Official New York Quitclaim Deed Document

Key takeaways

When dealing with a New York Quitclaim Deed, it’s essential to understand the following key points:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of property without guaranteeing the title. It is often used among family members or in situations where the parties trust each other.

- Completing the Form: Ensure that all required fields are filled out accurately. This includes the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), as well as a clear description of the property.

- Notarization Requirement: The Quitclaim Deed must be signed in the presence of a notary public. This step is crucial as it validates the document and helps prevent fraud.

- Filing the Deed: After completing and notarizing the Quitclaim Deed, it must be filed with the county clerk’s office where the property is located. This step is necessary to make the transfer official and public.

- Tax Implications: Be aware of potential tax consequences when transferring property. Consult with a tax professional to understand any implications related to gift taxes or property taxes.

By keeping these points in mind, you can navigate the process of using a Quitclaim Deed in New York more effectively.

Common mistakes

Filling out a New York Quitclaim Deed form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is failing to provide accurate information about the property. This includes not listing the correct legal description or address of the property being transferred. An incomplete or incorrect description can lead to confusion and may even invalidate the deed.

Another common mistake involves the omission of necessary signatures. Both the grantor and grantee must sign the deed for it to be valid. If one party neglects to sign, the document may be deemed ineffective. Additionally, if the signatures are not notarized, the deed may face challenges in its acceptance during property transactions.

People sometimes overlook the importance of including the date of the transaction. Without a date, it can be difficult to establish when the transfer of ownership took place. This information is crucial for legal records and can affect future transactions related to the property.

Finally, many individuals fail to record the Quitclaim Deed with the appropriate county office. Recording the deed is essential for public notice and protecting the new owner's rights. If the deed is not recorded, the new owner may face challenges in proving ownership in the future.

Misconceptions

Understanding the New York Quitclaim Deed form is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are six common misconceptions explained.

- A Quitclaim Deed Transfers Ownership Fully. Many believe that a quitclaim deed conveys full ownership rights. In reality, it transfers whatever interest the grantor has in the property, which may be none at all.

- Quitclaim Deeds Are Only Used Between Family Members. While quitclaim deeds are often used in family transactions, they are also utilized in various situations, including divorce settlements and business partnerships.

- Quitclaim Deeds Are Not Legal Documents. This is false. Quitclaim deeds are legal instruments recognized by the state of New York. They must be properly executed and recorded to be effective.

- Using a Quitclaim Deed Eliminates All Liability. A common misconception is that using a quitclaim deed releases the grantor from all liabilities related to the property. However, any existing liens or mortgages remain attached to the property regardless of the deed type.

- Quitclaim Deeds Are the Same as Warranty Deeds. Many confuse quitclaim deeds with warranty deeds. Unlike warranty deeds, which guarantee the grantor's clear title to the property, quitclaim deeds offer no such assurances.

- Once a Quitclaim Deed Is Signed, It Cannot Be Revoked. This is misleading. While a quitclaim deed is generally irrevocable once executed, the grantor can potentially challenge the deed in court under certain circumstances.

Clarifying these misconceptions can aid individuals in making informed decisions regarding property transfers in New York.

Dos and Don'ts

When filling out the New York Quitclaim Deed form, it is essential to follow specific guidelines to ensure accuracy and legality. Here is a list of things to do and avoid:

- Do ensure that all names are spelled correctly, as errors can lead to complications in property transfer.

- Do include a complete and accurate legal description of the property being transferred.

- Do sign the deed in the presence of a notary public to validate the document.

- Do check that the form is filled out completely, without leaving any required fields blank.

- Don't use a quitclaim deed if there are existing liens or encumbrances on the property without understanding the implications.

- Don't forget to file the deed with the county clerk's office after it has been signed and notarized.

- Don't assume that a quitclaim deed will provide any warranties or guarantees regarding the property title.

- Don't overlook the need for a witness if required, as this may vary by county.

Browse Popular Quitclaim Deed Forms for US States

Quick Claim Deeds Ohio - A Quitclaim Deed can clarify ownership for shared properties among friends.

The Employment Application PDF form is a standardized document used by employers to collect essential information from job applicants. This form typically includes sections for personal details, work history, education, and references. For those seeking to streamline the application process, the https://mypdfform.com/blank-employment-application-pdf/ provides an easily accessible template that candidates can fill out and submit during their job search. Completing this form accurately is vital for candidates seeking employment, as it serves as a primary tool for assessing qualifications and suitability for available positions.

Quit Claim Deed Real Estate - The form does not provide protection against possible claims from third parties.

Quit Claim Deed Form Georgia - This form is useful for conveying property between siblings or other relatives.

