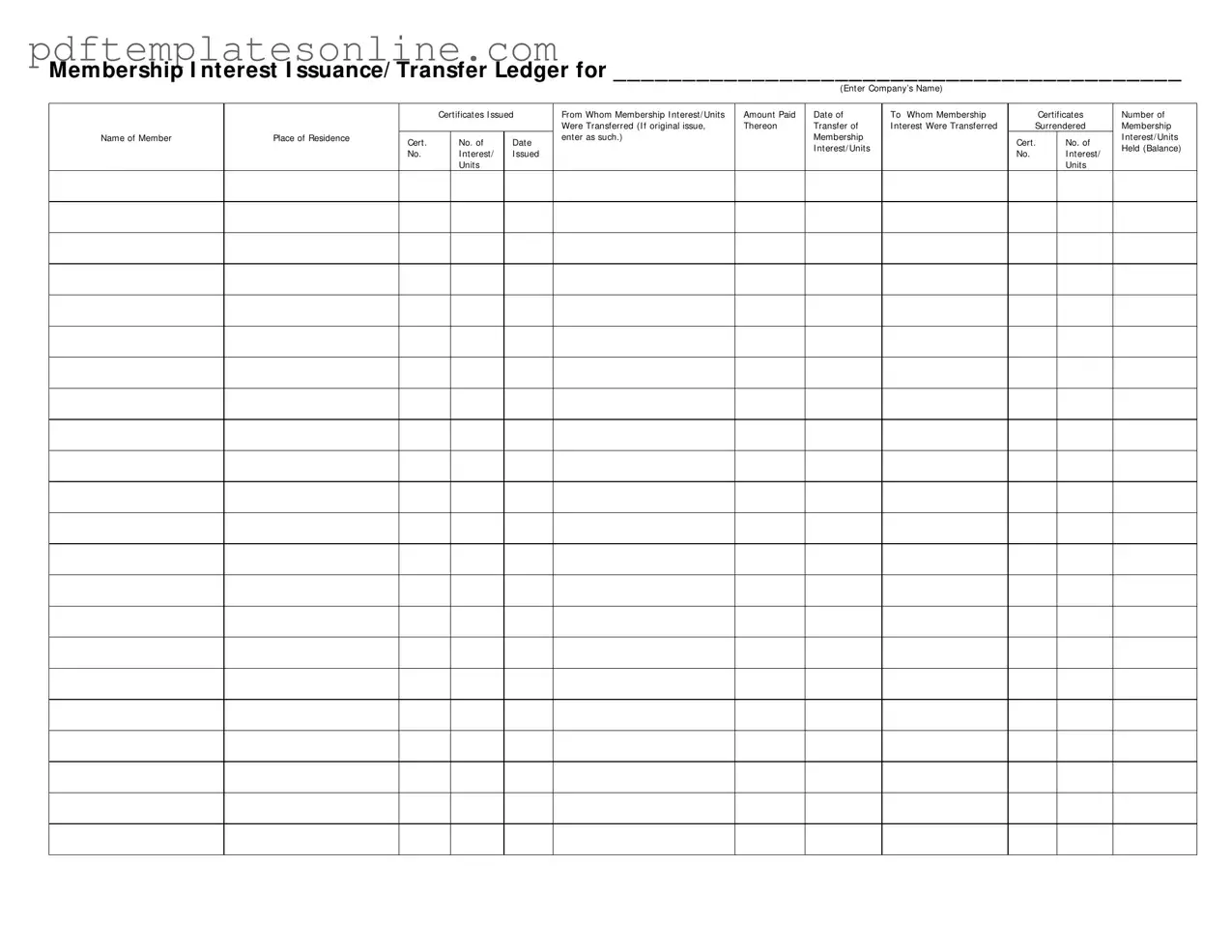

Blank Membership Ledger Form

Key takeaways

When filling out the Membership Ledger form, keep these key points in mind:

- Company Name: Always start by entering the full name of the company at the top of the form.

- Certificates Issued: Clearly indicate the number of certificates that have been issued.

- Transfer Details: If you are transferring membership interests, provide the name of the member receiving the transfer.

- Amount Paid: Record the amount paid for the membership interest or units to ensure accurate financial tracking.

- Date of Transfer: Include the date when the membership interest was transferred to maintain a clear timeline.

- Certificates Surrendered: If any certificates are surrendered during the process, note their certificate numbers.

- Balance Held: Keep track of the number of membership interests or units held after transfers to reflect the current ownership.

- Original Issue: If the entry pertains to an original issue, make sure to indicate this clearly on the form.

- Place of Residence: Provide the place of residence for each member to help with record-keeping and communication.

By following these guidelines, you can ensure that the Membership Ledger form is filled out accurately and effectively.

Common mistakes

Filling out the Membership Ledger form can seem straightforward, but many individuals stumble upon common pitfalls that can lead to confusion or even legal complications. One prevalent mistake is leaving the company name blank. This may seem minor, but without a clearly identified company, the entire ledger lacks context. Always ensure that the company's name is accurately entered at the top of the form.

