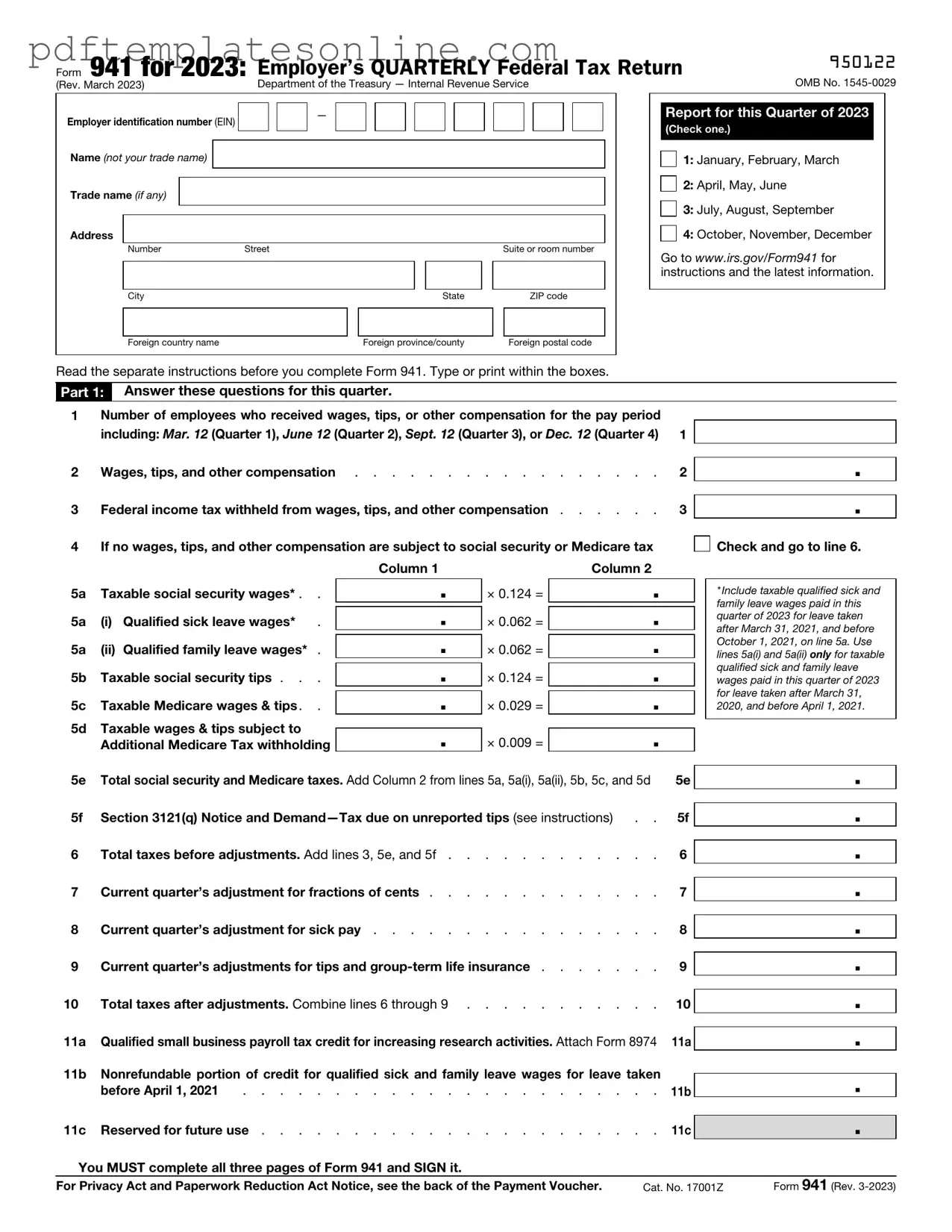

Blank IRS 941 Form

Key takeaways

Filling out the IRS 941 form is essential for employers to report payroll taxes. Here are some key takeaways to keep in mind:

- Accurate Reporting: Ensure that all employee wages, tips, and other compensation are reported correctly. Mistakes can lead to penalties.

- Quarterly Filing: The IRS 941 form must be filed quarterly. Deadlines are crucial, and late submissions can incur additional fees.

- Tax Calculations: Calculate the correct amount of federal income tax withheld, Social Security tax, and Medicare tax. This ensures compliance and avoids underpayment issues.

- Record Keeping: Maintain accurate records of all payroll information. This documentation is vital for future reference and potential audits.

Common mistakes

Filling out the IRS Form 941 can be a daunting task for many. It’s essential to understand that this form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Mistakes on this form can lead to penalties or delays in processing. Here are eight common mistakes people often make when completing the IRS 941 form.

One frequent error is not reporting the correct number of employees. Employers must accurately indicate the number of employees they had during the quarter. Failing to do so can result in discrepancies that may raise red flags with the IRS. Always double-check your records to ensure accuracy.

Another common mistake involves incorrect calculations of taxes owed. Many individuals miscalculate their payroll taxes, leading to underreporting or overreporting. This can happen due to simple math errors or misunderstanding tax rates. It’s crucial to review your calculations carefully and consider using a calculator or software to assist.

