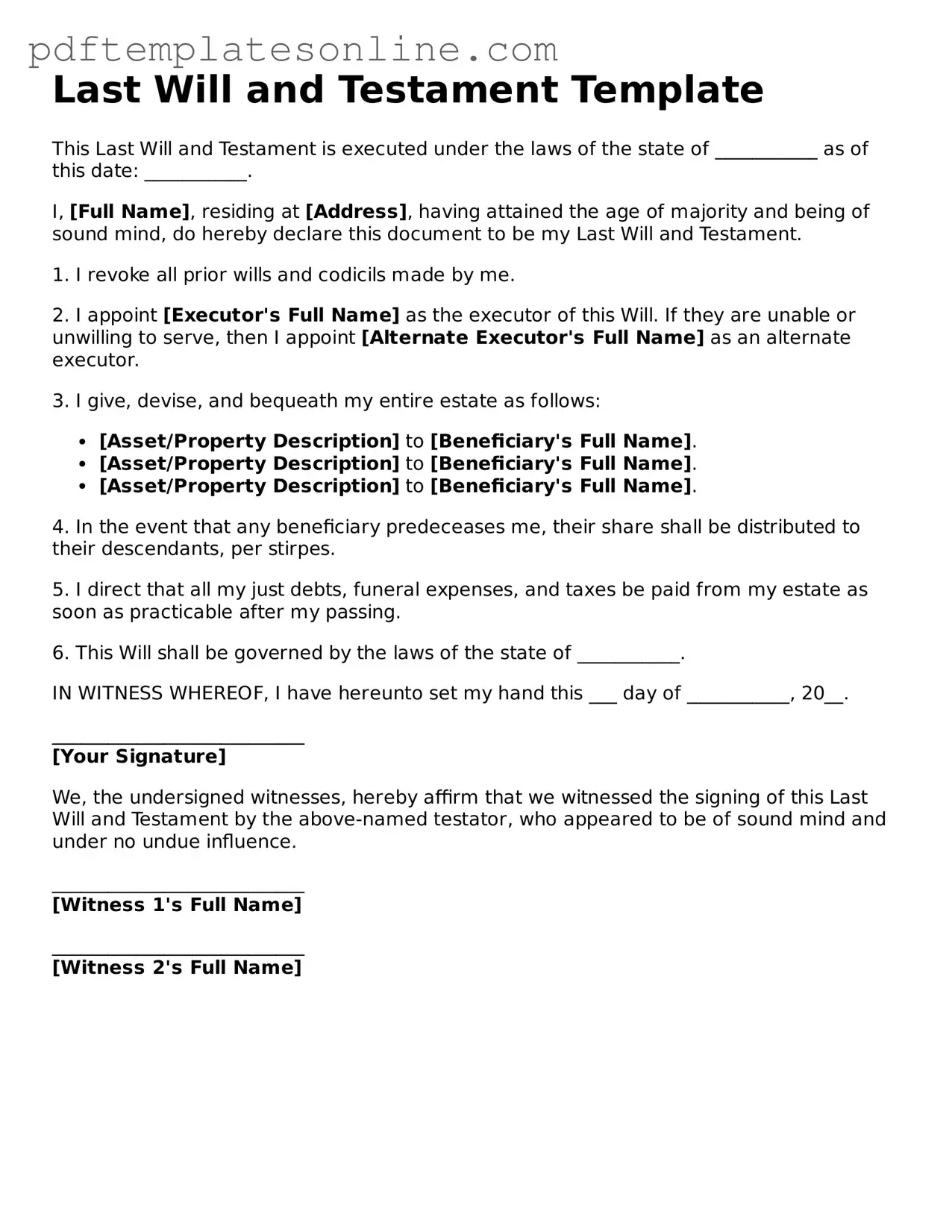

Fillable Last Will and Testament Document

Key takeaways

Creating a Last Will and Testament is an important step in ensuring your wishes are honored after your passing. Here are some key takeaways to consider when filling out and using this form:

- Understand the Purpose: A Last Will and Testament outlines how you want your assets distributed and who will care for any minor children.

- Choose an Executor: Select a trusted individual to manage your estate and ensure your wishes are carried out. This person is often referred to as the executor.

- Be Clear and Specific: Clearly describe your assets and how you wish to distribute them. Ambiguities can lead to disputes among heirs.

- Consider Witnesses: Most states require that your will be signed in the presence of witnesses. Ensure they are not beneficiaries to avoid conflicts of interest.

- Review State Laws: Wills are governed by state laws, which can vary significantly. Familiarize yourself with the requirements in your state.

- Update Regularly: Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your will. Regular reviews are advisable.

- Sign and Date: Your will must be signed and dated to be considered valid. This step cannot be overlooked.

- Store Safely: Keep your will in a safe place, such as a safe deposit box or with a trusted attorney. Ensure your executor knows where to find it.

- Communicate Your Wishes: Discuss your plans with family members to prevent misunderstandings and ensure everyone is aware of your intentions.

