Fillable LLC Share Purchase Agreement Document

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, consider the following key takeaways:

- Clarity is essential. Ensure that all terms and conditions are clearly defined. Ambiguities can lead to misunderstandings or disputes in the future.

- Accurate information is crucial. Double-check that all details, including names, addresses, and the number of shares, are correct. Errors can complicate the transaction.

- Review the rights and obligations. Understand the rights of both the buyer and the seller. This includes payment terms, transfer of shares, and any warranties or representations.

- Legal advice may be beneficial. Consider consulting with a legal professional to ensure compliance with state laws and to protect your interests.

Common mistakes

When filling out an LLC Share Purchase Agreement, individuals often overlook important details that can lead to complications down the line. One common mistake is failing to accurately identify the parties involved. This includes not only the buyer and seller but also the LLC itself. Clarity in identifying all parties ensures that the agreement is enforceable and that all involved understand their rights and responsibilities.

Another frequent error is neglecting to specify the purchase price and payment terms. Without clear terms, disputes can arise regarding how and when payments should be made. It’s essential to detail the total purchase price, any deposits required, and the timeline for payment. This transparency helps prevent misunderstandings and provides a clear framework for the transaction.

Additionally, many people do not include necessary representations and warranties. These are assurances made by the seller regarding the condition of the LLC and its assets. Omitting these can leave buyers vulnerable to unforeseen liabilities. By including these clauses, buyers can protect themselves and ensure they are making an informed decision.

Lastly, failing to address the conditions for closing the sale is a mistake that can derail the process. Closing conditions might include obtaining necessary approvals or completing due diligence. By outlining these conditions, both parties can have a clear understanding of what needs to happen before the sale is finalized, helping to avoid delays or complications.

Misconceptions

When it comes to the LLC Share Purchase Agreement, several misconceptions can lead to confusion for those involved in business transactions. Understanding these misconceptions can help clarify the purpose and function of the agreement.

- Misconception 1: An LLC Share Purchase Agreement is only necessary for large transactions.

- Misconception 2: The agreement is the same as a standard purchase agreement.

- Misconception 3: Once signed, the agreement cannot be modified.

- Misconception 4: Legal counsel is unnecessary when drafting the agreement.

This is not true. Regardless of the size of the transaction, having a formal agreement protects both the buyer and the seller. It outlines the terms and conditions of the sale, ensuring that all parties understand their rights and obligations.

While both documents serve similar purposes, they are not interchangeable. An LLC Share Purchase Agreement specifically addresses the sale of membership interests in a limited liability company, which involves unique considerations that standard purchase agreements may not cover.

This is incorrect. Parties can agree to modify the terms of the agreement after it has been signed. However, any changes should be documented in writing to ensure clarity and enforceability.

Many people believe they can draft the agreement without legal help. However, consulting with an attorney is advisable. Legal counsel can provide insights into state laws and regulations, ensuring that the agreement is comprehensive and compliant.

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it’s important to approach the task with care and attention to detail. Here are ten things to keep in mind, including both what to do and what to avoid.

- Do read the entire form carefully before starting. Understanding the requirements will help you fill it out correctly.

- Don’t rush through the process. Taking your time can prevent mistakes that may cause delays.

- Do ensure all parties involved are accurately identified. This includes full names and addresses.

- Don’t leave any required fields blank. Incomplete forms can lead to rejection or additional requests for information.

- Do double-check all numbers and figures. Accuracy is crucial, especially when it comes to financial details.

- Don’t use abbreviations or shorthand. Clarity is key, and full names and terms should be used.

- Do consult with legal or financial advisors if you have questions. Their expertise can provide valuable guidance.

- Don’t ignore the instructions provided with the form. They often contain essential information for successful completion.

- Do keep a copy of the completed form for your records. This can be helpful for future reference.

- Don’t forget to sign and date the form. An unsigned agreement may not be valid.

Check out Popular Documents

Printable Room Rental Agreement - Indicates whether the rental property includes shared common areas.

When engaging in a real estate transaction, understanding the nuances of a California Real Estate Purchase Agreement is essential to prevent any misunderstandings. This form serves to detail the critical aspects of the sale, such as price and inspections, ensuring that all parties involved are aware of their obligations. For those looking to access this important documentation, resources like California PDF Forms can be invaluable.

Non Borrower Credit Authorization Form - This form is used when a household member who is not on the mortgage contributes to the household income.

