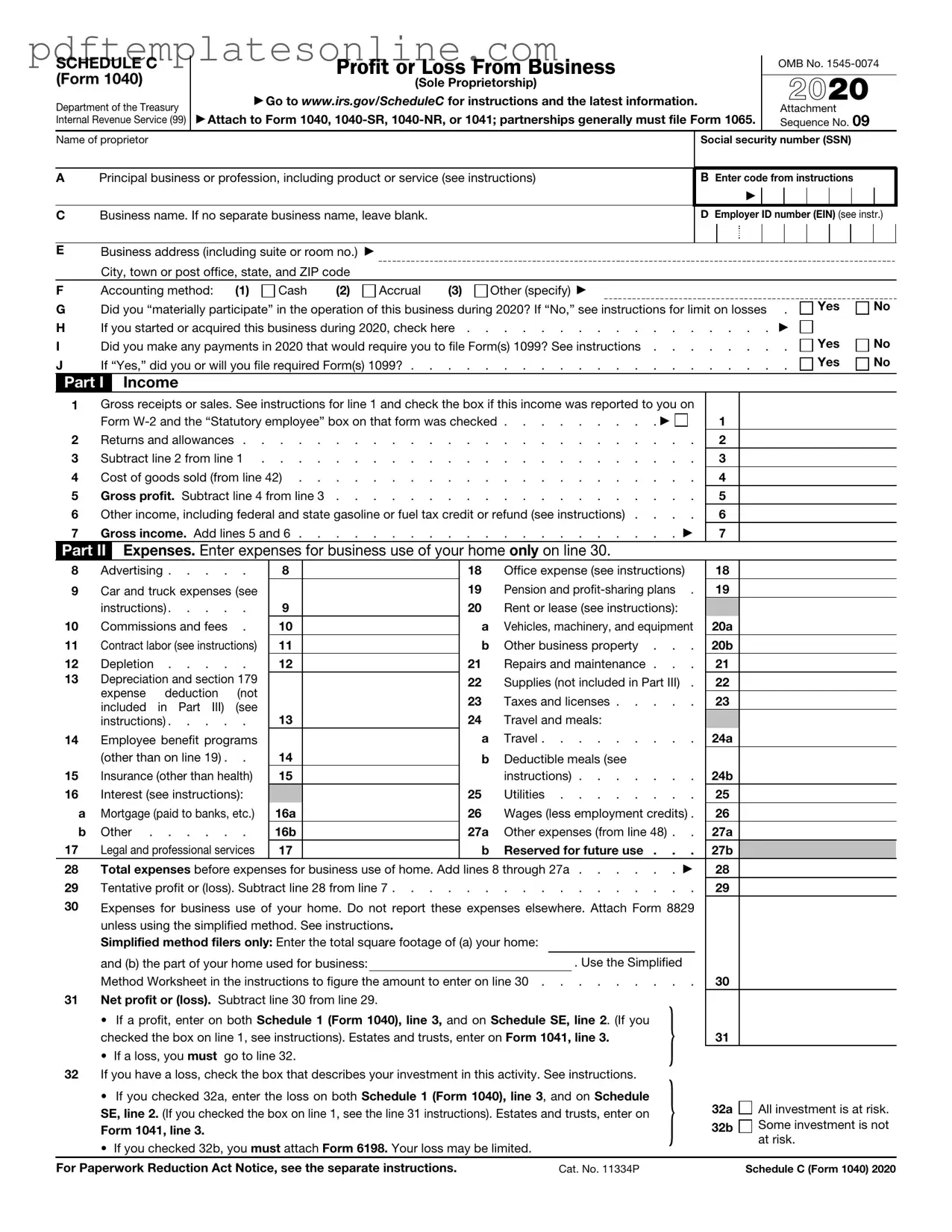

Blank IRS Schedule C 1040 Form

Key takeaways

The IRS Schedule C (Form 1040) is used by sole proprietors to report income and expenses from their business activities.

Accurate record-keeping is essential. Keeping detailed records of income and expenses will simplify the process of completing the form.

Report all income received from the business. This includes cash, checks, and credit card payments.

Deductible expenses can significantly reduce taxable income. Common deductions include costs for supplies, utilities, and business-related travel.

Self-employment tax applies to net earnings from the business. This tax covers Social Security and Medicare contributions.

Filing deadlines are crucial. Schedule C must be submitted along with the individual income tax return, typically by April 15.

Use the correct accounting method. Businesses can choose between cash and accrual accounting methods, which can affect income reporting.

Consulting a tax professional can provide valuable guidance. Tax laws can be complex, and professional advice may help maximize deductions and ensure compliance.

Common mistakes

When filling out the IRS Schedule C (Form 1040), many people make common mistakes that can lead to issues down the line. One frequent error is failing to report all income. It’s essential to include every dollar earned from your business. Even small amounts can add up and should be accounted for to avoid penalties.

