Fillable Letter of Intent to Purchase Business Document

Key takeaways

When considering the purchase of a business, a Letter of Intent (LOI) serves as an important first step. Here are some key takeaways to keep in mind when filling out and using this form:

- Clarity is Key: Clearly outline your intentions in the LOI. Specify what you are purchasing and any conditions that must be met.

- Include Essential Details: Ensure that the LOI includes the purchase price, payment terms, and any contingencies that may apply.

- Be Professional: Use a formal tone and structure. This document sets the stage for future negotiations.

- Outline Confidentiality: If sensitive information will be shared, include a confidentiality clause to protect both parties.

- Timeline Matters: Establish a timeline for due diligence and closing the deal. This helps keep everyone on track.

- Non-Binding Nature: Remember that an LOI is typically non-binding. This means that it expresses intent but does not create a legal obligation to complete the sale.

- Consult Professionals: Before finalizing the LOI, consider consulting with legal and financial advisors to ensure all bases are covered.

- Review and Revise: Take the time to review the document thoroughly. Revise any sections that may need clarification or adjustment.

By following these guidelines, you can create a Letter of Intent that effectively communicates your interest and lays the groundwork for a successful business purchase.

Common mistakes

Filling out a Letter of Intent to Purchase Business form is a crucial step in the process of acquiring a business. However, many individuals make common mistakes that can lead to complications later on. One frequent error is failing to include all necessary details about the business being purchased. Omitting key information, such as the business name, address, or specific assets involved, can create confusion and hinder negotiations.

Another common mistake is not clearly defining the terms of the offer. It is essential to outline the purchase price, payment terms, and any contingencies. If these terms are vague or incomplete, it may lead to misunderstandings between the buyer and seller. Both parties should have a clear understanding of what is being proposed.

Additionally, some individuals neglect to specify the timeline for the transaction. A lack of a defined timeline can result in delays or misaligned expectations. Establishing a clear timeframe helps keep the process on track and ensures that both parties are aware of important deadlines.

Many also overlook the importance of including a confidentiality clause. This clause protects sensitive information about the business from being disclosed to outside parties. Without it, proprietary information may be at risk, which could undermine the business’s value and competitive advantage.

Finally, not seeking professional advice can be a significant oversight. Engaging with a legal expert or a business advisor can provide valuable insights and help avoid costly mistakes. Professional guidance ensures that the Letter of Intent is comprehensive and legally sound, paving the way for a smoother transaction.

Misconceptions

The Letter of Intent to Purchase Business form is often misunderstood. Below are ten common misconceptions about this document, along with explanations to clarify each point.

-

It is a legally binding contract.

Many believe that a letter of intent (LOI) is a binding contract. In reality, an LOI typically outlines the intentions of the parties involved but does not create enforceable obligations unless specifically stated.

-

It must be signed to be effective.

Some assume that a signature is necessary for an LOI to hold weight. However, an unsigned LOI can still serve as a preliminary agreement, depending on the context and the parties' actions.

-

It guarantees the sale will go through.

Individuals may think that an LOI guarantees a business sale. In fact, it simply indicates interest and outlines terms for further negotiations, leaving room for potential changes or withdrawal.

-

All terms must be finalized in the LOI.

Some believe that every detail must be settled in the LOI. While it can include key terms, it is often used as a framework for ongoing discussions and negotiations.

-

It is only necessary for large transactions.

There is a misconception that LOIs are only relevant for high-value purchases. In reality, they can be beneficial for transactions of any size, providing clarity and direction for both parties.

-

It replaces the need for a formal purchase agreement.

Many think an LOI can substitute for a formal purchase agreement. However, a comprehensive purchase agreement is usually required to finalize the transaction and address all legal obligations.

-

It is a standard form that does not require customization.

Some individuals assume that LOIs are one-size-fits-all documents. In truth, each LOI should be tailored to reflect the specific circumstances and intentions of the parties involved.

-

It is only for buyers.

There is a belief that only buyers use LOIs. However, sellers also utilize them to outline their terms and expectations, making it a tool for both parties in the negotiation process.

-

It is unnecessary if both parties are familiar.

Some may think that an LOI is not needed if both parties have a good relationship. Nevertheless, having a written document helps clarify intentions and reduces the risk of misunderstandings.

-

It is irrelevant in negotiations.

Lastly, some believe that an LOI does not play a significant role in negotiations. In fact, it can serve as a valuable reference point, helping to guide discussions and ensuring both parties remain aligned.

Dos and Don'ts

When filling out the Letter of Intent to Purchase Business form, it is important to follow certain guidelines to ensure clarity and effectiveness. Here are six key dos and don'ts:

- Do provide accurate and complete information about your identity and the business you intend to purchase.

- Do clearly outline the terms of the purchase, including price and payment structure.

- Do include a timeline for the transaction, specifying any deadlines for due diligence or closing.

- Do state any contingencies that must be met before the purchase can proceed.

- Don't use vague language that could lead to misunderstandings about the terms.

