Fillable Loan Agreement Document

Key takeaways

When filling out and using a Loan Agreement form, it is important to keep the following key takeaways in mind:

- Complete All Sections: Ensure every section of the form is filled out accurately. Missing information can lead to delays or disputes.

- Clearly Define Terms: Specify the loan amount, interest rate, repayment schedule, and any fees. Clarity helps prevent misunderstandings.

- Include Signatures: Both parties must sign the agreement. This signifies acceptance of the terms and provides legal protection.

- Keep Copies: Retain copies of the signed agreement for both parties. This ensures that everyone has access to the same information.

- Consult Professionals: If unsure about any part of the agreement, seek advice from a financial advisor or attorney. This can help avoid potential issues.

Loan Agreement Forms for Particular States

Common mistakes

When filling out a Loan Agreement form, accuracy is crucial. One common mistake is providing incorrect personal information. This includes errors in names, addresses, or Social Security numbers. Such inaccuracies can lead to delays in processing the loan or even disqualification.

Another frequent error involves misunderstanding the loan terms. Borrowers sometimes overlook the interest rate or repayment schedule. This oversight can result in unexpected financial burdens later on. It is essential to read the terms carefully before signing.

Some individuals fail to disclose all sources of income. Lenders need a complete picture of a borrower’s financial situation. Omitting income can raise red flags and may lead to a denial of the loan application.

Additionally, applicants often underestimate their expenses. When filling out the form, it is vital to account for all monthly obligations. Ignoring expenses can create an unrealistic view of financial capability, affecting loan approval.

Another mistake is not providing required documentation. Many borrowers forget to include necessary documents such as pay stubs or tax returns. Missing documentation can slow down the approval process or result in outright denial.

Some people may rush through the application process. Taking time to review each section is essential. Rushing can lead to mistakes that could have been easily avoided with a careful review.

Inadequate communication with the lender can also be a problem. Borrowers should ask questions if they do not understand any part of the form. Failing to clarify uncertainties can lead to misunderstandings and complications down the line.

Finally, not keeping a copy of the completed Loan Agreement form is a mistake many make. Having a copy is important for personal records and future reference. This can help in tracking payments and understanding the terms agreed upon.

Misconceptions

When it comes to loan agreements, many individuals harbor misconceptions that can lead to misunderstandings and potential legal issues. Here are six common misconceptions about loan agreements:

-

All loan agreements are the same.

This is not true. Loan agreements can vary significantly based on the lender, the type of loan, and the specific terms negotiated. Each agreement is tailored to the needs of the parties involved.

-

Once signed, a loan agreement cannot be changed.

While it is true that loan agreements are binding, they can be modified if both parties agree to the changes. It is essential to document any modifications in writing to avoid future disputes.

-

A verbal agreement is just as binding as a written one.

Although verbal agreements can be enforceable, they are much harder to prove in court. A written loan agreement provides clarity and serves as evidence of the terms agreed upon.

-

Loan agreements are only necessary for large amounts of money.

Regardless of the loan amount, having a written agreement is advisable. It protects both the lender and the borrower by clearly outlining the terms of the loan.

-

Interest rates are fixed and cannot change.

Some loans come with fixed interest rates, but others may have variable rates that can fluctuate over time. It's crucial to understand the type of interest rate associated with the loan.

-

Signing a loan agreement means you have no options if you can't repay.

This misconception overlooks the possibility of negotiating with the lender. If repayment becomes difficult, borrowers can often discuss alternatives, such as restructuring the loan or seeking forbearance.

Understanding these misconceptions can help individuals navigate the complexities of loan agreements more effectively. Always seek clarity on the terms and conditions before entering into any financial commitment.

Loan Agreement Categories

Dos and Don'ts

When filling out a Loan Agreement form, it's important to be thorough and careful. A well-completed form can help ensure a smooth lending process. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate and truthful information.

- Do double-check your numbers and calculations.

- Do keep a copy of the completed form for your records.

- Do ask questions if any part of the form is unclear.

- Don’t rush through the form; take your time to avoid mistakes.

- Don’t leave any required fields blank.

- Don’t use abbreviations or slang that may confuse the lender.

- Don’t sign the form until you have reviewed it thoroughly.

By following these guidelines, you can help ensure that your Loan Agreement form is filled out correctly and completely, paving the way for a successful loan application process.

Check out Popular Documents

Sample Adoption Reference Letter - A heartfelt endorsement that reflects the adoptive parents’ commitment to family.

Emergency Leave - You will need to record both the start and end dates for your leave period.

Printable Drivers Time Record Sheet - Drivers should double-check their entries to avoid any potential discrepancies.

