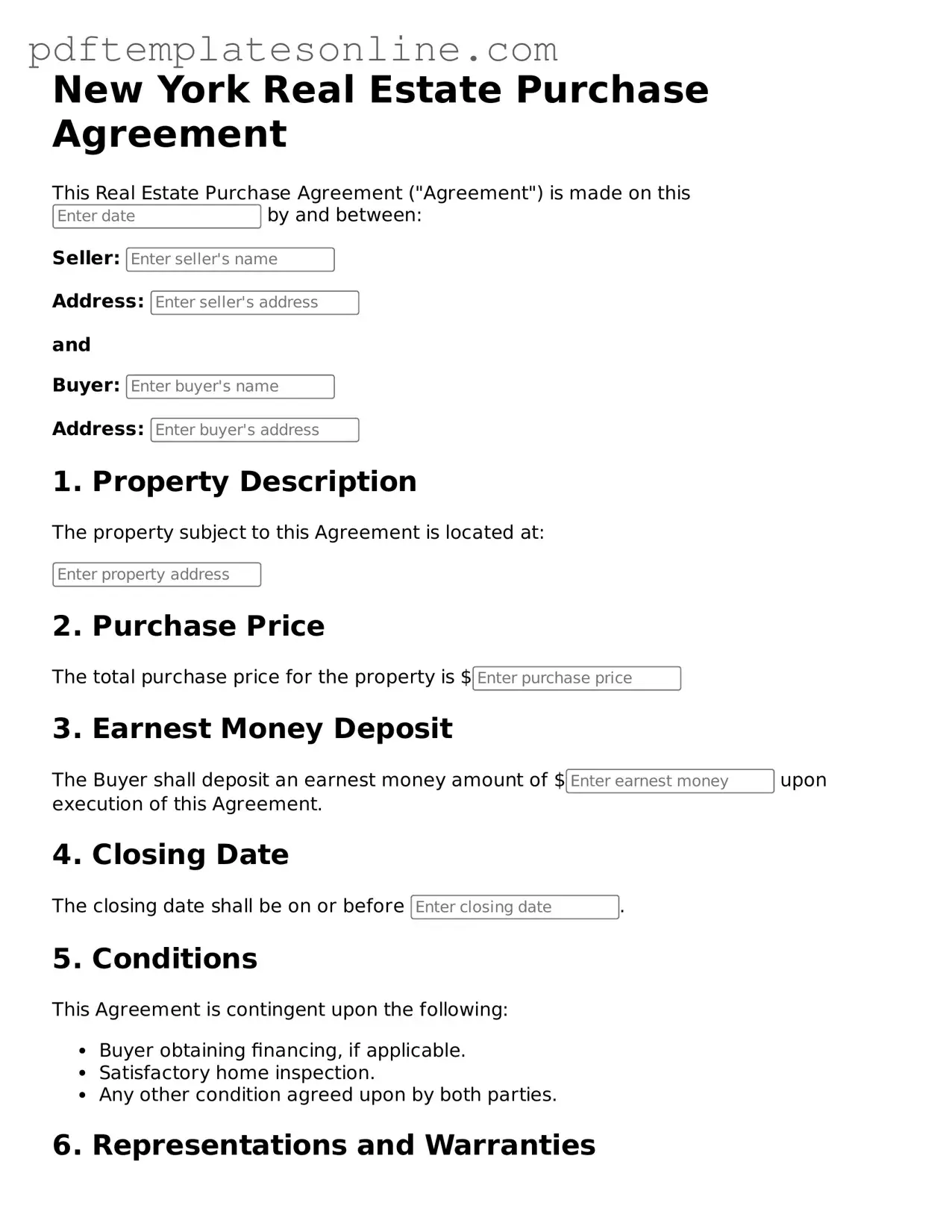

Official New York Real Estate Purchase Agreement Document

Key takeaways

When dealing with the New York Real Estate Purchase Agreement form, it’s essential to understand several key aspects to ensure a smooth transaction. Here are some important takeaways:

- Clarity is Crucial: Fill out the form with clear and precise information. Ambiguities can lead to misunderstandings and disputes later on.

- Review All Terms: Carefully examine all terms and conditions outlined in the agreement. Ensure that you understand the obligations and rights of both the buyer and seller.

- Include Contingencies: Consider including contingencies, such as financing or inspection clauses. These can protect your interests if certain conditions are not met.

- Seek Professional Guidance: Consulting with a real estate attorney or a qualified agent can provide valuable insights. They can help you navigate the complexities of the agreement.

By keeping these points in mind, you can better navigate the process of filling out and using the New York Real Estate Purchase Agreement form.

