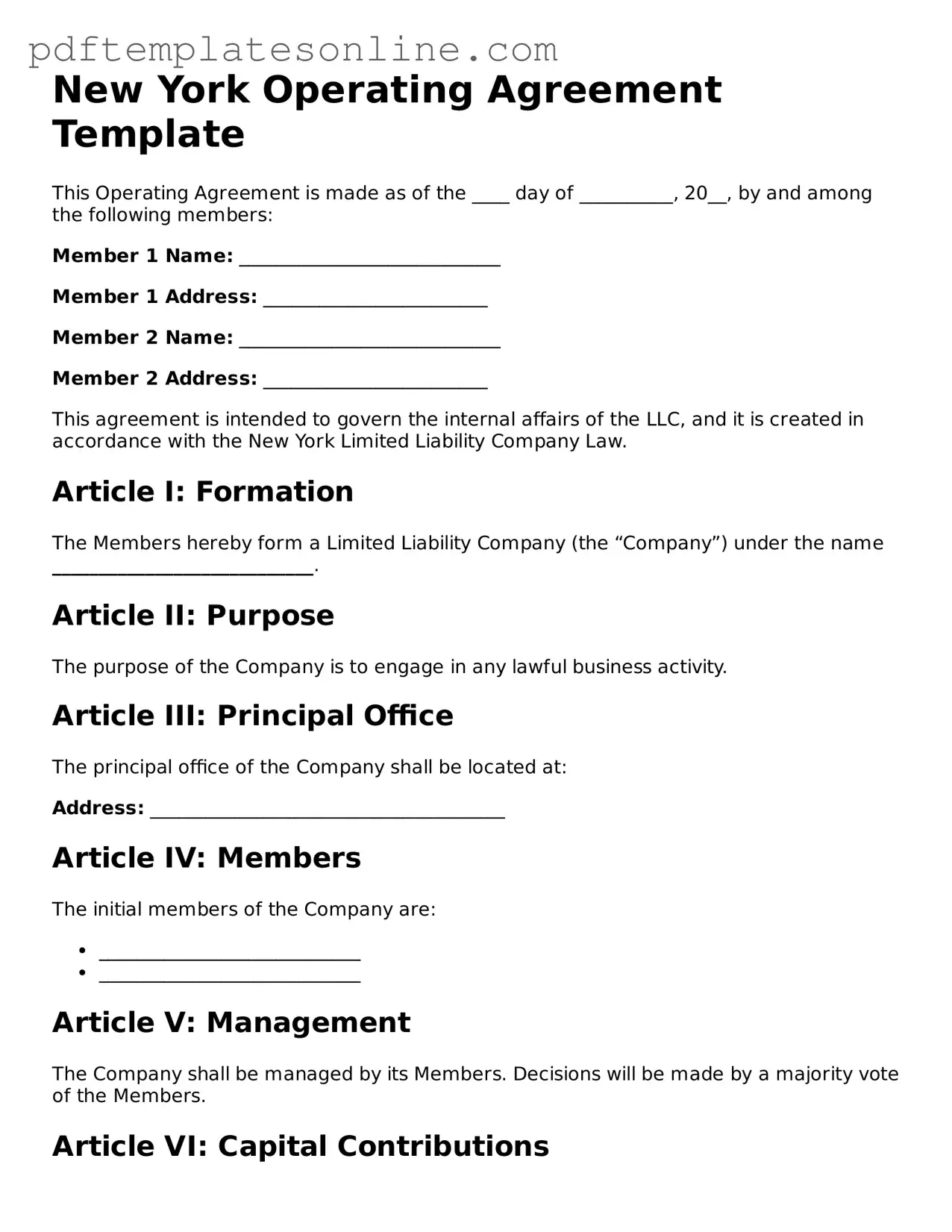

Official New York Operating Agreement Document

Key takeaways

Filling out and using the New York Operating Agreement form is an essential step for anyone looking to establish a limited liability company (LLC) in the state. Here are some key takeaways to keep in mind:

- The Operating Agreement outlines the management structure and operating procedures of the LLC.

- It is not required by law, but having one is highly recommended to clarify roles and responsibilities.

- All members of the LLC should agree on the terms outlined in the agreement to prevent future disputes.

- Include details such as profit distribution, decision-making processes, and member responsibilities.

- Regularly review and update the Operating Agreement to reflect any changes in the business structure or membership.

- While the form can be filled out independently, consulting with a legal professional can provide additional insights.

- Keep the Operating Agreement on file with other important business documents for easy access and reference.

By understanding these key points, you can ensure that your Operating Agreement serves its purpose effectively and supports the smooth operation of your LLC.

Common mistakes

When forming a Limited Liability Company (LLC) in New York, completing the Operating Agreement is a crucial step. However, many individuals make common mistakes that can lead to confusion or legal issues down the line. Understanding these pitfalls can help ensure that your Operating Agreement is both accurate and effective.

One frequent mistake is failing to identify all members of the LLC. It’s essential to list every individual or entity involved in the company. Omitting a member can create disputes later on, as everyone needs to be clear about their roles and responsibilities from the outset.

Another common error is neglecting to outline the management structure. Whether the LLC will be member-managed or manager-managed should be explicitly stated. This clarity helps in determining who has the authority to make decisions on behalf of the company, which is vital for smooth operations.

Some people also forget to include capital contributions. Each member’s initial investment in the LLC should be clearly documented. Without this information, it can be challenging to determine ownership percentages and profit distributions, leading to potential conflicts among members.

