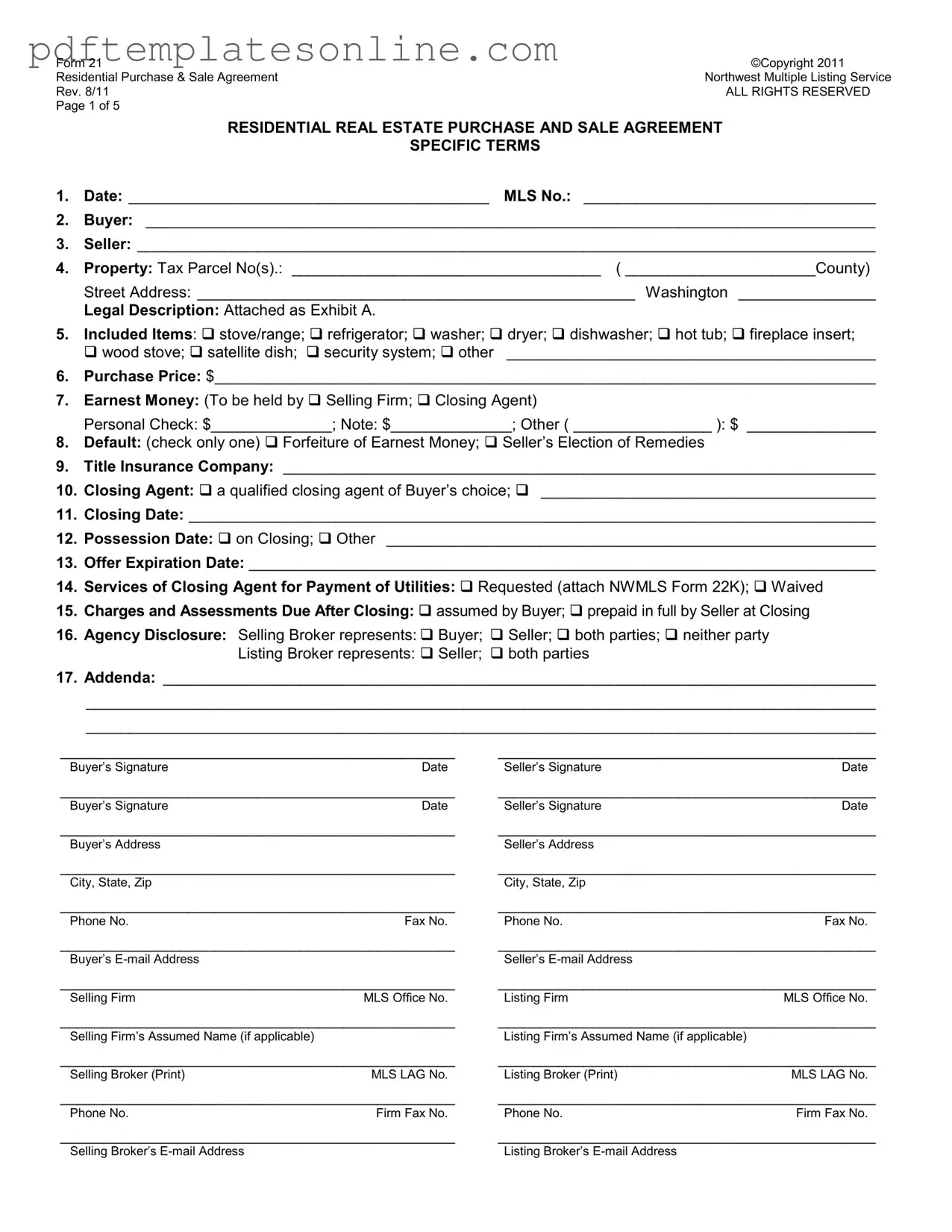

- Understand the Basics: The NWMLS 21 form is a Residential Purchase and Sale Agreement used in real estate transactions in Washington State.

- Complete All Sections: Fill out every section accurately, including buyer and seller information, property details, and purchase price.

- Earnest Money: Specify the amount of earnest money and who will hold it. This shows the seller that the buyer is serious.

- Included Items: Clearly list any items included in the sale, such as appliances or fixtures, to avoid misunderstandings later.

- Closing Details: Specify the closing date and possession date. These dates are crucial for both parties to understand when the sale will finalize.

- Consult Professionals: It’s advisable for both buyers and sellers to seek legal advice to understand their rights and obligations under the agreement.

- Review Before Signing: Carefully review the entire agreement before signing to ensure all terms are acceptable and understood.

Common mistakes

Filling out the Nwmls 21 form can be a straightforward process, but several common mistakes can lead to complications. One major error is failing to provide complete and accurate information in the buyer and seller sections. Incomplete names, addresses, or contact details can cause delays in communication and processing. Always double-check that all fields are filled out correctly to avoid any misunderstandings.

Another frequent oversight occurs in the property description. Buyers and sellers sometimes neglect to include the correct tax parcel number or street address. This information is crucial for identifying the property in question. Without it, the agreement may not be enforceable, leading to potential disputes later on.

Many people also make the mistake of not specifying included items. The section for included items should clearly list any appliances or fixtures that are part of the sale. If this section is left blank or filled out incorrectly, it may lead to disagreements over what is included in the sale, causing frustration for both parties.

Additionally, errors in the earnest money section are common. Buyers often forget to specify the amount or the party holding the earnest money. This can create confusion regarding who is responsible for handling the funds and can complicate the closing process.