- Don't forget to review the document for errors or omissions before submitting it.

Following these guidelines can help facilitate a smoother transaction process and establish clear expectations for both parties involved.

Browse Common Types of Letter of Intent to Purchase Business Templates

Intention to Marry Within 90 Days of Entry - The letter can also serve as a personal record of the couple’s commitment to each other.

Filing the California Homeschool Letter of Intent form is critical for parents who wish to begin homeschooling, as it lays the groundwork for a compliant educational program. To facilitate this process and ensure that all necessary steps are followed appropriately, resources such as Documents PDF Online can provide valuable assistance and information.

Detailed Guide for Writing Letter of Intent to Purchase Business

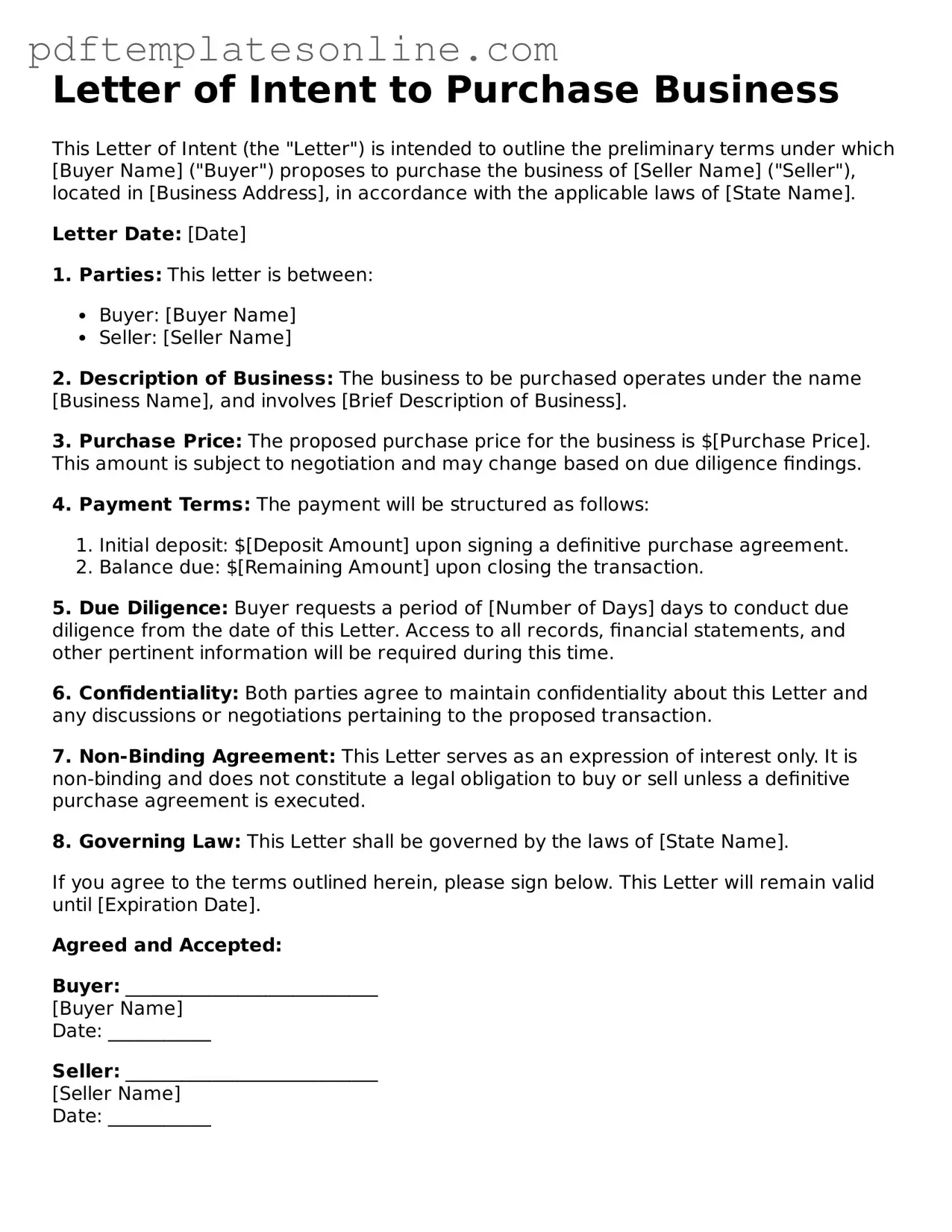

After gathering the necessary information, you are ready to fill out the Letter of Intent to Purchase Business form. This document outlines the intentions of the buyer and seller regarding the purchase of a business. Completing the form accurately is essential for moving forward in the transaction process.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the buyer and the seller.

- Clearly state the name of the business being purchased.

- Specify the purchase price and any terms of payment.

- Include any contingencies that must be met before the sale is finalized.

- Detail the timeline for completing the transaction.

- Sign and date the form at the bottom, ensuring both parties have their signatures.