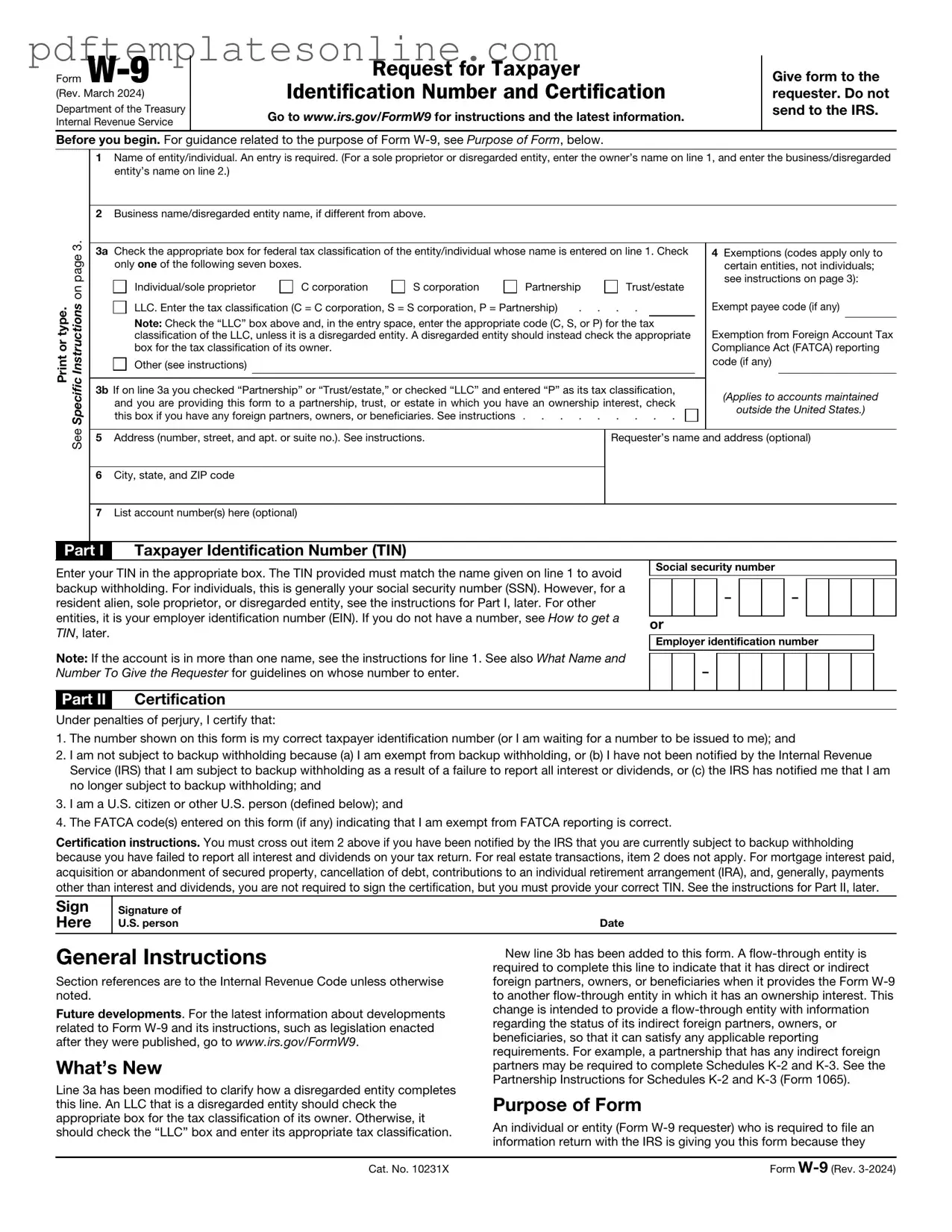

Blank IRS W-9 Form

Key takeaways

When filling out and using the IRS W-9 form, it is important to understand its purpose and requirements. Here are some key takeaways:

- The W-9 form is used to provide your taxpayer identification number (TIN) to a requester, typically for tax reporting purposes.

- Ensure that the information provided is accurate and matches the name on your tax return to avoid issues with the IRS.

- The form must be signed and dated to certify that the information is correct and that you are not subject to backup withholding.

- Keep a copy of the completed W-9 for your records, as it may be needed for future reference or tax filing.

- Submit the W-9 directly to the requester, not to the IRS, to comply with privacy and security guidelines.

Common mistakes

Filling out the IRS W-9 form can seem straightforward, but many people make common mistakes that can lead to delays or issues with tax reporting. One frequent error is providing incorrect personal information. Individuals often miswrite their names or use nicknames instead of their legal names. This can create confusion and may result in the IRS not being able to match the information with the correct taxpayer.

