Official New York Deed in Lieu of Foreclosure Document

Key takeaways

Filling out and using the New York Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing foreclosure. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer property ownership to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Check with your lender to see if you meet their criteria.

- Consult Professionals: It’s wise to seek advice from a real estate attorney or a housing counselor before proceeding.

- Prepare Necessary Documents: Gather all relevant documents, including the mortgage agreement and any correspondence with your lender.

- Complete the Form Accurately: Fill out the form carefully. Mistakes can delay the process or lead to complications.

- Include All Parties: Ensure that all owners of the property sign the deed. This is crucial for it to be valid.

- Review Outstanding Debts: Understand that the lender may still pursue you for any remaining debt after the deed is executed.

- Timing Matters: Submit the deed promptly to avoid further foreclosure actions. Time is often of the essence.

- Seek Release of Liability: Request a written agreement from the lender that releases you from future liability on the mortgage.

- Keep Records: Maintain copies of all documents related to the deed for your records. This can be important for future reference.

By following these guidelines, homeowners can navigate the Deed in Lieu of Foreclosure process more effectively and with greater peace of mind.

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can be a daunting task, and mistakes can lead to complications down the line. One common error is not including all necessary parties in the document. When multiple owners are involved, it’s essential that everyone signs the form. Failing to do so can create legal challenges later, as the lender may not recognize the deed as valid.

Another frequent mistake is neglecting to provide accurate property descriptions. The form requires a clear description of the property being transferred, including the address and any relevant parcel numbers. If this information is incorrect or incomplete, it may hinder the transfer process and could even result in disputes over property ownership.

Many people also overlook the importance of having the document notarized. A Deed in Lieu of Foreclosure typically needs to be notarized to be legally binding. Without a notary’s signature and seal, the document may not hold up in court, which could complicate matters for both the borrower and the lender.

Some individuals fail to read the entire form thoroughly before signing. It’s crucial to understand every section of the document, as there may be terms or conditions that could affect the outcome of the foreclosure process. Skipping over details can lead to misunderstandings or agreements that are not in the best interest of the signer.

Another common oversight is not consulting with a legal professional. While it may seem straightforward, the implications of a Deed in Lieu of Foreclosure can be significant. Seeking advice from an attorney can provide clarity and ensure that the form is filled out correctly, helping to avoid potential pitfalls.

Additionally, individuals often forget to keep copies of the completed form. After the deed is signed and notarized, it's important to retain a copy for personal records. This documentation can be vital for future reference or in case any disputes arise regarding the property transfer.

Lastly, some people mistakenly assume that submitting the Deed in Lieu of Foreclosure is the final step in the foreclosure process. In reality, there may be additional paperwork or steps required by the lender. Understanding the entire process and staying in communication with the lender can help ensure a smoother transition.

Misconceptions

Understanding the Deed in Lieu of Foreclosure process in New York can be challenging, and several misconceptions often arise. Here are four common misunderstandings:

-

It completely absolves the borrower of all debt.

Many people believe that signing a Deed in Lieu of Foreclosure means they no longer owe any money to the lender. However, this is not always the case. While it may eliminate the mortgage debt, there could still be other financial obligations or liens that remain. Additionally, lenders may seek a deficiency judgment if the property’s value is less than the outstanding mortgage balance.

-

It is a quick and easy process.

Some borrowers think that a Deed in Lieu of Foreclosure is a simple and fast alternative to foreclosure. In reality, the process can be lengthy and requires the lender's approval. Borrowers must provide extensive documentation, and lenders will conduct a thorough review before agreeing to accept the deed.

-

It does not affect the borrower’s credit score.

Another misconception is that a Deed in Lieu of Foreclosure has no impact on a borrower's credit report. In truth, this action can significantly affect credit scores, similar to a foreclosure. The borrower may face difficulties obtaining future loans or credit as a result.

-

All lenders offer Deed in Lieu of Foreclosure options.

Many assume that every lender will accept a Deed in Lieu of Foreclosure. However, this is not universally true. Some lenders may have policies against it or may only consider it under specific circumstances. It's essential for borrowers to check with their lender to understand their options.

Dos and Don'ts

When completing the New York Deed in Lieu of Foreclosure form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do read the form carefully before filling it out.

- Do provide accurate information about the property and parties involved.

- Do sign the document in the presence of a notary public.

- Do keep copies of the completed form for your records.

- Do consult with a legal professional if you have questions.

- Don't rush through the form; take your time to ensure correctness.

- Don't leave any required fields blank.

- Don't alter the form or add additional terms without guidance.

- Don't forget to check for any local requirements that may apply.

- Don't submit the form without verifying all details are accurate.

Browse Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu of Foreclosure Pa - Homes under mortgage assistance programs may have specific restrictions regarding Deed in Lieu arrangements.

Deed in Lieu Vs Foreclosure - Lenders usually evaluate the property’s condition to determine its market value before agreement.

Understanding the importance of a Notary Acknowledgment is crucial for anyone dealing with legal documents, as it not only affirms the signer’s identity but also adds a layer of security to the transaction. For those looking to streamline their notarization process, utilizing resources like California PDF Forms can be beneficial in accessing editable templates and information about the necessary steps involved in creating a valid acknowledgment.

