Fillable Lady Bird Deed Document

Key takeaways

The Lady Bird Deed is a powerful estate planning tool that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. Here are some key takeaways to consider when filling out and using the Lady Bird Deed form:

- Retain Control: The property owner retains the right to live in, sell, or change the property at any time, even after the deed is executed.

- Automatic Transfer: Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

- Tax Benefits: Beneficiaries may receive a step-up in basis for tax purposes, which can reduce capital gains taxes if they sell the property later.

- Simple Process: Filling out the form is generally straightforward, but it’s crucial to ensure all details are accurate to avoid complications.

- State-Specific Rules: The Lady Bird Deed is not recognized in every state, so it’s important to confirm its validity in your state of residence.

- Revocable: The deed can be revoked or modified at any time before the owner’s death, providing flexibility in estate planning.

- Consultation Recommended: While the form is accessible, consulting with an estate planning attorney can help clarify any complexities and ensure it meets your needs.

Lady Bird Deed Forms for Particular States

Common mistakes

When individuals prepare a Lady Bird Deed, they often encounter several common pitfalls that can lead to complications in the future. One frequent mistake is failing to provide accurate property descriptions. A precise legal description is essential for ensuring that the property is correctly identified. If the description is vague or incorrect, it may result in disputes or challenges to the deed’s validity.

Another common error involves not including all intended beneficiaries. People may assume that their heirs know they are included in the deed, but without explicit mention, this can lead to confusion or unintended exclusions. It is crucial to list all beneficiaries clearly to avoid potential conflicts after the grantor's passing.

Some individuals neglect to consider the implications of retaining a life estate. While a Lady Bird Deed allows for the grantor to retain control over the property during their lifetime, misunderstandings about this arrangement can lead to issues. For example, if the grantor sells the property without informing the beneficiaries, it can create legal complications.

Inadequate notarization is another mistake that can invalidate the deed. Many people forget that the Lady Bird Deed must be signed in the presence of a notary public. Without proper notarization, the document may not hold up in court, which defeats the purpose of the deed.

People also often overlook the importance of recording the deed with the appropriate local authority. Even if the deed is properly executed, failing to file it can mean that it is not legally recognized. Recording the deed ensures that it is part of the public record and protects the beneficiaries' interests.

Moreover, individuals sometimes do not account for tax implications. A Lady Bird Deed can have different tax consequences than a traditional transfer of property. Consulting with a tax professional can help clarify any potential liabilities or benefits associated with the deed.

Another mistake is misunderstanding the impact of Medicaid eligibility. While a Lady Bird Deed can help protect assets from Medicaid recovery, it is essential to understand how it interacts with Medicaid rules. Missteps in this area can lead to unintended financial consequences.

Finally, individuals may fail to update the deed after significant life changes. Events such as marriage, divorce, or the birth of a child can affect the intended distribution of property. Regularly reviewing and updating the deed ensures that it reflects the grantor’s current wishes and circumstances.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a useful estate planning tool, but several misconceptions can lead to confusion. Here are ten common misunderstandings about this form:

- It avoids probate entirely. While a Lady Bird Deed can help transfer property outside of probate, it does not eliminate the need for probate in all situations, especially if other assets are involved.

- It is only for married couples. Many believe that this deed is exclusively for married couples, but it can be used by individuals or any combination of owners.

- It cannot be revoked. Some think that once a Lady Bird Deed is executed, it cannot be changed. In reality, the grantor retains the right to revoke or modify the deed at any time during their lifetime.

- It protects against creditors. There is a misconception that this deed provides complete protection from creditors. However, the property may still be subject to claims, depending on the circumstances.

- It automatically transfers all property rights. A common belief is that the deed transfers all rights immediately. In fact, the grantor retains full control and rights to the property during their lifetime.

- It is only useful for real estate. While primarily associated with real property, the principles behind a Lady Bird Deed can also apply to other types of assets in some cases.

- It is a one-size-fits-all solution. Many assume that this deed is suitable for every situation. Each individual’s circumstances are unique, and it is essential to consider specific needs and goals.

- All states recognize Lady Bird Deeds. There is a misconception that this form is valid in all states. In reality, the acceptance and rules surrounding Lady Bird Deeds vary by state.

- It does not affect Medicaid eligibility. Some believe that using a Lady Bird Deed will not impact Medicaid eligibility. However, transferring property can have implications for Medicaid planning.

- It is a simple form that requires no legal advice. While the form may seem straightforward, it is advisable to consult with a legal professional to ensure it meets your specific needs and complies with state laws.

Understanding these misconceptions can help individuals make informed decisions about their estate planning needs. Always consider seeking guidance to navigate these complexities effectively.

Dos and Don'ts

When filling out a Lady Bird Deed form, it is essential to approach the task with care and attention. Here are some important dos and don'ts to consider:

- Do ensure that you have all necessary information ready, including the names of the grantor and grantee.

- Do clearly describe the property being transferred, including its legal description.

- Do consult with a legal professional if you have any questions or uncertainties about the process.

- Do keep a copy of the completed form for your records after filing.

- Don't rush through the form; take your time to avoid mistakes that could lead to complications.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't forget to sign the form in the presence of a notary public, as this is a crucial step.

- Don't assume that a verbal agreement is sufficient; written documentation is necessary for legal validity.

Browse Common Types of Lady Bird Deed Templates

Iowa Quit Claim Deed - There is no warranty from the grantor regarding the ownership claims of the property.

