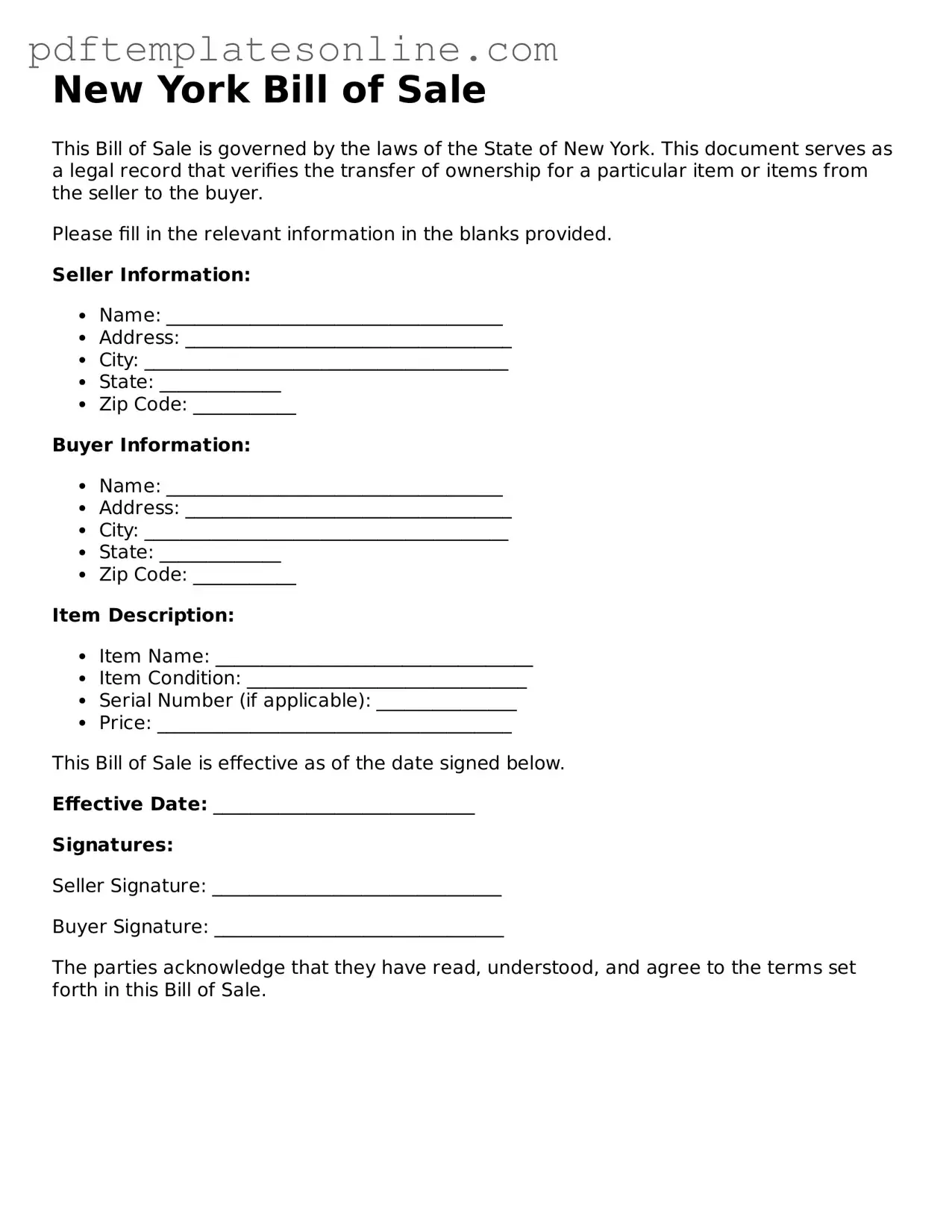

Official New York Bill of Sale Document

Key takeaways

When completing a New York Bill of Sale form, several important considerations come into play. Understanding these key takeaways can help ensure the process is smooth and legally sound.

- Purpose: A Bill of Sale serves as a legal document that records the transfer of ownership of a specific item, typically personal property such as vehicles, boats, or equipment.

- Details Required: The form should include essential information such as the names and addresses of both the buyer and seller, a description of the item, and the sale price.

- Item Description: Providing a clear and accurate description of the item being sold is crucial. This may include the make, model, year, and serial number if applicable.

