Blank Letter To Purchase Land Form

Key takeaways

When filling out and using the Letter To Purchase Land form, consider the following key takeaways:

- Clarity is Essential: Clearly outline the details of the buyer and seller, including contact information. This ensures effective communication throughout the process.

- Define the Property: Accurately describe the subject property, including its APN number. This avoids any confusion regarding the property being purchased.

- Set a Purchase Price: Clearly state the purchase price in both numerical and written form. This helps prevent misunderstandings about the financial terms.

- Establish a Feasibility Period: Specify a timeframe for conducting due diligence. This allows the buyer to investigate the property thoroughly before finalizing the purchase.

- Deposits Matter: Include details about initial and second deposits. Clarifying these terms helps both parties understand their financial commitments.

- Expiration of Offer: Indicate a clear expiration date for the offer. This sets a timeline for both parties to act and ensures that the agreement remains valid for a limited period.

Common mistakes

Filling out a Letter to Purchase Land form can be a straightforward process, but there are common mistakes that individuals often make. Understanding these errors can help ensure that the form is completed accurately and effectively.

One frequent mistake is failing to provide complete contact information for both the buyer and seller. This section is crucial for communication during the negotiation process. Missing or incorrect details can lead to delays and misunderstandings. It is essential to double-check that all names, addresses, and phone numbers are accurate and up to date.

Another common error is neglecting to specify the subject property clearly. The form requires a detailed description, including the property’s APN number. Omitting this information can create confusion and may even invalidate the offer. Buyers should take care to include all relevant details about the property to avoid complications later.

Additionally, many people overlook the importance of clearly stating the purchase price. This figure should be clearly written in both numerical and written form. Ambiguities in the purchase price can lead to disputes and may hinder the negotiation process. Buyers must ensure that this information is precise and unambiguous.

Another mistake involves misunderstanding the feasibility period. Buyers often fail to recognize the significance of this timeframe for conducting due diligence. Not specifying a clear deadline can result in rushed decisions or missed opportunities. It is crucial to define this period clearly to allow adequate time for evaluation.

Lastly, individuals sometimes forget to sign and date the form. This step is vital as it indicates agreement to the terms outlined in the letter. Without signatures, the document lacks authenticity and may not be considered valid. Always ensure that both parties have signed and dated the form before submitting it.

Misconceptions

Understanding the Letter To Purchase Land form is essential for both buyers and sellers in a real estate transaction. However, several misconceptions can lead to confusion. Below is a list of common misconceptions along with explanations.

- This letter is a binding contract. The Letter To Purchase Land is not a binding contract. It serves as a preliminary document outlining the intentions of the parties involved. A formal Purchase Agreement must be executed for the transaction to be legally binding.

- All terms are negotiable after the letter is signed. While some terms may be negotiable, the letter establishes a framework for negotiations. Changes to terms may require further discussions and mutual agreement.

- The buyer can back out without consequences. The buyer may terminate the letter during the feasibility period, but this must be done in writing. The initial deposit may be refundable, but the terms regarding deposits should be carefully reviewed.

- There is no deadline for negotiations. The letter specifies a Contract Negotiation Period, after which the offer automatically expires if not accepted. Timeliness is crucial in real estate transactions.

- All deposits are non-refundable. The letter outlines both an initial refundable deposit and a second non-refundable deposit. Understanding the conditions attached to each is important.

- The seller can continue to solicit other offers. During the Contract Negotiation Period, the seller is prohibited from soliciting other offers. This exclusivity is intended to facilitate negotiations.

- The feasibility period is unlimited. The letter specifies a defined feasibility period during which the buyer can conduct due diligence. After this period, the buyer's obligation to close escrow is contingent on specific conditions.

- The letter guarantees a clear title. While the letter outlines conditions for title insurance, it does not guarantee a clear title. The buyer must verify this through the title company.

- All communication can be verbal. Written communication is required for any terminations or notifications regarding the letter. Keeping records of all correspondence is essential for clarity and legal purposes.

Addressing these misconceptions can help facilitate smoother transactions and ensure that all parties understand their rights and responsibilities throughout the process.

Dos and Don'ts

When filling out the Letter to Purchase Land form, it's important to be thorough and accurate. Here’s a list of things you should and shouldn't do:

- Do clearly state the date at the top of the letter.

- Do provide complete contact information for both the buyer and seller.

- Do specify the property description, including the APN number.

- Do outline the purchase price clearly and accurately.

- Do include any specific items that are part of the sale.

- Don't leave any sections blank; all fields should be completed.

- Don't use vague terms; be specific about terms and conditions.

- Don't forget to mention the feasibility period for due diligence.

- Don't overlook the importance of signatures and dates from both parties.

Other PDF Forms

Pest Control Contracts - Initial service charges and payment plans are transparently outlined in the agreement.

What Is a Ub-04 Form - Your insurance company information should be filled out completely.

To facilitate the necessary legal processes, the important Affidavit of Death document is required for confirming the passing of an estate holder, ensuring a smooth transition of assets to beneficiaries.

House Load Calculation - The form provides a structured approach to evaluate the electrical demands of your project.