Another mistake occurs when individuals fail to check the appropriate box for their tax classification. The W-9 form requires filers to indicate whether they are an individual, corporation, partnership, or another type of entity. Neglecting to select the correct classification can lead to improper tax withholding and reporting, which can complicate matters down the line.

Many people also overlook the importance of including a valid Social Security Number (SSN) or Employer Identification Number (EIN). Providing an invalid number can result in the payer being unable to report payments correctly to the IRS. This mistake can lead to tax complications for both the payer and the individual filling out the form.

Signature errors are another common issue. Some filers forget to sign the form or fail to date it. Without a signature, the W-9 is not considered valid. A missing date can also cause confusion regarding when the form was completed, which may be important for tax purposes.

Additionally, individuals sometimes submit the W-9 form without reviewing it for accuracy. Double-checking the information helps catch any mistakes before submission. A small error can lead to significant issues, so taking a moment to review the form can save time and trouble later.

People also often fail to provide the correct mailing address. This can lead to important tax documents being sent to the wrong location. Ensuring that the address is accurate and up-to-date is crucial for receiving any necessary correspondence from the IRS or other tax authorities.

Lastly, some filers may not realize that the W-9 form should be submitted to the requester, not the IRS. Confusion about where to send the form can lead to unnecessary delays. Understanding the proper procedure for submitting the W-9 can help streamline the process and ensure that everything is handled correctly.

Misconceptions

The IRS W-9 form is a crucial document for individuals and businesses alike, yet several misconceptions surround its purpose and usage. Understanding these misconceptions can help ensure compliance and proper handling of tax-related matters.

- The W-9 is only for freelancers and independent contractors. Many believe that the W-9 form is exclusively for freelancers. In reality, it can be used by any individual or entity that receives income, including corporations and partnerships.

- Filling out a W-9 means I will be audited. Some people worry that submitting a W-9 will trigger an audit. This is not true; the form is simply a request for taxpayer information and does not inherently lead to increased scrutiny from the IRS.

- I only need to submit a W-9 once. It's a common belief that a W-9 form is a one-time requirement. However, if your information changes, such as your name or tax identification number, you must submit a new W-9 to the requester.

- The W-9 form is the same as a tax return. Some individuals confuse the W-9 with their tax return. The W-9 is not a tax return; it merely provides information to the requester for reporting purposes.

- I can ignore requests for a W-9. Ignoring a request for a W-9 can have consequences. If you do not provide the requested information, the payer may withhold taxes from your payments at a higher rate.

- The W-9 is only for U.S. citizens. While the W-9 is primarily used by U.S. citizens, certain non-resident aliens and foreign entities may also need to fill out a W-9 if they are engaged in a trade or business in the U.S.

- Once I submit a W-9, my information is public. There is a misconception that submitting a W-9 exposes your personal information to the public. In reality, the information is kept confidential by the requester and is used solely for tax reporting purposes.

By dispelling these misconceptions, individuals and businesses can navigate the complexities of tax compliance with greater confidence and clarity.

Dos and Don'ts

When filling out the IRS W-9 form, it's important to ensure accuracy and compliance. Here are some key dos and don'ts to keep in mind:

- Do provide your correct name as it appears on your tax return.

- Do include your Social Security Number (SSN) or Employer Identification Number (EIN) accurately.

- Do check the box that applies to your tax classification, such as individual, corporation, or partnership.

- Do sign and date the form to certify that the information provided is true.

- Don't leave any required fields blank, as this may delay processing.

- Don't use a name that is different from what is on your tax return.

- Don't forget to update the form if your information changes in the future.

- Don't submit the W-9 form to the IRS; instead, provide it to the requester.

Other PDF Forms

Hunter Permission - It helps ensure that all parties are on the same page regarding expectations.

Ca Divorce Forms - Legal counsel can provide valuable insights on correctly completing the Application For Divorce.

Aoa Transfer Form - The box for capturing various appliance types helps outline current orthodontic methods used.

Detailed Guide for Writing IRS W-9

Once you have the IRS W-9 form in front of you, it’s time to fill it out accurately. This form is essential for providing your taxpayer information to the requester, often for purposes like reporting income. Follow these steps to complete the form correctly.

- Download the W-9 form: Visit the IRS website or use a reliable source to obtain the most recent version of the W-9 form.

- Provide your name: In the first line, enter your full name as it appears on your tax return.

- Enter your business name (if applicable): If you operate under a different name, fill that in on the second line.

- Select your tax classification: Check the box that applies to you, such as Individual/Sole Proprietor, Corporation, Partnership, etc.

- Fill in your address: Provide your street address, city, state, and ZIP code in the designated fields.

- Enter your taxpayer identification number (TIN): This can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certify your information: Sign and date the form at the bottom to confirm that the information you provided is accurate.

After completing the form, make sure to review all your entries for accuracy. Then, submit the W-9 to the requester, who will use it for their records. Keep a copy for your own files as well.