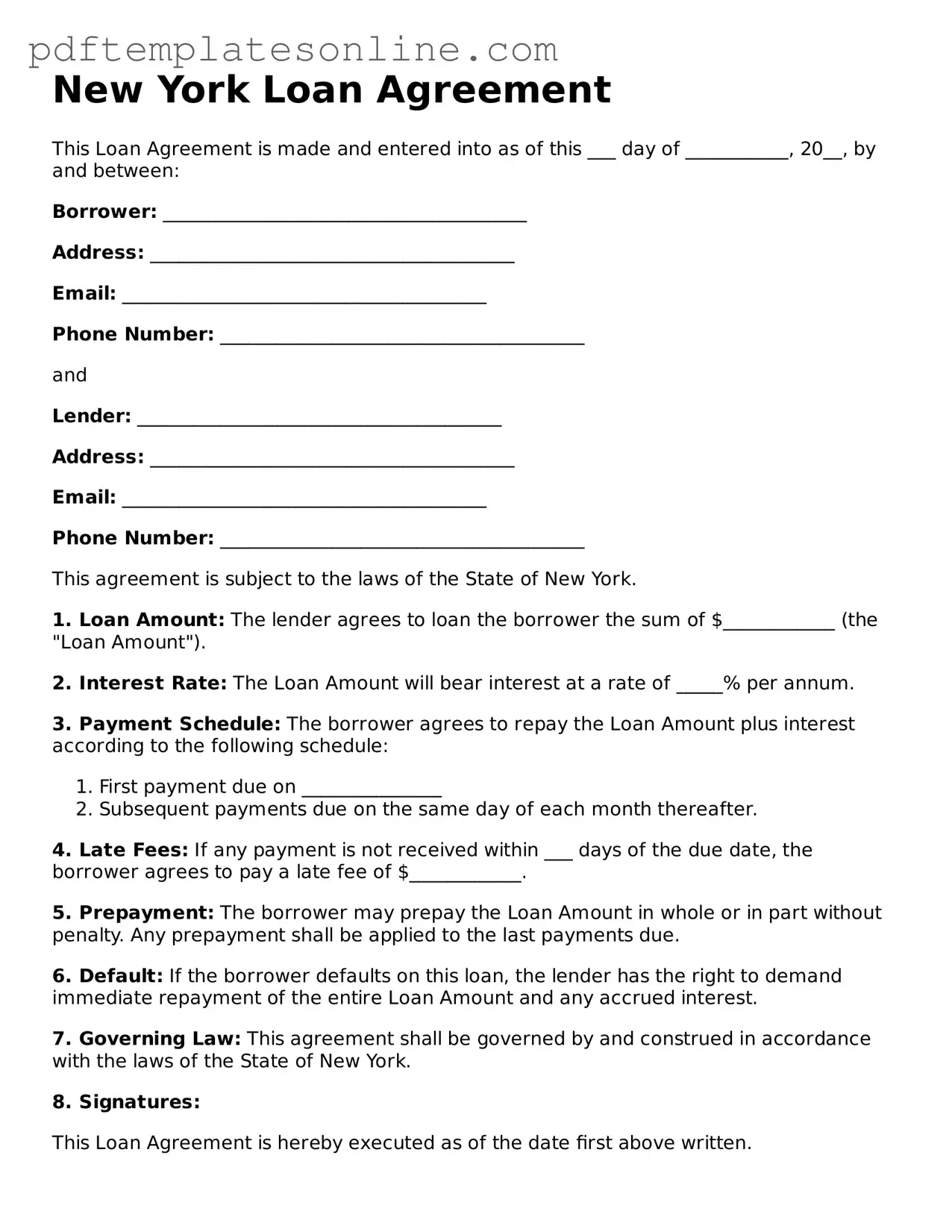

Official New York Loan Agreement Document

Key takeaways

When dealing with the New York Loan Agreement form, there are several important aspects to keep in mind. Understanding these can help ensure that the agreement is filled out correctly and used effectively.

- Clarity is Key: Clearly define the terms of the loan, including the principal amount, interest rate, and repayment schedule. Ambiguities can lead to disputes later.

- Identify the Parties: Ensure that both the lender and borrower are correctly identified. This includes full names and contact information to avoid confusion.

- Consider Legal Requirements: Familiarize yourself with New York state laws regarding loans. Certain regulations may affect the terms you can include in your agreement.

