Official New York Transfer-on-Death Deed Document

Key takeaways

When it comes to the New York Transfer-on-Death Deed, there are several important points to keep in mind. This deed allows property owners to transfer their real estate to beneficiaries upon their death, bypassing probate. Here are some key takeaways to help you navigate this process:

- Understand the Purpose: A Transfer-on-Death Deed enables you to designate who will inherit your property without the need for probate, simplifying the transfer process for your loved ones.

- Eligibility: Ensure you are eligible to use this deed. It applies only to real property in New York and must be executed by the property owner.

- Complete the Form Accurately: Fill out the form carefully. Include all required information, such as the property description and the names of the beneficiaries.

- Sign and Notarize: Your signature must be notarized to validate the deed. This step is crucial for the deed to be legally effective.

- File with the County Clerk: After completing the deed, file it with the county clerk's office where the property is located. This step officially records the transfer-on-death designation.

- Revocation is Possible: You can revoke the deed at any time before your death. This gives you flexibility if your circumstances change.

- Consult a Professional: While the process can be straightforward, consider consulting a legal professional to ensure everything is done correctly and to address any specific questions you may have.

By keeping these takeaways in mind, you can confidently navigate the process of using a Transfer-on-Death Deed in New York. This tool can provide peace of mind, knowing that your property will be transferred according to your wishes.

Common mistakes

Filling out the New York Transfer-on-Death Deed form can be straightforward, but many individuals make critical mistakes that can lead to complications later. One common error is failing to include all required information. The form demands specific details about the property and the beneficiaries. Omitting even a single piece of information can render the deed invalid, creating potential issues in the future.

Another frequent mistake involves incorrect beneficiary designations. People sometimes assume that simply naming a beneficiary is enough. However, it is essential to ensure that the names are spelled correctly and that the relationship to the property owner is clear. Misidentifying a beneficiary can lead to disputes or unintended consequences, such as assets going to the wrong person.

Many individuals neglect to sign the deed properly. In New York, the deed must be signed in the presence of a notary public. Failing to follow this requirement can invalidate the deed. It is crucial to ensure that all signatures are executed correctly and that the notary's acknowledgment is included.

Another mistake is not recording the deed with the appropriate county clerk's office. Even if the form is filled out correctly, it must be recorded to be effective. Some people mistakenly believe that simply signing the deed is sufficient. Without proper recording, the transfer may not be recognized, leaving the property subject to probate.

Lastly, individuals often overlook the need for a backup plan. Life can be unpredictable, and circumstances may change. Failing to update the deed when there are changes in relationships or intentions can lead to complications. It is advisable to review and, if necessary, revise the deed periodically to reflect current wishes.

Misconceptions

Understanding the New York Transfer-on-Death Deed can help clarify how property is transferred after someone's passing. However, several misconceptions often arise about this legal document. Here are six common myths and the truths behind them:

- Myth 1: A Transfer-on-Death Deed is the same as a will.

- Myth 2: You can only use a Transfer-on-Death Deed for residential properties.

- Myth 3: The property automatically transfers upon signing the deed.

- Myth 4: You cannot change or revoke a Transfer-on-Death Deed once it is filed.

- Myth 5: A Transfer-on-Death Deed avoids all taxes.

- Myth 6: Only certain people can be named as beneficiaries in a Transfer-on-Death Deed.

This is not true. While both documents deal with the transfer of property, a Transfer-on-Death Deed specifically allows for the direct transfer of real estate without going through probate, unlike a will.

This misconception is incorrect. The deed can be used for various types of real estate, including commercial properties, as long as they are located in New York.

Not quite. The transfer occurs only after the property owner passes away. Until that time, the owner retains full control of the property.

This is false. Property owners can modify or revoke the deed at any time while they are alive, as long as they follow the proper legal procedures.

This is misleading. While the deed helps avoid probate, it does not eliminate potential estate or inheritance taxes that may apply when the property owner passes away.

This is not accurate. You can name anyone as a beneficiary, including family members, friends, or even charitable organizations, as long as they are legally capable of receiving property.

By understanding these misconceptions, you can better navigate the process of using a Transfer-on-Death Deed in New York. It's always wise to consult with a legal professional if you have specific questions or concerns.

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it's important to follow specific guidelines to ensure the process goes smoothly. Here are some dos and don'ts to keep in mind:

- Do: Clearly identify the property by including the full legal description.

- Do: Provide accurate names and addresses of all parties involved.

- Do: Sign the form in the presence of a notary public.

- Do: Ensure that the form is filed with the appropriate county clerk's office.

- Do: Keep a copy of the completed deed for your records.

- Don't: Leave any sections of the form blank; incomplete forms may be rejected.

- Don't: Use ambiguous language that could lead to confusion about ownership.

- Don't: Forget to check local regulations that may affect the deed.

- Don't: Attempt to fill out the form without understanding its implications.

By adhering to these guidelines, you can help ensure that your Transfer-on-Death Deed is processed correctly and effectively.

Browse Popular Transfer-on-Death Deed Forms for US States

Transfer on Death Deed California Common Questions - Simplifies the inheritance process by skipping probate court.