- Signatures: Both parties must sign the Bill of Sale. This indicates that both the buyer and seller agree to the terms outlined in the document.

- Notarization: While notarization is not always required, having the document notarized can add an extra layer of authenticity and may be necessary for certain transactions.

- State-Specific Requirements: New York may have specific requirements regarding the Bill of Sale for certain items, such as vehicles. Always check local regulations.

- Record Keeping: Both the buyer and seller should keep a copy of the Bill of Sale for their records. This can be important for future reference or in case of disputes.

- Tax Implications: Be aware of any tax obligations that may arise from the sale. In some cases, sales tax may need to be collected and reported.

- Use for Proof of Ownership: The Bill of Sale can serve as proof of ownership for the buyer, which is particularly important for items like vehicles when registering them with the state.

Common mistakes

When completing the New York Bill of Sale form, individuals often overlook critical details that can lead to complications later. One common mistake is failing to provide accurate information about the item being sold. This includes not specifying the make, model, year, and Vehicle Identification Number (VIN) for vehicles. Incomplete descriptions can create disputes regarding ownership and the condition of the item.

Another frequent error involves neglecting to include the correct names and addresses of both the buyer and the seller. Inaccurate or outdated contact information can hinder communication and complicate any potential legal matters. It is essential that both parties are clearly identified to ensure that the transaction is valid and enforceable.

Many people also forget to include the date of the sale. This date is crucial for establishing the timeline of ownership transfer and can impact tax obligations. Without a clear date, both parties may face challenges in proving when the transaction occurred, which can lead to misunderstandings or legal issues.

Lastly, some individuals do not sign the form or fail to have it notarized when required. A signature is a fundamental part of any legal document, signifying agreement to the terms laid out in the Bill of Sale. Notarization, while not always necessary, adds an extra layer of authenticity and can be beneficial in verifying the identities of the parties involved. Omitting these steps can render the document ineffective and complicate future transactions.

Misconceptions

Many people have misunderstandings about the New York Bill of Sale form. Here are five common misconceptions:

-

A Bill of Sale is only needed for vehicles.

This is not true. A Bill of Sale can be used for a variety of transactions, including the sale of personal property, such as furniture, electronics, and collectibles, in addition to vehicles.

-

Bill of Sale forms are only necessary if the item is expensive.

Even for low-value items, a Bill of Sale can provide proof of ownership and protect both the buyer and seller in case of disputes.

-

Once a Bill of Sale is signed, the transaction is final and cannot be reversed.

While a Bill of Sale serves as a record of the transaction, it does not prevent either party from disputing the sale under certain circumstances, such as fraud or misrepresentation.

-

Notarization is required for a Bill of Sale in New York.

This is a misconception. Notarization is not mandatory for a Bill of Sale in New York, although having it notarized can add an extra layer of security and authenticity.

-

A Bill of Sale is the same as a title transfer.

While both documents are important in a transaction, a Bill of Sale serves as proof of the sale, while a title transfer is necessary to officially change ownership of a vehicle or property.

Dos and Don'ts

When filling out the New York Bill of Sale form, there are important dos and don'ts to keep in mind. Following these guidelines can help ensure that the document is completed correctly and serves its intended purpose.

- Do provide accurate information about the buyer and seller.

- Do include a detailed description of the item being sold.

- Do sign and date the form to make it legally binding.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use vague language; be specific about the transaction.

Browse Popular Bill of Sale Forms for US States

Georgia Dmv Bill of Sale - The use of a Bill of Sale emphasizes transparency between buyer and seller.

Handwritten Bill of Sale Example - The form is straightforward and can often be completed in just a few minutes.

Detailed Guide for Writing New York Bill of Sale

Completing the New York Bill of Sale form is a straightforward process. After filling out the form, it should be signed by both parties to finalize the transaction. Ensure that all information is accurate to avoid any future disputes.

- Obtain the New York Bill of Sale form from a reliable source.

- Enter the date of the transaction at the top of the form.

- Fill in the full names and addresses of both the seller and the buyer.

- Provide a detailed description of the item being sold, including make, model, year, and any identifying numbers.

- Indicate the sale price of the item clearly.

- Include any additional terms or conditions if applicable.

- Both parties should sign and date the form at the designated areas.

- Make copies of the completed form for both the seller and the buyer for their records.