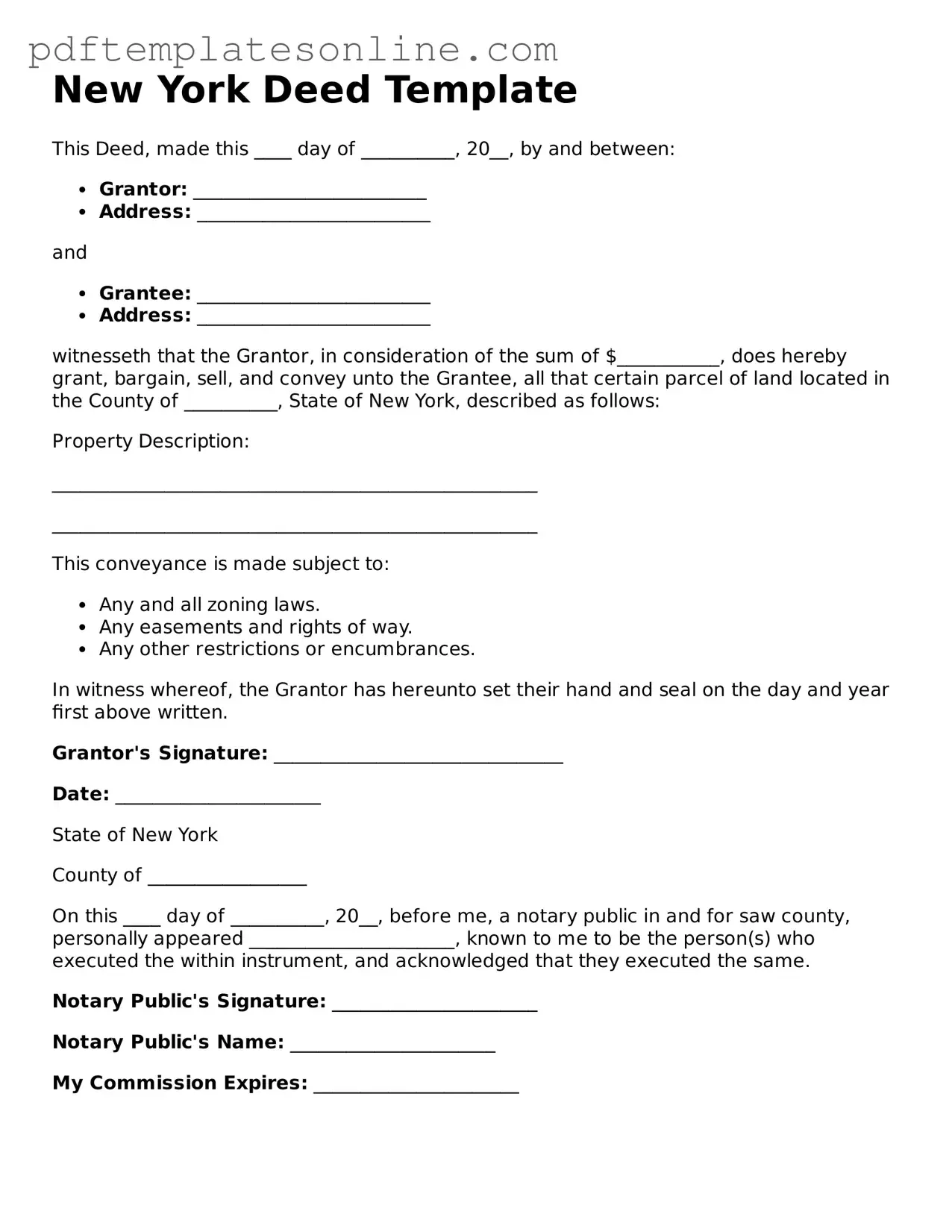

Official New York Deed Document

Key takeaways

Filling out and using the New York Deed form requires attention to detail. Here are some key takeaways to keep in mind:

- The deed must clearly identify the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Accurate legal descriptions of the property are essential. This includes boundaries and any relevant details.

- Consideration, or the value exchanged for the property, should be stated clearly in the deed.

- Signatures are required from all parties involved. Ensure that the grantor’s signature is notarized.

- After completion, the deed must be filed with the county clerk’s office where the property is located.

- Check for any local requirements that may affect how the deed is filled out or filed.

- Retain a copy of the recorded deed for your records. This serves as proof of ownership.

Common mistakes

Filling out a New York Deed form can be straightforward, but mistakes can lead to complications. One common error is failing to include the correct names of the grantor and grantee. It is essential that the names match those on identification documents to avoid confusion or disputes later.

Another frequent mistake is not providing a complete legal description of the property. The description should be precise and match the information recorded in the county clerk's office. Incomplete or vague descriptions can result in legal challenges regarding property boundaries.