Another frequent error involves misplacing the details of the certificates issued. Individuals often forget to include the certificate numbers or provide incorrect amounts. Each certificate should be accounted for, and the corresponding membership interest or units must match the figures listed. Inaccuracies here can lead to discrepancies in ownership records.

People sometimes overlook the importance of recording the correct dates. Whether it's the date of issuance or the date of transfer, these details are crucial. An incorrect date can create confusion about when ownership changed hands, potentially leading to disputes among members.

Additionally, failing to specify the recipient of the membership interest is a common oversight. When transferring units, the recipient's name must be clearly stated. Ambiguities in this section can result in ownership issues later on, so clarity is key.

Another mistake is neglecting to include the amount paid for the membership interest or units. This is vital information that reflects the financial transaction between parties. Omitting this detail can raise questions about the legitimacy of the transfer.

Some individuals also forget to indicate whether the membership interest was originally issued or transferred. This distinction is important for maintaining accurate records and understanding the history of the ownership. Always make sure to clarify this aspect on the form.

Moreover, people often fail to surrender the original certificates when transferring interests. If the original certificates are not returned, it can lead to confusion about who holds the rightful ownership. Always ensure that the original documents are accounted for during a transfer.

Another common error is miscalculating the balance of membership interests or units held. This section should reflect the total number of interests or units remaining after any transfers. Double-checking these figures can prevent future discrepancies and ensure that all parties are on the same page.

Lastly, individuals sometimes forget to sign the form. A signature is not just a formality; it serves as an acknowledgment of the information provided. Without a signature, the form may be deemed incomplete, leading to delays in processing.

By being mindful of these common mistakes, individuals can fill out the Membership Ledger form more accurately and efficiently. Attention to detail is essential in ensuring that ownership records are clear and legally sound.

Misconceptions

Here are seven common misconceptions about the Membership Ledger form:

- It is only for new members. Many believe the form is only necessary when new members join. In reality, it is also used for tracking transfers and changes in membership interests.

- Only one ledger is needed for all transactions. Some think a single ledger can handle all membership transactions. However, multiple ledgers may be required for different types of memberships or interests.

- All information is optional. There is a misconception that filling out the form is flexible. In truth, providing complete and accurate information is essential for legal compliance and clarity.

- It does not require signatures. Some assume that signatures are unnecessary. However, proper authorization is crucial for validating transfers and ensuring accountability.

- It is only relevant during financial audits. Many think the form is only important during audits. In fact, it serves as a vital record for day-to-day operations and member interactions.

- Electronic versions are not acceptable. Some believe only paper forms are valid. However, electronic versions are acceptable as long as they comply with applicable regulations and are properly maintained.

- It is a one-time task. There is a belief that once the form is filled out, it is done forever. In reality, it requires ongoing updates to reflect changes in membership interests and transactions.

Dos and Don'ts

When filling out the Membership Ledger form, it is important to follow certain guidelines to ensure accuracy and clarity. Below is a list of things you should and shouldn't do.

- Do enter the company’s name clearly at the top of the form.

- Do provide accurate details for each member, including their full name and place of residence.

- Do specify the certificate number for each membership interest issued.

- Do include the amount paid for the membership interest or units.

- Do record the date of transfer accurately.

- Don't leave any fields blank; ensure all required information is filled in.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to double-check for spelling errors in names and addresses.

- Don't alter any pre-printed information on the form.

- Don't submit the form without reviewing it for completeness.

Other PDF Forms

Michigan Annulment Laws - Completing the DCH 0838 accurately prevents potential legal issues down the line.

A Non-disclosure Agreement (NDA) is a legal contract that protects confidential information shared between parties. This agreement ensures that sensitive data remains private, preventing unauthorized disclosure. To safeguard your interests, consider filling out the Non-disclosure Agreement form by clicking the button below.

How to Create Payroll Checks - Employers can ensure compliance with labor laws using this record.

Ubc Dli Number - This application is necessary for individuals aiming to pursue academic opportunities in Canada as international students.

Detailed Guide for Writing Membership Ledger

Completing the Membership Ledger form is an important step in maintaining accurate records of membership interests. Once you have filled out the form, you will be able to track the issuance and transfer of membership interests effectively. Follow these steps carefully to ensure that all necessary information is accurately recorded.

- Begin by entering the company’s name in the designated space at the top of the form.

- In the section labeled "Certificates Issued," list the details of each certificate issued. Include the name of the member, their place of residence, and the certificate number.

- Next, under "Membership Interest/Units," specify the amount paid for each membership interest or unit that was issued.

- Indicate the date on which the membership interest or units were issued.

- If there has been a transfer of membership interest, fill in the "To Whom Membership Were Transferred" section. Include the name of the new member and the date of the transfer.

- In the "Membership Interest/Units Surrendered" section, enter the certificate number of any units that were surrendered, along with the corresponding membership interest or units.

- Finally, calculate and record the total number of membership interest or units held, which represents the balance after all transactions.