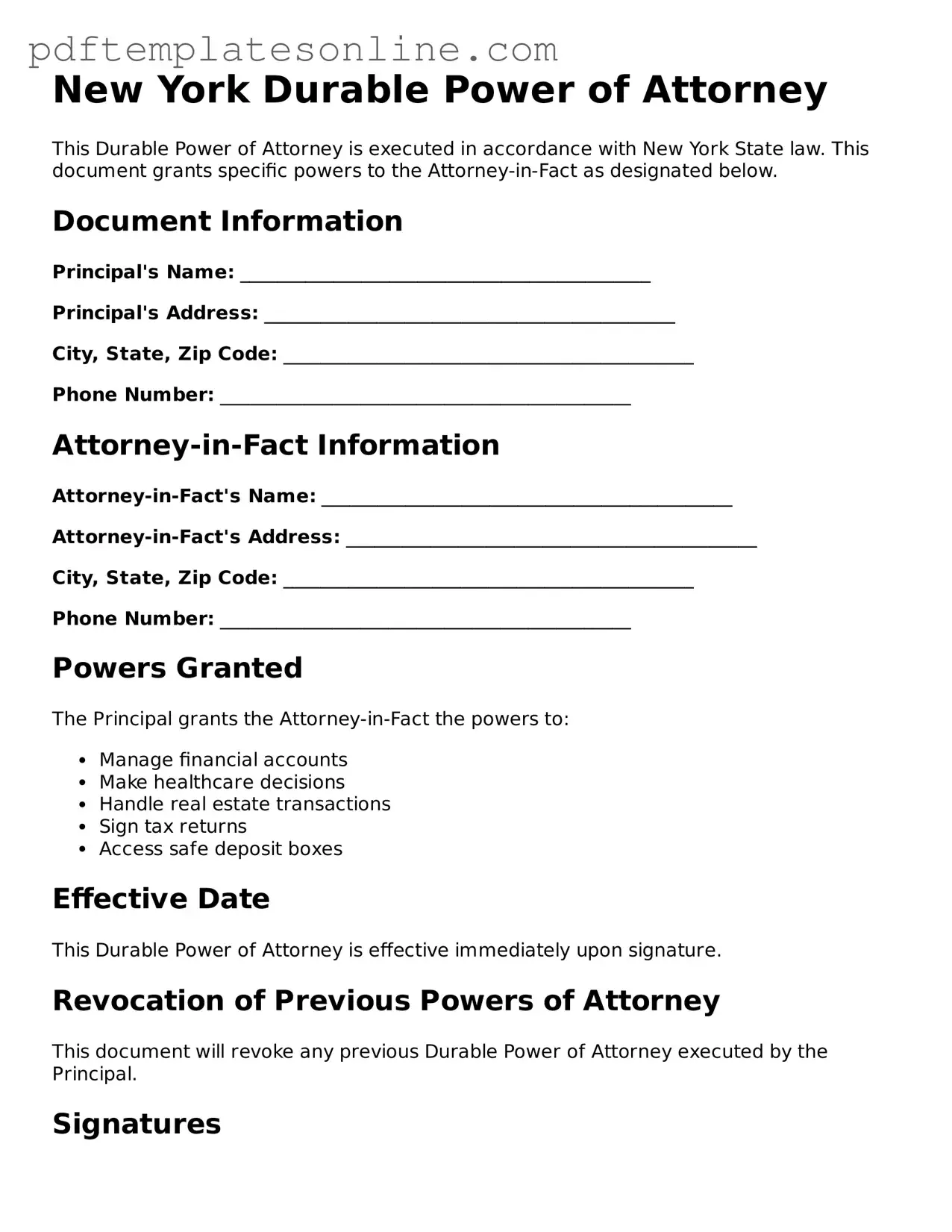

Official New York Durable Power of Attorney Document

Key takeaways

Filling out and using the New York Durable Power of Attorney form can be a straightforward process if you keep a few key points in mind. Here are ten important takeaways to consider:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to manage your financial affairs if you become incapacitated.

- Choose Your Agent Wisely: Select a trustworthy individual as your agent, as they will have significant control over your financial decisions.

- Be Specific: Clearly outline the powers you want to grant to your agent. This can include handling bank accounts, real estate transactions, and more.

- Consider Alternatives: Think about whether a Durable Power of Attorney is the best option for your situation. Other legal tools may also be available.

- Sign and Date: Ensure that you sign and date the form in the presence of a notary public to make it legally binding.

- Revocation: You can revoke the Durable Power of Attorney at any time as long as you are mentally competent. Make sure to inform your agent and any relevant institutions.

- Keep Copies: After completing the form, keep copies for yourself and provide copies to your agent and any financial institutions involved.

- Check State Laws: Familiarize yourself with New York state laws regarding Durable Power of Attorney to ensure compliance and validity.