- Review Default Terms: Clearly outline what constitutes a default and the consequences that will follow. This helps both parties understand their obligations.

- Signatures Matter: Both parties should sign the agreement. Consider having it notarized to add an extra layer of authenticity and legal standing.

By focusing on these key takeaways, you can navigate the process of filling out and utilizing the New York Loan Agreement form with greater confidence and clarity.

Common mistakes

When completing the New York Loan Agreement form, individuals often overlook crucial details that can lead to complications down the line. One common mistake is failing to provide accurate personal information. This includes not only names but also addresses and contact numbers. Inaccurate information can create confusion and may delay the loan approval process. It is essential to double-check all entries to ensure they match official documents.

Another frequent error is neglecting to read the terms and conditions thoroughly. Many people rush through the agreement without fully understanding the implications of the terms they are signing. This oversight can lead to misunderstandings regarding interest rates, repayment schedules, and potential penalties. Taking the time to comprehend these details can prevent future disputes and financial strain.

Additionally, individuals sometimes forget to include necessary documentation that supports their loan application. This could include proof of income, bank statements, or identification. Without these documents, the application may be deemed incomplete, resulting in delays or outright rejection. It is advisable to compile all required paperwork before starting the form to streamline the process.

Lastly, many applicants fail to sign and date the form correctly. A missing signature or incorrect date can render the agreement invalid. It is important to review the entire document to ensure that all signatures are in place and that the dates correspond to when the agreement was completed. Paying attention to these details can make a significant difference in the loan process.

Misconceptions

Understanding the New York Loan Agreement form can be challenging. Here are nine common misconceptions that people may have about it:

-

The form is only for large loans.

This is not true. The New York Loan Agreement form can be used for loans of any size, whether small or large.

-

All loan agreements are the same.

Each loan agreement is unique and tailored to the specific terms negotiated between the lender and borrower. Variations can significantly impact the rights and obligations of both parties.

-

Once signed, the agreement cannot be changed.

While a signed agreement is binding, parties can agree to modify the terms. Any changes should be documented in writing and signed by both parties.

-

The lender always has the upper hand.

This is a misconception. Borrowers have rights and can negotiate terms that are fair and reasonable.

-

Verbal agreements are sufficient.

While verbal agreements can be legally binding, they are difficult to enforce. A written agreement provides clarity and serves as evidence of the terms.

-

Loan agreements are only for personal loans.

Loan agreements are applicable to various types of loans, including business loans, mortgages, and student loans.

-

The interest rate is fixed and cannot be negotiated.

Interest rates can often be negotiated based on the borrower's creditworthiness and market conditions.

-

Signing the agreement means you understand all terms.

Signing does not guarantee understanding. It is essential to read and comprehend all terms before signing.

-

The agreement protects only the lender.

While lenders have protections, the agreement also safeguards the borrower's rights. It outlines repayment terms and consequences for default.

Dos and Don'ts

When filling out the New York Loan Agreement form, it is essential to approach the task with care and attention to detail. Here are some important do's and don'ts to keep in mind:

- Do read the entire agreement carefully before starting.

- Do provide accurate and complete information.

- Do double-check your calculations, especially for interest rates and payment amounts.

- Do ensure all required signatures are included before submission.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't ignore any additional documentation that may be required.

By following these guidelines, you can help ensure a smooth process when completing your Loan Agreement form. Attention to detail can make a significant difference in the outcome of your loan application.

Browse Popular Loan Agreement Forms for US States

Free Promissory Note Template Texas - Indicates whether a cosigner is required and their obligations.

For those seeking an efficient way to manage property ownership, the Arizona Deed in Lieu of Foreclosure can serve as a valuable tool. Understanding the implications of this agreement is crucial, so consider reviewing our insights on the Deed in Lieu of Foreclosure basics to get started. More information can be found here.

California Promissory Note Template - Clearly state any collateral that secures a loan within the agreement.

Detailed Guide for Writing New York Loan Agreement

Filling out the New York Loan Agreement form is an important step in securing a loan. After completing the form, you will be ready to submit it for processing. Make sure all information is accurate to avoid delays.

- Start by entering the date at the top of the form.

- Provide the names and addresses of both the borrower and the lender in the designated sections.

- Clearly state the loan amount you are requesting.

- Specify the interest rate for the loan.

- Indicate the repayment terms, including the duration of the loan and payment schedule.

- Include any collateral details, if applicable.

- Sign and date the form at the bottom to validate it.

- Make a copy for your records before submitting the form.