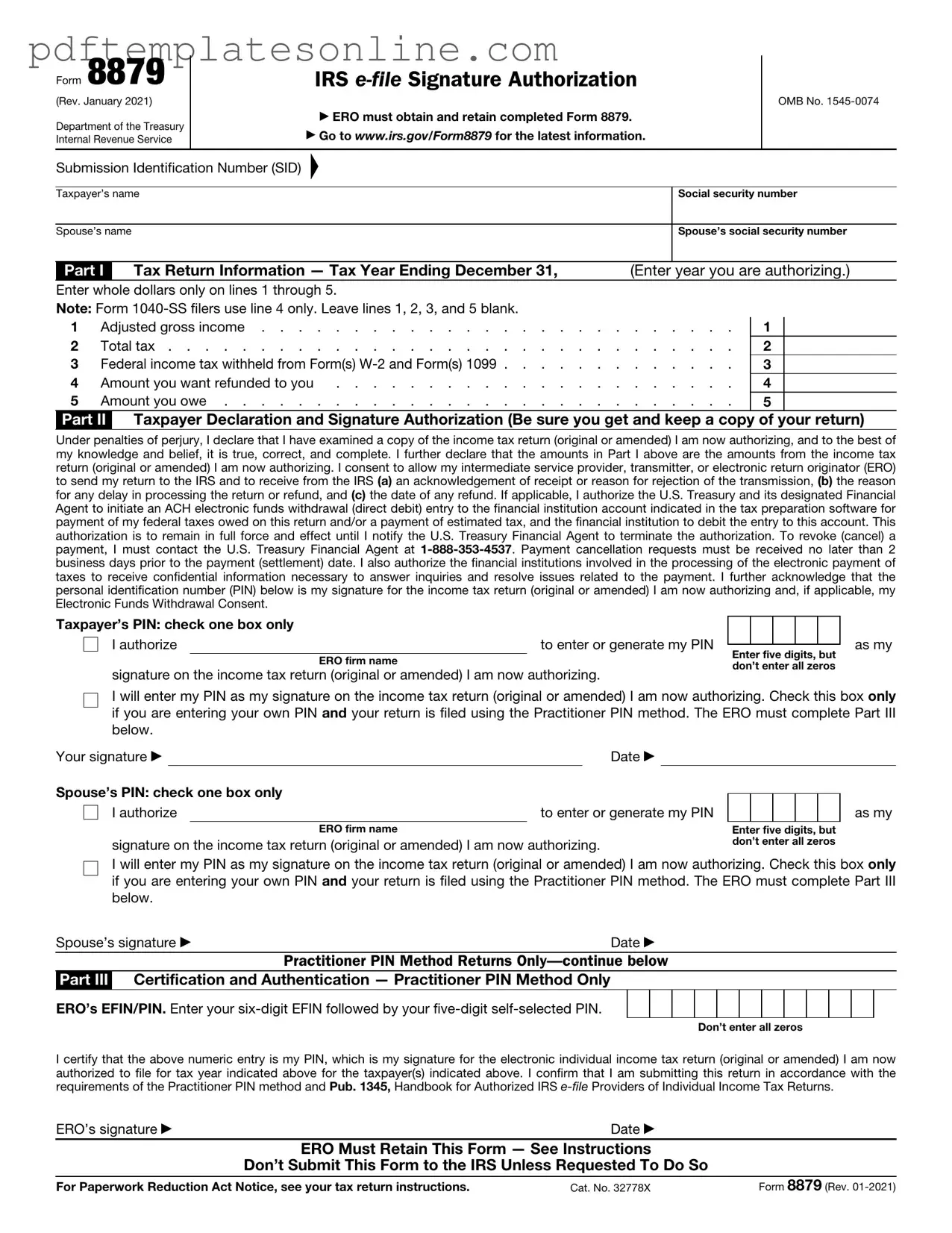

Blank IRS 8879 Form

Key takeaways

Here are some important points to remember when filling out and using the IRS 8879 form:

- The IRS 8879 form serves as an e-signature authorization for your tax return.

- Ensure all information is accurate and matches your tax return to avoid delays.

- Both you and your tax preparer must sign the form before submission.

- Keep a copy of the signed form for your records, as it may be needed for future reference.

- Submit the form electronically along with your tax return to complete the filing process.

Common mistakes

Filling out the IRS Form 8879, which authorizes an e-filed tax return, can be straightforward, but many individuals make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure a smoother filing process.

One frequent error is incomplete information. Taxpayers often overlook essential details, such as their Social Security number or the tax preparer's information. Every box on the form is there for a reason. Missing even one piece of information can lead to rejection of the e-filed return.

Another common mistake involves incorrect signatures. The form requires signatures from both the taxpayer and the tax preparer. If either signature is missing or not properly executed, the IRS may not accept the return. Always double-check that both parties have signed and dated the form correctly.

Some people mistakenly forget to review the return before signing the 8879. It’s crucial to ensure that the tax return accurately reflects your financial situation. If there are errors in the return, signing the 8879 could mean you are agreeing to incorrect information, which can lead to penalties or audits later on.