- Consider Professional Help: If your estate is complex or if you have significant assets, consulting with an estate planning attorney can provide valuable guidance.

By taking these steps, you can create a Last Will and Testament that reflects your wishes and provides peace of mind for you and your loved ones.

Last Will and Testament Forms for Particular States

Common mistakes

Filling out a Last Will and Testament form is an important task that ensures your wishes are honored after your passing. However, many individuals make mistakes that can lead to complications. One common error is failing to properly identify the beneficiaries. It's essential to provide full names and, if possible, addresses to avoid any confusion later.

Another mistake is not updating the will after major life events. Changes such as marriage, divorce, or the birth of a child can significantly impact your wishes. Neglecting to revise the document can result in unintended distributions of your assets.

Some people overlook the requirement for witnesses. Most states require at least two witnesses to sign the will. If this step is skipped, the will may be deemed invalid, leading to potential disputes among heirs.

Additionally, individuals sometimes forget to date the document. A missing date can create ambiguity about the will's validity, especially if multiple versions exist. Always ensure the date is clearly marked to establish the most current intentions.

Another common oversight is using unclear language. Ambiguities can lead to misinterpretations and conflicts among beneficiaries. It's crucial to be as specific as possible regarding asset distribution to minimize confusion.

People may also fail to consider the executor's role. Choosing someone who is not trustworthy or who lacks the ability to manage the estate can create issues. Selecting a responsible executor is vital for ensuring your wishes are carried out effectively.

Lastly, neglecting to store the will in a safe yet accessible location can be detrimental. If the will cannot be found after your passing, your assets may be distributed according to state laws rather than your wishes. Ensure that your loved ones know where to locate the document when needed.

Misconceptions

Understanding the Last Will and Testament is crucial for ensuring that one's wishes are honored after passing. However, several misconceptions can cloud this important document. Here are five common misunderstandings:

-

My will only needs to be written once. Many people believe that once they create a will, it remains valid indefinitely. In reality, significant life changes—such as marriage, divorce, or the birth of a child—may necessitate updates to the will to reflect new circumstances.

-

Having a will avoids probate entirely. While a will is essential for outlining how assets should be distributed, it does not prevent the probate process. Probate is the legal procedure through which a will is validated, and it can be time-consuming and costly.

-

Only wealthy individuals need a will. This misconception overlooks the fact that everyone can benefit from having a will. It allows individuals to dictate how their possessions, regardless of value, should be handled after their death, ensuring that their wishes are respected.

-

A handwritten will is always valid. While some states recognize handwritten wills, known as holographic wills, they may not always meet legal requirements. It is advisable to consult local laws and consider formalizing the document with proper legal assistance.

-

Once I create a will, I don’t need to think about it again. This belief can lead to outdated documents that no longer reflect a person's wishes. Regularly reviewing and updating a will is important to ensure that it aligns with current intentions and circumstances.

By addressing these misconceptions, individuals can take informed steps toward creating a will that truly reflects their wishes and provides peace of mind for their loved ones.

Last Will and Testament Categories

Dos and Don'ts

When filling out the Last Will and Testament form, it is important to follow certain guidelines to ensure that your document is valid and reflects your wishes. Below is a list of things to do and avoid.

- Do clearly state your full name and address at the beginning of the document.

- Do specify the date on which the will is being created.

- Do appoint an executor who will carry out your wishes after your passing.

- Do list all beneficiaries and clearly define what each person will receive.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to sign the document in the presence of witnesses, if required by your state.

- Don't make changes to the will without following proper procedures, such as creating a codicil.

Check out Popular Documents

Reg 135 - Acts as a legal safeguard for both parties involved.

Hunting Liability Waiver Template - Signing without understanding the provisions could lead to forfeiting important legal protections.

Detailed Guide for Writing Last Will and Testament

After gathering all necessary information, you are ready to fill out the Last Will and Testament form. This document will help ensure your wishes are followed regarding the distribution of your assets after your passing. Follow these steps carefully to complete the form accurately.

- Title the document: At the top of the page, write "Last Will and Testament." This clearly identifies the purpose of the document.

- Identify yourself: Include your full name, address, and date of birth. This establishes your identity as the testator.

- Declare your capacity: State that you are of sound mind and at least 18 years old. This confirms your legal ability to create a will.

- Appoint an executor: Choose a trusted person to carry out your wishes. Write their full name and contact information.

- List your beneficiaries: Clearly name the individuals or organizations that will inherit your assets. Include their full names and relationships to you.

- Detail your assets: Provide a clear description of your property and assets. Be specific about what each beneficiary will receive.

- Include guardianship provisions: If you have minor children, designate a guardian for them. Include the guardian's full name and relationship to the children.

- Sign and date the document: At the end of the form, sign your name and write the date. This is crucial for the validity of the will.

- Witness requirements: Check your state’s laws for witness requirements. Generally, you will need two witnesses to sign the document in your presence.

- Store the will safely: Keep the completed will in a secure place, such as a safe or with your attorney. Inform your executor of its location.