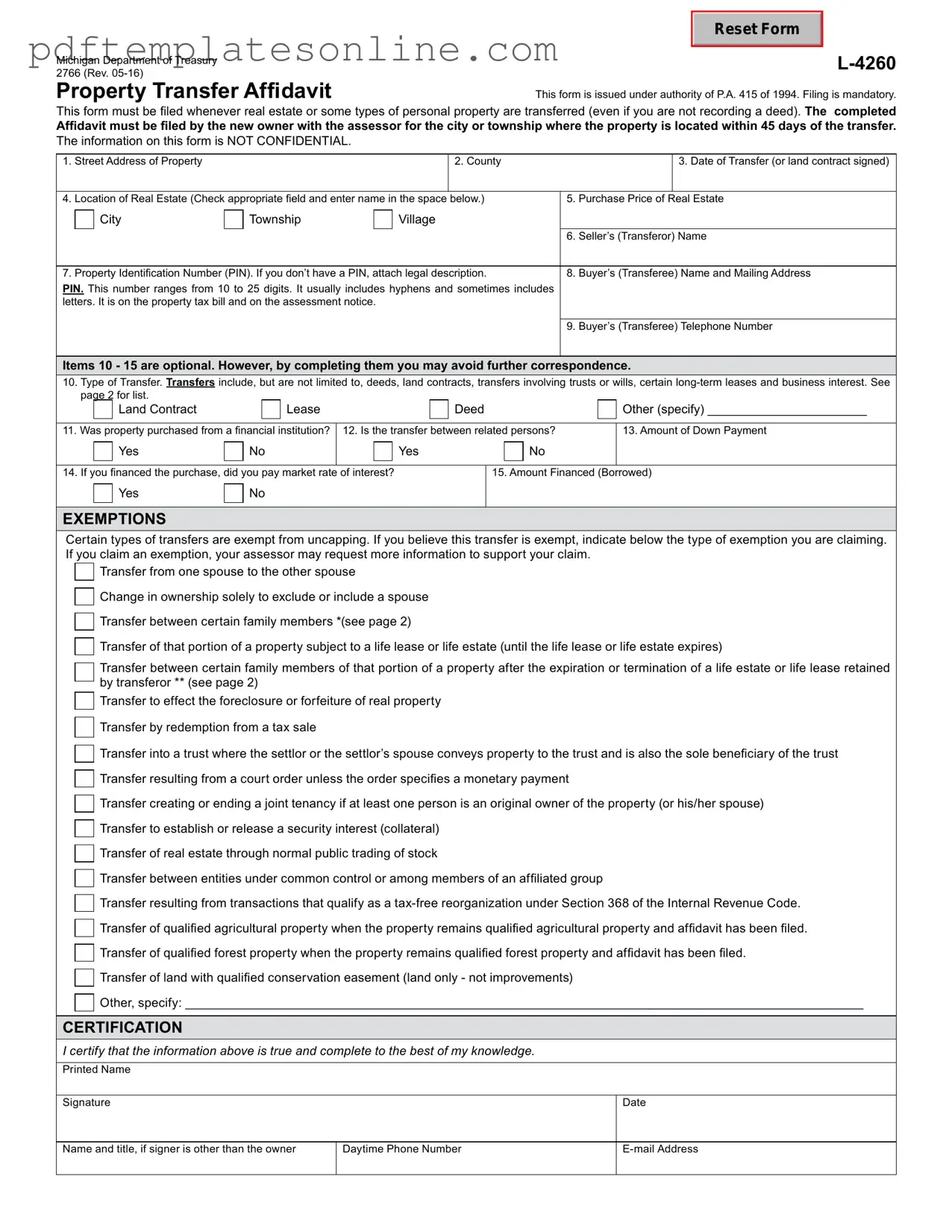

Blank Michigan Property Transfer Affidavit 2766 Form

Key takeaways

When dealing with the Michigan Property Transfer Affidavit 2766 form, several important considerations come into play. Understanding these aspects can simplify the process and ensure compliance with state regulations.

- Purpose of the Form: This affidavit is primarily used to report property transfers to the local assessor's office. It provides essential information about the property and the transaction.

- Filing Deadline: It is crucial to submit the form within 45 days of the property transfer. Failing to do so may result in penalties or delays in property tax assessments.

- Accurate Information: Ensure that all details, such as the property description, buyer and seller information, and sale price, are accurate. Inaccuracies can lead to complications in the assessment process.

- Signature Requirement: Both the buyer and seller must sign the affidavit. This signature confirms the accuracy of the information provided and acknowledges the transfer of ownership.

Common mistakes

Filling out the Michigan Property Transfer Affidavit 2766 form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One prevalent mistake is failing to provide accurate property descriptions. It’s essential to include the correct legal description of the property, as this information is crucial for identification purposes. Omitting or misrepresenting this data can create issues down the line.

