Blank Netspend Dispute Form

Key takeaways

Here are some key takeaways about filling out and using the Netspend Dispute form:

- The form must be submitted within 60 days of the disputed transaction date.

- Complete all sections of the form to ensure timely processing.

- Provide detailed information for each disputed transaction, including the merchant's name and transaction details.

- Supporting documents can help expedite the review process.

- Notify Netspend immediately if your card is lost or stolen to limit your liability.

- Resetting your PIN is recommended after reporting a lost or stolen card.

- Include a copy of the police report if applicable.

- Submit the form via fax to the number provided: 512-531-8770.

- A decision regarding the dispute will be made within 10 business days of receiving the completed form.

Common mistakes

Filling out the Netspend Dispute form can be straightforward, but many people make common mistakes that can delay the process or lead to complications. Here are eight mistakes to avoid when completing the form.

First, failing to submit the form within the required timeframe is a critical error. The form must be submitted no later than 60 days after the transaction in question. Missing this deadline can result in the denial of your dispute.

Secondly, neglecting to provide complete information can hinder the resolution process. Ensure that all fields are filled out accurately, including your name, phone number, address, and card or account number. Incomplete forms may be returned or delayed.

Another common mistake is not including sufficient details about the disputed transactions. Each transaction should have its disputed amount, date, time, and merchant's name clearly listed. Omitting any of this information can lead to confusion and delays.

Many individuals also forget to indicate whether they have contacted the merchant regarding the disputed transaction. This information is crucial as it helps Netspend understand the context of the dispute. If you have contacted the merchant, be sure to include whether a refund was offered and the expected date of that refund.

Additionally, some people overlook the importance of attaching supporting documentation. Providing a police report, receipts, or other relevant documents can strengthen your case. Without this evidence, your dispute may lack the necessary support for a favorable outcome.

Another mistake is failing to explain the situation in detail. The form includes a section for a detailed explanation, and skipping this can leave important context out of your submission. A thorough explanation can help Netspend make a more informed decision.

Furthermore, not resetting your PIN after reporting a lost or stolen card is a significant oversight. It is essential to take this step to prevent further unauthorized transactions. Indicate on the form that your card was lost or stolen to ensure proper handling of your dispute.

Lastly, forgetting to sign and date the form can lead to immediate rejection. Always double-check that your signature is included before submitting the form. A missing signature means the form is incomplete and will not be processed.

By avoiding these common mistakes, you can help ensure that your Netspend Dispute form is processed smoothly and efficiently.

Misconceptions

Here are some common misconceptions about the Netspend Dispute form. Understanding these can help you navigate the process more effectively.

- You must submit the form immediately. While it is best to act quickly, you have up to 60 days from the date of the transaction to submit your dispute.

- All disputes will be resolved within a few days. Once Netspend receives your completed form, they will make a decision within 10 business days, but the resolution may take longer depending on the circumstances.

- You will never be liable for unauthorized transactions. If your card was lost or stolen, you might still be liable for some transactions made before you reported it. However, you won't be liable for transactions after you’ve instructed them to block your card.

- You can only dispute one transaction at a time. The form allows you to dispute up to five transactions at once, making it easier to handle multiple issues in one go.

- You don’t need to provide any documentation. While it’s not mandatory, including supporting documents like a police report or receipts can help strengthen your case.

- Contacting the merchant before filing a dispute is unnecessary. It’s a good idea to reach out to the merchant first. Your dispute may be resolved more quickly if they agree to issue a refund.

- Filing a police report is optional. If your card was lost or stolen, filing a police report is recommended and may be necessary for your dispute to be processed effectively.

- Resetting your PIN is not important. If your card has been compromised, resetting your PIN is crucial for protecting your account from further unauthorized access.

Clarifying these misconceptions can empower you to take the right steps in resolving any issues with your Netspend account.

Dos and Don'ts

When filling out the Netspend Dispute form, consider the following guidelines:

- Do complete the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do provide accurate and detailed information for each transaction you are disputing.

- Do include supporting documentation, such as receipts or emails, to strengthen your case.

- Do indicate if your card was lost or stolen to help block further unauthorized activity.

- Do sign and date the form before submitting it.

- Don't leave any sections of the form blank; fill out all required fields.

- Don't forget to check if anyone else has access to your PIN, as this information is important.

- Don't submit the form without a full copy of the police report if your card was lost or stolen.

- Don't wait too long to submit the form, as delays may affect the outcome of your dispute.

Other PDF Forms

6 Team Single Elimination Bracket With Consolation - Match results will determine not only rankings but also lessons learned for future competitions.

Fee Sheet - This tool enhances transparency throughout the loan transaction lifecycle.

Ncoer Support Form Pdf - The comprehensive layout helps ensure transparency in the evaluation process.

Detailed Guide for Writing Netspend Dispute

After completing the Netspend Dispute Notification Form, you will need to submit it promptly to ensure your dispute is processed within the required timeframe. The form must be sent to Netspend no later than 60 days after the transaction in question. Once received, Netspend will review the information provided and aim to make a decision regarding your dispute within 10 business days.

