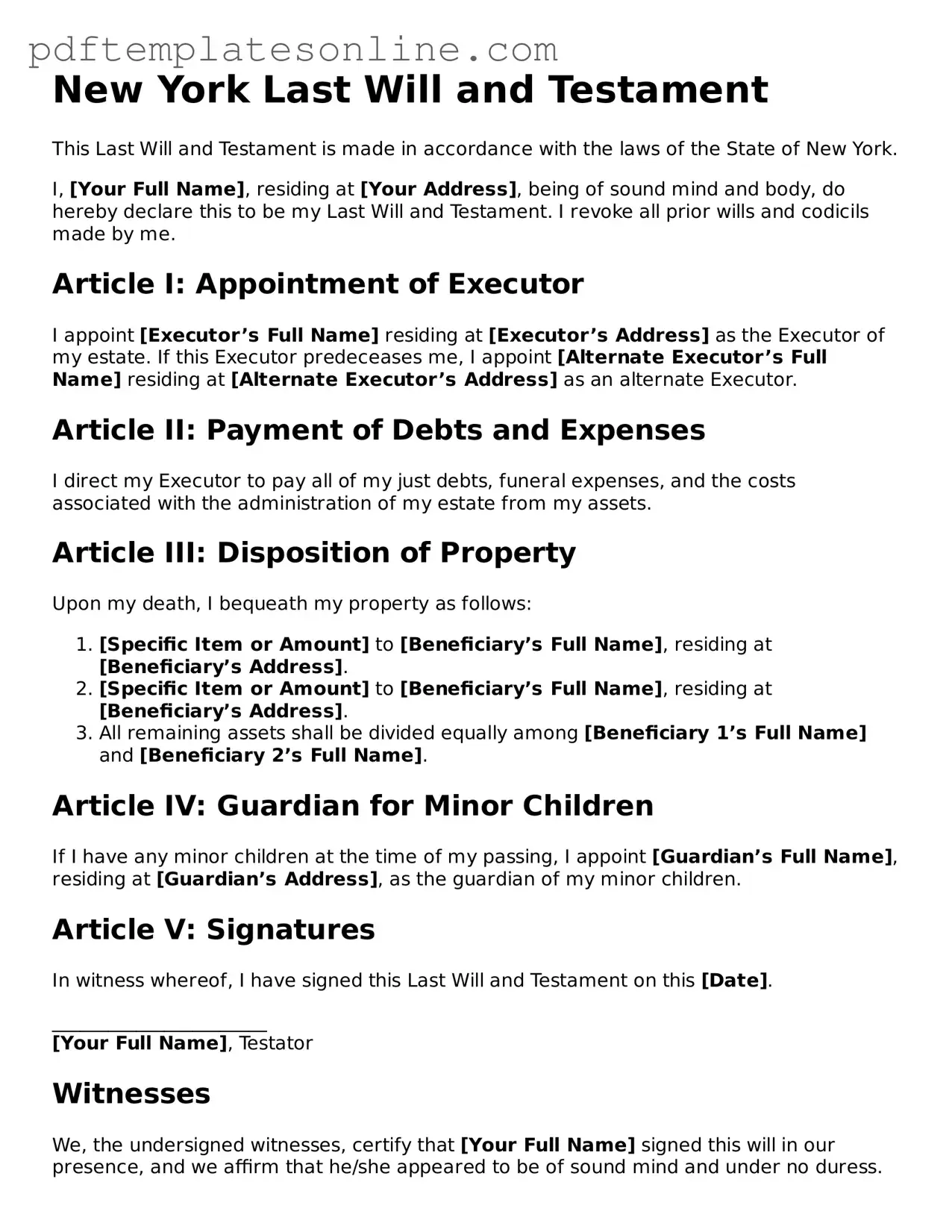

Official New York Last Will and Testament Document

Key takeaways

Creating a Last Will and Testament in New York is an important step in ensuring that your wishes are honored after your passing. Here are some key takeaways to keep in mind when filling out and using the form:

- Eligibility: To create a valid will in New York, you must be at least 18 years old and of sound mind.

- Written Document: Your will must be in writing. Oral wills are not recognized in New York.

- Signature Requirements: You must sign the will at the end. If you are unable to sign, another person can sign on your behalf in your presence.

- Witnesses: At least two witnesses must be present when you sign your will. They should not be beneficiaries to avoid potential conflicts of interest.

- Revocation: If you decide to change your will, the previous version can be revoked by destroying it or creating a new will that explicitly states the revocation.

Understanding these key points can help ensure that your Last Will and Testament is properly executed and reflects your final wishes.

Common mistakes

Filling out a Last Will and Testament form in New York can seem straightforward, but many individuals make common mistakes that can lead to complications later on. One frequent error is failing to properly identify the beneficiaries. It is crucial to clearly state the full names and relationships of all beneficiaries. Omitting this information or using nicknames can create confusion and lead to disputes among heirs.

Another mistake involves not being specific about the distribution of assets. Simply stating that everything goes to a particular person can be vague. It is advisable to list specific assets and their intended recipients. This clarity helps ensure that your wishes are honored and reduces the risk of misunderstandings.

