Blank Loan Estimate Form

Key takeaways

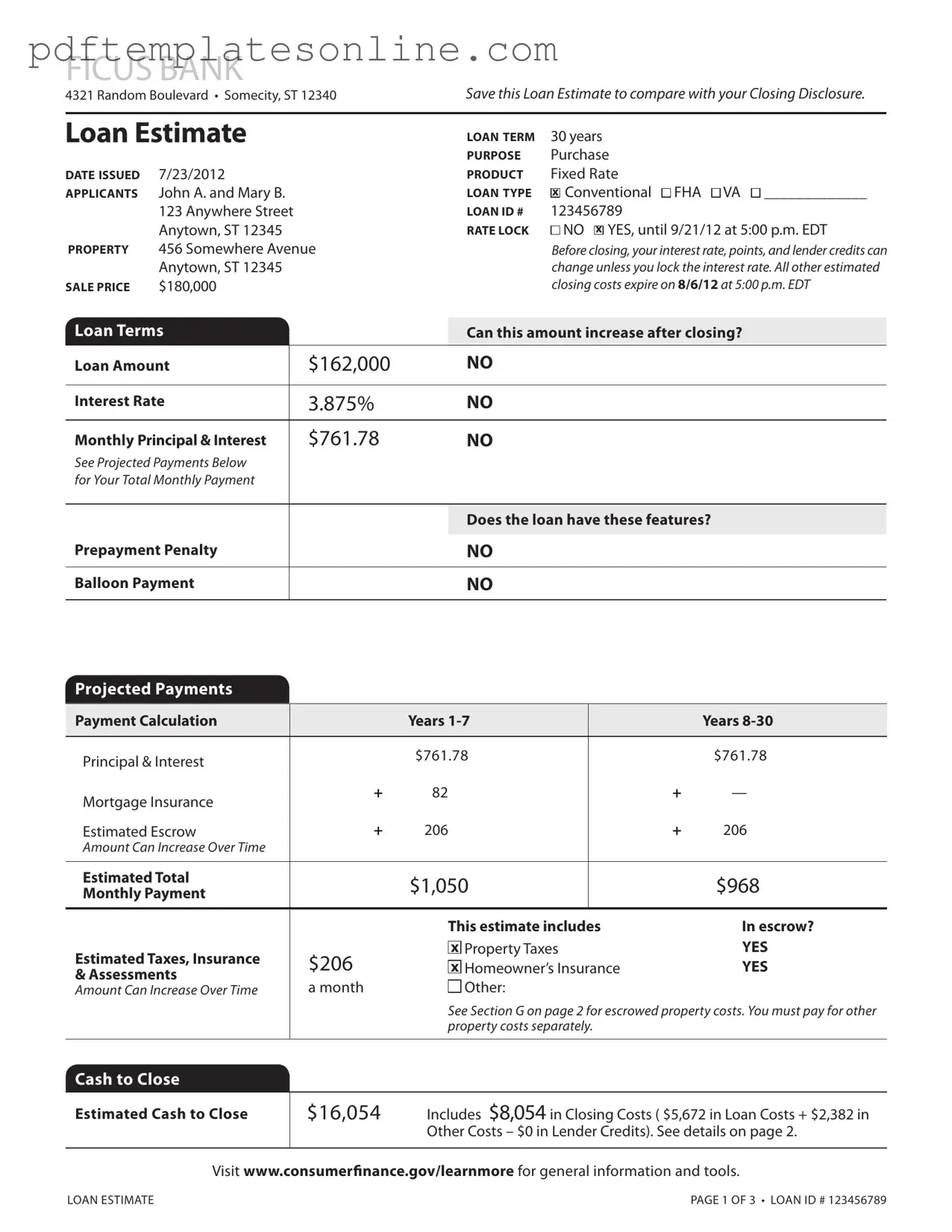

When filling out and using the Loan Estimate form, it is essential to understand its significance and the details it contains. Here are some key takeaways:

- Compare Estimates: Save your Loan Estimate to compare it with your Closing Disclosure. This helps ensure that the terms you were initially offered remain consistent throughout the process.

- Interest Rate Lock: Pay attention to whether you have locked in your interest rate. If not, your rate may change before closing, which could affect your monthly payments.

- Closing Costs: Review the estimated cash to close, which includes closing costs and down payment. Understanding these figures will help you prepare financially for the transaction.

- Projected Payments: Look closely at the projected payments section. This outlines your expected monthly payments, including principal, interest, taxes, and insurance, giving you a clearer picture of your financial commitment.

Common mistakes

Filling out the Loan Estimate form is a critical step in the home-buying process, yet many individuals make common mistakes that can lead to confusion and potential financial pitfalls. One frequent error is failing to review the estimated closing costs thoroughly. Many applicants overlook the detailed breakdown of fees and charges associated with the loan. These costs can vary significantly depending on the lender and the specific loan terms. It’s essential to take the time to understand each component, including origination charges, appraisal fees, and prepaids, to avoid surprises at closing.

Another mistake is neglecting to compare the Loan Estimate with other offers. Borrowers often accept the first loan they are presented without exploring other options. The Loan Estimate is designed to facilitate comparisons between different lenders and loan products. By not comparing estimates, individuals may miss out on better interest rates, lower closing costs, or more favorable loan terms. It’s advisable to obtain estimates from multiple lenders and evaluate them side by side to ensure the best financial decision is made.

Additionally, some applicants fail to lock in their interest rates. The Loan Estimate indicates whether the interest rate is locked or if it can change before closing. If borrowers do not lock in their rates, they risk fluctuations that could lead to higher monthly payments. Understanding the implications of a rate lock and making a timely decision is crucial for maintaining budgetary control throughout the loan process.

