Blank Nc 4 Form

Key takeaways

Here are key takeaways regarding the NC-4 form:

- Purpose: The NC-4 form is used to determine the correct amount of State income tax withheld from an employee's paycheck.

- Filing Requirement: If an employee does not submit an NC-4, the employer will withhold taxes as if the employee is single with zero allowances.

- Form Variants: There are different versions of the NC-4 form, including NC-4 EZ for those claiming standard deductions and NC-4 NRA for nonresident aliens.

- Allowance Worksheet: Completing the NC-4 Allowance Worksheet helps individuals calculate their withholding allowances based on various deductions and credits.

- Multiple Jobs: Employees with more than one job should use a single NC-4 Allowance Worksheet to determine total allowances, typically claiming all on the higher-paying job.

- Changes in Status: If an individual's withholding allowances decrease, they must submit a new NC-4 within 10 days, except in specific circumstances like ceasing to be "Head of Household."

- Penalties: Providing false information on the NC-4 can result in a penalty of 50% of the under-withheld tax amount.

Common mistakes

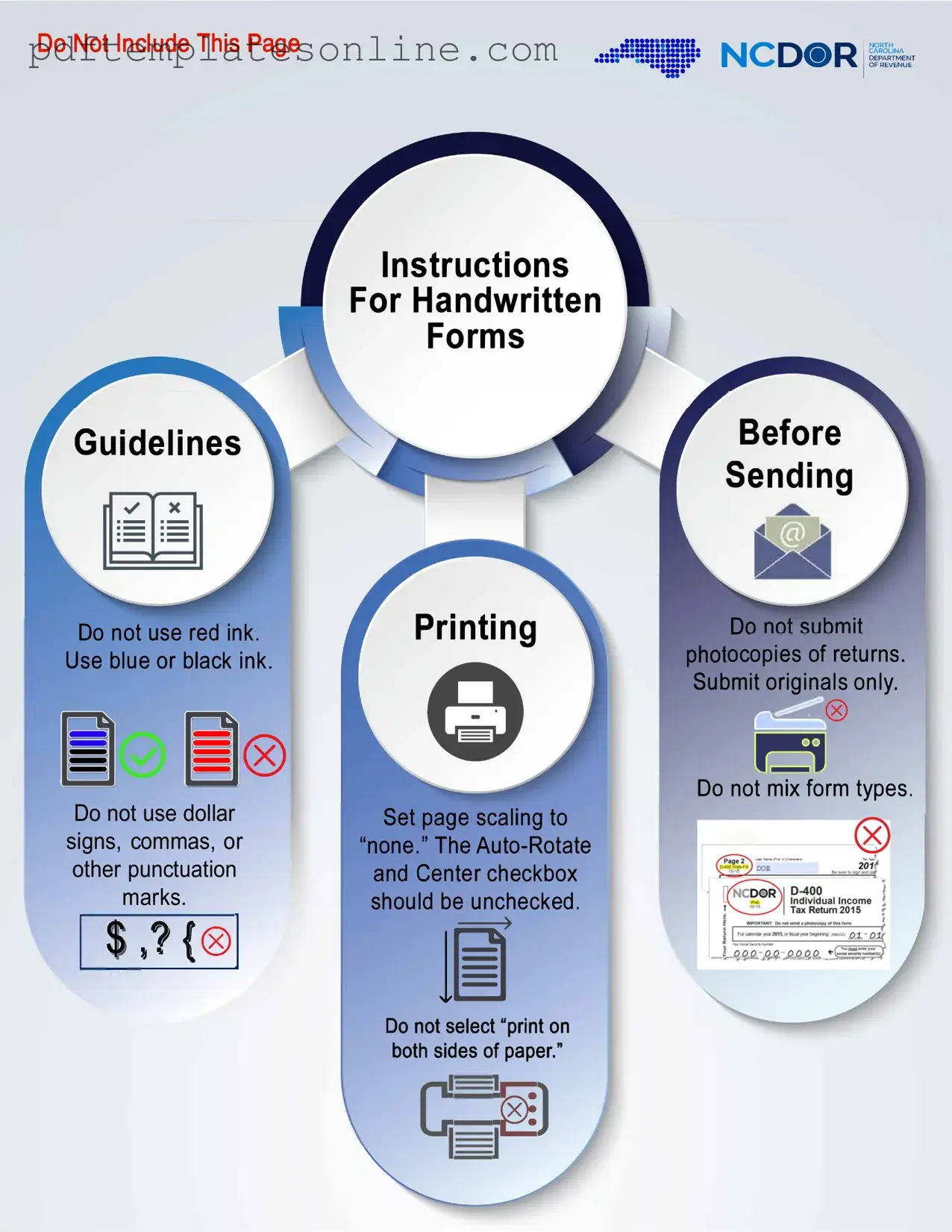

Filling out the NC-4 form can seem straightforward, but many people make common mistakes that can lead to complications. One major error is using the wrong ink color. The instructions clearly state to use blue or black ink only. Using red ink can result in the form being rejected or delayed. It's essential to follow this guideline to ensure your form is processed smoothly.

