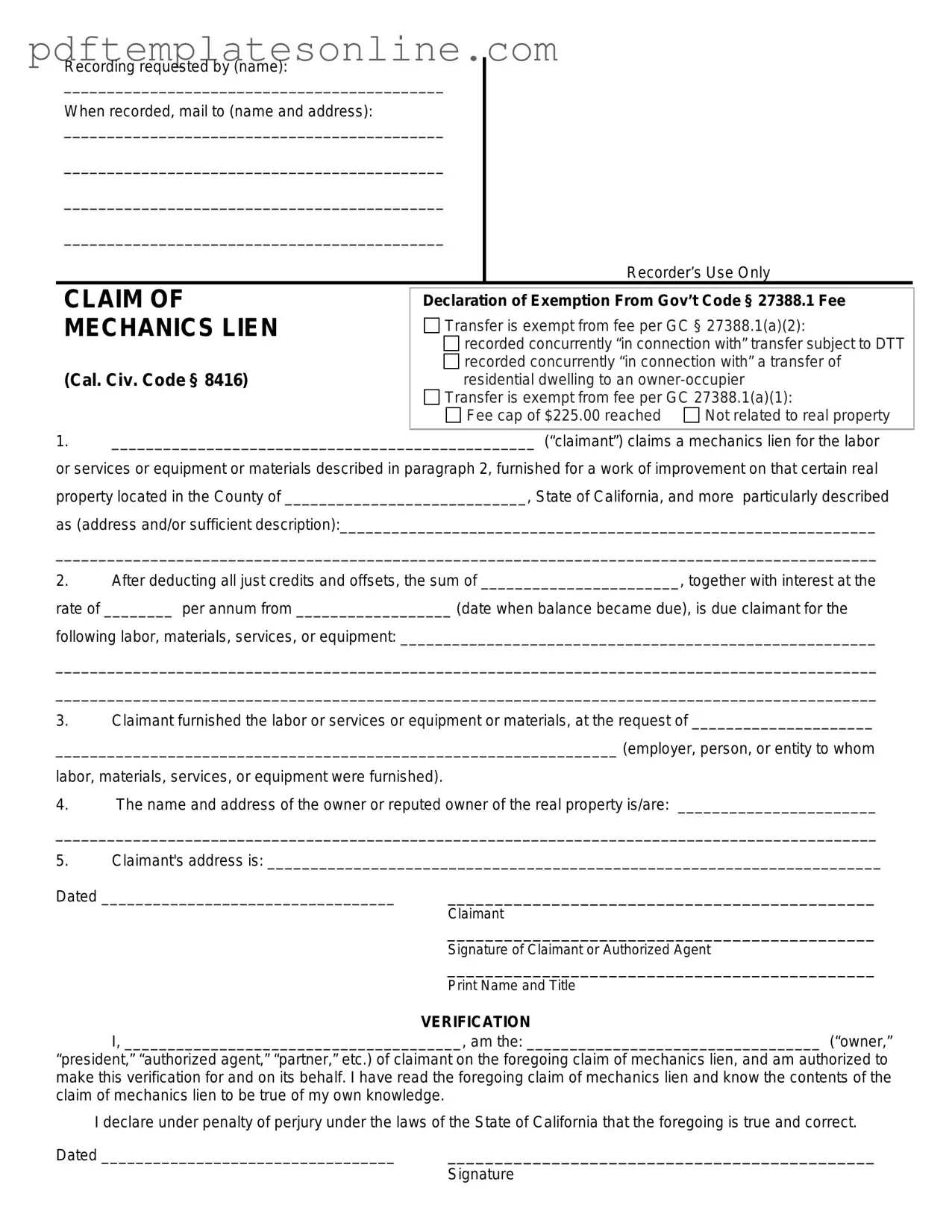

Blank Mechanics Lien California Form

Key takeaways

When filling out and using the Mechanics Lien California form, several important points should be considered to ensure compliance and effectiveness. Here are the key takeaways:

- Understand the Purpose: A Mechanics Lien serves as a legal claim against a property, ensuring that contractors and suppliers are paid for their work and materials.

- Know the Timeline: It is crucial to file the lien within 90 days of completing the work or delivering materials to the property.

- Gather Necessary Information: Collect details such as the property owner’s name, the property address, and a description of the work performed.

- Complete the Form Accurately: Fill out the Mechanics Lien form carefully. Any errors can lead to delays or dismissal of the lien.

- File with the Correct County: Submit the completed form to the county recorder's office where the property is located.

- Provide Notice: After filing, notify the property owner and other relevant parties about the lien to ensure they are aware of the claim.