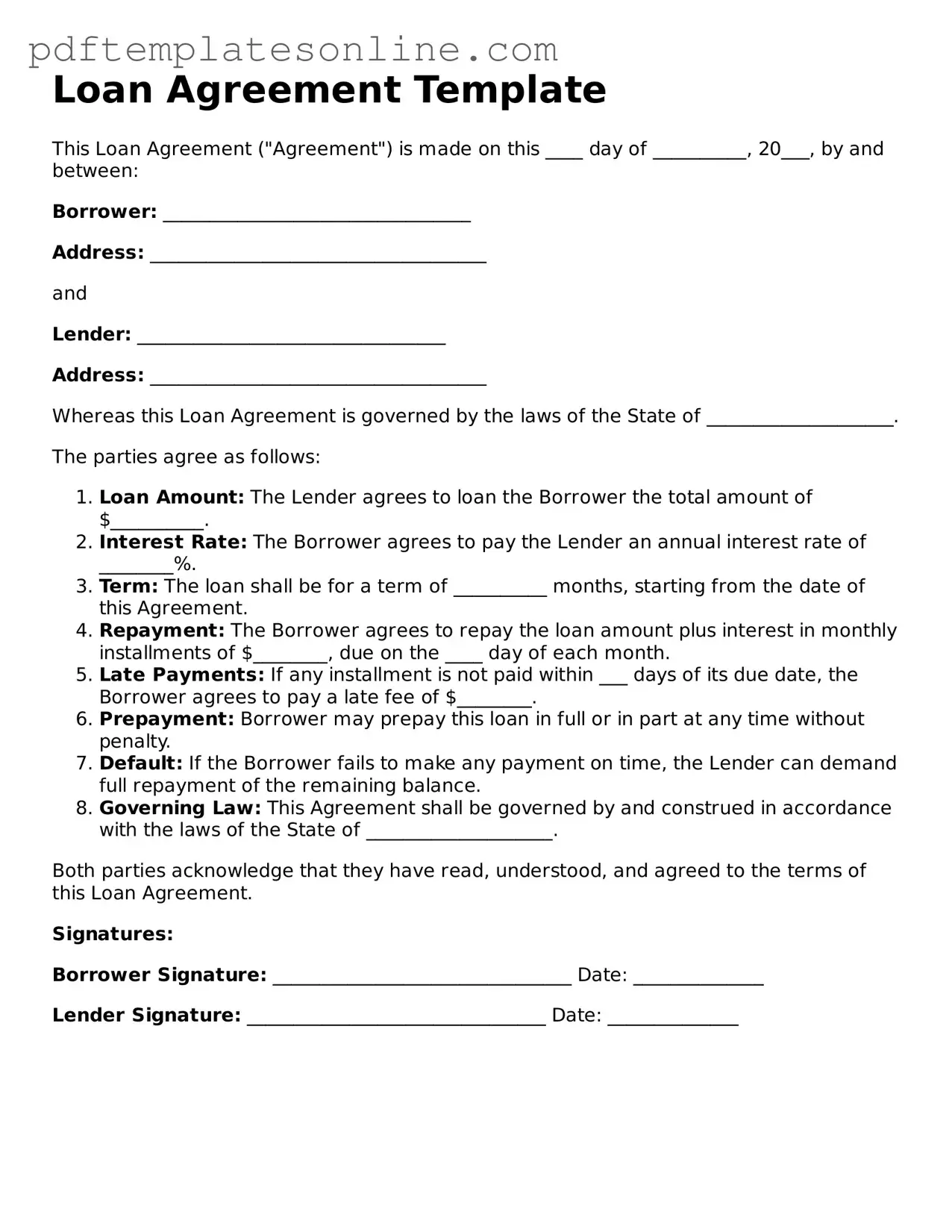

Detailed Guide for Writing Loan Agreement

Filling out the Loan Agreement form requires careful attention to detail. Follow these steps to ensure that all necessary information is provided accurately.

- Begin by entering the date at the top of the form. This should reflect the day you are completing the agreement.

- Provide the full names of all parties involved in the loan. This includes both the lender and the borrower.

- Next, fill in the loan amount. Clearly state the total sum being borrowed.

- Specify the interest rate. This should be expressed as a percentage.

- Indicate the repayment schedule. Detail how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any collateral, if applicable. Describe the assets that will secure the loan.

- Sign and date the form at the bottom. Both parties must provide their signatures to validate the agreement.

After completing these steps, review the form for accuracy before submitting it. Ensuring that all fields are filled out correctly will help prevent future disputes.