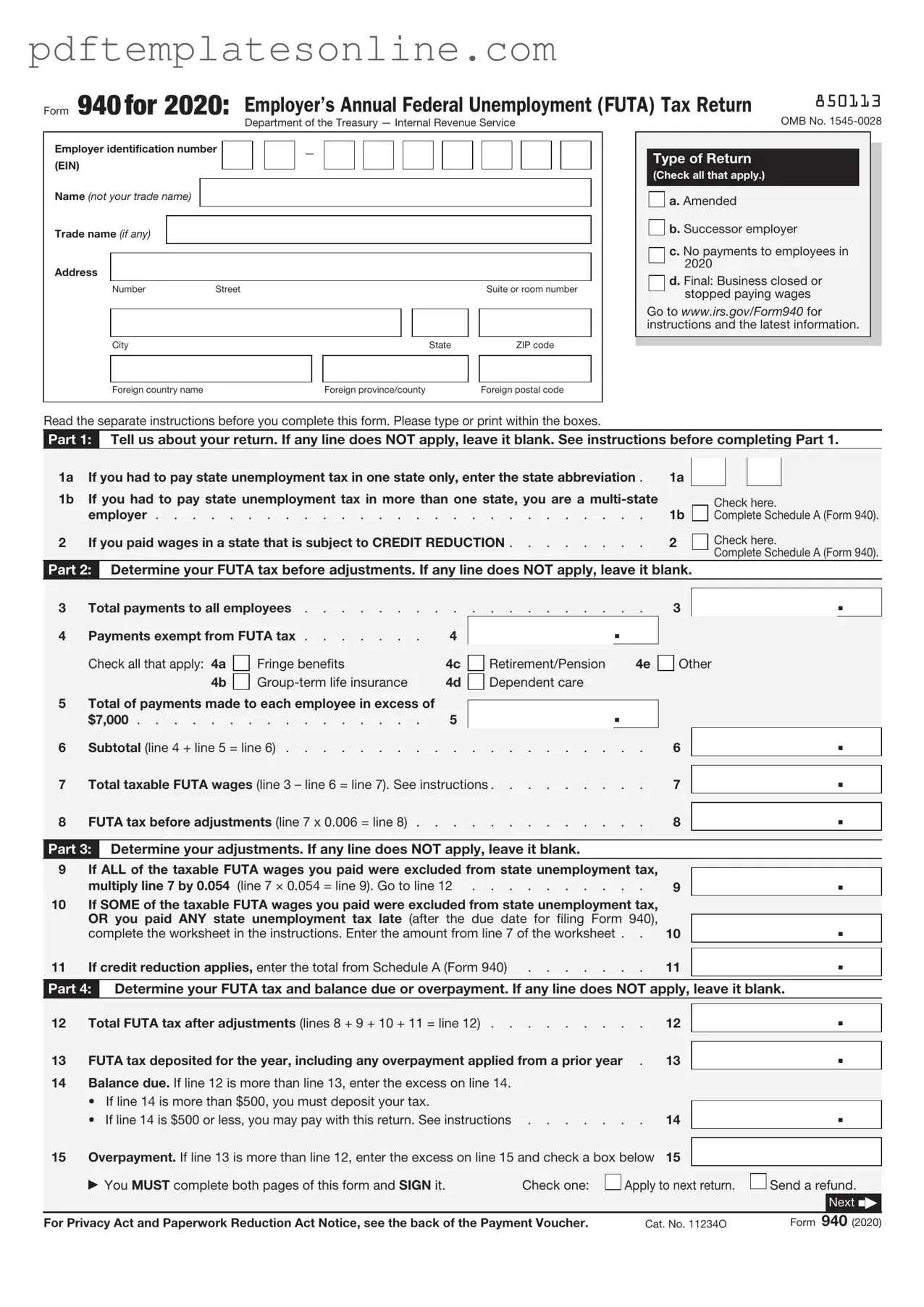

Blank IRS 940 Form

Key takeaways

When it comes to the IRS 940 form, understanding the key points can make the process smoother. Here are some essential takeaways:

- The IRS 940 form is used to report annual Federal Unemployment Tax Act (FUTA) taxes.

- This form is typically due by January 31st of the following year, but if you file electronically, you may have until February 10th.

- Employers must file this form if they paid $1,500 or more in wages in any calendar quarter or if they had at least one employee for any part of a day in 20 or more weeks during the year.

- FUTA tax is calculated at a rate of 6.0% on the first $7,000 of each employee's wages.

- Employers can receive a credit of up to 5.4% if they pay state unemployment taxes, effectively reducing the FUTA tax rate to 0.6%.

- Be sure to keep accurate records of wages and taxes paid, as this information is crucial for filling out the form correctly.

- Filing the IRS 940 form can be done electronically or by mail, but electronic filing is often faster and more efficient.

By keeping these points in mind, you can ensure that you fill out and submit the IRS 940 form correctly and on time.

Common mistakes

Filling out the IRS 940 form can be a daunting task, especially for those who are new to payroll taxes. One common mistake is not checking the eligibility criteria for filing the form. Many employers mistakenly assume they need to file without confirming whether they meet the threshold for federal unemployment tax liability. It's essential to understand the requirements to avoid unnecessary complications.