People often overlook the need for notarization. A deed must be signed in the presence of a notary public to be valid. Without this step, the deed may not be recognized by the county or other entities involved in the property transfer.

Some individuals forget to check for any outstanding liens or encumbrances on the property. Ignoring these can lead to unexpected financial responsibilities for the new owner. It is advisable to conduct a title search prior to completing the deed.

Another mistake involves not recording the deed promptly. After signing and notarizing, it is important to file the deed with the appropriate county office. Delays in recording can complicate future transactions or ownership disputes.

People sometimes fail to include the necessary transfer tax information. New York requires that certain taxes be paid upon the transfer of property. Not providing this information can lead to penalties or delays in processing the deed.

Misunderstanding the type of deed being used is also a common issue. Different types of deeds, such as warranty deeds or quitclaim deeds, have different implications for ownership rights. Choosing the wrong type can impact the legal protections afforded to the new owner.

Inaccurate dates can cause problems as well. The date of the transaction should be clear and accurate. Incorrect dates may lead to confusion regarding the timeline of ownership and can complicate legal matters.

People may also neglect to include any required additional documentation. Depending on the nature of the property transfer, other forms or disclosures may be necessary. Failing to include these can delay the process or invalidate the deed.

Lastly, individuals sometimes do not seek legal advice when needed. Consulting with a real estate attorney can help ensure that all aspects of the deed are correctly handled. This step can prevent costly mistakes and provide peace of mind during the property transfer process.

Misconceptions

Understanding the New York Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- Misconception 1: The New York Deed form is only necessary for sales transactions.

- Misconception 2: All Deed forms are the same across New York.

- Misconception 3: Once a Deed is signed, it cannot be changed.

- Misconception 4: The Deed must be notarized to be valid.

This is incorrect. The New York Deed form is also required for transfers of property ownership that do not involve a sale, such as gifts or inheritance.

In reality, there are different types of Deeds, such as Warranty Deeds and Quitclaim Deeds, each serving distinct purposes. The choice of Deed affects the rights and protections for the parties involved.

This is misleading. While a signed Deed is a binding document, it can be amended or revoked through legal processes, depending on the circumstances and the type of Deed.

While notarization is highly recommended for authenticity and may be required for recording, the validity of a Deed can still exist without it, depending on the specific circumstances and local regulations.

Dos and Don'ts

When filling out the New York Deed form, it’s important to follow certain guidelines to ensure that the document is completed accurately and legally binding. Below is a list of things you should and shouldn't do:

- Do double-check the names of all parties involved to ensure they are spelled correctly.

- Do provide the correct property description, including the address and any relevant identifiers.

- Do sign the deed in front of a notary public to validate the document.

- Do keep a copy of the completed deed for your records.

- Don't leave any fields blank; incomplete forms can lead to delays or rejections.

- Don't use abbreviations for names or addresses, as this can create confusion.

- Don't forget to check local regulations, as requirements may vary by county.

By adhering to these guidelines, you can help ensure that your New York Deed form is filled out correctly and effectively. Taking the time to follow these steps can save you from potential issues down the line.

Browse Popular Deed Forms for US States

How Do I Get a Copy of My House Title in California - The form must be complete to ensure successful ownership transfer.

Release of Dower Rights Ohio Form - Important for estate planning and asset distribution.

Understanding the significance of the California Notary Acknowledgment form is crucial for anyone involved in legal documentation, as it assures that the signer's identity and signature are verified properly. For those seeking to access and complete this essential form, visit California PDF Forms, where you can find editable versions that streamline the process while adhering to the necessary legal standards.

Quick Claim Deeds Georgia - Affects future sales and property value assessments.

Detailed Guide for Writing New York Deed

After obtaining the New York Deed form, it is essential to complete it accurately to ensure the proper transfer of property ownership. Following the steps below will guide you through the process of filling out the form correctly.

- Begin by entering the date of the deed at the top of the form. This is the date on which the deed will take effect.

- Next, provide the name of the grantor (the person transferring the property). Make sure to include the full legal name as it appears on official documents.

- Following the grantor's name, list the name of the grantee (the person receiving the property). Again, use the full legal name.

- In the designated section, write the complete address of the property being transferred. This should include the street address, city, state, and zip code.

- Detail the legal description of the property. This may require referencing a prior deed or property survey to ensure accuracy.

- Indicate the consideration amount, which is the value being exchanged for the property. This can be a monetary amount or other forms of compensation.

- Sign the deed in the presence of a notary public. The notary will then sign and stamp the document, verifying the authenticity of your signature.

- Finally, make copies of the completed deed for your records before submitting it to the appropriate county office for recording.

Once the form is filled out and submitted, it will be recorded in the public records, formalizing the transfer of ownership. This step is crucial for establishing legal rights to the property.