Another mistake is misclassifying expenses. Some individuals may not know which expenses are deductible. It’s important to understand what qualifies as a business expense versus personal expenses. Keeping clear records can help ensure that only legitimate business costs are reported.

People often overlook the importance of accurate record-keeping. Without proper documentation, it becomes difficult to substantiate claims made on the Schedule C. Receipts, invoices, and bank statements should be organized and kept for at least three years in case of an audit.

Additionally, many individuals forget to account for self-employment taxes. Unlike traditional employees, self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This can lead to an unexpected tax bill if not planned for in advance.

Another common error is not taking advantage of the Qualified Business Income deduction. This deduction can significantly reduce taxable income for eligible businesses. However, many people do not realize they qualify or fail to calculate it correctly, missing out on potential savings.

Lastly, some filers neglect to sign and date the form. This may seem minor, but an unsigned form can lead to delays in processing or even rejection. Always double-check that all required signatures are included before submitting.

Misconceptions

Many individuals who operate small businesses or are self-employed may have misconceptions about the IRS Schedule C (Form 1040). Understanding the facts can help ensure accurate reporting and compliance. Here are seven common misconceptions:

- All income must be reported on Schedule C. While self-employed individuals report their business income on Schedule C, income from other sources, such as investments or rental properties, should be reported on different forms.

- Only businesses with a formal structure need to file Schedule C. This is not true. Sole proprietors, freelancers, and independent contractors also need to file Schedule C, regardless of whether they have registered their business.

- Expenses can only be deducted if they are paid in cash. In reality, both cash and non-cash expenses can be deducted. For example, if you bartered services, the fair market value of those services can be deducted.

- All business expenses are fully deductible. While many expenses are deductible, some may be subject to limitations. For example, meals and entertainment expenses have specific rules regarding deductibility.

- Filing Schedule C guarantees a tax refund. Filing does not guarantee a refund. The amount of tax owed or refunded depends on total income, deductions, and tax credits.

- Schedule C is only for profit-making businesses. If a business operates at a loss, it can still file Schedule C. Losses can offset other income, which may reduce overall tax liability.

- Once filed, Schedule C cannot be amended. This is incorrect. If errors are discovered after filing, taxpayers can amend their Schedule C using Form 1040-X to correct the information.

Clarifying these misconceptions can help individuals navigate their tax responsibilities more effectively and avoid potential issues with the IRS.

Dos and Don'ts

When filling out the IRS Schedule C 1040 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do keep accurate records of all income and expenses related to your business.

- Do categorize your expenses correctly to maximize your deductions.

- Do report all income, even if you did not receive a 1099 form.

- Do double-check your math to avoid errors that could trigger an audit.

- Do consult a tax professional if you have questions or concerns.

- Don't underestimate your expenses; be sure to include all relevant costs.

- Don't mix personal and business expenses on the form.

- Don't ignore the deadlines for filing your taxes.

- Don't forget to sign and date the form before submitting it.

- Don't leave any sections blank; fill out all required fields.

Other PDF Forms

Alabama Public Title Portal - Ensure that all applicable deadlines are followed to maintain the legality of your lien record.

For those looking to secure their property rights, utilizing a Florida Deed form is crucial. This document is a vital part of any real estate transaction, ensuring the legitimate transfer of ownership. You can find more details on the process within our guide to the necessary Florida deed documentation.

Salary Amount and Frequency I983 - Each I-983 is unique and tailored to the individual student and their training opportunities.

Stock Transfer Form Download - Can be used for maintaining detailed corporate records.

Detailed Guide for Writing IRS Schedule C 1040

Completing the IRS Schedule C (Form 1040) is an essential step for self-employed individuals and sole proprietors. This form helps report income or loss from a business you operated or a profession you practiced as a sole proprietor. After filling out this form, you'll be able to accurately report your business earnings on your tax return, ensuring compliance with tax regulations.

- Gather your financial records, including income statements, receipts for expenses, and any relevant documentation related to your business.

- Start by filling out your name and Social Security number at the top of the form.

- In the section labeled “Principal business activity,” describe your business. Be clear and concise.

- Enter your business address if it differs from your home address.

- Provide your Employer Identification Number (EIN) if you have one; otherwise, leave it blank.

- Report your gross receipts or sales in the section labeled “Gross receipts or sales.” This is the total income generated from your business activities.

- Next, list your business expenses in the designated sections. Common expenses include advertising, car and truck expenses, and supplies. Be sure to keep your records organized to support these claims.

- Calculate your total expenses and subtract this amount from your gross income to determine your net profit or loss.

- Complete the “Net profit or loss” section. If you made a profit, this amount will be added to your income. If you incurred a loss, it may offset other income.

- Review your completed form for accuracy, ensuring that all calculations are correct and all necessary information is included.

- Once you are satisfied with the form, sign and date it. If you are filing jointly, your spouse should also sign.

- Finally, submit the completed Schedule C with your Form 1040 when filing your taxes.