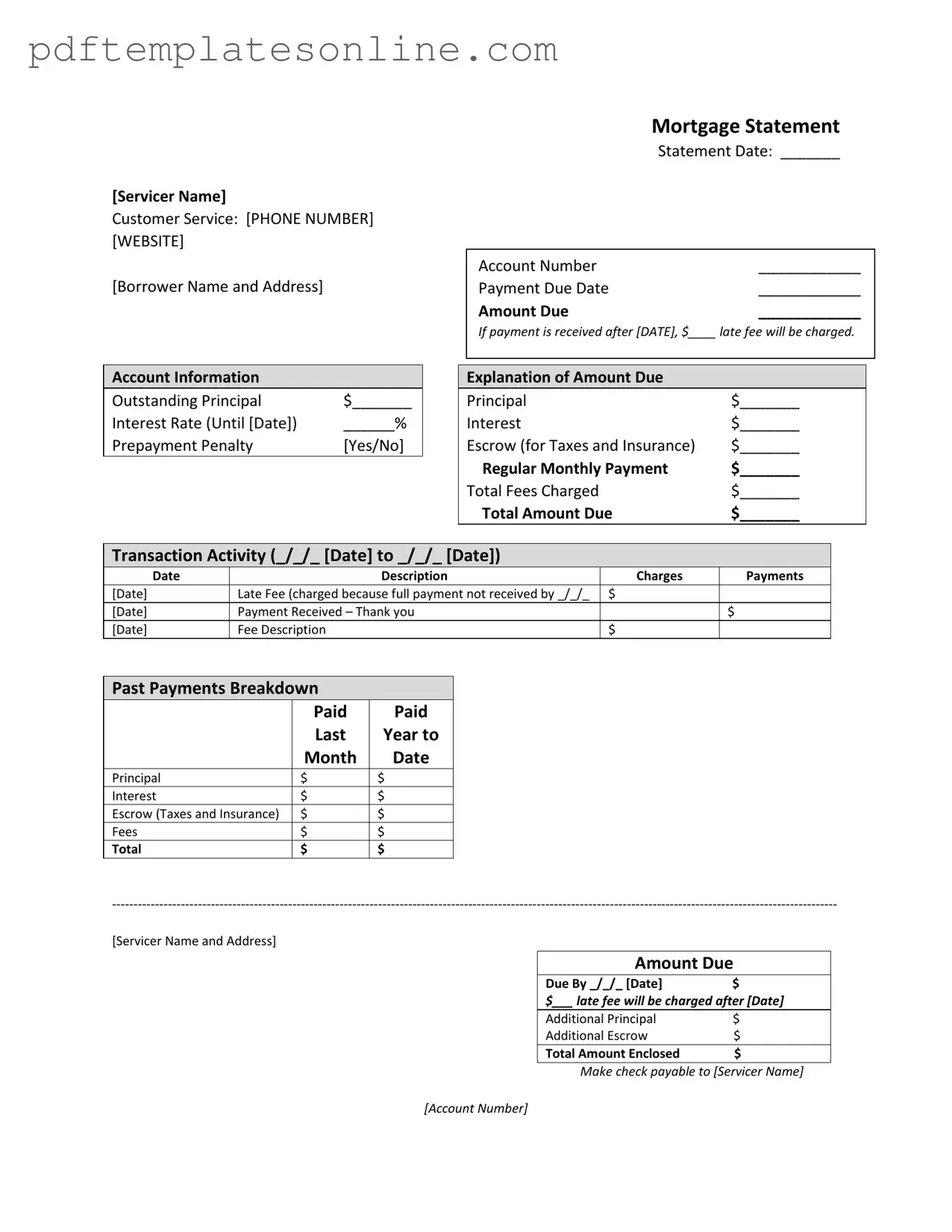

Blank Mortgage Statement Form

Key takeaways

Understanding your Mortgage Statement is crucial for managing your mortgage effectively. Here are some key takeaways to keep in mind:

- Identify the Servicer: The name and contact information of your mortgage servicer are prominently displayed. Reach out if you have questions.

- Payment Due Date: Know when your payment is due to avoid late fees. This date is clearly indicated on the statement.

- Amount Due: The total amount you owe is listed. Ensure you pay this amount by the due date to keep your account in good standing.

- Late Fees: Be aware of the late fee policy. If your payment is received after a specific date, a fee will be charged.

- Account Information: Review the outstanding principal and interest rate. This information helps you understand your loan better.

- Transaction Activity: Keep track of recent transactions. This section shows payments made and any fees charged.

- Partial Payments: Know that partial payments are held in a suspense account and do not apply to your mortgage until the full balance is paid.

- Delinquency Notice: If you are behind on payments, this notice warns you of potential fees and the risk of foreclosure.

- Recent Account History: This section summarizes your payment history, helping you track your payment behavior over time.

- Financial Assistance: If you’re struggling financially, look for information about mortgage counseling or assistance options on the back of the statement.

