Blank Non Borrower Credit Authorization Form

Key takeaways

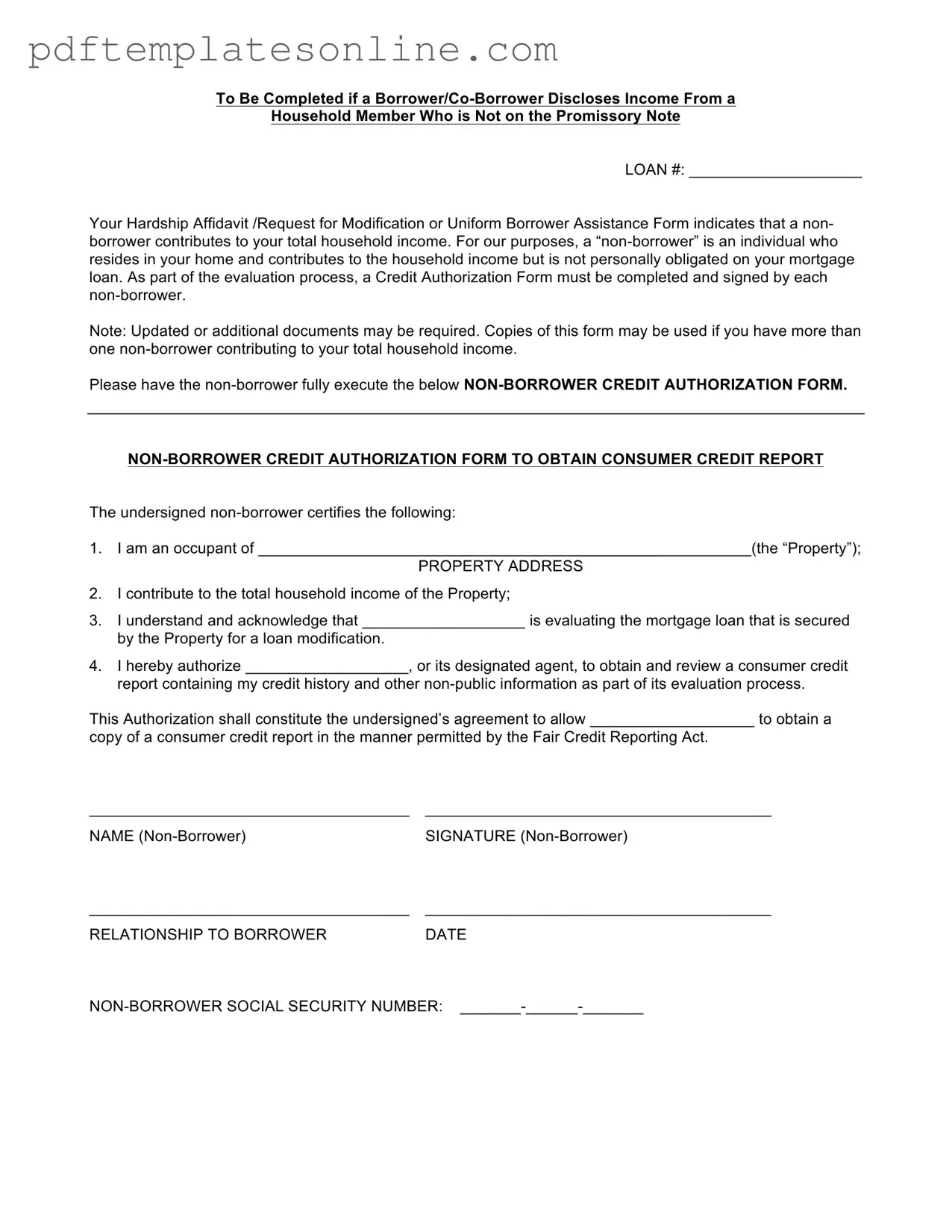

When filling out and using the Non Borrower Credit Authorization form, it is essential to follow specific guidelines to ensure compliance and efficiency. Here are key takeaways:

- The form is required if a borrower or co-borrower discloses income from a household member who is not on the promissory note.

- A non-borrower is defined as someone who resides in the home and contributes to the household income but is not obligated on the mortgage loan.

- Each non-borrower must complete and sign their own Credit Authorization Form.

- Updated or additional documents may be necessary during the evaluation process.

- If there are multiple non-borrowers, copies of the form can be used for each individual.

- The form includes a section for the non-borrower to certify their occupancy and contribution to the household income.

- The non-borrower must authorize the lender to obtain and review their consumer credit report as part of the evaluation.

- All signatures and dates must be accurately filled out to avoid delays in processing the loan modification request.