- Review Regularly: Revisit your Durable Power of Attorney periodically to ensure it still reflects your wishes and circumstances.

- Seek Legal Advice: If you have questions or concerns, consider consulting with a legal professional to ensure you understand the implications of the form.

Common mistakes

When filling out the New York Durable Power of Attorney form, individuals often make several common mistakes that can lead to complications in the future. One significant error is failing to specify the powers granted to the agent. Without clear definitions, the agent may lack the authority to act in specific situations, which can hinder decision-making during critical times.

Another frequent mistake is neglecting to date the document. A Durable Power of Attorney must be dated to establish its validity. If the form is undated, it may be challenged in court, leading to delays and potential disputes over its legitimacy.

Many people also overlook the importance of having the form properly witnessed and notarized. New York law requires that the Durable Power of Attorney be signed in the presence of a notary public and, in some cases, witnesses. Failing to follow these requirements can render the document invalid.

Additionally, individuals sometimes choose an agent without considering their qualifications or reliability. Selecting someone who may not act in the principal's best interest can lead to mismanagement of finances or personal affairs. It is crucial to choose an agent who is trustworthy and capable of handling the responsibilities assigned.

Lastly, some individuals forget to review and update the Durable Power of Attorney as their circumstances change. Life events such as marriage, divorce, or changes in health can affect the appropriateness of the designated agent or the powers granted. Regularly reviewing the document ensures that it remains aligned with current needs and intentions.

Misconceptions

Understanding the New York Durable Power of Attorney (DPOA) form is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- Misconception 1: A Durable Power of Attorney is only for elderly individuals.

- Misconception 2: The agent can do anything they want with the principal's assets.

- Misconception 3: A Durable Power of Attorney is the same as a healthcare proxy.

- Misconception 4: A DPOA becomes invalid if the principal becomes incapacitated.

- Misconception 5: You cannot change or revoke a Durable Power of Attorney once it is signed.

- Misconception 6: A Durable Power of Attorney is only necessary if you have significant assets.

This is not true. A DPOA can be beneficial for anyone, regardless of age. It allows individuals to designate someone to manage their financial affairs if they become incapacitated.

While an agent does have significant authority, they must act in the best interest of the principal and follow the guidelines set forth in the document. Misuse of authority can lead to legal consequences.

These are distinct documents. A DPOA focuses on financial matters, while a healthcare proxy designates someone to make medical decisions on behalf of the principal.

This is incorrect. The "durable" aspect means that the authority granted to the agent remains effective even if the principal is incapacitated.

In fact, a principal can revoke or modify a DPOA at any time, as long as they are mentally competent to do so. Proper procedures must be followed to ensure the revocation is valid.

This is a common error. Even individuals with modest assets can benefit from a DPOA. It ensures that someone can manage financial matters without court intervention if the principal becomes unable to do so.

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, it is essential to approach the task with care and attention. This document allows someone to act on your behalf in financial matters, and getting it right is crucial. Here are some important dos and don'ts to keep in mind:

- Do choose a trustworthy agent. Your agent will have significant authority over your financial decisions.

- Do clearly specify the powers you are granting. Be explicit about what actions your agent can take on your behalf.

- Do sign the document in the presence of a notary public. This adds a layer of legitimacy to your form.

- Do keep a copy of the completed form for your records. It’s important to have access to it when needed.

- Don't leave any sections blank. Incomplete forms can lead to confusion or disputes later.

- Don't rush through the process. Take your time to ensure that all information is accurate and complete.

By following these guidelines, you can help ensure that your Durable Power of Attorney is effective and serves your intended purpose. The implications of this document are significant, so it is vital to handle it with the necessary care.

Browse Popular Durable Power of Attorney Forms for US States

Texas Durable Power of Attorney - A Durable Power of Attorney can be revoked or amended by you at any time as long as you are capable.

Financial Power of Attorney Georgia - It provides peace of mind, knowing that someone responsible will be overseeing your affairs if needed.

Detailed Guide for Writing New York Durable Power of Attorney

Filling out the New York Durable Power of Attorney form is an important step in designating someone to manage your financial matters if you become unable to do so. Once you have the form completed, you’ll need to sign it in front of a notary public. This ensures that your document is valid and legally recognized.

- Obtain the New York Durable Power of Attorney form. You can download it online or get a hard copy from a legal office.

- Fill in your name and address at the top of the form. Make sure the information is clear and accurate.

- Designate your agent by writing their name and address in the designated section. This person will act on your behalf.

- Specify any limitations or powers you want to grant your agent. Be clear about what decisions they can make.

- Include your signature and the date at the bottom of the form. This is crucial for the document to be valid.

- Find a notary public to witness your signature. They will need to sign and stamp the document to complete the process.

- Keep a copy of the completed form for your records. It’s important to have this document accessible when needed.