By keeping these points in mind, you can navigate your mortgage statement with confidence and ensure you stay on top of your payments.

Common mistakes

Filling out the Mortgage Statement form can be straightforward, but many make critical mistakes that can lead to confusion or delays. One common error is failing to provide accurate account information. This includes the account number and the correct servicer name. If these details are incorrect, it can cause significant issues with processing your payment or inquiries about your mortgage.

Another mistake people often make is neglecting to check the payment due date. Missing this date can lead to unexpected late fees. Always verify the due date and ensure that your payment is submitted on time. Ignoring this detail can result in unnecessary charges and may impact your credit score.

Some individuals also overlook the importance of understanding the total amount due. This figure includes not just the principal and interest, but also any escrow for taxes and insurance, as well as any fees charged. Failing to account for these components can lead to underpayment and further complications with your mortgage.

Lastly, many people do not read the important messages section thoroughly. This section contains vital information about partial payments and delinquency notices. Ignoring these warnings can result in serious consequences, including foreclosure. Take the time to read and understand these messages to avoid potential pitfalls.

Misconceptions

Understanding mortgage statements can be challenging, and there are several misconceptions that may lead to confusion. Here are five common misconceptions:

- All payments are applied immediately to the mortgage balance. Many people believe that any payment made will instantly reduce their mortgage balance. However, partial payments are often held in a separate suspense account until the total amount due is paid in full.

- Late fees are automatically charged for any missed payment. While late fees can be applied if payment is not received by a specified date, it is important to note that there is usually a grace period. Understanding the specific terms of your mortgage statement is essential.

- The amount due includes all fees and charges. Some borrowers assume that the total amount due on their mortgage statement includes all potential fees. In reality, the total amount due may not reflect additional fees that could be incurred later, such as late fees or penalties.

- Escrow accounts are optional. Many homeowners think they can choose whether to have an escrow account for taxes and insurance. In fact, lenders often require escrow accounts to ensure that these important expenses are paid on time.

- Receiving a delinquency notice means foreclosure is imminent. While a delinquency notice indicates that payments are overdue, it does not mean foreclosure will happen immediately. Homeowners are often given opportunities to catch up on missed payments before any drastic actions are taken.

Being informed about these misconceptions can help homeowners better manage their mortgage and avoid unnecessary stress.

Dos and Don'ts

When filling out the Mortgage Statement form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are recommendations on what to do and what to avoid.

- Do: Provide accurate personal information, including your name and address.

- Do: Double-check the account number for accuracy.

- Do: Fill in the payment due date and the amount due clearly.

- Do: Include any additional amounts that may be due, such as late fees or additional principal.

- Don't: Leave any sections blank; all fields must be completed.

- Don't: Use abbreviations or shorthand that may confuse the servicer.

- Don't: Ignore the instructions regarding partial payments and delinquency notices.

- Don't: Forget to sign the form if required; an unsigned form may not be processed.

Other PDF Forms

Completed Immunization Records - Proper completion ensures that all health requirements are met with accuracy.

6 Team Single Elimination Bracket With Consolation - The bracket includes thrilling matchups like Game 9 featuring the losers of Game 5 and Game 6.

The California Transfer-on-Death Deed form allows homeowners to pass on their property to a beneficiary without the complexities of going through probate court. This legal document offers a straightforward way for property owners to ensure their real estate transitions smoothly after they pass away. For those interested in obtaining this essential form, resources like California PDF Forms can provide valuable assistance, making the process of transferring property ownership in California even easier.

Free Printable Puppy Health Guarantee Template - The seller commits to providing ongoing support to puppy owners.

Detailed Guide for Writing Mortgage Statement

After gathering the necessary information, you can begin filling out the Mortgage Statement form. This form requires specific details about your mortgage account, including personal information, payment history, and amounts due. It is essential to complete each section accurately to ensure proper processing.

- At the top of the form, enter the Servicer Name and their Customer Service Phone Number and Website.

- Fill in your Borrower Name and Address.

- In the Statement Date section, write the current date.

- Provide your Account Number.

- Enter the Payment Due Date for your next payment.

- Fill in the Amount Due for this payment period.

- Note the late fee amount that will be charged if payment is received after the specified date.

- In the Account Information section, list the Outstanding Principal amount.

- Indicate the Interest Rate and the date it is effective until.

- State whether there is a Prepayment Penalty by marking Yes or No.

- In the Explanation of Amount Due section, fill in the amounts for Principal, Interest, Escrow (for taxes and insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- For the Transaction Activity, record the dates and descriptions of any charges and payments made during the specified period.

- Complete the Past Payments Breakdown by entering the amounts paid for Principal, Interest, Escrow, and Fees for the last year.

- Fill in the Amount Due and the Due By date at the bottom of the form.

- List any Additional Principal or Additional Escrow amounts, if applicable.

- Calculate and enter the Total Amount Enclosed if sending a payment.

- Make the check payable to the Servicer Name and include your Account Number on the check.

- Review the Important Messages section for any specific instructions or notices related to your account.