Fillable Mortgage Lien Release Document

Key takeaways

When dealing with the Mortgage Lien Release form, it is crucial to understand several key points to ensure proper completion and use. Here are the essential takeaways:

- Purpose: The Mortgage Lien Release form is used to formally remove a lien from a property once the mortgage has been paid off.

- Eligibility: Only the lender or mortgage holder can initiate the release process after the borrower has fulfilled their payment obligations.

- Documentation: Ensure that all relevant documents, including the original mortgage agreement, are available when completing the form.

- Signatures: Both the lender and the borrower must sign the form to validate the release.

- Filing: After completion, the form must be filed with the appropriate county recorder's office to make the release official.

- Fees: Be aware that there may be filing fees associated with submitting the Mortgage Lien Release form.

- Timeframe: Processing times can vary; follow up with the county office if you do not receive confirmation of the release.

- Copies: Keep a copy of the completed form for your records as proof of the lien release.

- Impact on Credit: A lien release can positively affect the borrower's credit score by reflecting the paid-off status of the mortgage.

- Legal Advice: Consider consulting a legal professional if there are any uncertainties about the process or implications of the lien release.

Understanding these key points can facilitate a smoother process in handling the Mortgage Lien Release form.

Common mistakes

Filling out a Mortgage Lien Release form can seem straightforward, but many individuals make common mistakes that can lead to delays or complications. One prevalent error occurs when the borrower fails to provide accurate property information. It is crucial to ensure that the property address and legal description match exactly what is recorded in public records. Any discrepancies can lead to confusion and potential legal issues down the line.

Another frequent mistake involves omitting signatures. Both the borrower and the lender must sign the form for it to be valid. If either party neglects to sign, the release will not be processed, leaving the lien in place. It’s essential to double-check that all required signatures are present before submitting the document.

People often overlook the importance of the date. Failing to date the form correctly can result in complications regarding when the lien is officially released. This date is significant because it can affect the timing of subsequent transactions involving the property.

Inaccurate or incomplete notary information is another common pitfall. Many people forget that the Mortgage Lien Release must be notarized to be legally binding. Without a proper notary acknowledgment, the form may be rejected. Ensuring that the notary's information is complete and accurate is vital for the validity of the release.

Some individuals mistakenly believe that they can submit the form without any supporting documentation. In many cases, lenders require additional paperwork to accompany the release form, such as a payoff statement or proof of payment. Not including these documents can lead to delays in processing the release.

Additionally, individuals sometimes fail to check for outstanding liens or judgments against the property. If there are unresolved issues, the release may not be granted. It’s wise to conduct a thorough title search before submitting the form to avoid unexpected complications.

Another mistake involves submitting the form to the wrong office. Each jurisdiction has specific requirements regarding where to file a Mortgage Lien Release. Sending the form to the incorrect location can lead to unnecessary delays. Understanding local filing procedures is crucial for a smooth process.

People may also forget to keep copies of the submitted form and any accompanying documents. Maintaining records of what was submitted is important, as it provides proof of the release and can be helpful in case of future disputes.

Some individuals rush through the process without reading the instructions carefully. Each form may have specific requirements or variations depending on the lender or state. Taking the time to read and understand these instructions can prevent many common errors.

Lastly, failing to follow up after submission can lead to uncertainty about the status of the lien release. It is advisable to check in with the appropriate office to ensure that the form has been processed and the lien has been officially released. This proactive approach can help individuals avoid potential issues in the future.

Misconceptions

Understanding the Mortgage Lien Release form is crucial for homeowners and borrowers. Unfortunately, several misconceptions can cloud this important topic. Here are nine common misunderstandings:

- 1. A Mortgage Lien Release is the same as a mortgage payoff. Many believe that paying off their mortgage automatically means the lien is released. While paying off the loan is necessary, a formal release document must also be filed.

- 2. The lender automatically files the lien release. Some assume that once the mortgage is paid, the lender will take care of everything. In reality, it is often the borrower’s responsibility to ensure the lien release is filed with the appropriate government office.

- 3. A lien release is only needed for paid-off mortgages. People often think that only mortgages that have been fully paid require a lien release. However, lien releases are also necessary if a borrower refinances or sells the property.

- 4. The lien release is just a formality. While it may seem like a simple step, failing to obtain a lien release can lead to complications in future transactions involving the property.

- 5. The lien release has no impact on credit scores. Some individuals think that a lien release does not affect their credit history. In truth, having a lien released can positively impact credit scores by showing that debts have been settled.

- 6. You can’t sell your home until the lien is released. Many believe they cannot sell their property if there is an outstanding lien. While it complicates the sale, it is possible to sell the home; the lien must be paid off at closing.

- 7. Lien releases are only relevant for residential properties. Some people think that lien releases only apply to homes. However, they are also important for commercial properties and any real estate with a mortgage.

- 8. You can ignore the lien release if you don’t plan to sell. Ignoring the lien release can lead to future problems, even if you plan to keep the property. It’s best to have a clear title to avoid issues down the line.

- 9. All lien releases are the same. There is a misconception that all lien releases follow the same format and process. In reality, the requirements can vary by state and lender, so it’s essential to understand the specific procedures involved.

By clearing up these misconceptions, homeowners can better navigate the process of obtaining a Mortgage Lien Release and protect their property rights.

Dos and Don'ts

When dealing with a Mortgage Lien Release form, it's essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do double-check all personal information for accuracy.

