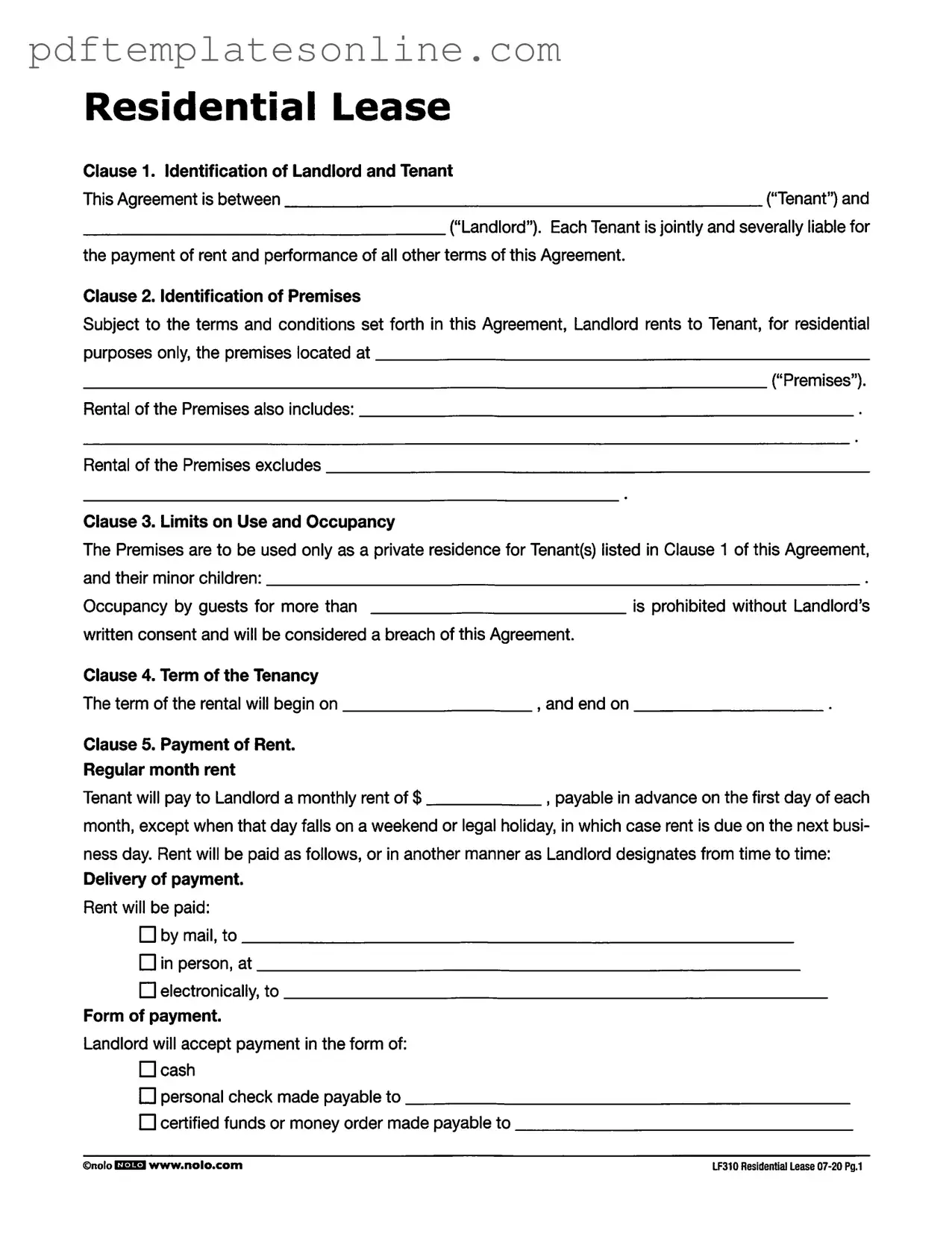

Blank Lf310 Residential Lease Form

Key takeaways

When filling out and using the LF310 Residential Lease form, it is essential to pay attention to several key aspects to ensure a smooth rental experience. Here are some important takeaways:

- Identification of Parties: Clearly identify both the landlord and tenant in Clause 1. Each tenant is responsible for the entire rent and obligations, so accuracy is crucial.