- Consider Legal Assistance: If unsure about the process or facing disputes, consulting with a legal professional can be beneficial.

By following these takeaways, individuals can navigate the Mechanics Lien process more effectively and protect their rights in the construction industry.

Common mistakes

Filing a Mechanics Lien in California can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is failing to provide accurate property information. When completing the form, it is crucial to include the correct address and legal description of the property. Omitting or miswriting these details can lead to complications, such as delays in processing or even rejection of the lien.

Another mistake involves not adhering to the strict timelines required for filing. California law stipulates specific deadlines for filing a Mechanics Lien based on the type of project and the nature of the work performed. Missing these deadlines can result in losing the right to enforce the lien. It is essential to be aware of these timelines and ensure that the form is submitted promptly.

Additionally, individuals sometimes overlook the necessity of including all required supporting documents. The Mechanics Lien form may require additional paperwork, such as proof of the work completed or invoices for services rendered. Failing to attach these documents can weaken the validity of the lien and may lead to disputes later on.

Lastly, many people neglect to properly sign and notarize the form. A Mechanics Lien must be signed by the claimant and, in some cases, notarized to be considered valid. Incomplete signatures or missing notarization can render the lien ineffective. It is vital to review the form thoroughly to ensure all signatures and notary requirements are fulfilled before submission.

Misconceptions

Understanding the Mechanics Lien California form is crucial for property owners, contractors, and suppliers involved in construction projects. However, several misconceptions can lead to confusion and potential legal issues. Here are seven common misconceptions:

- All contractors can file a mechanics lien. Not all contractors have the right to file a mechanics lien. Only those who have a direct contract with the property owner or have provided materials or labor directly to the project can file.

- A mechanics lien guarantees payment. Filing a mechanics lien does not guarantee payment. It merely provides a legal claim against the property, which can lead to foreclosure if the debt remains unpaid.

- The mechanics lien must be filed immediately. While there are deadlines, the mechanics lien does not have to be filed immediately after the work is completed. However, it is essential to adhere to the specific time frames set by California law.

- All types of construction work qualify for a mechanics lien. Not every type of construction work qualifies. For instance, work done without the necessary permits or on a property that is not subject to a mechanics lien may not be eligible.

- Filing a mechanics lien is a simple process. The process can be complex and requires specific information and documentation. Mistakes in the filing can lead to the lien being invalidated.

- Once a mechanics lien is filed, it cannot be removed. A mechanics lien can be removed. This can occur through payment of the debt, a court order, or if the lien is found to be invalid.

- Only the property owner can challenge a mechanics lien. Contractors and suppliers can also challenge a mechanics lien if they believe it was filed incorrectly or without justification.

Being informed about these misconceptions can help individuals navigate the mechanics lien process more effectively and protect their rights in construction-related matters.

Dos and Don'ts

When filling out the Mechanics Lien form in California, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do provide accurate information about the property owner and the property address.

- Do include a clear description of the work completed or materials supplied.

- Do file the lien within the required time frame to protect your rights.

- Do sign and date the form before submitting it.

- Don't omit important details, as this can lead to delays or rejection.

- Don't forget to check for any local filing requirements that may apply.

Following these guidelines can help ensure that your Mechanics Lien is processed smoothly and effectively.

Other PDF Forms

Odometer Disclosure Statement California - All entries must be completed in legible handwriting.

The California Prenuptial Agreement form is a legal document designed to detail how a couple wishes to divide their assets and responsibilities should their marriage end. It provides a clear agreement on financial matters, safeguarding both parties' interests. By setting these terms before marriage, couples can ensure a measure of security and clarity for their future. For those interested in preparing this document, resources such as California PDF Forms can be incredibly helpful.

Florida Real Estate Forms - Landlords can require written consent for tenants to keep pets in the unit.

Hazmat Bol - The document ensures awareness of the potential risks involved in transportation.

Detailed Guide for Writing Mechanics Lien California

Filling out the Mechanics Lien form in California requires careful attention to detail. Ensure you have all necessary information ready before you start. This form needs to be completed accurately to protect your rights regarding unpaid work or materials provided. Follow these steps to fill it out correctly.

- Begin by entering your name and address at the top of the form.

- Next, provide the name and address of the property owner.

- Include the address of the property where the work was performed.

- Specify the nature of the work done or materials supplied.

- Indicate the date when the work was completed or materials were provided.

- List the total amount owed for the work or materials.

- Sign the form to certify that the information is accurate.

- Date the form after signing.

- Make copies of the completed form for your records.

- File the original form with the county recorder’s office where the property is located.

Once you have completed the form, ensure you keep a copy for your records. Timely filing is crucial, so make sure to submit it promptly to protect your interests.