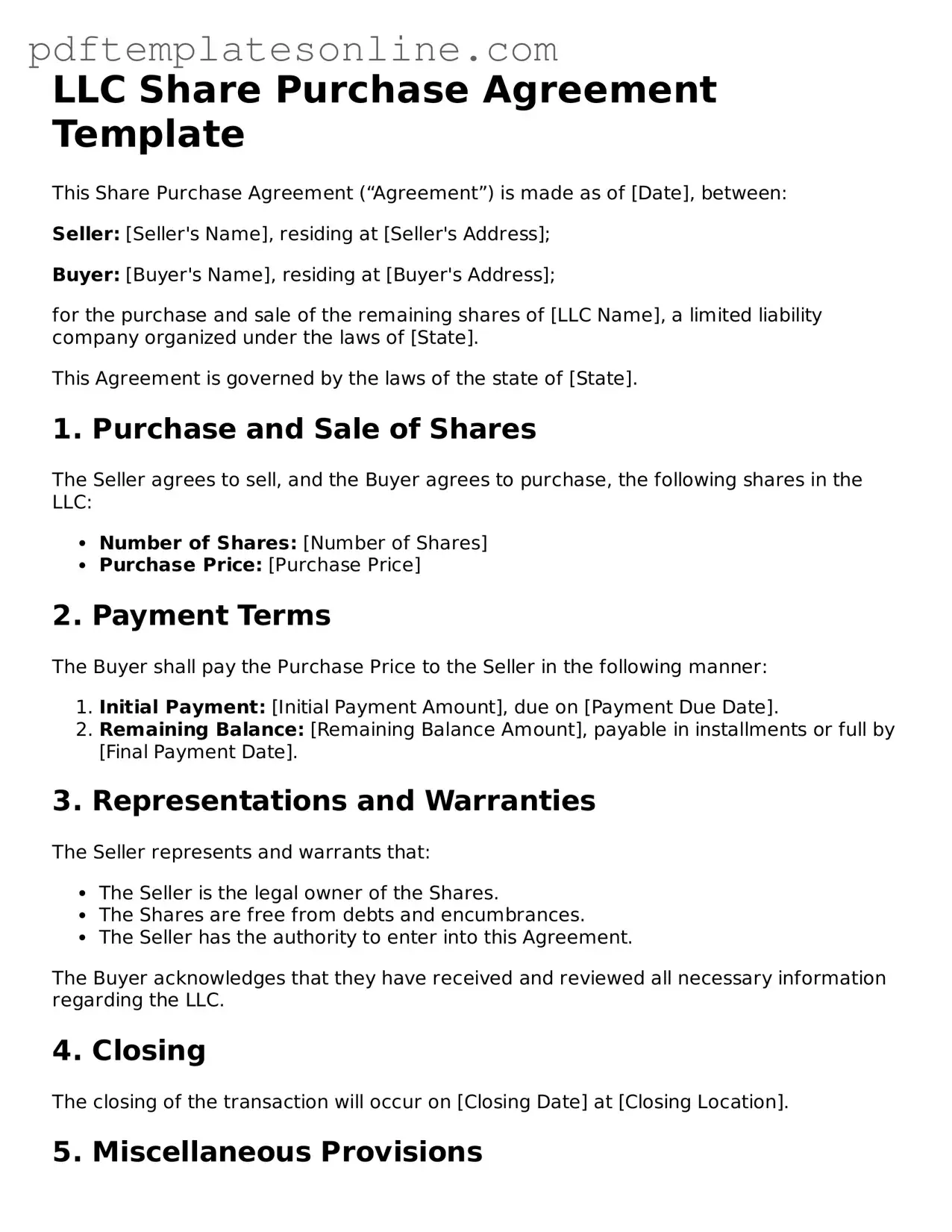

Detailed Guide for Writing LLC Share Purchase Agreement

Completing the LLC Share Purchase Agreement form is an important step in formalizing the purchase of shares in a limited liability company. This agreement outlines the terms of the transaction and protects the interests of both the buyer and the seller. Below are the steps you need to follow to accurately fill out the form.

- Begin by entering the date of the agreement at the top of the form. This date marks when the agreement becomes effective.

- Provide the full name and address of the seller. Ensure that all details are accurate to avoid any misunderstandings later.

- Next, fill in the buyer's full name and address. Like the seller's information, this must be precise.

- Specify the name of the LLC whose shares are being purchased. This should match the official name registered with the state.

- Indicate the total number of shares being sold. This figure should correspond to the shares agreed upon in the negotiation.

- List the purchase price for the shares. Clearly state the amount in numbers and words to eliminate any ambiguity.

- Include the payment method. Specify whether the payment will be made in cash, check, or another form of payment.

- Outline any conditions or contingencies that must be met before the sale is finalized. This may include approvals or inspections.

- Both parties should sign and date the agreement at the bottom of the form. Signatures confirm that both the buyer and seller agree to the terms outlined.

After completing these steps, review the agreement carefully to ensure all information is correct. It is advisable to keep a copy for your records and provide a copy to the other party involved in the transaction.