- Premises Description: Specify the exact location of the rental property in Clause 2. This helps avoid any confusion regarding the leased premises.

- Usage Restrictions: Understand that the premises are to be used solely as a private residence. Clause 3 outlines that unauthorized guests may lead to a breach of the agreement.

- Rent Payment Details: In Clause 5, note the payment amount, due date, and acceptable payment methods. Be aware of the prorated rent for the first month as well.

- Late Charges: Familiarize yourself with the late fee structure in Clause 6. Late payments incur charges, which can accumulate daily, emphasizing the importance of timely payments.

- Security Deposit Regulations: Clause 8 discusses the security deposit. Understand your rights regarding its return and the conditions under which deductions may occur.

By keeping these points in mind, both landlords and tenants can navigate the LF310 Residential Lease form more effectively, fostering a positive rental relationship.

Common mistakes

Filling out the Lf310 Residential Lease form is a crucial step in establishing a clear agreement between landlords and tenants. However, several common mistakes can lead to misunderstandings or legal issues. Awareness of these pitfalls can help ensure that the lease is completed accurately.

One frequent error is leaving the Identification of Landlord and Tenant section incomplete. This section requires the full names of both parties. Omitting this information can create ambiguity regarding who is responsible for fulfilling the terms of the lease. Each tenant is jointly and severally liable, meaning that all tenants are responsible for rent and obligations. Failure to identify all parties can complicate enforcement of the lease.

Another mistake involves the Identification of Premises clause. Tenants often forget to specify the complete address of the rental property. Without this critical information, it may be unclear which property is being rented, leading to disputes. Additionally, leaving out details about what is included or excluded in the rental agreement can create confusion regarding the rights and responsibilities of both parties.

In the Limits on Use and Occupancy section, tenants sometimes neglect to clarify who will occupy the premises. This clause is essential for defining occupancy limits and ensuring compliance with local regulations. If guests stay longer than allowed without written consent, it may be considered a breach of the lease. Properly identifying all occupants can prevent future conflicts.

The Payment of Rent clause also presents opportunities for error. Tenants may forget to specify the exact amount of rent or the due date. This oversight can lead to late payments and potential penalties. Moreover, not detailing the acceptable methods of payment can create confusion. Clearly stating how and when rent should be paid is essential for maintaining a good landlord-tenant relationship.

Additionally, many tenants overlook the importance of the Security Deposits clause. It is critical to specify the amount of the deposit and the conditions for its return. Tenants may mistakenly believe they can use the deposit for last month’s rent, which is typically not allowed without written consent from the landlord. Understanding these terms can help avoid disputes when the lease ends.

Another common mistake involves the Utilities section. Tenants sometimes fail to clarify which utilities they are responsible for and which will be covered by the landlord. This lack of clarity can lead to unexpected expenses and frustrations. Clearly outlining these responsibilities is vital for budgeting and ensuring a smooth living experience.

Finally, tenants often disregard the Prohibition of Assignment and Subletting clause. Many assume they can sublet the property without the landlord's consent. This misunderstanding can lead to serious consequences, including eviction. It is crucial to understand the restrictions on subletting to ensure compliance with the lease terms.

By being aware of these common mistakes, both landlords and tenants can work towards a more effective and harmonious leasing experience. Properly completing the Lf310 Residential Lease form is essential for protecting the rights and responsibilities of all parties involved.

Misconceptions

- Misconception 1: The Lf310 form allows tenants to use the premises for any purpose.

- Misconception 2: Tenants can apply their security deposit to the last month’s rent.

- Misconception 3: Rent payments can be made in any form the tenant chooses.

- Misconception 4: There are no consequences for late rent payments.

- Misconception 5: Tenants can have guests stay indefinitely without permission.

- Misconception 6: The landlord has no obligation to return the security deposit.

- Misconception 7: Tenants can sublet the premises at their discretion.