Additionally, individuals often use outdated versions of the form. The IRS updates forms periodically, and using an old version can cause complications. Always download the latest version from the official IRS website to avoid any issues.

Another mistake is not keeping a copy of the signed form. After submitting the 8879, it’s essential to retain a copy for your records. This document serves as proof of authorization for the e-filed return and may be needed for future reference or audits.

Finally, some taxpayers overlook deadlines. The 8879 must be submitted in a timely manner to ensure that the e-filed return is processed without delay. Missing the deadline can result in penalties or interest on any taxes owed. Staying organized and aware of important dates is key to a successful filing.

Misconceptions

The IRS 8879 form, also known as the "IRS e-file Signature Authorization," is often misunderstood. Here are ten common misconceptions about this form, along with clarifications to help you better understand its purpose and use.

-

Misconception 1: The IRS 8879 form is required for all tax returns.

This is not true. The form is only necessary for electronically filed tax returns. If you are filing a paper return, you do not need to submit this form.

-

Misconception 2: The IRS 8879 form is the same as the tax return.

While the form is related to the tax return, it serves a different purpose. It authorizes the e-filing of your return but does not contain any tax information itself.

-

Misconception 3: You can e-file without signing the IRS 8879 form.

To e-file your return, you must sign the IRS 8879 form. This signature confirms that you authorize the e-filing of your return.

-

Misconception 4: Only tax professionals need to use the IRS 8879 form.

While tax professionals often handle the form, individual taxpayers who e-file can also use it. If you are e-filing your own return, you will still need to complete the form.

-

Misconception 5: The IRS 8879 form is only for individual tax returns.

This form can be used for various types of returns, including business returns. It is not limited to individual taxpayers.

-

Misconception 6: You must submit the IRS 8879 form to the IRS.

The form is not sent to the IRS. Instead, it is retained by the tax preparer or the taxpayer as proof of authorization for e-filing.

-

Misconception 7: The IRS 8879 form can be signed electronically.

While the form is used for e-filing, it typically requires a physical signature unless the tax preparer has a specific electronic signature process in place.

-

Misconception 8: You can change your mind after signing the IRS 8879 form.

Once you sign the form, you are authorizing the e-filing of your return. If you wish to change your decision, you must communicate this to your tax preparer before they submit the return.

-

Misconception 9: The IRS 8879 form is not important.

The form plays a crucial role in the e-filing process. It ensures that the taxpayer has authorized the submission of their return, which helps prevent fraud.

-

Misconception 10: You can use any version of the IRS 8879 form.

It is essential to use the correct version of the form for the tax year you are filing. Each year, the IRS may update the form, and using an outdated version can cause issues with your e-filing.

Understanding these misconceptions can help you navigate the e-filing process more effectively and ensure that your tax return is submitted correctly.

Dos and Don'ts

When filling out the IRS 8879 form, it's important to approach the task with care. This form is crucial for e-filing your tax return and requires accurate information. Here are five essential do's and don'ts to keep in mind:

- Do double-check all personal information for accuracy, including your name, Social Security number, and address.

- Do ensure that the form is signed and dated by both you and your tax preparer, if applicable.

- Do keep a copy of the signed form for your records, as it may be needed for future reference.

- Don't leave any required fields blank; incomplete information can lead to delays in processing your return.

- Don't forget to review the form for any errors before submission, as mistakes can complicate your tax situation.

By following these guidelines, you can help ensure a smoother filing process and reduce the likelihood of issues with your tax return.

Other PDF Forms

Rent Receipt Example Filled Out - Indicates professionalism in property management practices.

The California Loan Agreement form is essential for anyone looking to formalize a lending arrangement, as it provides a comprehensive framework that details all vital aspects of the loan. For those interested in accessing a customizable template, visit California PDF Forms, which can facilitate the creation of a tailored agreement to suit specific needs.

Da 1380 - Correct filing of the DA 1380 assists in maintaining organized personnel records in the AMHRR.

Detailed Guide for Writing IRS 8879

Once you have gathered all necessary information and documents, you can begin filling out the IRS Form 8879. This form is essential for e-filing your tax return, and it requires accurate information to ensure compliance with IRS regulations. Follow these steps carefully to complete the form.

- Begin by entering your name and Social Security Number (SSN) in the designated fields at the top of the form.

- Next, provide your spouse's name and SSN, if applicable. If you are filing jointly, both names must be included.

- Fill in the tax year for which you are filing. This is typically the year you are reporting income for.

- In the next section, enter the total income amount as calculated on your tax return.

- Indicate the amount of refund or balance due, depending on your situation. Make sure this matches your tax return.

- Review the declaration section carefully. You will need to confirm that the information provided is accurate and complete.

- Sign and date the form. If filing jointly, your spouse must also sign and date the form.

- Finally, ensure that you have the proper electronic signature PINs for both you and your spouse, if applicable. This will be used to validate your identity when e-filing.

After completing the form, you can submit it electronically along with your tax return. Make sure to keep a copy for your records, as it serves as proof of your e-filing authorization.