Additionally, many individuals make the mistake of not specifying profit and loss distribution. How profits and losses will be allocated among members should be clearly defined in the Operating Agreement. This detail is crucial for financial planning and maintaining good relationships among members.

Another oversight involves not addressing the process for adding or removing members. Life changes, and so do business circumstances. Including a clear procedure for membership changes helps to avoid confusion and ensures that the LLC can adapt as needed.

Some people also neglect to include dispute resolution mechanisms. Conflicts can arise in any business. Having a predefined process for resolving disputes can save time and money, and it can prevent issues from escalating into legal battles.

Moreover, failing to address dissolution procedures is a common mistake. It’s important to outline how the LLC can be dissolved if necessary. This ensures that all members understand the steps involved and can plan accordingly should the need arise.

Another pitfall is using vague language throughout the document. Clarity is key in legal documents. Ambiguous terms can lead to different interpretations, which can create problems in the future. Therefore, it’s vital to be as specific as possible.

Lastly, many individuals forget to review and update the Operating Agreement regularly. As the business evolves, so too should the Operating Agreement. Regular reviews ensure that the document remains relevant and accurately reflects the current state of the LLC.

By avoiding these common mistakes, individuals can create a robust Operating Agreement that serves as a solid foundation for their LLC. A well-prepared agreement not only helps in preventing disputes but also provides clarity and direction for all members involved.

Misconceptions

When it comes to the New York Operating Agreement, there are several misconceptions that people often have. Understanding these can help clarify the purpose and importance of this document for business owners. Here’s a look at some common misunderstandings:

- It’s not necessary for single-member LLCs. Many believe that if an LLC has only one owner, an Operating Agreement is unnecessary. However, even single-member LLCs benefit from having this document to outline management and operational guidelines.

- It’s a public document. Some think that the Operating Agreement must be filed with the state and is available for public viewing. In reality, this document is kept private and does not need to be submitted to the state.

- It can’t be changed. There’s a belief that once the Operating Agreement is created, it cannot be modified. On the contrary, owners can amend the agreement as needed, provided they follow the procedures outlined within the document itself.

- It’s only for large businesses. Some people assume that Operating Agreements are only relevant for larger companies. In fact, they are beneficial for businesses of all sizes, providing clarity and structure regardless of the number of members.

- It covers everything about the business. While the Operating Agreement is comprehensive, it does not cover every aspect of a business. It primarily focuses on the internal workings and governance of the LLC, leaving other areas, like taxes and employment, to be addressed separately.

- It’s the same as the Articles of Organization. Many confuse the Operating Agreement with the Articles of Organization. The Articles of Organization are filed with the state to officially form the LLC, while the Operating Agreement outlines how the LLC will operate.

- It’s only important during disputes. Some think that the Operating Agreement is only necessary when conflicts arise. In reality, having a clear agreement in place can help prevent disputes by setting expectations from the start.

- Legal help is not needed to create one. While it’s possible to draft an Operating Agreement without legal assistance, many believe that doing so is advisable. Consulting with a legal professional can ensure that the document meets all necessary requirements and adequately protects the interests of the members.

By addressing these misconceptions, business owners can better understand the significance of the New York Operating Agreement and its role in the successful management of their LLC.

Dos and Don'ts

When filling out the New York Operating Agreement form, it’s important to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure everything goes smoothly.

- Do read the entire form thoroughly before starting. Understanding each section will help you provide accurate information.

- Do gather all necessary information about your LLC, including member names, addresses, and ownership percentages.

- Do be clear and specific when outlining the roles and responsibilities of each member.

- Do review the completed form for any errors or omissions before submitting it.

- Do keep a copy of the signed Operating Agreement for your records.

- Don't rush through the form. Taking your time can prevent mistakes that may cause issues later.

- Don't leave any required fields blank. Incomplete forms can lead to delays or rejections.

- Don't use vague language. Clear and precise wording is essential for avoiding misunderstandings.

- Don't forget to include all members’ signatures. An unsigned agreement may not be valid.

By following these guidelines, you can ensure that your New York Operating Agreement is filled out correctly and efficiently. This will help lay a solid foundation for your LLC's operations and governance.

Browse Popular Operating Agreement Forms for US States

Operating Agreement Llc California Template - The Operating Agreement is not always filed with state authorities but is crucial for internal governance.

Texas Llc Operating Agreement - An Operating Agreement is crucial for securing financing or investment in the LLC.

Detailed Guide for Writing New York Operating Agreement

Filling out the New York Operating Agreement form is an important step in establishing your business. This document outlines the management structure and operational procedures for your limited liability company (LLC). Follow these steps carefully to ensure that all necessary information is included.

- Start by entering the name of your LLC at the top of the form. Make sure it matches the name registered with the state.

- Provide the principal office address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members. Include each member's percentage of ownership in the LLC.

- Specify the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Outline the voting rights of members. State how decisions will be made and what percentage of votes is required for approval.

- Include provisions for adding or removing members. Clearly state the process for membership changes.

- Detail how profits and losses will be distributed among members. This should reflect each member's ownership percentage.

- Set guidelines for meetings. Describe how often meetings will be held and the notice required for them.

- Sign and date the form. All members should sign to indicate their agreement to the terms outlined in the document.

Once completed, keep a copy for your records and consider filing the agreement with your state if required. This will help ensure that everyone is on the same page regarding the operation of your LLC.