California Pre-foreclosure Property Transfer - This document can provide relief to borrowers facing financial hardship, enabling a smoother transition away from homeownership.

Deed in Lieu of Mortgage - Borrowers should be prepared for the adjustment period after giving up the home, including potential housing alternatives.

Detailed Guide for Writing New York Deed in Lieu of Foreclosure

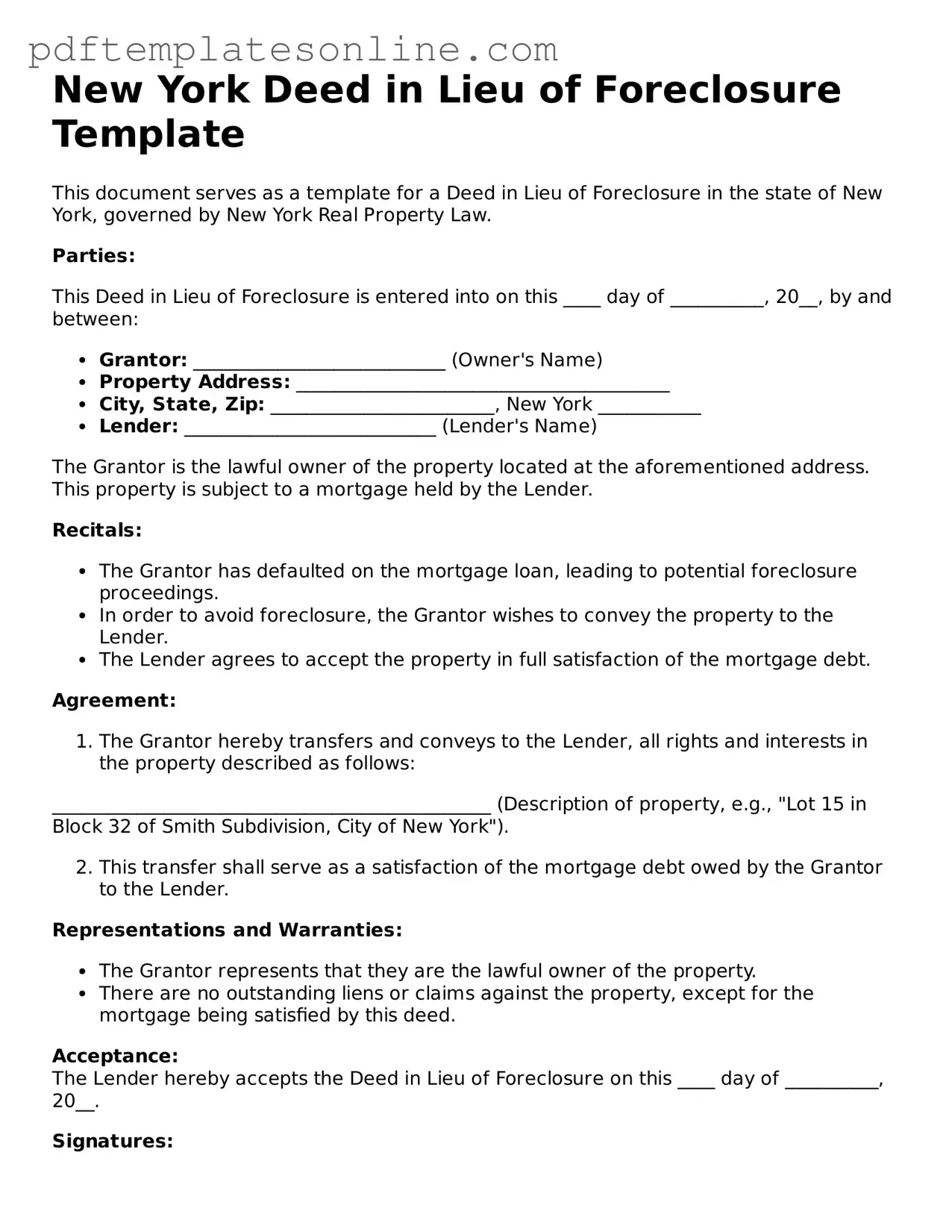

After gathering the necessary information and ensuring you have the appropriate documentation, you will proceed to fill out the New York Deed in Lieu of Foreclosure form. Completing this form correctly is essential for a smooth transition. Follow these steps to ensure accuracy.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor, which is typically the property owner. Include any relevant titles or designations.

- Next, fill in the name of the grantee. This is usually the lender or financial institution receiving the deed.

- Include the complete address of the property involved in the deed. This should be the physical location of the property.

- Clearly describe the property. Include details such as the lot number, block number, or any other identifying information.

- Indicate the consideration, or any payment or compensation involved in the transaction, if applicable.

- Sign the form in the designated area. The signature should be that of the grantor.

- Have the signature notarized. This step is crucial for the validity of the document.

- Ensure all parties involved receive a copy of the completed form for their records.

Once the form is filled out and notarized, it should be submitted to the appropriate county clerk's office for recording. This action officially transfers ownership and completes the process. Be sure to keep a copy of the recorded deed for your records.