A Living Will form, specifically in California, is a legal document that lets people state their wishes for end-of-life medical care, in case they become unable to communicate their decisions. It's a way to ensure that one's healthcare preferences are known and respected. For those interested in preparing such documents, resources like California PDF Forms can be incredibly helpful. Understanding this form is crucial for anyone looking to have control over their medical treatment options.

Transfer on Death Affidavit Ohio - This deed can help prevent complications that can arise during the probate process for heirs.

Detailed Guide for Writing New York Transfer-on-Death Deed

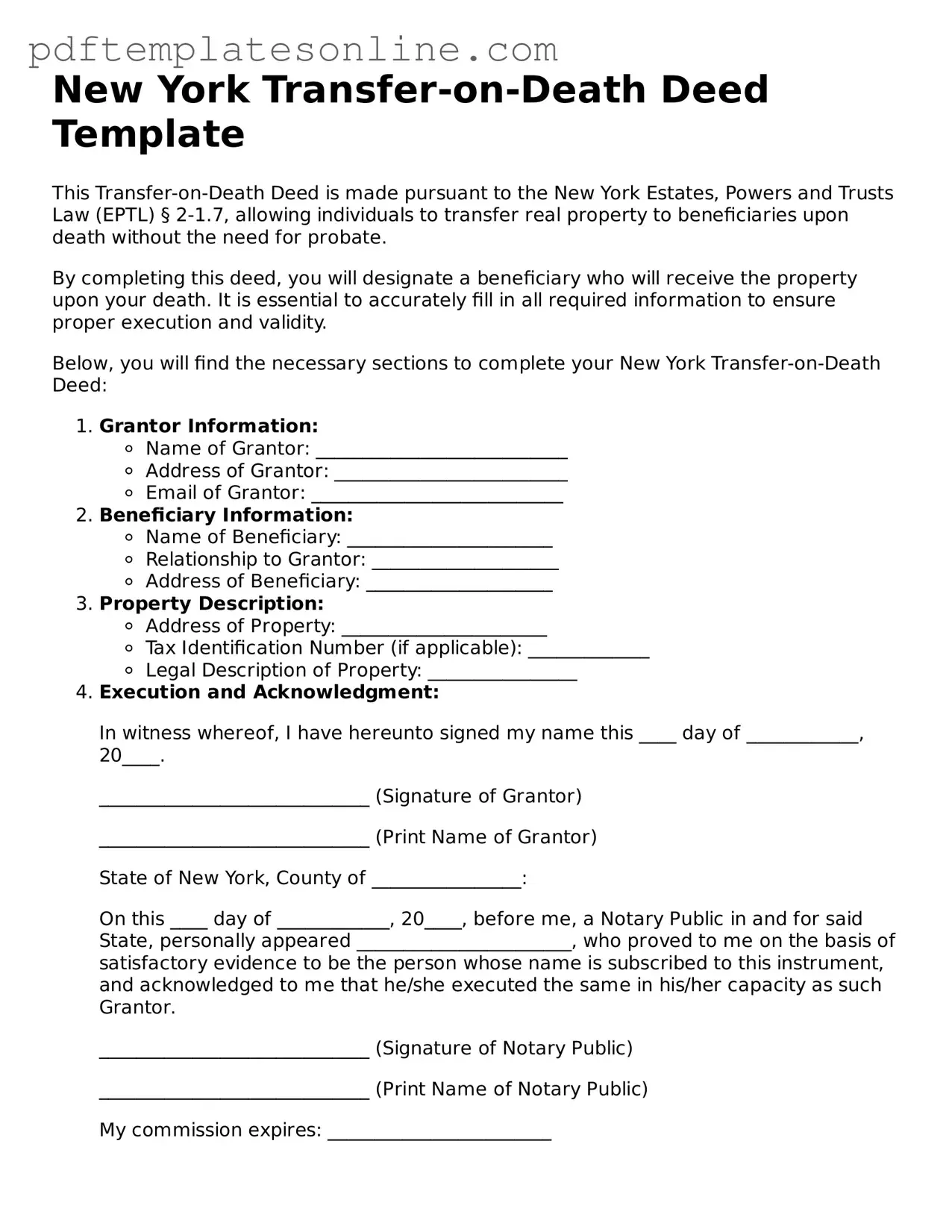

Once you have obtained the New York Transfer-on-Death Deed form, it is essential to complete it accurately to ensure the transfer of property upon death is executed as intended. Following the steps below will guide you through the process of filling out the form correctly.

- Begin by writing the date at the top of the form.

- Provide your full name as the grantor (the person transferring the property).

- Enter your address, including the city, state, and zip code.

- Identify the property being transferred by including its legal description. This may include the lot number, block number, and any other identifying information.

- Designate the beneficiary who will receive the property upon your death. Include their full name and address.

- If there are multiple beneficiaries, list them in the order of preference for the transfer.

- Sign the form in the designated area. Ensure your signature matches the name you provided as the grantor.

- Have the form notarized. This step is crucial for the document to be legally valid.

- Submit the completed form to the appropriate county clerk’s office where the property is located. This should be done before your death for the deed to take effect.