Many people also neglect to sign their will correctly. In New York, a will must be signed in the presence of at least two witnesses. If this requirement is not met, the will may be deemed invalid. Additionally, witnesses should not be beneficiaries themselves, as this can lead to challenges regarding the will’s validity.

In some cases, individuals forget to update their wills after significant life events, such as marriage, divorce, or the birth of a child. Failing to make these updates can result in unintended consequences, like excluding a new spouse or child from inheritance. Regularly reviewing and updating your will is essential to reflect your current wishes.

Another common oversight is not including a residuary clause. This clause addresses any assets not specifically mentioned in the will. Without it, those assets could be subject to state laws regarding intestacy, which may not align with your intentions.

People often overlook the importance of appointing an executor. This individual will be responsible for carrying out the terms of your will. Choosing someone who is organized and trustworthy is vital. Failing to name an executor can lead to delays and complications in the probate process.

Additionally, some individuals make the mistake of thinking that a handwritten will, or “holographic will,” is valid in New York. While New York does recognize holographic wills under certain circumstances, they must meet specific criteria to be enforceable. It is generally safer to use a formal template or seek legal assistance.

Lastly, individuals may not consider the tax implications of their estate. Depending on the size of the estate, there may be estate taxes due. Failing to plan for these taxes can reduce the amount your beneficiaries ultimately receive. Consulting with a financial advisor or an estate planning attorney can help navigate these complexities.

Misconceptions

Understanding the New York Last Will and Testament form is essential for anyone looking to prepare their estate plan. However, several misconceptions often arise. Here are five common misunderstandings:

-

All wills must be notarized. Many people believe that a will must be notarized to be valid in New York. In reality, while notarization can help in proving the authenticity of a will, it is not a requirement. A will can be valid as long as it is signed by the testator and witnessed properly.

-

Only lawyers can create a will. Some think that only attorneys can draft a Last Will and Testament. While having a lawyer can be helpful, individuals can prepare their own wills using templates or forms, provided they follow the legal requirements set by New York law.

-

Wills are only for wealthy individuals. This misconception suggests that only those with substantial assets need a will. In truth, anyone can benefit from having a will, regardless of their financial situation. A will ensures that your wishes are honored and your loved ones are taken care of after your passing.

-

Once a will is created, it cannot be changed. Some people believe that a will is set in stone once it is signed. However, wills can be amended or revoked at any time, as long as the testator is of sound mind and follows the proper legal procedures.

-

Oral wills are valid in New York. A common myth is that verbal wills hold legal weight. In New York, oral wills are not recognized. A valid will must be in writing and meet specific requirements to be enforceable.

By clearing up these misconceptions, you can approach your estate planning with confidence and ensure that your wishes are properly documented.

Dos and Don'ts

When filling out the New York Last Will and Testament form, it is important to approach the task with care. Below is a list of things you should and shouldn't do to ensure that your will is valid and clearly reflects your wishes.

- Do clearly identify yourself at the beginning of the document.

- Don't use vague language that could lead to confusion about your intentions.

- Do name an executor who will be responsible for carrying out your wishes.

- Don't forget to sign the will in the presence of witnesses.

- Do ensure that your witnesses are not beneficiaries of the will.

- Don't make handwritten changes without initialing them; this could invalidate parts of the will.

- Do keep the will in a safe place and inform your executor of its location.

- Don't assume that verbal agreements will be honored; they should be documented in writing.

- Do review and update your will periodically, especially after major life events.

Following these guidelines can help ensure that your Last Will and Testament is properly executed and reflects your true intentions.

Browse Popular Last Will and Testament Forms for US States

Is It Legal to Write Your Own Will - Encourages proactive planning, avoiding the stress and complications that may arise without one.

Utilizing a Self-Proving Affidavit form can greatly enhance the efficiency of will validation and estate administration in California. For those looking to access this essential document, resources such as California PDF Forms provide convenient options to obtain and customize the form for their needs.

California Holographic Will - May include trusts to manage assets for beneficiaries who are minors.

Detailed Guide for Writing New York Last Will and Testament

Completing the New York Last Will and Testament form requires careful attention to detail. After filling out the form, it will need to be signed and witnessed according to state law. Following the steps below will help ensure that the document is completed accurately.

- Obtain the New York Last Will and Testament form from a reliable source.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your marital status clearly, indicating if you are single, married, or divorced.

- List your children’s names and ages, if applicable. If you do not have children, indicate this on the form.

- Designate an executor by writing their full name and address. This person will be responsible for carrying out the terms of your will.

- Clearly outline how you wish your assets to be distributed. Specify items or amounts for each beneficiary.

- Include any specific wishes regarding funeral arrangements or guardianship for minor children.

- Review the completed form for accuracy and completeness.

- Sign the form in the presence of at least two witnesses, who must also sign the document.

- Ensure that the witnesses provide their names and addresses on the form.

- Store the signed will in a safe place, and inform your executor of its location.