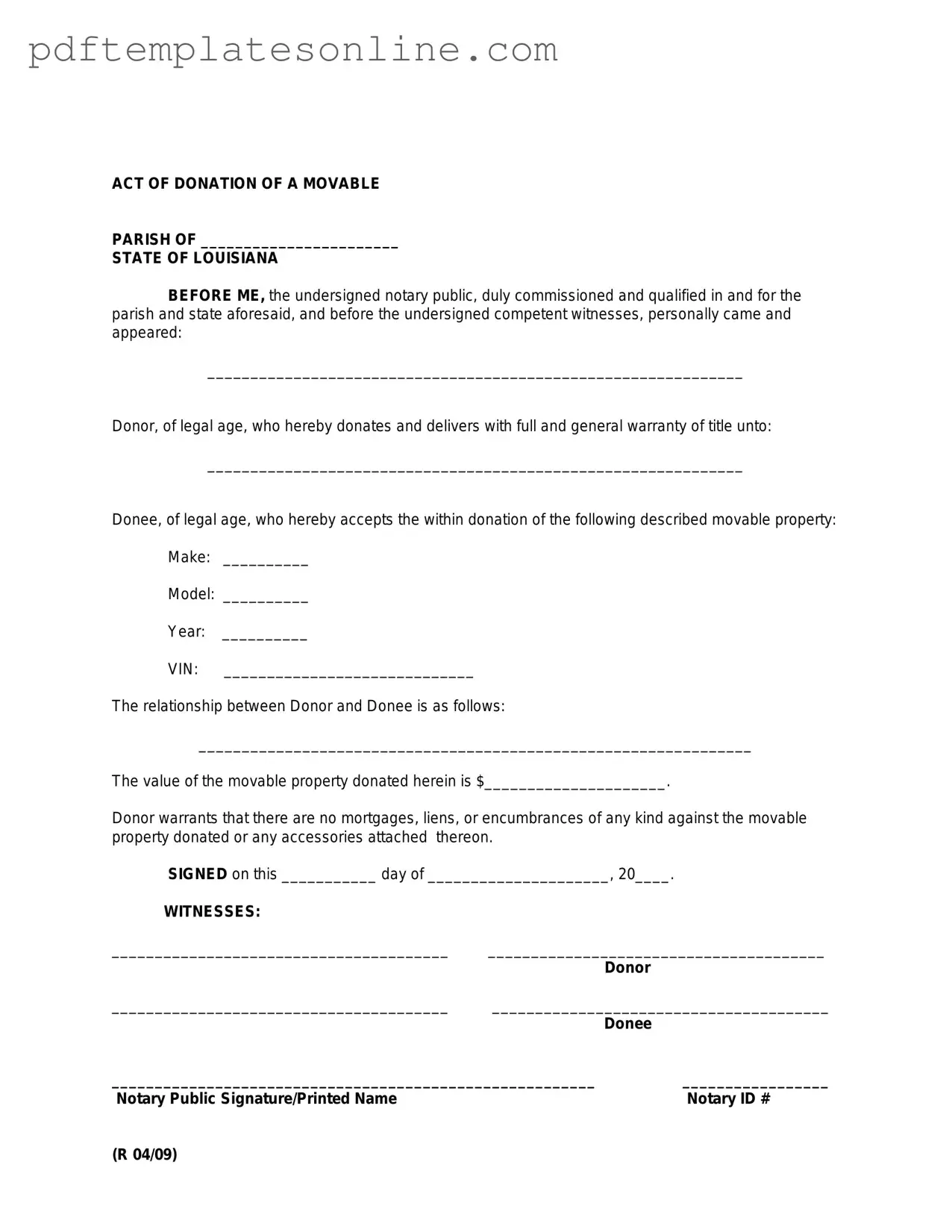

Blank Louisiana act of donation Form

Key takeaways

Filling out the Louisiana Act of Donation form is an important process that requires careful attention to detail. Below are key takeaways to ensure a smooth experience.

- The form is used to legally transfer ownership of property without compensation.

- Both the donor and the donee must be clearly identified, including their full names and addresses.

- It is crucial to provide a detailed description of the property being donated.

- The form must be signed in the presence of a notary public to be legally binding.

- Consider consulting with a legal professional to ensure all requirements are met.

- Once completed, the form should be filed with the appropriate local government office.

- Keep a copy of the signed form for your records, as it serves as proof of the donation.

- Be aware of any tax implications that may arise from the donation of property.

By following these guidelines, individuals can navigate the donation process more effectively and ensure compliance with Louisiana law.