Another mistake involves the closing date. Buyers and sellers sometimes leave this field blank or fail to agree on a date. A missing or ambiguous closing date can lead to disputes and delays, as both parties may have different expectations about when the transaction will be finalized.

Misunderstanding the default options is also a common issue. Buyers may not check the appropriate box for the default terms, which can lead to confusion about the consequences of failing to fulfill the agreement. Understanding these terms is essential for both parties to avoid potential legal issues down the line.

Lastly, failing to sign and date the agreement correctly is a significant mistake. All parties must provide their signatures and the corresponding dates in the designated areas. Without proper signatures, the agreement may not be legally binding, leaving both parties vulnerable to potential disputes.

Misconceptions

- Misconception 1: The Nwmls 21 form is only for buyers.

- Misconception 2: The earnest money is non-refundable.

- Misconception 3: The form guarantees a successful sale.

- Misconception 4: The closing date is set in stone.

- Misconception 5: All included items in the sale are automatically transferred.

- Misconception 6: The seller is responsible for all repairs before closing.

- Misconception 7: Buyers do not need to worry about title insurance.

- Misconception 8: The Nwmls 21 form is the only document needed for a real estate transaction.

- Misconception 9: Buyers can skip the inspection process.

- Misconception 10: The form does not allow for negotiation.

This form is designed for both buyers and sellers. It outlines the terms of the sale, ensuring both parties have a clear understanding of their rights and obligations.

Earnest money can be refunded under specific circumstances, such as if the buyer terminates the agreement due to undisclosed issues with the property.

While the Nwmls 21 form lays out the agreement, it does not guarantee that the sale will go through. Various factors can affect the transaction.

The closing date can be adjusted if both parties agree. Flexibility is often necessary due to unforeseen circumstances.

Only items checked in the "Included Items" section will be part of the sale. Buyers should verify what is included to avoid surprises.

Unless specified, sellers are typically only required to maintain the property in its current condition until closing.

Title insurance is crucial as it protects buyers from potential claims against the property. Buyers should ensure it is part of the agreement.

Additional documents, such as disclosures and addenda, may be necessary to complete the transaction legally.

It is highly advisable for buyers to conduct an inspection to uncover any potential issues with the property before finalizing the purchase.

Negotiation is a key part of the home buying process. Buyers and sellers can discuss and amend terms before finalizing the agreement.

Dos and Don'ts

When filling out the NWMLS 21 form, consider the following guidelines:

- Do ensure all required fields are completed accurately.

- Do double-check the purchase price and earnest money amounts.

- Do include all included items in the sale, checking the appropriate boxes.

- Do provide correct contact information for all parties involved.

- Don't leave any sections blank unless they are optional.

- Don't use vague terms; be specific in your descriptions and amounts.

- Don't forget to sign and date the form to validate the agreement.

Other PDF Forms

Form I 9 - It generally requires authorization from the employee to disclose employment details.

By utilizing the simple Notary Acknowledgement process, parties can ensure the legitimacy of their legal documents, reinforcing the trust and integrity essential for any transaction. This form plays a significant role in verifying identities and understanding the agreement's terms, thereby safeguarding all involved parties.

Futa Chart - Accurate data entry is essential when filling out the details of Form 940.

Detailed Guide for Writing Nwmls 21

Filling out the NWMLS 21 form is an essential step in the home buying process. This form serves as a comprehensive agreement between the buyer and seller, detailing the terms of the sale. Completing it accurately ensures that both parties understand their obligations and helps facilitate a smooth transaction. Below are the steps to guide you through the process of filling out this important document.

- Date: Write the current date in the designated space.

- MLS No.: Enter the Multiple Listing Service number associated with the property.

- Buyer: Fill in the full names of all buyers.

- Seller: Provide the full names of all sellers.

- Property: Include the Tax Parcel Number(s) and the street address of the property, along with the county.

- Legal Description: Indicate that the legal description is attached as Exhibit A.

- Included Items: Check any items included in the sale, such as appliances or fixtures, and specify any other items if necessary.

- Purchase Price: Clearly state the total purchase price of the property.

- Earnest Money: Indicate the amount of earnest money and who will hold it (Selling Firm or Closing Agent). Specify the amounts for personal check, note, and any other forms of payment.

- Default: Check one option regarding default remedies.

- Title Insurance Company: Enter the name of the title insurance company.

- Closing Agent: Choose either a qualified closing agent of the buyer’s choice or specify the name of the closing agent.

- Closing Date: Write the anticipated closing date.

- Possession Date: Indicate when possession will occur (on closing or another date).

- Offer Expiration Date: Provide the date by which the offer will expire.

- Services of Closing Agent for Payment of Utilities: Check whether these services are requested or waived.

- Charges and Assessments Due After Closing: Specify who will assume these charges.

- Agency Disclosure: Indicate the representation of the selling and listing brokers.

- Addenda: List any additional documents or agreements related to the sale.

- Signatures: Ensure all buyers and sellers sign and date the form in the designated areas, providing their addresses, phone numbers, and email addresses.

- Broker Information: Fill in the details for the selling and listing firms, including assumed names and contact information.

Once you have completed the form, review it carefully to ensure all information is accurate and complete. Both parties should retain copies of the signed document for their records. This step is crucial in moving forward with the sale and ensuring a clear understanding between the buyer and seller.