Common mistakes

When filling out the New York Real Estate Purchase Agreement form, many buyers and sellers make common mistakes that can lead to complications down the road. One of the most frequent errors is not providing accurate property details. This includes the address, lot number, and any other identifying information. Inaccuracies can create confusion and may even lead to disputes later on. Always double-check these details to ensure they are correct.

Another mistake often seen is the failure to clearly outline the terms of the sale. This includes the purchase price, deposit amount, and any contingencies. If these terms are vague or missing, it can result in misunderstandings between the parties involved. Clarity is crucial. Make sure to spell out each term explicitly to avoid any ambiguity.

People also tend to overlook the importance of including necessary disclosures. New York law requires sellers to provide certain information about the property, such as any known defects or issues. Failing to disclose these can lead to legal repercussions. It’s essential to be transparent and provide all required disclosures to protect both parties.

Finally, many individuals forget to sign and date the agreement. A purchase agreement is not legally binding until it is properly executed. Without signatures, the document holds no weight. Ensure that all parties involved sign and date the agreement to make it official. This simple step is often overlooked but is vital for the validity of the contract.

Misconceptions

Understanding the New York Real Estate Purchase Agreement form is crucial for both buyers and sellers. However, several misconceptions can lead to confusion and potentially problematic situations. Here are four common misconceptions:

- It is a standard form that requires no customization. Many believe that the New York Real Estate Purchase Agreement is a one-size-fits-all document. In reality, each transaction is unique, and specific terms may need to be tailored to fit the circumstances of the sale.

- Signing the agreement is the final step in the process. Some individuals think that once the agreement is signed, the deal is done. However, this is not the case. The agreement is just the beginning; there are still inspections, financing, and other contingencies that must be addressed before closing.

- All agreements are legally binding immediately upon signing. While it is true that a signed agreement can be legally binding, certain conditions or contingencies may need to be fulfilled first. Buyers and sellers should be aware of these conditions to avoid misunderstandings.

- Real estate agents handle all aspects of the agreement. Many assume that real estate agents will take care of everything related to the agreement. However, it is essential for both parties to read and understand the terms, as they are ultimately responsible for the agreement's implications.

Being informed about these misconceptions can help you navigate the New York Real Estate Purchase Agreement more effectively. Always consider seeking professional advice to clarify any doubts you may have.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, consider the following do's and don'ts to ensure accuracy and clarity.

- Do read the entire form carefully before starting.

- Do provide accurate information about the property.

- Do include all necessary details about the buyer and seller.

- Do double-check all numbers and dates for correctness.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations that may cause confusion.

- Don't rush through the form; take your time to ensure completeness.

- Don't forget to sign and date the agreement at the end.

Browse Popular Real Estate Purchase Agreement Forms for US States

Purchase Agreement for a House - The agreement can set out how properties are to be shown during the sale process.

To further facilitate the notarization process, you can access various resources, including templates and forms, such as the California PDF Forms, which streamline the creation of Notary Acknowledgment forms to ensure compliance and accuracy in legal procedures.

Home Purchase Contract - This form establishes a timeline for completing various phases of the transaction.

Detailed Guide for Writing New York Real Estate Purchase Agreement

Completing the New York Real Estate Purchase Agreement form is an essential step in the property buying process. This form outlines the terms and conditions of the sale, ensuring that both the buyer and seller are on the same page. Once filled out, the agreement will serve as a binding contract, guiding the transaction forward.

- Obtain the Form: Start by downloading the New York Real Estate Purchase Agreement form from a reliable source or obtaining it from your real estate agent.

- Fill in Buyer Information: Enter the full names, addresses, and contact information of all buyers involved in the transaction.

- Fill in Seller Information: Provide the full names, addresses, and contact information of all sellers involved in the transaction.

- Property Description: Clearly describe the property being sold. Include the address, lot number, and any relevant details that identify the property.

- Purchase Price: State the agreed-upon purchase price for the property. Be sure to write this amount clearly and accurately.

- Deposit Amount: Indicate the amount of the deposit that the buyer will provide as part of the agreement. Specify how this will be handled.

- Financing Details: If applicable, describe the financing terms. Include details about mortgages or other financing arrangements that will be used.

- Closing Date: Specify the proposed closing date for the transaction. This is when ownership will officially transfer from the seller to the buyer.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections, financing approval, or other conditions.

- Signatures: Ensure that all parties involved sign and date the agreement. This includes both buyers and sellers, as well as any necessary witnesses.

After completing the form, review it carefully to confirm that all information is accurate and complete. Once everyone has signed, the agreement can be submitted to the appropriate parties, and the next steps in the buying process can begin.