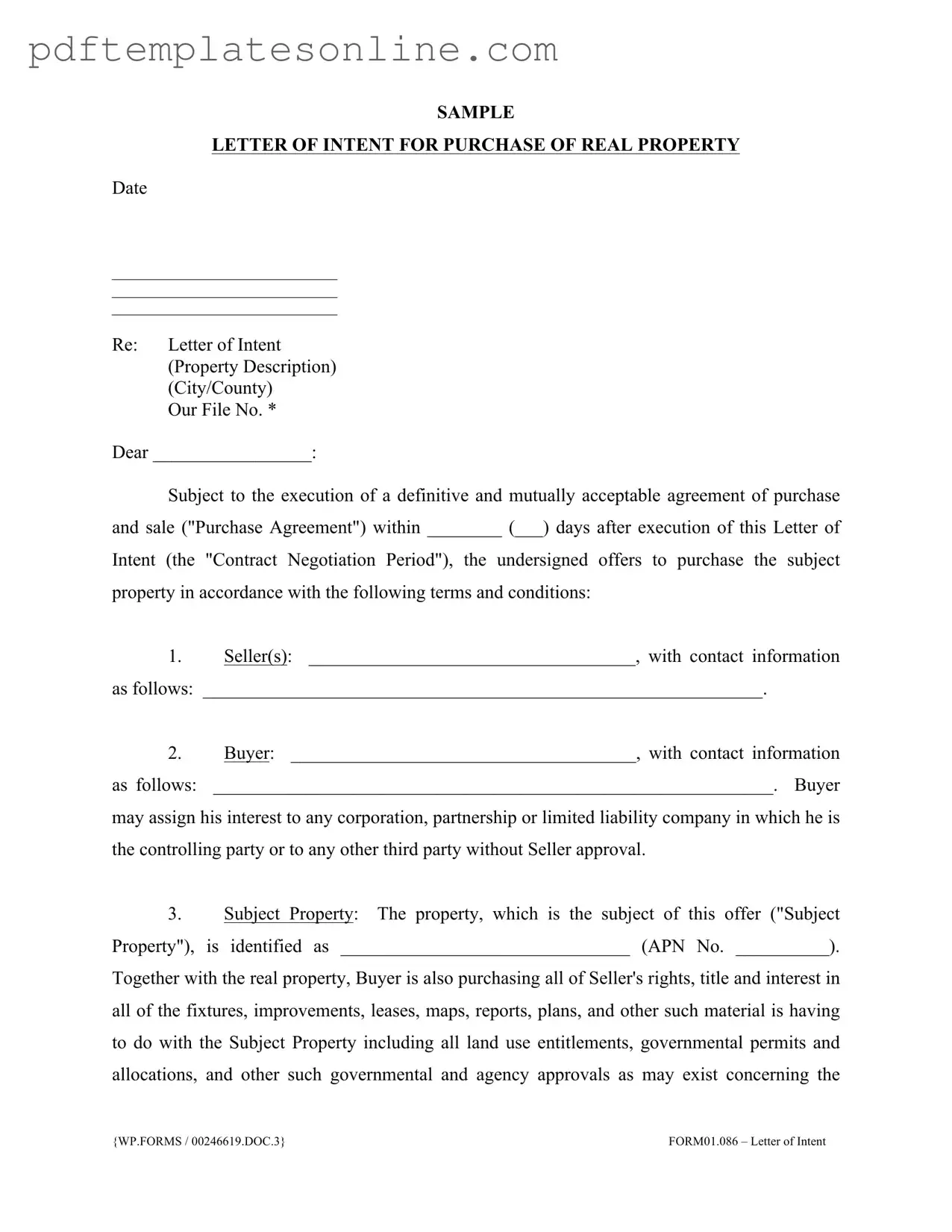

Detailed Guide for Writing Letter To Purchase Land

Filling out the Letter to Purchase Land form is a crucial step in initiating a real estate transaction. It serves as a preliminary agreement that outlines the basic terms and conditions of the proposed purchase. Once completed, this letter will set the stage for further negotiations and the eventual drafting of a formal purchase agreement.

- Date: Write the current date at the top of the form.

- Property Description: Fill in the specific details of the property you wish to purchase, including the city or county.

- Recipient Name: Address the letter to the seller by writing their name in the designated space.

- Seller Information: Provide the seller's name and contact information, including phone number and email address.

- Buyer Information: Write your name and contact information in the appropriate section.

- Subject Property: Clearly identify the property by including its address and APN (Assessor's Parcel Number).

- Purchase Price: State the proposed purchase price in both words and numbers.

- Terms of Purchase: Describe any specific terms related to the purchase, such as financing or contingencies.

- Opening of Escrow: Specify the title company where escrow will be opened and the time frame for this action.

- Deposit Toward Purchase Price: Indicate the amounts for both the initial and second deposits, along with any conditions related to these deposits.

- Feasibility Period: Define the time frame you will need to conduct due diligence on the property.

- Buyer's Condition Precedent to Closing: List any conditions that must be met before closing, such as title insurance and absence of liens.

- Close of Escrow: Specify the anticipated closing date.

- Other Provisions: Mention any additional terms that may be relevant to the purchase agreement.

- Expiration of Offer: Indicate the date when this letter will expire if not executed by the seller.

- Signatures: Both the buyer and seller should sign and date the letter to indicate their agreement with the terms outlined.