Detailed Guide for Writing New York Quitclaim Deed

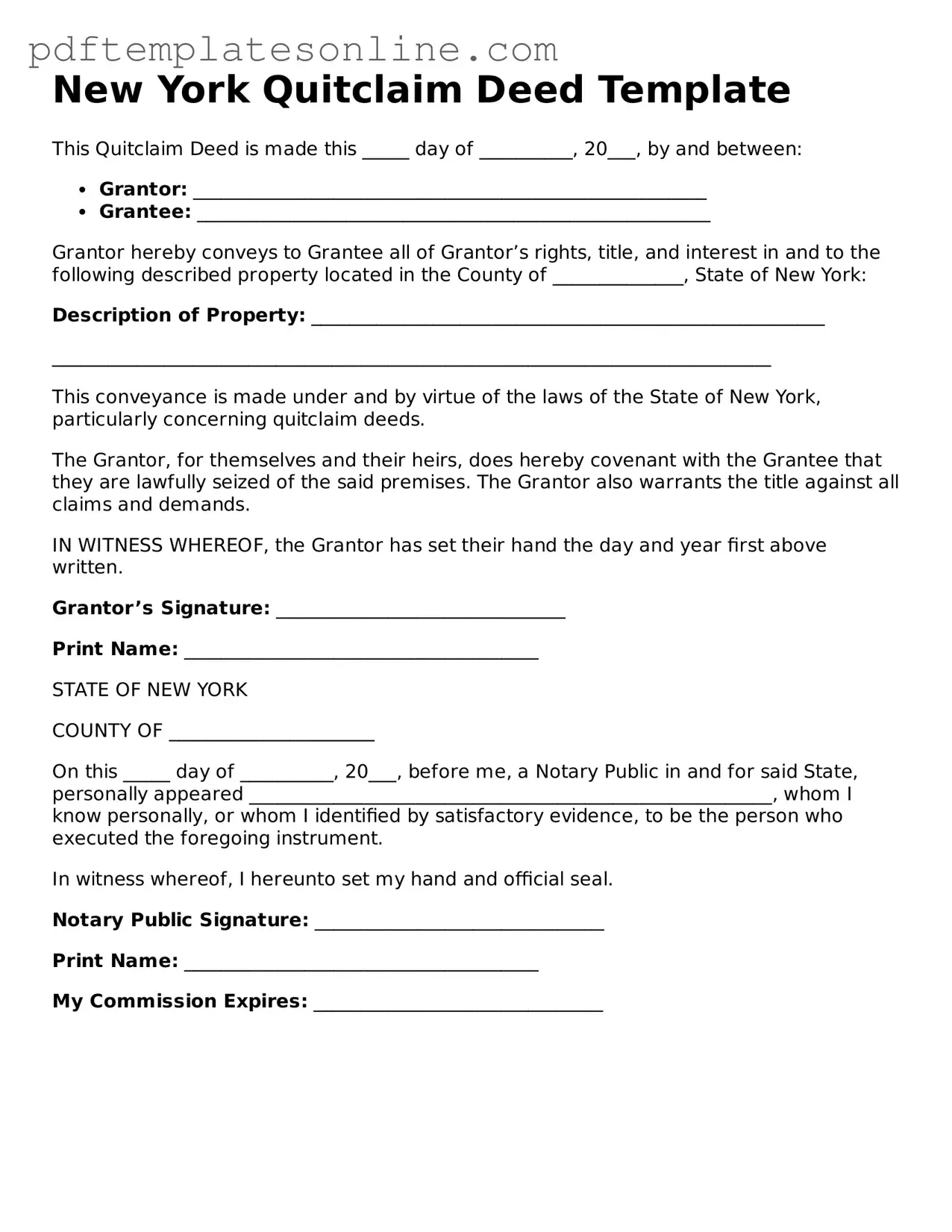

After obtaining the New York Quitclaim Deed form, you are ready to fill it out. This form facilitates the transfer of property ownership from one party to another. Ensure you have all necessary information at hand before starting the process.

- Begin by entering the date of the deed at the top of the form.

- Provide the name of the grantor (the person transferring the property). Include their full legal name.

- Next, list the name of the grantee (the person receiving the property). Again, use their full legal name.

- Clearly describe the property being transferred. Include the address and any relevant details, such as the county and tax identification number.

- Indicate the consideration, which is the value exchanged for the property. This can be a monetary amount or a statement indicating it is a gift.

- Sign the form in the designated area. The grantor must sign in the presence of a notary public.

- Have the notary public complete their section, including their signature and seal, confirming the authenticity of the grantor's signature.

- Make copies of the completed deed for your records.

- File the original Quitclaim Deed with the appropriate county clerk’s office to finalize the transfer.