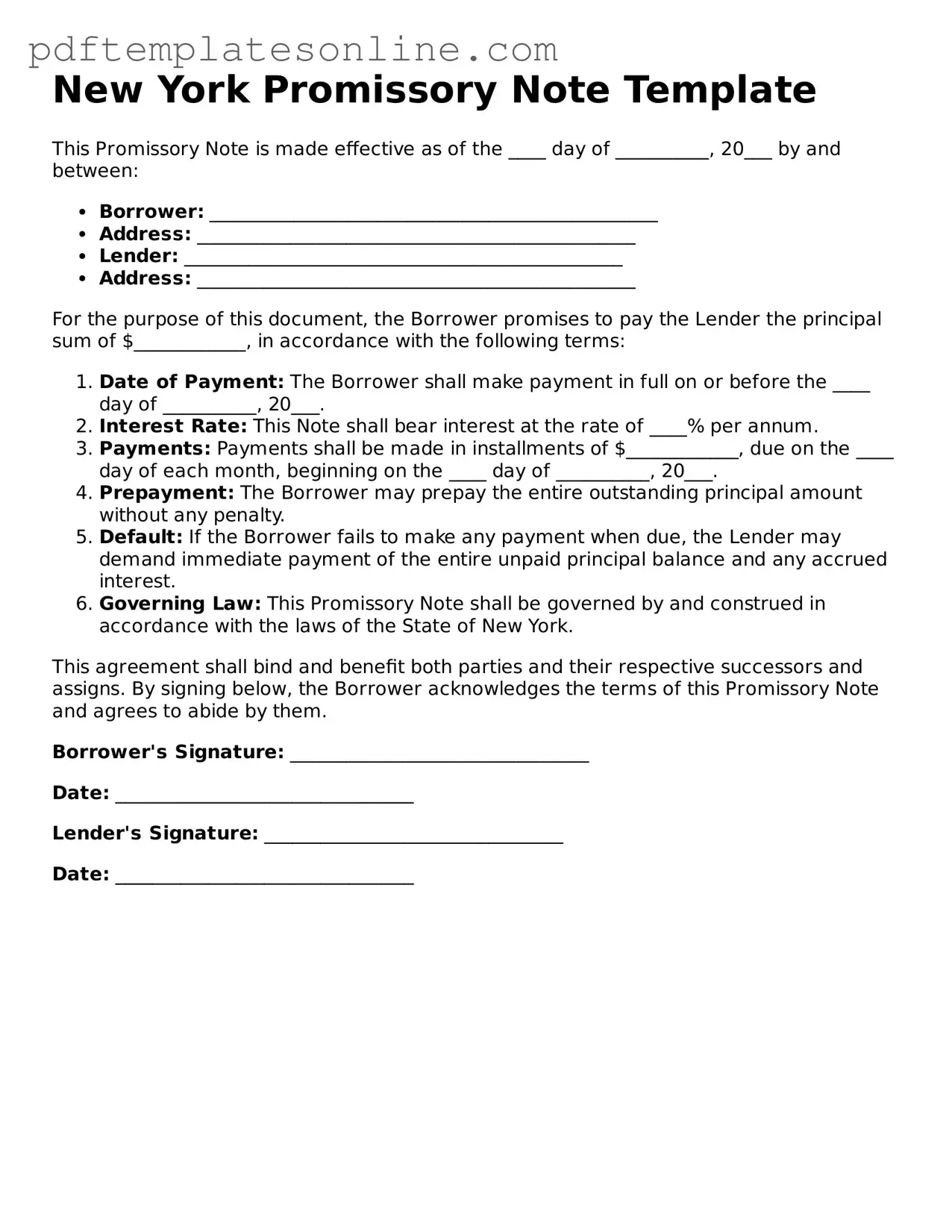

Official New York Promissory Note Document

Key takeaways

When dealing with a New York Promissory Note, understanding its key elements is essential for both lenders and borrowers. Here are some important takeaways to keep in mind:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are properly identified.

- Specify the Amount: Clearly indicate the principal amount being borrowed. This is the total sum that the borrower agrees to repay.

- Interest Rate: Include the interest rate applicable to the loan. If the loan is interest-free, this should be explicitly stated.

- Payment Terms: Outline how and when payments will be made. This includes the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Default Conditions: Define what constitutes a default. This could include missed payments or failure to meet other obligations outlined in the note.

- Governing Law: Specify that the note is governed by New York law. This clarifies which legal framework applies in case of disputes.

- Signatures: Ensure that both parties sign and date the document. This formalizes the agreement and makes it legally binding.

- Keep Copies: After filling out the form, both parties should retain copies for their records. This helps in resolving any future disputes.

Common mistakes

Filling out a New York Promissory Note form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls is essential for ensuring that the note is valid and enforceable.

One frequent mistake is failing to include the correct names of the parties involved. It is crucial that both the borrower and lender are clearly identified. If there are any discrepancies in names, it could create confusion about who is responsible for the repayment. Always double-check the spelling and ensure that the names match official identification.