Some people forget to sign and date the form. This may seem like a minor detail, but an unsigned form can be considered incomplete. Always ensure that the form is signed by the appropriate person, typically the employer or an authorized representative.

Inaccurate or missing information regarding the employer identification number (EIN) is another common mistake. The EIN is essential for the IRS to identify your business. Ensure that you enter the correct EIN and that it matches the number on your previous tax filings.

Many individuals also overlook the importance of keeping records. Failing to maintain adequate payroll records can lead to difficulties when completing the form. It’s essential to have all necessary documentation on hand, including wages paid and taxes withheld, to ensure accurate reporting.

Another mistake is not checking for updates to tax laws or IRS guidelines. Tax laws can change frequently, and it’s vital to stay informed about any updates that may affect your filing. Consulting the IRS website or a tax professional can help you remain compliant.

Some people neglect to file the form on time. Late submissions can incur penalties and interest. Mark your calendar with the due dates and set reminders to ensure that you file your Form 941 promptly.

Lastly, many individuals fail to review the completed form before submission. Taking the time to carefully read through the entire form can help catch errors before they become an issue. A thorough review can save time and prevent complications down the line.

Misconceptions

The IRS Form 941 is an essential document for employers, but there are several misconceptions that can lead to confusion. Understanding these misconceptions can help ensure compliance and avoid potential penalties. Here are nine common misunderstandings about Form 941:

- Form 941 is only for large businesses. Many believe that only large employers need to file this form. In reality, any employer who pays wages to employees must file Form 941, regardless of the size of the business.

- You only need to file if you have employees. Some think that if they have no employees during a quarter, they do not need to file. However, if you have employees at any point during the year, you still need to file Form 941, even if you had no wages to report.

- Form 941 is filed annually. This is a common misconception. Form 941 is actually filed quarterly. Employers must submit it four times a year, detailing the wages paid and the taxes withheld.

- Filing Form 941 is optional. Some individuals mistakenly believe that filing is optional. It is mandatory for employers to file Form 941 to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

- All tax payments are made with Form 941. While Form 941 reports taxes withheld, it does not serve as the payment method. Employers must make separate tax payments to the IRS, usually on a monthly or semi-weekly basis.

- Filing late will not result in penalties. Many assume that late filing is not a big deal. However, the IRS imposes penalties for late filings, which can accumulate quickly, adding unnecessary costs to your business.

- Form 941 only reports federal taxes. This is misleading. While Form 941 primarily deals with federal taxes, it also provides information relevant to state and local taxes, depending on the jurisdiction.

- You can ignore corrections on Form 941. Some employers think that corrections are not necessary. However, if you discover errors after filing, it is crucial to amend the form to avoid complications with the IRS.

- Once filed, Form 941 cannot be changed. This misconception can lead to issues. You can amend Form 941 if you find mistakes or need to adjust figures. It’s important to address any discrepancies promptly.

By clarifying these misconceptions, employers can better navigate their responsibilities regarding Form 941. Staying informed is key to maintaining compliance and avoiding penalties.

Dos and Don'ts

When filling out the IRS 941 form, it's important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do double-check all employee information for accuracy.

- Don't leave any required fields blank.

- Do calculate your tax liability carefully.

- Don't forget to sign and date the form before submission.

- Do keep a copy of the completed form for your records.

- Don't submit the form late; be aware of deadlines.

- Do consult the IRS guidelines if you're unsure about any section.

Other PDF Forms

Doctor Note Template - Indicates the date of a patient’s visit to the healthcare provider.

The EDD DE 2501 form is a document used in California to apply for state disability insurance benefits. It provides essential information about the applicant's medical condition and work history. Understanding how to complete this form accurately is crucial for securing the financial support you may need during a period of temporary disability. For more information, you can visit https://mypdfform.com/blank-edd-de-2501/.

Toledo Edison Bill Pay - Your bill is based on your electricity usage over the billing period of April 2 to May 1, 2008.

Detailed Guide for Writing IRS 941

Completing the IRS Form 941 is an important task for employers, as it reports payroll taxes withheld from employee wages. Once you have filled out the form, you will need to submit it to the IRS along with any payment due. Here are the steps to guide you through the process of filling out the form.

- Download the IRS Form 941 from the IRS website or obtain a physical copy.

- Enter your business name, address, and Employer Identification Number (EIN) in the designated fields at the top of the form.

- Indicate the quarter for which you are filing the form. The quarters are January-March, April-June, July-September, and October-December.

- In Part 1, report the number of employees you paid during the quarter.

- Fill in the total wages, tips, and other compensation paid to employees in the appropriate box.

- Calculate the total federal income tax withheld from employee wages and enter that amount.

- Report any adjustments for tips and group-term life insurance in the provided fields.

- Calculate the total taxes owed by adding the amounts reported in the previous steps.

- In Part 2, complete the section on tax liability for the quarter, including any adjustments for prior periods.

- Sign and date the form. Ensure that the person signing has the authority to do so.

- Submit the completed form to the IRS by the due date, either electronically or by mail, depending on your preference.