Finally, many people do not pay close attention to the projected payments section. This area outlines the expected monthly payments, including principal, interest, and escrow for taxes and insurance. Ignoring these projections can lead to unrealistic expectations about affordability. Borrowers should carefully consider their financial situation and ensure they can comfortably manage the estimated monthly payments before committing to a loan.

Misconceptions

- Misconception 1: The Loan Estimate is a final loan offer.

- Misconception 2: The interest rate on the Loan Estimate is guaranteed.

- Misconception 3: All closing costs are included in the Loan Estimate.

- Misconception 4: The Loan Estimate is only for first-time homebuyers.

- Misconception 5: You cannot shop around for better loan terms after receiving a Loan Estimate.

- Misconception 6: The Loan Estimate will not change before closing.

- Misconception 7: The Loan Estimate includes all potential fees for the entire loan term.

- Misconception 8: You must accept the loan terms presented in the Loan Estimate.

- Misconception 9: The Loan Estimate is the same as the Closing Disclosure.

- Misconception 10: The Loan Estimate is only about the interest rate.

Many people mistakenly believe that the Loan Estimate is a binding contract. In reality, it is simply an estimate of the loan terms and costs. You can still negotiate terms or choose a different lender after receiving this document.

Some assume that the interest rate listed on the Loan Estimate is locked in. However, unless you formally lock your interest rate, it can change before closing.

People often think that the Loan Estimate covers every possible cost associated with closing. While it provides a detailed breakdown, some costs may arise later or be excluded, such as certain third-party fees.

This form is useful for anyone seeking a mortgage, regardless of whether they are first-time buyers or seasoned homeowners. It helps all borrowers understand their loan options and costs.

Many believe that once they have a Loan Estimate, they are committed to that lender. In fact, you can and should compare estimates from multiple lenders to find the best deal.

Some borrowers think that the figures on the Loan Estimate are final. Changes can occur due to various factors, such as changes in your credit score or the loan amount.

Individuals often expect the Loan Estimate to reflect all fees throughout the loan's life. Instead, it primarily focuses on upfront costs and does not include ongoing fees that may arise later.

Receiving a Loan Estimate does not obligate you to accept the loan. You have the right to review the terms and decide whether they meet your needs.

While both documents provide information about loan costs, they serve different purposes. The Loan Estimate is provided early in the process, while the Closing Disclosure is given shortly before closing and reflects final terms.

Many people think the Loan Estimate focuses solely on the interest rate. However, it includes various aspects, such as loan terms, monthly payments, and closing costs, giving a comprehensive view of the loan.

Dos and Don'ts

When filling out the Loan Estimate form, consider the following guidelines:

- Do read the entire document carefully before signing.

- Don't leave any sections blank; provide all required information.

- Do compare the Loan Estimate with other offers to ensure you get the best deal.

- Don't ignore the interest rate and terms; they significantly affect your payments.

- Do ask questions if you do not understand any part of the form.

- Don't rush through the process; take your time to ensure accuracy.

- Do keep a copy of the Loan Estimate for your records.

- Don't assume that the terms will remain the same after closing.

- Do verify all fees listed to avoid unexpected costs at closing.

Other PDF Forms

Florida State Return - This form supports taxpayers who might have language barriers by allowing them to choose a representative who can communicate effectively with the IRS.

The necessary California Firearm Bill of Sale is vital for anyone involved in the sale or transfer of firearms, ensuring all transactions are legally documented and compliant with state regulations.

Cadet Command - Fosters accountability in the students' academic commitments.

Detailed Guide for Writing Loan Estimate

Completing the Loan Estimate form is a vital step in understanding the financial obligations associated with a mortgage. This form will guide you through the costs and terms of your loan, allowing you to make informed decisions. Follow these steps carefully to ensure that all necessary information is accurately filled out.

- Identify the lender: At the top of the form, find the lender's name and address. In this case, it is Ficus Bank, located at 4321 Random Boulevard, Somecity, ST 12340.

- Fill in the loan details: Look for the loan term, purpose, and date issued. For example, the loan term is 30 years, the purpose is purchase, and the date issued is 7/23/2012.

- Enter the applicant information: Input the names of the applicants, John A. and Mary B., along with their loan type, which can be Conventional, FHA, or VA.

- Provide property address: Fill in the property address where the loan will be applied, such as 456 Somewhere Avenue, Anytown, ST 12345.

- Loan ID: Write down the loan ID number, which is 123456789 in this case.

- Rate lock information: Indicate whether the interest rate is locked. In this example, it is locked until 9/21/12 at 5:00 p.m. EDT.

- List the sale price: Enter the estimated sale price of the property, which is $180,000.

- Complete loan terms: Fill in the loan amount, interest rate, and monthly principal and interest. For this form, the loan amount is $162,000, the interest rate is 3.875%, and the monthly payment is $761.78.

- Projected payments: Calculate the projected payments for the first seven years and the subsequent years. Input these amounts accordingly.

- Cash to close: Calculate the estimated cash to close, which is $16,054 in this example. Include details about closing costs and down payment.

- Closing cost details: Fill out the breakdown of closing costs, including loan costs, other costs, and total closing costs.

- Additional information: Review the section about the lender, loan officer, and comparisons to other loans. Ensure all contact information is accurate.

- Sign and date: Finally, both applicants should sign and date the form to confirm receipt of the Loan Estimate.

Once the form is completed, it’s essential to keep it for your records. This document will serve as a reference point when you receive your Closing Disclosure, helping you to compare and ensure that the terms remain consistent throughout the mortgage process.