Another frequent error is incorrect calculations of taxable wages. Employers often miscalculate the total wages subject to unemployment tax, which can lead to underpayment or overpayment of taxes. Keeping accurate records and regularly updating payroll information can help mitigate this issue.

Many people also overlook the importance of reporting all employees accurately. Failing to include all employees who received wages during the year can result in discrepancies. This includes part-time workers, seasonal employees, and even those who may have left the company. Every employee's wages need to be accounted for to ensure compliance.

Additionally, errors can occur when transferring information from payroll records to the form. Simple typos or transposed numbers can lead to significant issues. It's advisable to double-check all entries and consider having a second pair of eyes review the information before submission.

Some employers neglect to sign and date the form. This might seem minor, but an unsigned form is considered incomplete and can delay processing. Always ensure that the form is signed and dated before sending it to the IRS.

Another common mistake is failing to file on time. The IRS imposes penalties for late submissions, which can accumulate quickly. Setting reminders or using electronic filing options can help ensure that deadlines are met.

Inaccurate identification of the state unemployment tax paid can also pose problems. Employers sometimes confuse state tax payments with federal obligations. It’s crucial to distinguish between the two and report them correctly to avoid potential audits.

Lastly, not keeping copies of submitted forms is a mistake that can lead to headaches down the line. Having a record of what was filed is essential for reference and can be invaluable in case of any discrepancies or audits. Keeping organized records can save time and stress in the future.

Misconceptions

The IRS Form 940 is essential for employers, but several misconceptions surround it. Understanding these misconceptions can help ensure compliance and avoid unnecessary penalties. Here are eight common misunderstandings about the IRS 940 form:

-

Only large businesses need to file Form 940.

This is not true. Any employer who pays wages of $1,500 or more in a calendar year or employs at least one person for any part of a day in 20 or more weeks must file.

-

Form 940 is only for federal unemployment tax.

While it primarily addresses federal unemployment tax (FUTA), it also considers state unemployment taxes. Employers must report both on this form.

-

Filing Form 940 is optional.

This misconception can lead to serious issues. Filing Form 940 is mandatory for qualifying employers, and failure to do so can result in penalties.

-

Form 940 is the same as Form 941.

These forms serve different purposes. Form 941 is used for reporting income taxes, Social Security tax, and Medicare tax withheld from employee wages, while Form 940 focuses on unemployment taxes.

-

Form 940 can be filed at any time.

Employers must adhere to specific deadlines. The form is typically due by January 31 of the following year, which is crucial for compliance.

-

There is no penalty for late filing.

In reality, the IRS imposes penalties for late filings. These can accumulate quickly, making timely submission important.

-

All employers pay the same FUTA rate.

The FUTA rate can vary based on the employer's state unemployment tax rate and whether they have any outstanding federal unemployment tax liabilities.

-

Once filed, the information on Form 940 cannot be amended.

This is incorrect. If an error is discovered, employers can file an amended return to correct any mistakes on their original Form 940.

By dispelling these misconceptions, employers can better navigate their responsibilities and ensure compliance with federal regulations.

Dos and Don'ts

When filling out the IRS 940 form, it's essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do double-check your employer identification number (EIN) to ensure accuracy.

- Do report all wages paid to employees accurately, including any taxable fringe benefits.

- Do keep a copy of your completed form for your records.

- Do file the form on time to avoid penalties and interest.

- Do consult the IRS instructions for any specific guidance related to your situation.

- Don't forget to sign and date the form before submitting it.

- Don't leave any required fields blank; this can lead to processing delays.

- Don't mix up the IRS 940 with other forms, such as the 941 or 944.

- Don't ignore the deadlines; late submissions can incur penalties.

- Don't hesitate to seek help if you're unsure about any part of the form.

Other PDF Forms

Geico Supplement Form - This form serves as an important link between the customer, repair shop, and GEICO.

The California Transfer-on-Death Deed form allows homeowners to pass on their property to a beneficiary without the complexities of going through probate court. This legal document offers a straightforward way for property owners to ensure their real estate transitions smoothly after they pass away. For additional resources and options regarding this form, you can visit California PDF Forms, a valuable tool designed to simplify the process of transferring property ownership in California.

Roof Warranty - Homeowners can transfer the warranty to new owners with written request.

Detailed Guide for Writing IRS 940

Filling out the IRS 940 form is a straightforward process that requires accurate information about your business and its employment tax obligations. Follow these steps carefully to ensure the form is completed correctly.

- Gather necessary information: Collect your business details, including your Employer Identification Number (EIN), business name, and address.

- Access the form: Download the IRS 940 form from the IRS website or obtain a physical copy from a tax professional.

- Fill out Part 1: Enter your business name, EIN, and the tax year for which you are filing.

- Complete Part 2: Report your total payments to employees and any adjustments. Be precise in your calculations.

- Move to Part 3: Indicate if you are a seasonal employer and provide the necessary details if applicable.

- Complete Part 4: Calculate your tax liability based on the wages reported in Part 2.

- Fill out Part 5: Provide any applicable credits that reduce your tax liability.

- Complete Part 6: Sign and date the form, confirming that the information is accurate.

- Submit the form: Mail the completed form to the appropriate IRS address or file electronically, if eligible.

After completing the form, keep a copy for your records. Ensure you file it by the deadline to avoid penalties. If you have questions, consider consulting a tax professional for assistance.