- Do ensure that the form is signed by all necessary parties.

- Do keep a copy of the completed form for your records.

- Do submit the form to the appropriate county office promptly.

- Don't leave any required fields blank.

- Don't forget to include any supporting documentation, if necessary.

- Don't rush through the process; take your time to review everything.

By following these guidelines, you can help ensure a smoother experience when completing your Mortgage Lien Release form.

Browse Common Types of Mortgage Lien Release Templates

Media Release Form Template - A signed release can also facilitate easier sharing of content across different platforms.

Understanding the importance of a proper "comprehensive Release of Liability" form is crucial for anyone participating in activities that carry risks. This document not only helps to mitigate potential legal issues but also clarifies the terms under which participants agree to engage in various events. For more in-depth information, visit the comprehensive Release of Liability guidelines.

Conditional Waiver - A preventive measure for ongoing contractual agreements.

Employee Photo Release Form - No financial compensation will be provided for the use of employee images.

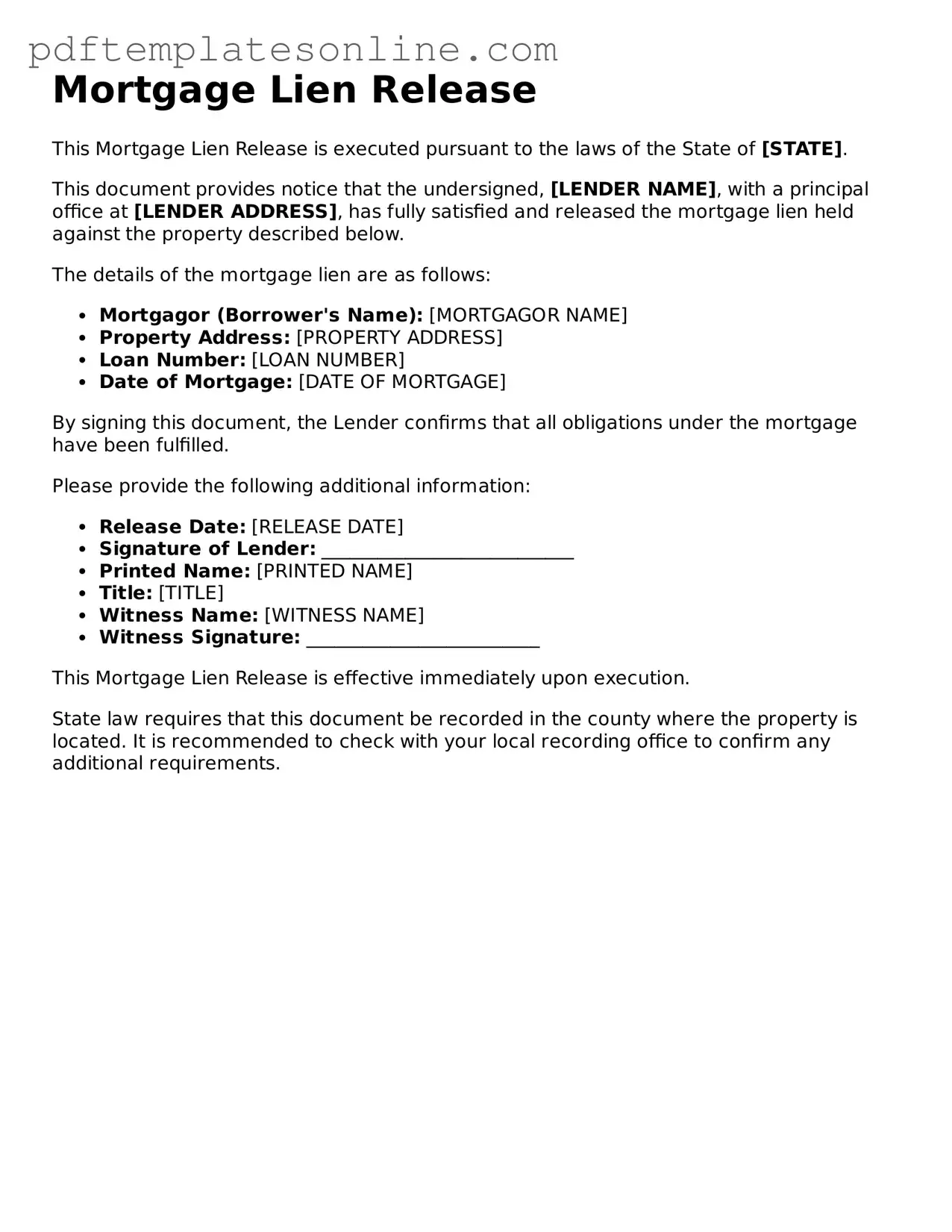

Detailed Guide for Writing Mortgage Lien Release

After completing the Mortgage Lien Release form, the next step involves submitting the document to the appropriate county recorder's office. This ensures that the lien is officially removed from the property records. It is important to keep a copy of the submitted form for your records.

- Obtain the Mortgage Lien Release form from your lender or download it from the official website.

- Fill in the property owner's name as it appears on the original mortgage document.

- Provide the property address, including the street number, street name, city, state, and zip code.

- Enter the lender's name and contact information, including their address.

- Include the date the mortgage was paid off or satisfied.

- Sign and date the form in the designated area. If applicable, have the signature notarized.

- Make a copy of the completed form for your records.

- Submit the original form to the county recorder's office in the jurisdiction where the property is located.