- Misconception 8: Utilities are always the responsibility of the landlord.

This is incorrect. The Lf310 form specifies that the premises are to be used only as a private residence for the tenant and their minor children. Any other use requires written consent from the landlord.

This is not true. The security deposit cannot be applied to the last month’s rent or any other dues without the landlord's prior written consent.

This is misleading. The Lf310 form outlines specific methods of payment that the landlord will accept, including cash, checks, and electronic transfers.

This is false. The form includes provisions for late charges if rent is not paid in full within a specified number of days after the due date.

This is incorrect. The lease specifies that occupancy by guests beyond a certain duration without written consent is a breach of the agreement.

This is not accurate. The landlord must return the security deposit within a specified timeframe after the tenant vacates, or provide an itemized statement of any deductions.

This is misleading. The Lf310 form prohibits subletting or assignment of the lease without the landlord's written consent.

This is not true. The form states that tenants are responsible for all utility charges, except for those specifically designated to be paid by the landlord.

Dos and Don'ts

When filling out the LF310 Residential Lease form, it's important to approach the task with care. Here are ten things to keep in mind:

- Do ensure that all names of tenants and the landlord are clearly printed and spelled correctly.

- Don't leave any sections blank. Every part of the form should be completed to avoid confusion later.

- Do specify the exact address of the premises being rented, including unit numbers if applicable.

- Don't use abbreviations or shorthand when filling out the form. Clarity is key.

- Do read through the entire lease agreement before signing to understand all terms and conditions.

- Don't assume that verbal agreements are valid. Everything should be documented in the lease.

- Do note the payment methods accepted for rent and ensure you understand the due dates.

- Don't forget to ask about the security deposit and how it will be handled after the tenancy ends.

- Do keep a copy of the completed lease for your records after it has been signed.

- Don't overlook the clauses regarding late charges and returned checks, as they can affect your finances.

Other PDF Forms

What Is a Form 8300 Used For? - The form needs to include the payer's name, address, and Social Security number or taxpayer identification number.

A well-prepared Prenuptial Agreement is essential for couples looking to solidify their financial understanding before marriage. It not only clarifies asset division and responsibilities but also offers peace of mind for both parties. For those seeking additional resources, the California PDF Forms provide an accessible way to create and customize their agreements.

Copy of Birth Certificate - The form may also ask for additional details, such as the delivery method and any complications during birth.

Detailed Guide for Writing Lf310 Residential Lease

Completing the LF310 Residential Lease form requires careful attention to detail. This form outlines the agreement between the landlord and tenant, ensuring both parties understand their rights and responsibilities. By following these steps, you can fill out the form accurately and confidently.

- Identify the Parties: Fill in the names of the Tenant(s) and Landlord in Clause 1. Ensure that all tenants are listed, as they are jointly responsible for the lease.

- Specify the Premises: In Clause 2, enter the address of the rental property. Include any additional details about what is included or excluded in the rental.

- Define Use and Occupancy: In Clause 3, specify the names of the tenants and any minor children who will reside in the property. Remember that occupancy by guests requires written consent from the landlord.

- Set the Term of Tenancy: In Clause 4, indicate the start date and end date of the rental period. This information is crucial for both parties.

- Detail Rent Payment: In Clause 5, write the monthly rent amount. Specify the payment method, such as by mail or electronically, and the due date. Include any late fees or charges for returned checks.

- Security Deposit: In Clause 8, indicate the amount of the security deposit to be paid upon signing the agreement. Be clear about the conditions for its return after the tenant vacates the premises.

- Utilities Responsibility: In Clause 9, list which utilities the tenant will be responsible for and which will be covered by the landlord.

- Restrictions on Subletting: In Clause 10, acknowledge that tenants cannot sublet or assign the lease without written consent from the landlord. This ensures clarity on occupancy rules.

Once you have filled out the LF310 Residential Lease form, review it carefully to ensure all information is accurate. Both the landlord and tenant should sign the document to finalize the agreement, establishing a clear understanding of the terms of the lease.