Another frequent mistake is the incorrect entry of allowances. Individuals often miscalculate the total number of allowances they are entitled to claim. This can happen if they do not complete the NC-4 Allowance Worksheet accurately. It’s crucial to take the time to fill out the worksheet carefully, as it directly impacts the amount of tax withheld from your paycheck.

Many people also forget to update their NC-4 form when their circumstances change. If you experience a decrease in your withholding allowances, you are required to submit a new NC-4 within ten days of that change. Failing to do so can lead to under-withholding and potential tax penalties later on.

Mixing different form types is another common error. For instance, some individuals mistakenly submit the NC-4 form when they should be using the NC-4 EZ or NC-4 NRA forms. Each form serves a specific purpose, and using the wrong one can complicate your tax situation.

Additionally, people often neglect to provide their Social Security number or other required personal information. Omitting this information can delay processing and may require you to resubmit the form. Always double-check that all necessary fields are filled out completely before submission.

Lastly, some individuals mistakenly believe they can claim allowances based on assumptions rather than facts. Providing inaccurate information can result in a penalty of 50% of the amount not properly withheld. It’s essential to ensure that all information provided has a reasonable basis to avoid such penalties.

Misconceptions

Misconceptions about the NC-4 form can lead to confusion and mistakes. Here are seven common misunderstandings:

- Only Single Filers Need to Complete the NC-4: This is not true. Anyone who has income subject to North Carolina withholding, including married individuals and heads of household, must complete the NC-4.

- Using the NC-4 Form is Optional: Many people think they can skip this form if they don’t want to. However, if you do not submit an NC-4, your employer will withhold taxes as if you are single with zero allowances, which may not be accurate for your situation.

- All Allowances Must Be Claimed: Some believe they must claim all allowances they qualify for. In fact, you can choose to claim fewer allowances if you prefer to have more tax withheld from your paycheck.

- NC-4 is the Same as Federal W-4: While both forms deal with tax withholding, they are not the same. The NC-4 is specific to North Carolina state taxes, while the W-4 is for federal taxes.

- Form NC-4 is Only for Full-Time Employees: This is a misconception. Part-time workers or those with multiple jobs also need to fill out the NC-4 to ensure correct withholding.

- Once Submitted, the NC-4 Never Needs to Be Updated: Many think that after submitting the NC-4, they do not need to change it. However, if your circumstances change, such as a change in job or marital status, you must submit a new NC-4 within 10 days.

- Nonresident Aliens Do Not Need to File NC-4: Nonresident aliens must use a specific version of the form, the NC-4 NRA. They are not exempt from completing the necessary paperwork for tax withholding.

Dos and Don'ts

When filling out the NC-4 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to keep in mind:

- Do use blue or black ink. Avoid using red ink, as it may not be processed correctly.

- Do not include dollar signs or commas. Keep your entries simple and straightforward.

- Do complete the NC-4 Allowance Worksheet. This will help you determine the correct number of allowances to claim.

- Do not mix different form types. Stick to one type of form to avoid confusion.

- Do submit only original forms. Make sure to send the original NC-4 to your employer, not copies.

- Do check your filing status. Ensure you select the correct status, such as Single, Married, or Head of Household.

- Do not forget to sign and date the form. Your signature is necessary to validate the information provided.

Other PDF Forms

Pt Observation Hours - Timely submission of the form is essential for success.

How Old Do You Have to Be to Take a Ged Test - This process is designed to be straightforward for your convenience.

In addition to its vital role in the probate process, the Self-Proving Affidavit form can also be accessed through various online resources, such as California PDF Forms, which provide editable versions to ensure that individuals can easily manage their estate planning documents.

Dd Form 5960 - This form must be submitted to the appropriate military personnel office for processing.

Detailed Guide for Writing Nc 4

After gathering the necessary information, you are ready to fill out the NC-4 form. This form helps your employer withhold the correct amount of state income tax from your paycheck. Make sure to use blue or black ink and avoid any punctuation marks. Follow these steps to complete the form accurately.

- Obtain a copy of the NC-4 form and the NC-4 Allowance Worksheet.

- Fill in your personal details at the top of the form, including your Social Security Number, Filing Status, First Name, M.I., Last Name, Address, County, City, State, Zip Code, and Country (if not U.S.).

- Determine the total number of allowances you are claiming. Refer to the NC-4 Allowance Worksheet for guidance.

- Enter the total number of allowances on Line 1 of the NC-4 form.

- If applicable, indicate any additional amount to be withheld from each pay period on Line 2.

- Sign and date the form at the bottom to certify the information provided is accurate.

- Submit the completed form to your employer. Keep the top portion for your records.

Once you have submitted the NC-4 form, your employer will use the information to adjust your state tax withholding accordingly. If your circumstances change, such as a new job or a change in filing status, remember to update your NC-4 form within ten days.