Another frequent error involves not signing the affidavit. The form requires the signatures of all parties involved in the transaction. If one or more signatures are missing, the form may be deemed incomplete, which can stall the transfer process. Always double-check that every necessary signature is present before submission.

People often overlook the importance of including the purchase price. This information is vital for tax assessment purposes. If the purchase price is not clearly stated, it may lead to incorrect tax calculations, which could result in financial discrepancies later. Always ensure that the purchase price is accurately reflected on the form.

Incorrectly marking the type of property transfer is another mistake that can cause confusion. The form requires you to specify whether the transfer is a sale, gift, or other types of conveyance. Mislabeling the transaction can lead to complications with the local tax authority, so it’s important to be precise in this section.

Many individuals also fail to provide the correct mailing address for the property owner. This address is necessary for future correspondence and tax notifications. If the address is incorrect or incomplete, important documents may not reach the intended recipient, leading to further issues.

Additionally, people sometimes neglect to include all necessary attachments. Certain transactions may require supporting documents, such as a copy of the deed or prior property tax statements. Failing to include these attachments can result in the form being rejected or delayed in processing.

Lastly, not keeping a copy of the completed affidavit is a common oversight. It’s always wise to retain a copy for personal records. Having a copy can be beneficial for future reference and may be required if any disputes arise. Taking the time to review and maintain records can save headaches later on.

Misconceptions

- Misconception 1: The Property Transfer Affidavit is only needed for sales.

- Misconception 2: It must be filed before closing on the property.

- Misconception 3: Only the buyer must sign the affidavit.

- Misconception 4: The form is optional for all property transfers.

- Misconception 5: The form can be submitted at any time after the transfer.

- Misconception 6: There are no consequences for not filing the affidavit.

- Misconception 7: The affidavit does not affect property taxes.

- Misconception 8: The form is the same for all counties in Michigan.

This form is required for various types of property transfers, not just sales. Transfers can occur through gifts, inheritances, or other means.

The affidavit should be submitted within a specific timeframe after the transfer occurs, but it does not need to be filed before closing.

Both the buyer and the seller are typically required to sign the Property Transfer Affidavit to ensure all parties agree on the details of the transfer.

In Michigan, filing the Property Transfer Affidavit is mandatory for most property transfers to ensure proper assessment and taxation.

There are specific deadlines for submitting the affidavit, usually within 45 days of the transfer. Failing to meet this deadline can lead to penalties.

Not filing the Property Transfer Affidavit can result in additional taxes or fines. It is crucial to comply with local regulations to avoid complications.

The information provided in the affidavit can influence property tax assessments. Accurate reporting is essential for fair taxation.

While the basic structure is similar, some counties may have specific requirements or additional forms that need to be completed alongside the Property Transfer Affidavit.

Dos and Don'ts

When filling out the Michigan Property Transfer Affidavit 2766 form, it’s important to follow certain guidelines. Here’s a helpful list of dos and don’ts to ensure the process goes smoothly.

- Do provide accurate information about the property.

- Do include the correct property identification number.

- Do sign and date the affidavit where indicated.

- Do submit the form in a timely manner to avoid penalties.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank.

- Don’t use white-out or other correction methods on the form.

- Don’t forget to check for errors before submitting.

- Don’t submit the form without the necessary signatures.

Other PDF Forms

Notarized Identity Verification Form - This document is integral to ensuring compliance with identity verification standards.

Filing a Mechanics Lien California form is essential for contractors and suppliers looking to guarantee their payment rights when labor or materials are provided. For those seeking to navigate this process effectively, resources such as California PDF Forms can be invaluable, offering the necessary tools to ensure compliance and protect financial interests in property transactions.

Traders Joe - Strong background in customer relationship management.

Hurt Feelings Report - Together, we will explore how to mend your emotional wounds.

Detailed Guide for Writing Michigan Property Transfer Affidavit 2766

Filling out the Michigan Property Transfer Affidavit 2766 form is an important step when transferring property ownership. Once you have completed the form, it will need to be submitted to the appropriate local government office. This ensures that the property records are updated accurately and efficiently.

- Begin by downloading the Michigan Property Transfer Affidavit 2766 form from the Michigan Department of Treasury website or obtaining a physical copy from your local assessor's office.

- In the top section of the form, provide the name and address of the current property owner. Ensure that all information is accurate and up-to-date.

- Next, fill in the parcel number associated with the property. This number can typically be found on your property tax statement.

- Enter the property address in the designated section. Be sure to include the street number, street name, city, and zip code.

- Indicate the date of transfer in the appropriate field. This is the date when the ownership will officially change hands.

- Provide the new owner's information in the next section. This includes the name and address of the individual or entity acquiring the property.

- Next, check the box that best describes the type of transfer. Options may include sale, gift, or inheritance, among others.

- If applicable, fill out any additional details regarding the transfer, such as the purchase price or any relevant terms.

- Sign and date the form at the bottom. If there are multiple owners, ensure that all necessary signatures are included.

- Finally, submit the completed form to your local assessor's office. Keep a copy for your records.