Common mistakes

When filling out the Non Borrower Credit Authorization form, many people make mistakes that can delay the process. One common error is not providing the correct property address. The property address must be filled in accurately to ensure that the evaluation is linked to the right mortgage. Double-check the address before submitting the form.

Another frequent mistake is failing to sign the form. Without a signature, the authorization is incomplete. The non-borrower must sign in the designated area to validate the authorization. Remember, a signature is not just a formality; it confirms consent.

Some individuals neglect to specify their relationship to the borrower. This information is crucial as it helps the lender understand the context of the income contribution. Be clear about your relationship, whether you are a spouse, partner, or other household member.

Inaccurate social security numbers are also a common issue. Providing the wrong social security number can lead to complications in obtaining the credit report. It’s essential to verify that the number is correct and formatted properly.

Additionally, people sometimes forget to indicate that they contribute to the total household income. This acknowledgment is vital for the lender's assessment. Make sure to check the box or include a statement confirming your contribution.

Another oversight is not understanding the purpose of the form. Some individuals fill it out without realizing it is part of a larger evaluation for a loan modification. Understanding this context can help ensure that all necessary information is provided.

Using a form that is not the most current version can also lead to mistakes. Always check that you are using the latest version of the Non Borrower Credit Authorization form. Outdated forms may not comply with current regulations.

Lastly, many people fail to provide complete information. Incomplete forms can cause delays in processing. Take your time to fill out every section carefully and review your entries before submission. A little attention to detail can make a significant difference in the outcome.

Misconceptions

There are several misconceptions surrounding the Non Borrower Credit Authorization form. Understanding these can help clarify its purpose and importance in the loan modification process.

- Misconception 1: The form is only for borrowers.

- Misconception 2: Only one form is needed, regardless of the number of non-borrowers.

- Misconception 3: Signing the form guarantees loan modification approval.

- Misconception 4: The form requires the non-borrower to take on mortgage responsibility.

This is incorrect. The Non Borrower Credit Authorization form is specifically designed for individuals who contribute to the household income but are not obligated on the mortgage loan. Their financial information is relevant for the evaluation of the loan modification.

In reality, if there are multiple non-borrowers contributing to the household income, a separate form must be completed for each individual. This ensures that all relevant financial information is accurately assessed.

Signing the Non Borrower Credit Authorization form does not guarantee approval for a loan modification. It is simply part of the evaluation process, allowing the lender to review the credit history of the non-borrower.

This is not true. Completing the form does not make the non-borrower responsible for the mortgage. It only allows the lender to access the non-borrower’s credit information as part of the assessment process.

Dos and Don'ts

When filling out the Non Borrower Credit Authorization form, keep these important points in mind:

- Do provide accurate information about the property address.

- Do clearly state your relationship to the borrower.

- Do ensure that all required signatures are present.

- Do read the entire form carefully before signing.

- Don't leave any fields blank; complete all sections fully.

- Don't forget to include your social security number.

- Don't sign the form without understanding what you are authorizing.

Other PDF Forms

Hurt Feelings Report - The information you provide helps us understand your needs.

Understanding the significance of a Mechanics Lien California form is essential for anyone involved in property improvements, as it acts as a safeguard for contractors, subcontractors, and suppliers seeking payment for their services. For those looking to access or edit these important documents, resources like California PDF Forms can be extremely helpful, ensuring that all parties can properly secure their financial interests in the event of non-payment.

Md State Inspection - Wipers must perform properly to ensure visibility.

Printable Drivers Time Record Sheet - Monitoring driving hours is essential for both legal compliance and driver health.

Detailed Guide for Writing Non Borrower Credit Authorization

Completing the Non Borrower Credit Authorization form is a crucial step in the evaluation process for your loan modification request. It is important to ensure that all information is accurate and complete. Follow these steps carefully to fill out the form correctly.

- Write the loan number at the top of the form where indicated.

- In the section labeled "PROPERTY ADDRESS," fill in the complete address of the property.

- Confirm that the non-borrower is an occupant of the property and contributes to the household income.

- In the blank space, write the name of the entity evaluating the mortgage loan for modification.

- In the next blank, write the same entity's name again to indicate who is authorized to obtain the credit report.

- Ensure the non-borrower signs the form in the designated area.

- Fill in the relationship of the non-borrower to the borrower.

- Write the date the form is being completed.

- Provide the non-borrower’s Social Security number in the specified format (XXX-XX-XXXX).

After completing the form, review it for accuracy before submitting it. Keep in mind that additional documents may be required during the evaluation process. Make sure to have everything ready to avoid delays.