Another common error is neglecting to specify the loan amount. The amount borrowed should be clearly stated in both numerical and written form. Omitting this detail can lead to misunderstandings regarding the terms of the loan. It is advisable to write the amount in words as well as numbers to avoid any ambiguity.

People often forget to include the interest rate, which is a critical component of the agreement. If the interest rate is not specified, the note may be considered incomplete. Additionally, if the interest rate is too high, it could violate usury laws, making the note unenforceable. Therefore, it is important to research and include a fair interest rate.

Another mistake involves the repayment terms. It is essential to outline how and when payments will be made. Whether the borrower will make monthly payments or a lump sum at the end should be clearly articulated. Lack of clarity in repayment terms can lead to disputes and financial strain.

Many individuals overlook the importance of including a date. The date on which the promissory note is signed is significant because it marks the beginning of the loan agreement. Without a date, it can be challenging to establish timelines for repayment and interest accrual.

Furthermore, some people fail to sign the document. A promissory note is not legally binding unless it is signed by the borrower. In some cases, lenders may also choose to sign the document for added security. Always ensure that all necessary signatures are present before finalizing the note.

Another issue arises when individuals do not keep a copy of the signed note. It is vital for both parties to retain a copy of the agreement for their records. Having a copy helps in case any disputes arise in the future, providing evidence of the terms agreed upon.

Lastly, individuals sometimes forget to have the document witnessed or notarized. While not always required, having a witness or notary public can add an extra layer of legitimacy to the agreement. This step can be especially important if the note is ever challenged in court.

Misconceptions

Misconceptions about the New York Promissory Note form can lead to confusion for both lenders and borrowers. Understanding these misconceptions is essential for anyone involved in a financial transaction. Below is a list of common misunderstandings:

- All promissory notes are the same. Each promissory note can vary significantly in terms of terms, conditions, and legal requirements. A New York Promissory Note has specific elements that must be included to be enforceable.

- A promissory note must be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note to be valid in New York.

- Only large loans require a promissory note. Even small personal loans can benefit from a written agreement. A promissory note helps clarify the terms, regardless of the loan amount.

- Promissory notes do not require interest. While some notes may be interest-free, many include an interest rate. The terms of the note dictate whether interest is applicable.

- Once signed, a promissory note cannot be changed. Parties can mutually agree to modify the terms of a promissory note, provided that both parties consent to the changes in writing.

- A promissory note guarantees repayment. While it is a formal commitment to repay, it does not guarantee that the borrower will have the funds available to do so. Default can still occur.

- Only individuals can issue promissory notes. Businesses and organizations can also issue promissory notes. The entity’s legal structure will determine how the note is executed.

- Promissory notes are only for personal loans. They are frequently used in business transactions as well, such as financing arrangements and inter-company loans.

- Once a promissory note is created, it is permanent. Promissory notes can be paid off early or refinanced, allowing for flexibility in the repayment process.

Understanding these misconceptions can help individuals navigate the complexities of financial agreements more effectively. A well-drafted promissory note protects both parties and clarifies expectations.

Dos and Don'ts

When filling out the New York Promissory Note form, it’s essential to follow certain guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn’t do:

- Do: Clearly state the names of the borrower and lender.

- Do: Specify the loan amount in both numbers and words.

- Do: Include the interest rate, if applicable.

- Do: Outline the repayment schedule, including due dates.

- Do: Sign and date the document in the presence of a witness or notary.

- Don't: Leave any sections blank; complete all required fields.

- Don't: Use ambiguous language; be clear and precise.

- Don't: Forget to keep a copy for your records.

- Don't: Alter the terms after signing without mutual consent.

Browse Popular Promissory Note Forms for US States

Notarized Promissory Note - A Promissory Note can help establish credit history for the borrower.

If you are considering transferring assets without a monetary exchange, utilizing a reliable resource like the informative Gift Deed template can simplify the process and ensure legal compliance.

Promissory Note Template California Word - the flexibility in drafting allows for added conditions tailored to the specific agreement.

Detailed Guide for Writing New York Promissory Note

Once you have the New York Promissory Note form ready, it’s time to fill it out accurately. Make sure you have all the necessary information at hand, such as the names of the parties involved, the amount being borrowed, and the repayment terms. Follow these steps to complete the form.

- Identify the Parties: Write the name and address of the borrower and the lender at the top of the form.

- Loan Amount: Clearly state the total amount of money being borrowed.

- Interest Rate: Specify the interest rate that will be applied to the loan, if any.

- Payment Terms: Outline how and when the borrower will repay the loan. Include details about the payment schedule.

- Late Fees: If applicable, mention any late fees that will be charged if payments are missed.

- Signatures: Both the borrower and lender must sign the document. Include the date of signing next to each signature.

- Notarization: If required, have the document notarized to add an extra layer of authenticity.

After completing the form, keep copies for both parties. It’s important to store them in a safe place for future reference.