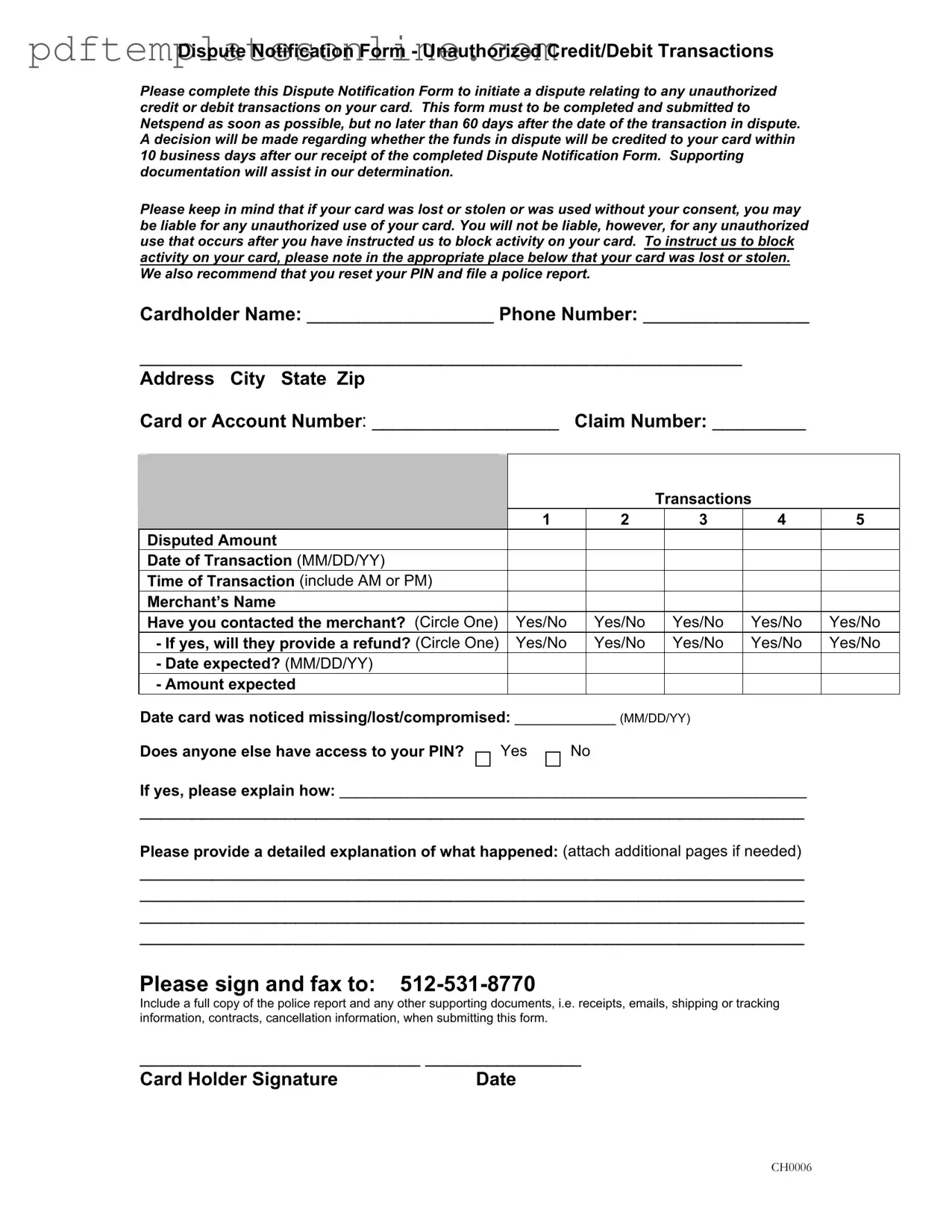

- Begin by entering your Cardholder Name in the designated field.

- Provide your Phone Number for contact purposes.

- Fill in your complete Address, including City, State, and Zip code.

- Input your Card or Account Number accurately.

- Write your Claim Number if you have one.

- For each disputed transaction (up to five), fill out the following details:

- Disputed Amount

- Date of Transaction (format: MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant by circling Yes or No.

- If you contacted the merchant, circle Yes or No for whether they will provide a refund.

- If a refund is expected, provide the Date expected (format: MM/DD/YY).

- Include the Amount expected.

- Note the Date when your card was noticed missing, lost, or compromised (format: MM/DD/YY).

- Answer whether anyone else has access to your PIN by circling Yes or No.

- If you answered Yes, provide an explanation of how they have access.

- Write a detailed explanation of what happened regarding the unauthorized transactions. You may attach additional pages if necessary.

- Sign the form in the designated area to validate your dispute.

- Include the Date of your signature.

- Fax the completed form to 512-531-8770.

- Attach a full copy of the police report and any supporting documents, such as receipts, emails, or contracts, to your fax.