Common mistakes

Filling out the Louisiana Act of Donation form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is not providing complete information about the donor and the recipient. It’s essential to include full names, addresses, and other identifying details. Omitting even one piece of information can create confusion and potentially invalidate the donation.

Another mistake involves failing to properly describe the property being donated. The form requires a clear and accurate description of the property, whether it’s real estate, personal belongings, or financial assets. Vague descriptions can lead to disputes or misunderstandings about what is being donated.

Many people also overlook the importance of signatures. Both the donor and the recipient must sign the form for it to be legally binding. If either party forgets to sign, the donation may not be recognized, which can be frustrating for everyone involved.

In addition, some individuals neglect to have the form notarized. While notarization is not always mandatory, it adds an extra layer of authenticity and can help prevent future legal challenges. Skipping this step can leave the donation vulnerable to disputes.

Another common error is not understanding the implications of the donation. Donors should be aware of any tax consequences or liabilities that may arise from their gift. Failing to consider these factors can lead to unexpected financial burdens later on.

People sometimes also forget to check for any specific requirements that may apply to certain types of property. For example, real estate donations may require additional documentation or disclosures. Ignoring these requirements can complicate the donation process.

Additionally, some individuals make the mistake of not keeping a copy of the completed form. It’s crucial to retain a copy for personal records and future reference. Without this documentation, tracking the donation or resolving any issues that arise can become much more difficult.

Lastly, many individuals rush through the process without thoroughly reviewing the completed form. Taking the time to double-check all entries can help catch errors before they become problems. A careful review can save time, money, and stress in the long run.

Misconceptions

The Louisiana act of donation form is an important legal document that allows individuals to donate property or assets to another person. However, there are several misconceptions surrounding this form that can lead to confusion. Here are five common misconceptions:

- Misconception 1: The act of donation form is only for real estate.

- Misconception 2: A verbal agreement is enough to complete a donation.

- Misconception 3: The donor can change their mind after the donation is made.

- Misconception 4: Donations are tax-free and do not have any implications.

- Misconception 5: Only family members can receive donations.

This is not true. While the form is often associated with real estate transactions, it can also be used for personal property, such as vehicles, jewelry, and other valuable items.

Many believe that a simple conversation suffices. However, to ensure legal validity and clarity, a written act of donation is required. This protects both the donor and the recipient.

Once the act of donation is executed and accepted, it generally cannot be revoked without the consent of the recipient. This underscores the importance of careful consideration before signing.

While many donations may not incur taxes, there can be tax implications depending on the value of the donation and the relationship between the donor and recipient. Consulting a tax professional is advisable.

This is a common misunderstanding. Anyone can receive a donation, regardless of their relationship to the donor. Friends, charities, and organizations can all be recipients.

Understanding these misconceptions can help individuals navigate the donation process more effectively. Always consider seeking professional advice to ensure that your intentions are clearly documented and legally binding.

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below is a list of dos and don'ts to keep in mind.

- Do read the entire form carefully before starting.

- Do provide complete and accurate information.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't use correction fluid on the form.

- Don't submit the form without verifying all details are correct.

Other PDF Forms

What Is Auto Consignment - A strategic approach to pricing can attract more buyers.

Having a properly executed California Medical Power of Attorney form is crucial for ensuring that your healthcare preferences are respected. By designating someone you trust to make medical decisions for you when you cannot, you can create a sense of security for both yourself and your loved ones. For those looking to obtain or customize this important document, resources such as California PDF Forms can be invaluable in guiding you through the process.

Free Paystub Template - Employees may use the Pay Stub as proof of income when applying for loans or rentals.

Detailed Guide for Writing Louisiana act of donation

Once you have the Louisiana Act of Donation form in front of you, it’s essential to carefully fill it out to ensure all necessary information is accurately provided. This form will require details about the donor and the recipient, as well as a description of the property being donated. Following the steps outlined below will help streamline the process and ensure compliance with state requirements.

- Begin by entering the date at the top of the form.

- Provide the full name of the donor, including any middle initials.

- List the donor’s address, including city, state, and zip code.

- Next, fill in the full name of the recipient, also including any middle initials.

- Enter the recipient’s address in the same format as the donor's address.

- Clearly describe the property being donated. Include details such as address, legal description, and any identifying information.

- Indicate whether the donation is made with or without conditions.

- If applicable, specify any conditions or restrictions related to the donation.

- Sign the form in the designated area for the donor.

- Have the form notarized to validate the donation. The notary will provide their signature and seal.

After completing the form, ensure that both the donor and recipient retain copies for their records. It may also be prudent to consult with a legal professional to confirm that all aspects of the donation are properly handled.