For those seeking to draft a formalized agreement, a California Promissory Note form is essential, as it lays out the terms under which the borrower agrees to repay the lender. Details such as the financial sum, interest rates, and repayment schedules are integral to this document. By utilizing resources like California PDF Forms, individuals can create a tailored promissory note that meets their specific lending needs, ensuring a clear and enforceable understanding between both parties.

Deed in Lieu Meaning - The Deed in Lieu may not erase all homeowner obligations; additional liens might still require resolution after the deed transfer.

Detailed Guide for Writing Lady Bird Deed

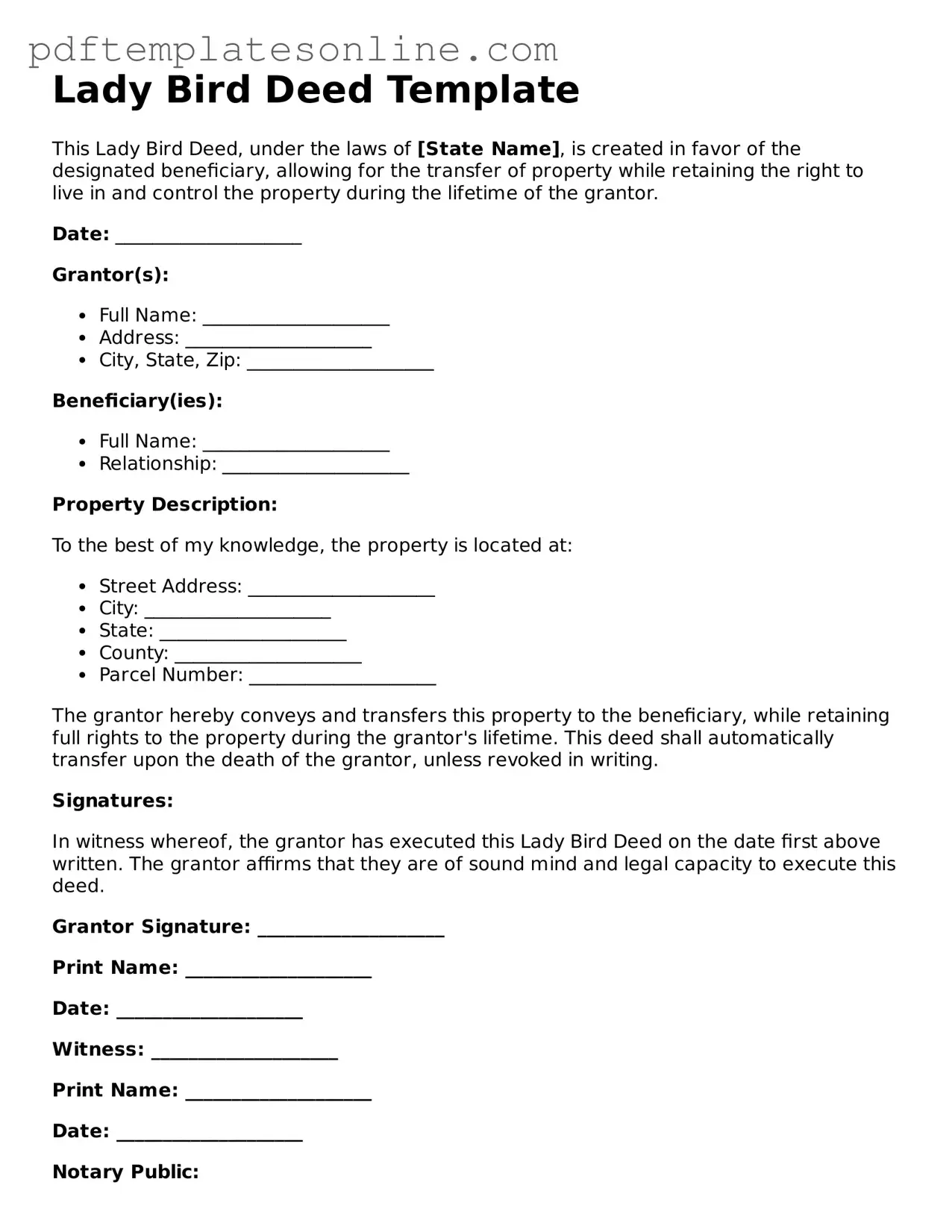

Completing a Lady Bird Deed form requires careful attention to detail. This document serves a specific purpose in estate planning, allowing property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. Following the steps outlined below will help ensure that the form is filled out accurately and effectively.

- Begin by gathering all necessary information, including the property address and the names of the current property owners.

- Clearly write the name of the current owner(s) at the top of the form. Ensure that names are spelled correctly and match the titles on the property deed.

- Next, provide the full address of the property being transferred. This should include the street address, city, state, and zip code.

- Identify the beneficiaries who will receive the property upon the owner's passing. List their full names and relationship to the owner.

- In the section regarding retained rights, indicate that the current owner retains the right to live in and use the property for the duration of their life. This may be stated in a specific clause on the form.

- Include any additional instructions or conditions for the beneficiaries, if applicable. Be clear and concise to avoid confusion later on.

- Review the completed form for accuracy. Check that all names, addresses, and details are correct and that there are no omissions.

- Once confirmed, sign and date the form in the designated areas. If there are multiple owners, ensure that all necessary signatures are included.

- Finally, have the form notarized. This step adds a layer of authenticity and may be required for the deed to be legally recognized.